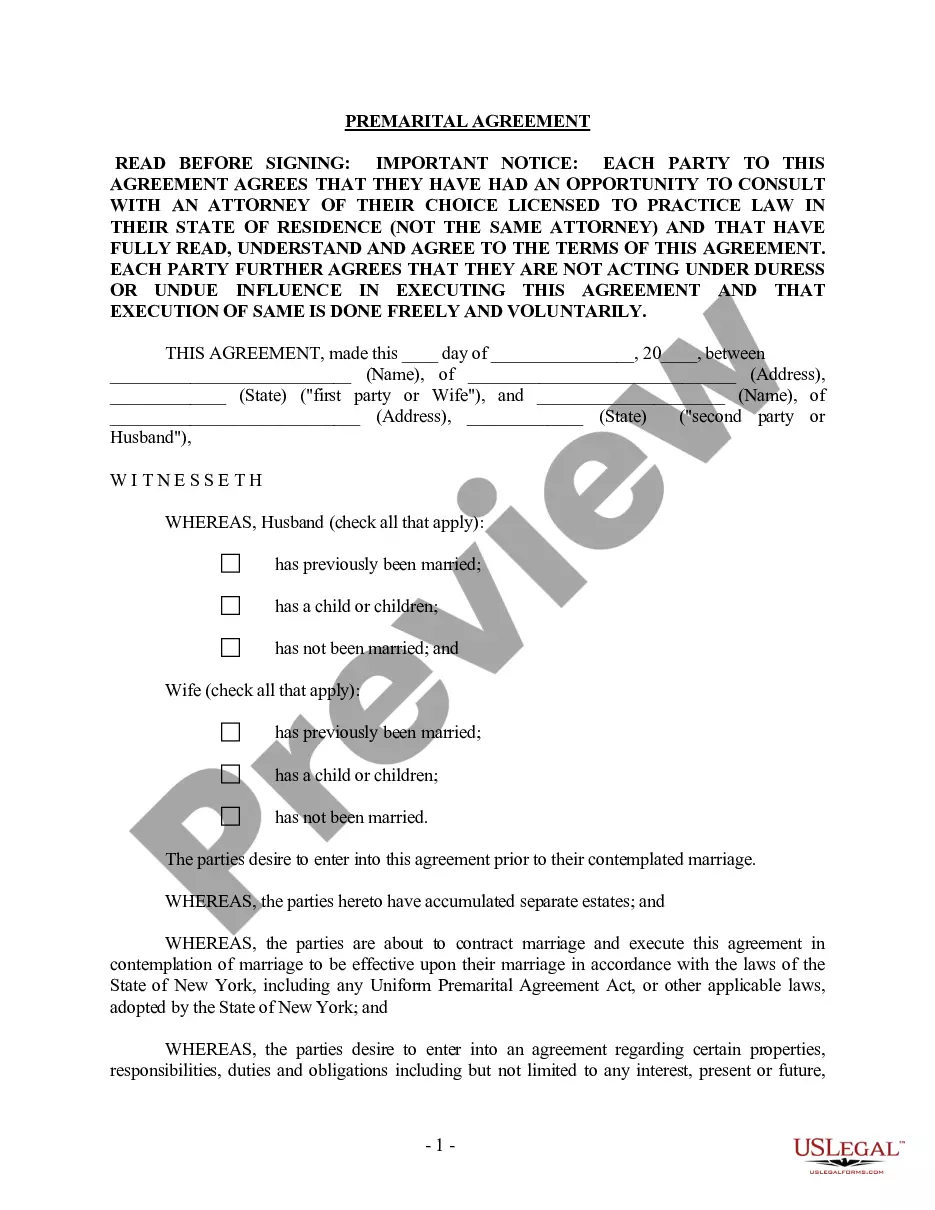

