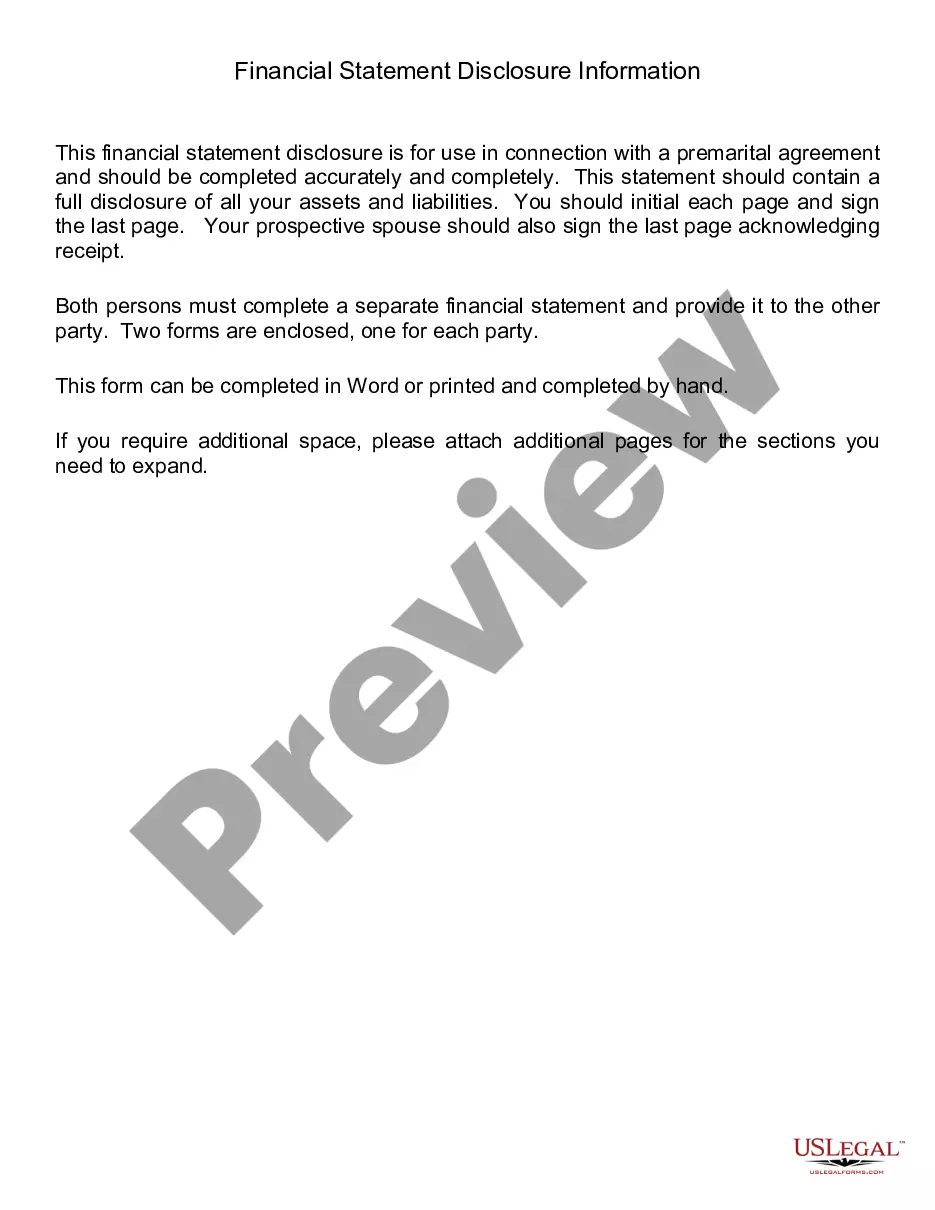

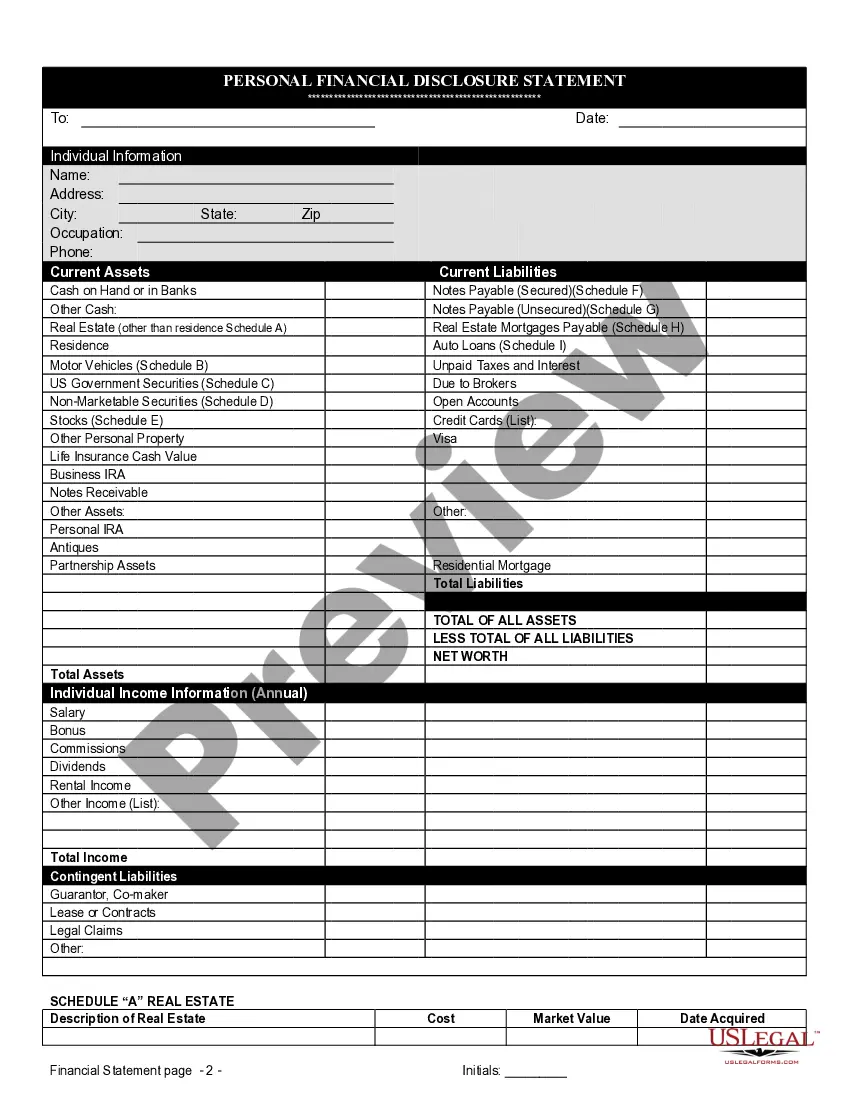

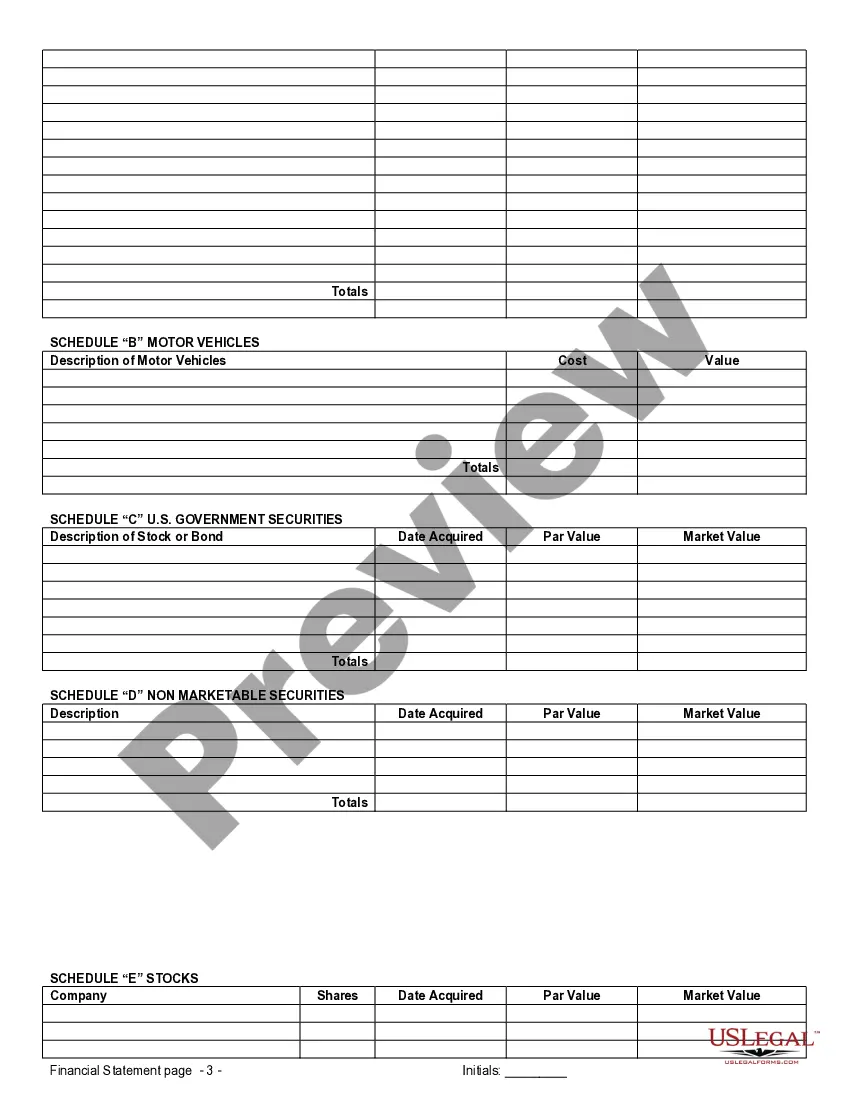

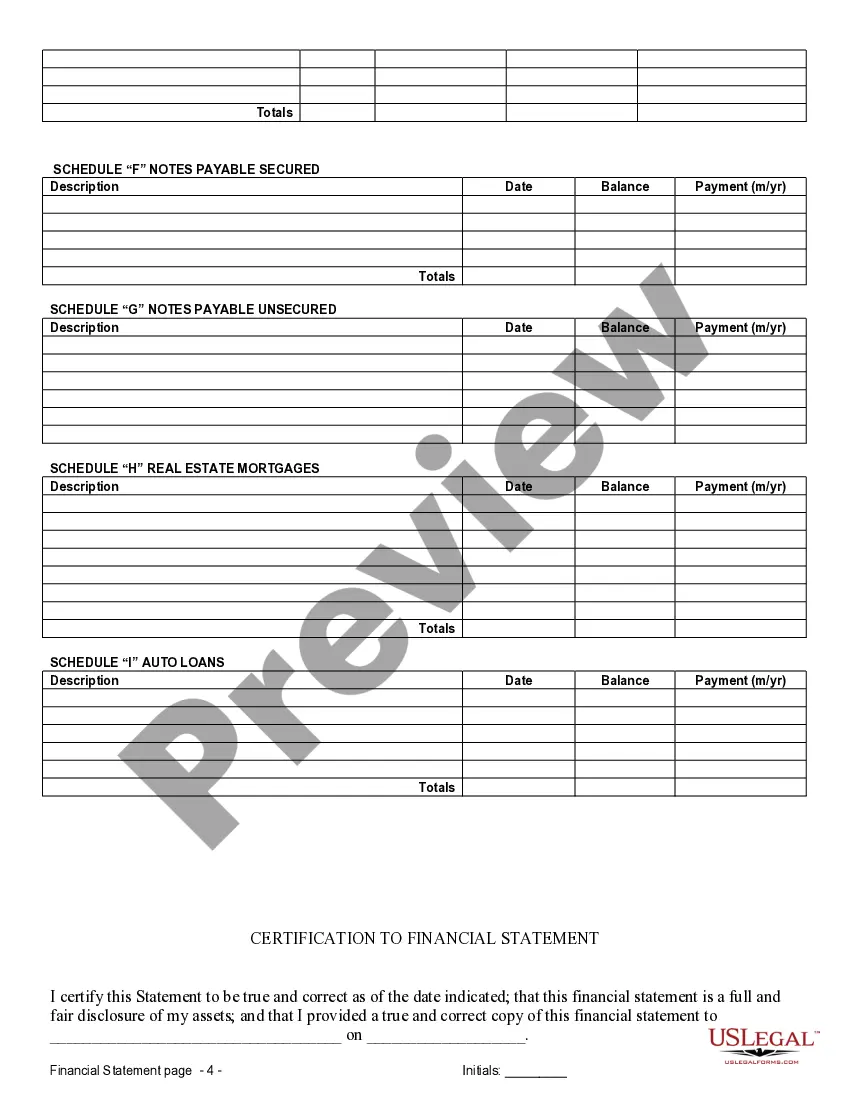

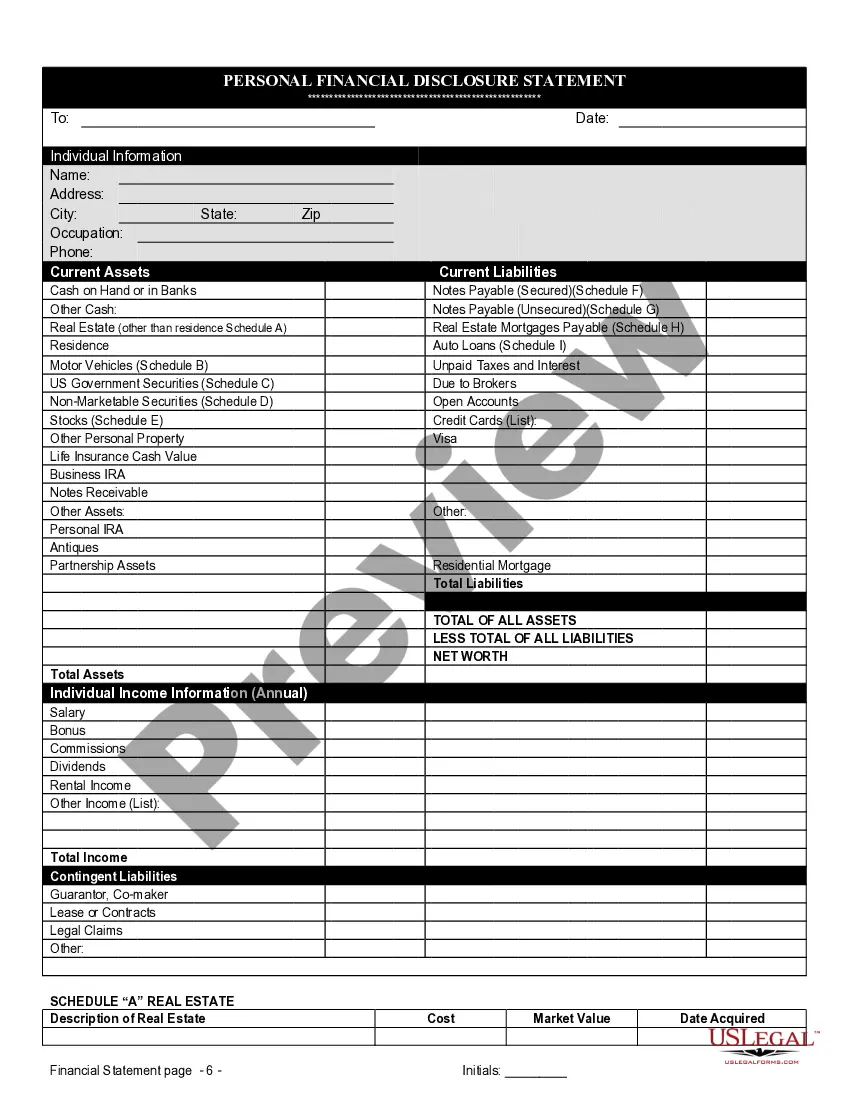

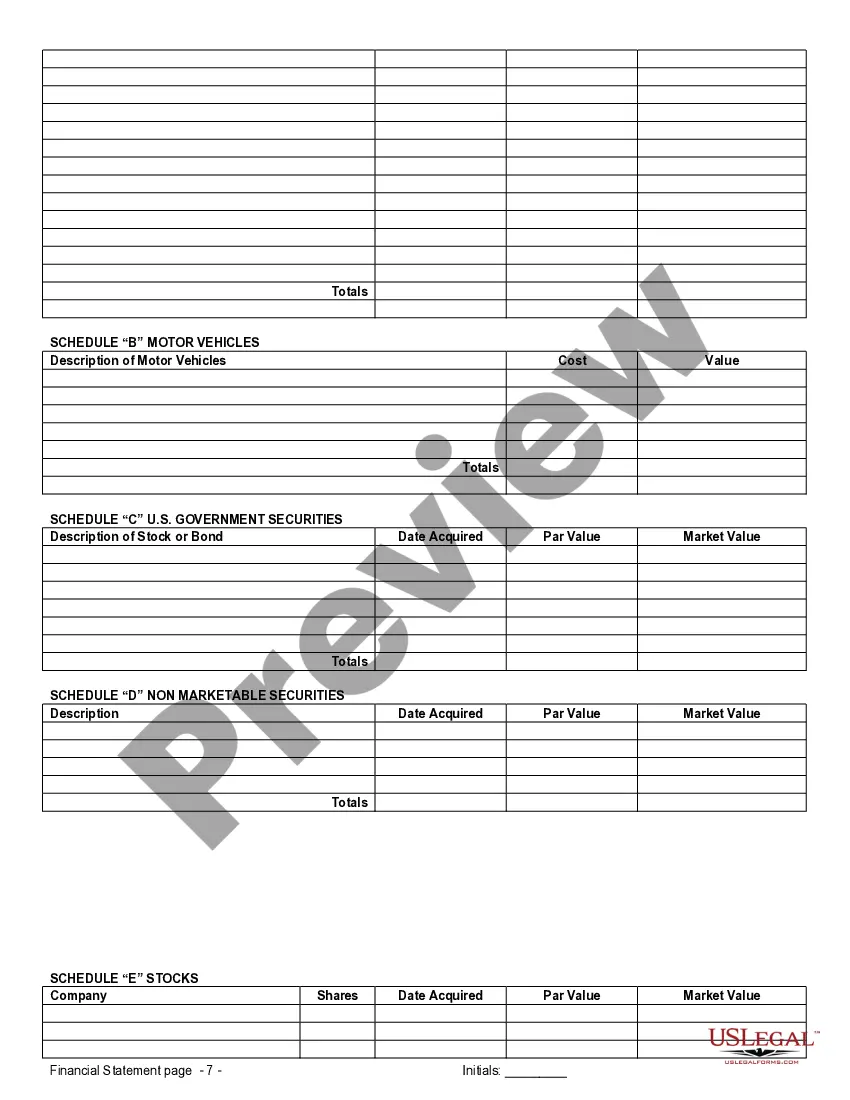

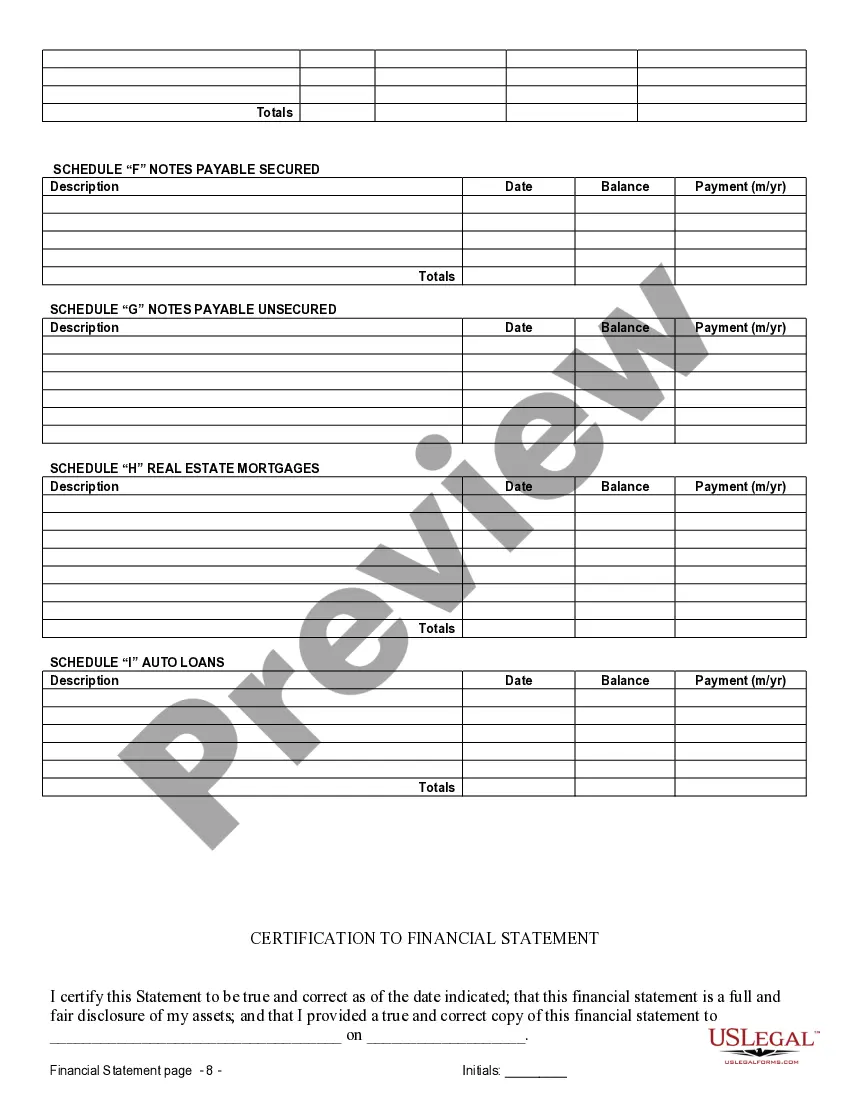

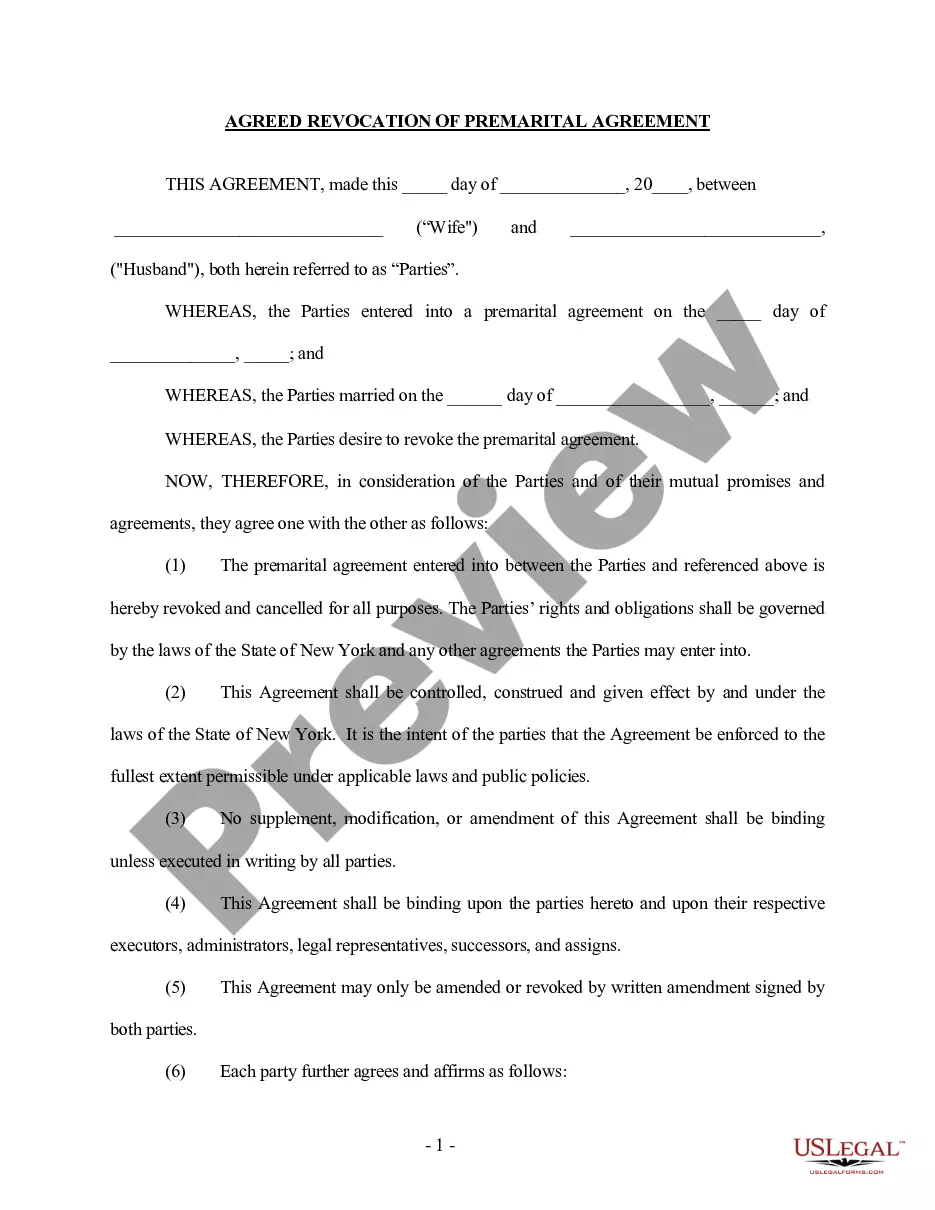

Suffolk New York Financial Statements in connection with Prenuptial Premarital Agreement Financial statements play a crucial role in the creation of a prenuptial or premarital agreement in Suffolk, New York. These statements are essential for full financial disclosure between the parties involved, ensuring transparency and fairness. Here, we will explore what Suffolk New York Financial Statements only in connection with Prenuptial Premarital Agreement entail and outline various types that may be considered: 