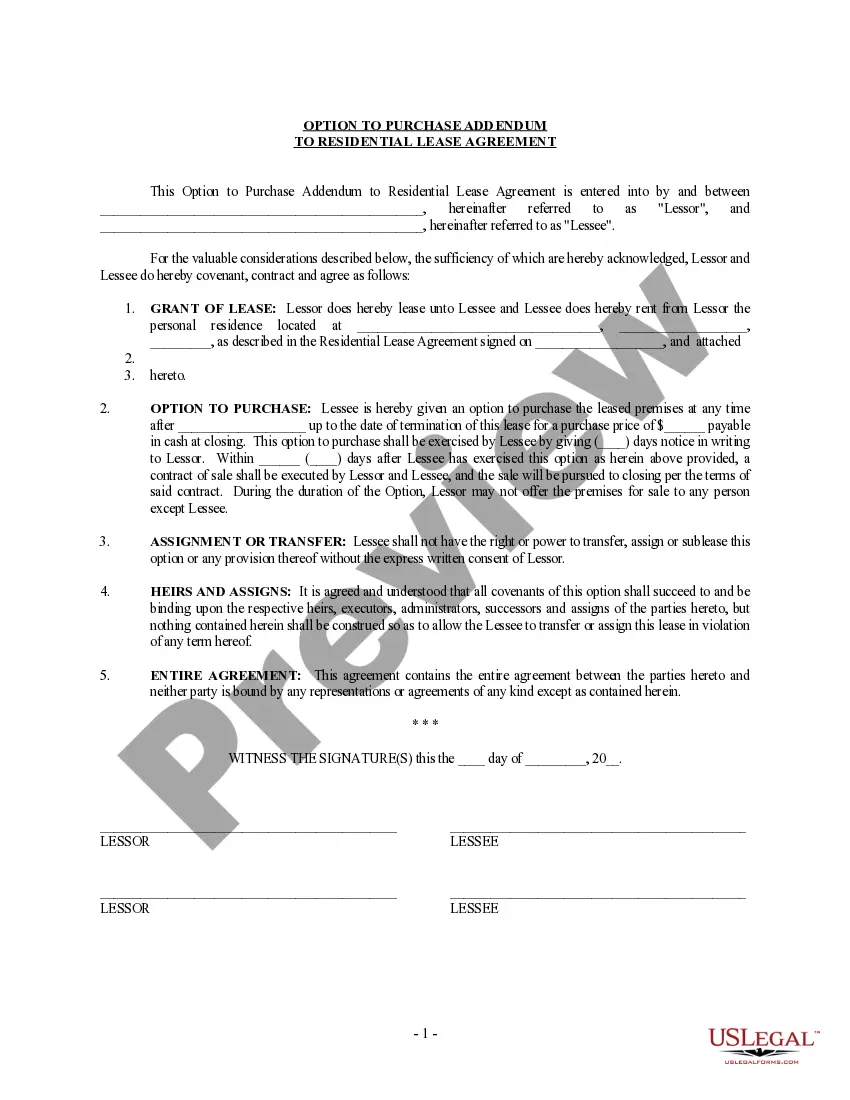

This Option to Purchase Addendum to Residential and Lease Agreement is entered into by and between the lessor and the lessee. The lessor agrees not to offer the residence for sale to anyone during the term of the lease, and to give the lessee (tenant) the option to purchase the residence at any time prior to the expiration of the lease, provided the lessee gives notice of intent to purchase in accordance with the provisions of the Addendum. At that point, a separate contract of sale will be executed and the sale will proceed as any sale would.

Please note: This Addendum form is NOT a lease agreement. You will need a separate Residential Lease Agreement. The Addendum would be attached to that Agreement

The Suffolk New York Option to Purchase Addendum to Residential Lease is a legal document that allows tenants to have the option to buy the property they are leasing in the future. This addendum provides an opportunity for individuals to enter into a lease or rent to own agreement, providing a pathway to homeownership in Suffolk County, New York. This addendum outlines the terms and conditions of the option to purchase agreement, including the agreed-upon purchase price, the duration of the lease, and the terms of any rent credits that may be applied towards the purchase price. It helps tenants secure a property they desire while allowing them to accumulate funds or improve their creditworthiness to eventually become homeowners. There are different types of Suffolk New York Option to Purchase Addendum to Residential Lease — Lease or Rent to Own, catered to meet specific needs and circumstances: 1. Fixed Purchase Price: This type of addendum stipulates a fixed purchase price at the start of the lease agreement, ensuring that the tenant knows the exact amount they are required to pay to buy the property. 2. Rent Credit Agreement: In this type of addendum, a portion of the monthly rent payments made by the tenant is agreed to be credited toward the future purchase price. This helps tenants save money over time and accumulate funds that can be used towards the down payment. 3. Flexibility Agreement: This addendum allows for negotiation and flexibility regarding the purchase price and terms, offering tenants the ability to discuss and modify the agreement based on their specific circumstances. 4. Terms and Conditions Agreement: This type of addendum focuses on outlining the various terms and conditions that both the landlord and tenant need to adhere to throughout the lease period and during the option to purchase process. It is important for all parties involved to consult with a real estate attorney or a knowledgeable professional to ensure that the addendum is drafted correctly, covering all legal aspects and protecting the rights and interests of both the landlord and tenant.