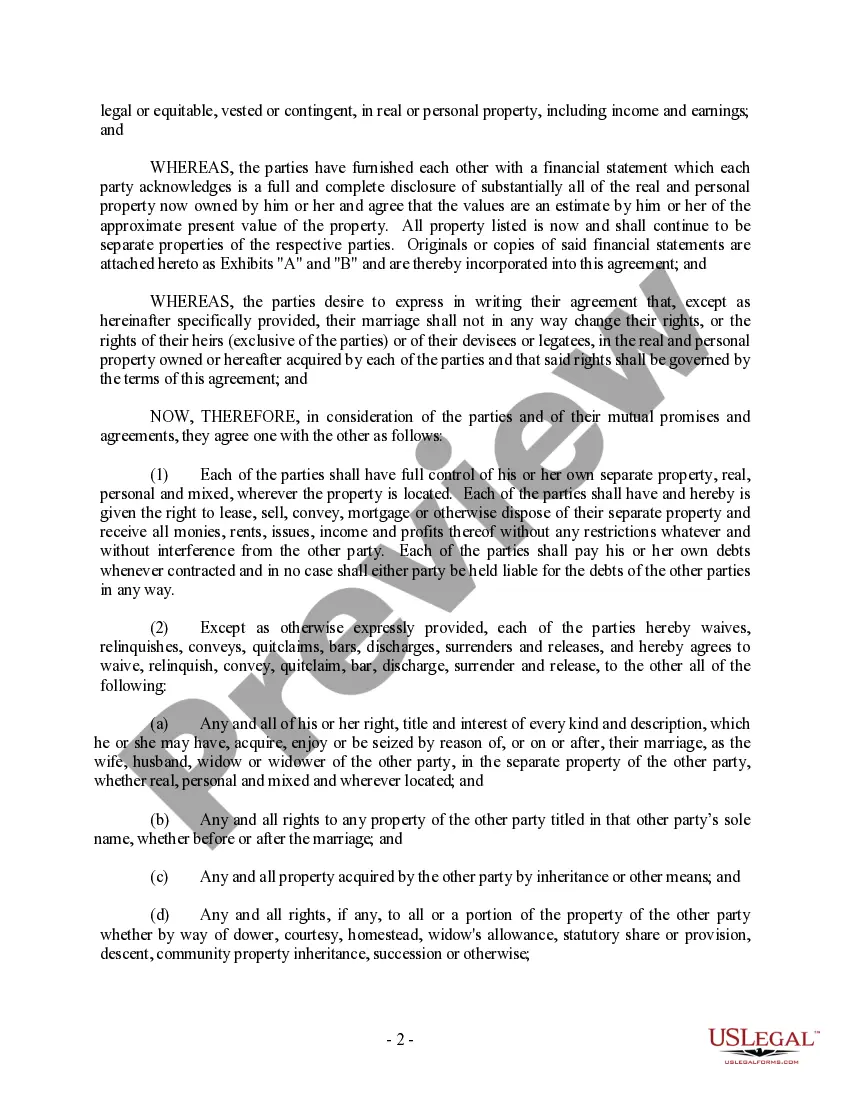