1. Personal Balance Sheet: A personal balance sheet outlines an individual's assets, liabilities, and net worth. It provides a comprehensive snapshot of one's financial position, including bank accounts, investments, real estate holdings, and outstanding debts. 2. Income Statement: An income statement presents an individual's income and expenses over a given period. It details the sources of income, such as employment, investments, and business ventures, along with expenses such as rent, utility bills, and credit card payments. 3. Tax Returns: Recent tax returns are crucial documents to assess an individual's income, deductions, and overall financial history. They provide a comprehensive overview of assets, liabilities, and income sources, aiding in the determination of the prenuptial agreement's terms. 4. Bank Statements: Bank statements showcase an individual's cash flow and financial activities over a specified period. These statements provide details about deposits, withdrawals, and any recurring expenses or debts. 5. Investment Portfolio Statements: If either party holds an investment portfolio, providing statements from investment brokers or financial institutions is necessary. This information includes stocks, bonds, mutual funds, real estate investments, and other valuable assets. 6. Retirement Account Statements: Retirement account statements, including 401(k), IRAs, pensions, and other forms of retirement savings, should be included. These documents outline future financial security and should be thoroughly reviewed during the prenuptial agreement process. 7. Business Financial Statements: If one or both parties own a business, financial statements related to the company's operations can be included. These statements might include profit and loss statements, balance sheets, and cash flow statements. They provide insight into the business's financial health and help in determining the division of business assets or potential spousal support. It is essential to note that both parties entering into a prenuptial agreement should fully disclose their financial status voluntarily. By providing these Suffolk New York Financial Statements, individuals can ensure transparency and establish a solid foundation for a fair and equitable prenuptial or premarital agreement.

Suffolk New York Financial Statements in connection with Prenuptial Premarital Agreement Financial statements play a crucial role in the creation of a prenuptial or premarital agreement in Suffolk, New York. These statements are essential for full financial