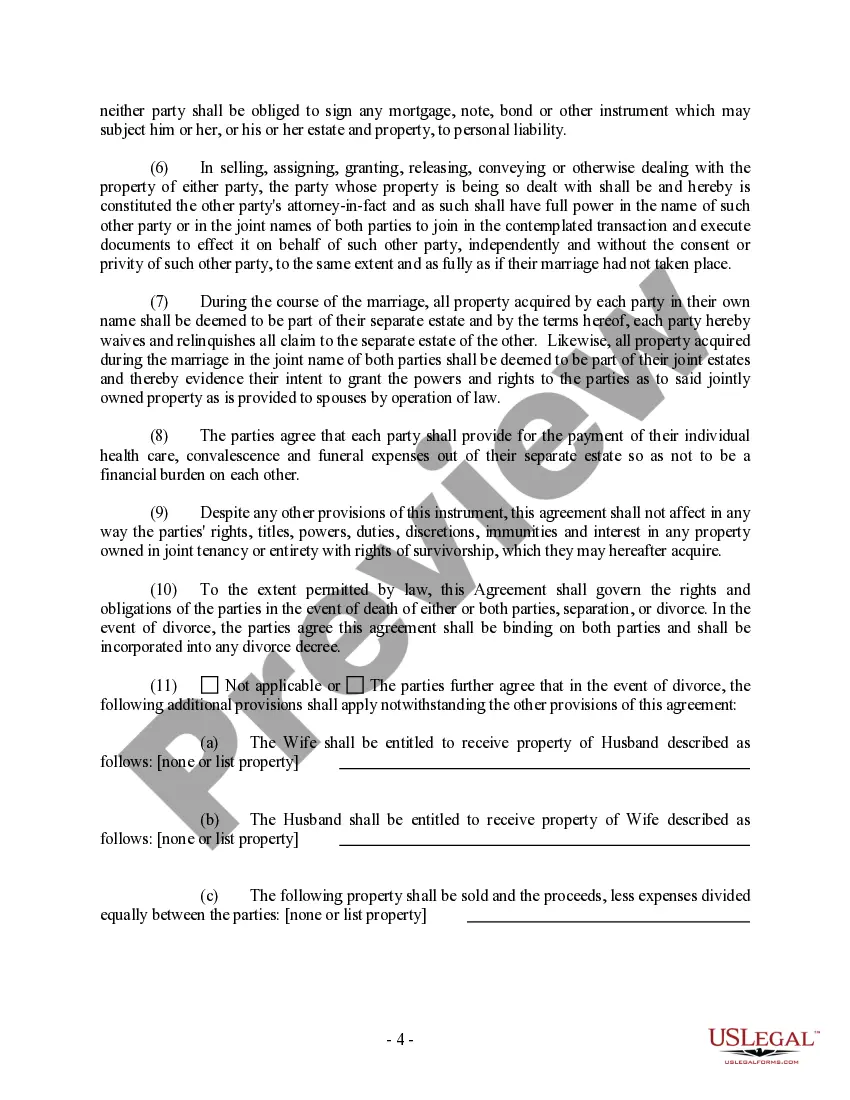

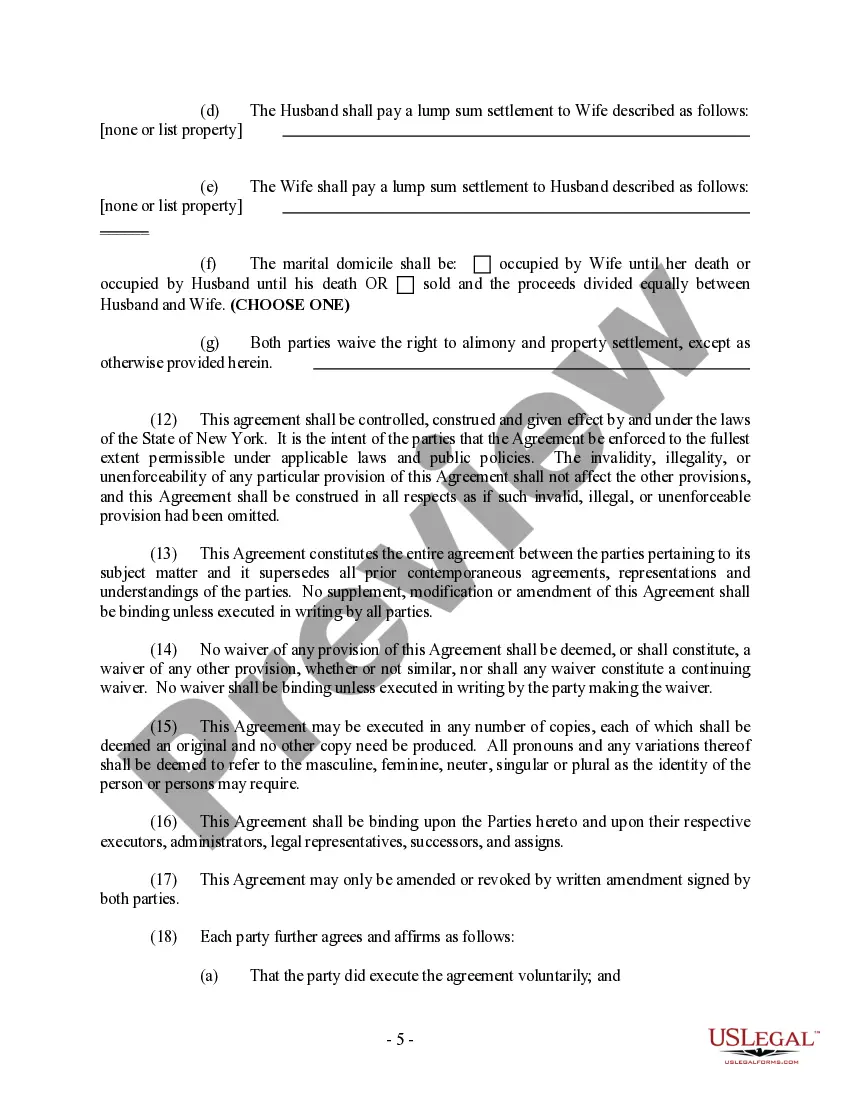