disclosure between the parties involved, ensuring transparency and fairness. Here, we will explore what Suffolk New York Financial Statements only in connection with Prenuptial Premarital Agreement entail and outline various types that may be considered: 1. Personal Balance Sheet: A personal balance sheet outlines an individual's assets, liabilities, and net worth. It provides a comprehensive snapshot of one's financial position, including bank accounts, investments, real estate holdings, and outstanding debts. 2. Income Statement: An income statement presents an individual's income and expenses over a given period. It details the sources of income, such as employment, investments, and business ventures, along with expenses such as rent, utility bills, and credit card payments. 3. Tax Returns: Recent tax returns are crucial documents to assess an individual's income, deductions, and overall financial history. They provide a comprehensive overview of assets, liabilities, and income sources, aiding in the determination of the prenuptial agreement's terms. 4. Bank Statements: Bank statements showcase an individual's cash flow and financial activities over a specified period. These statements provide details about deposits, withdrawals, and any recurring expenses or debts. 5. Investment Portfolio Statements: If either party holds an investment portfolio, providing statements from investment brokers or financial institutions is necessary. This information includes stocks, bonds, mutual funds, real estate investments, and other valuable assets. 6. Retirement Account Statements: Retirement account statements, including 401(k), IRAs, pensions, and other forms of retirement savings, should be included. These documents outline future financial security and should be thoroughly reviewed during the prenuptial agreement process. 7. Business Financial Statements: If one or both parties own a business, financial statements related to the company's operations can be included. These statements might include profit and loss statements, balance sheets, and cash flow statements. They provide insight into the business's financial health and help in determining the division of business assets or potential spousal support. It is essential to note that both parties entering into a prenuptial agreement should fully disclose their financial status voluntarily. By providing these Suffolk New York Financial Statements, individuals can ensure transparency and establish a solid foundation for a fair and equitable prenuptial or premarital agreement.