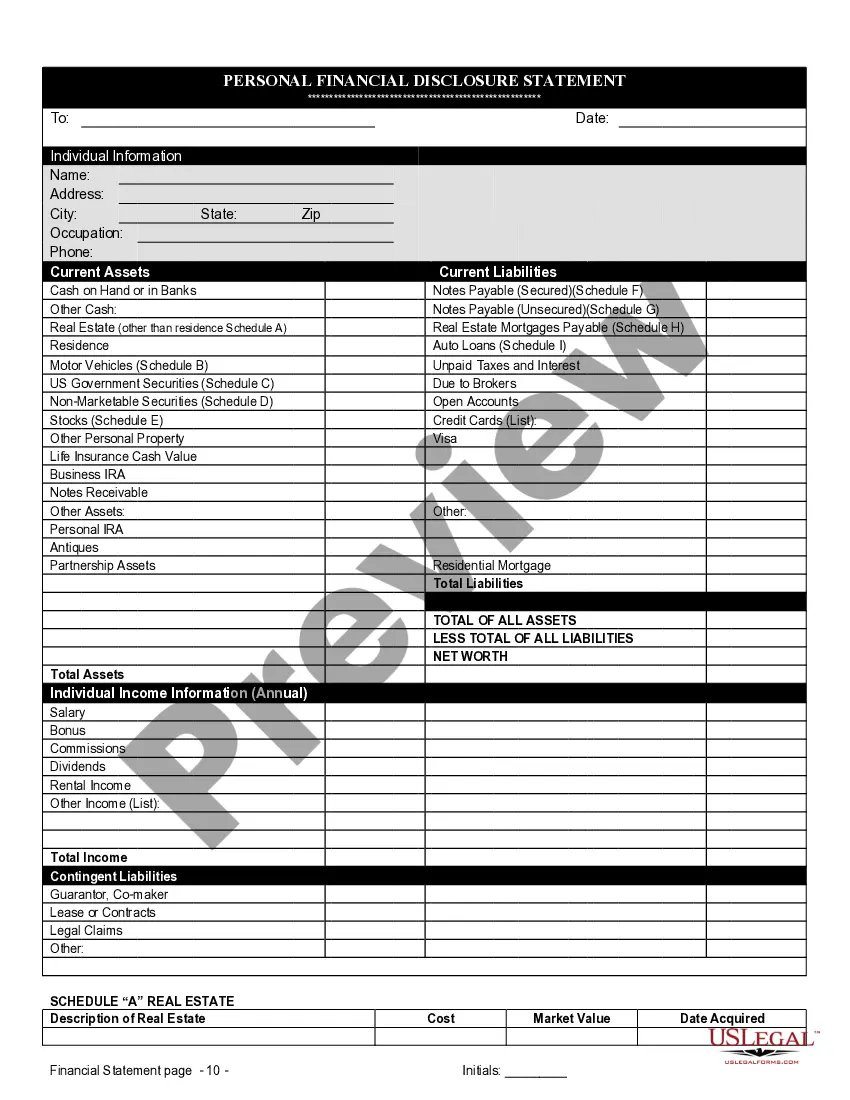

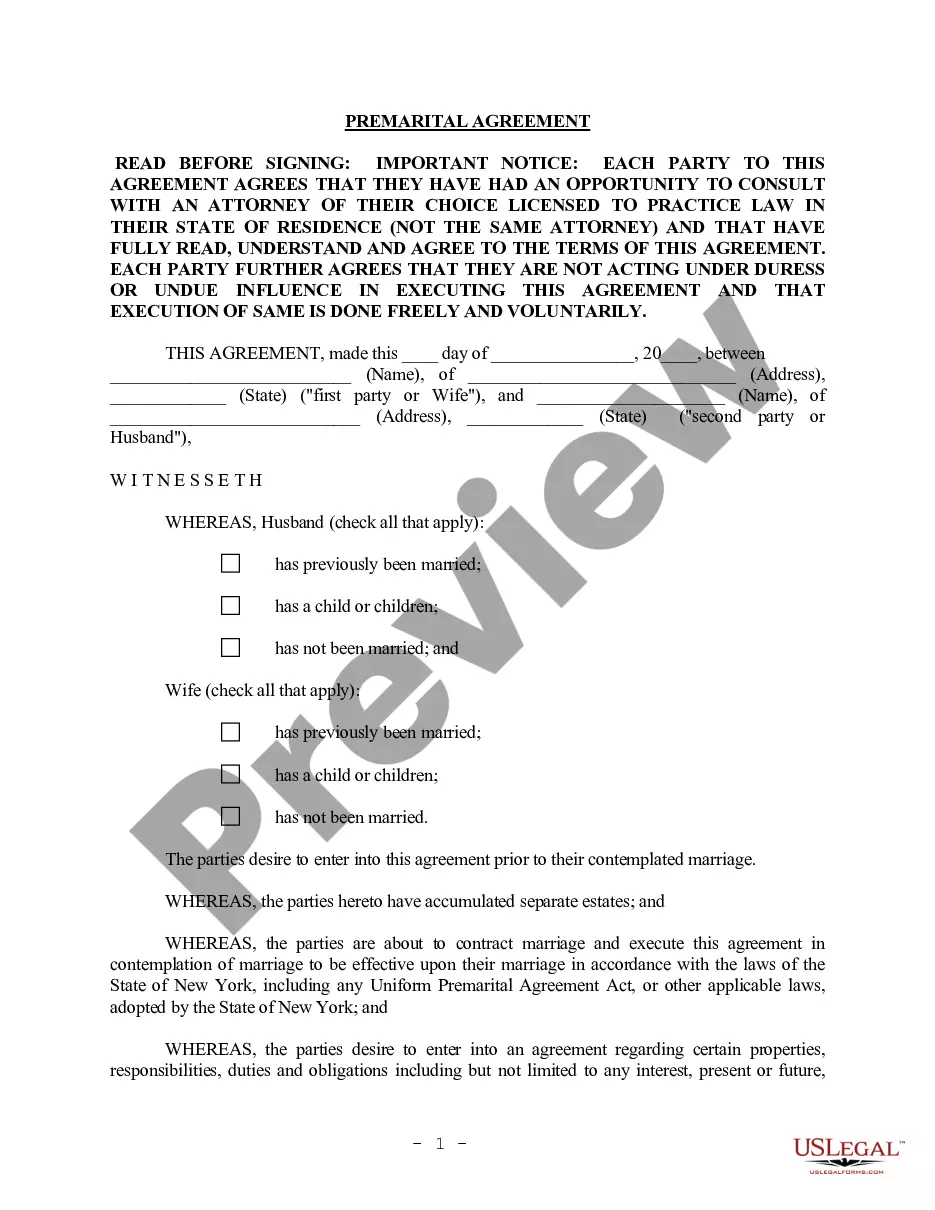

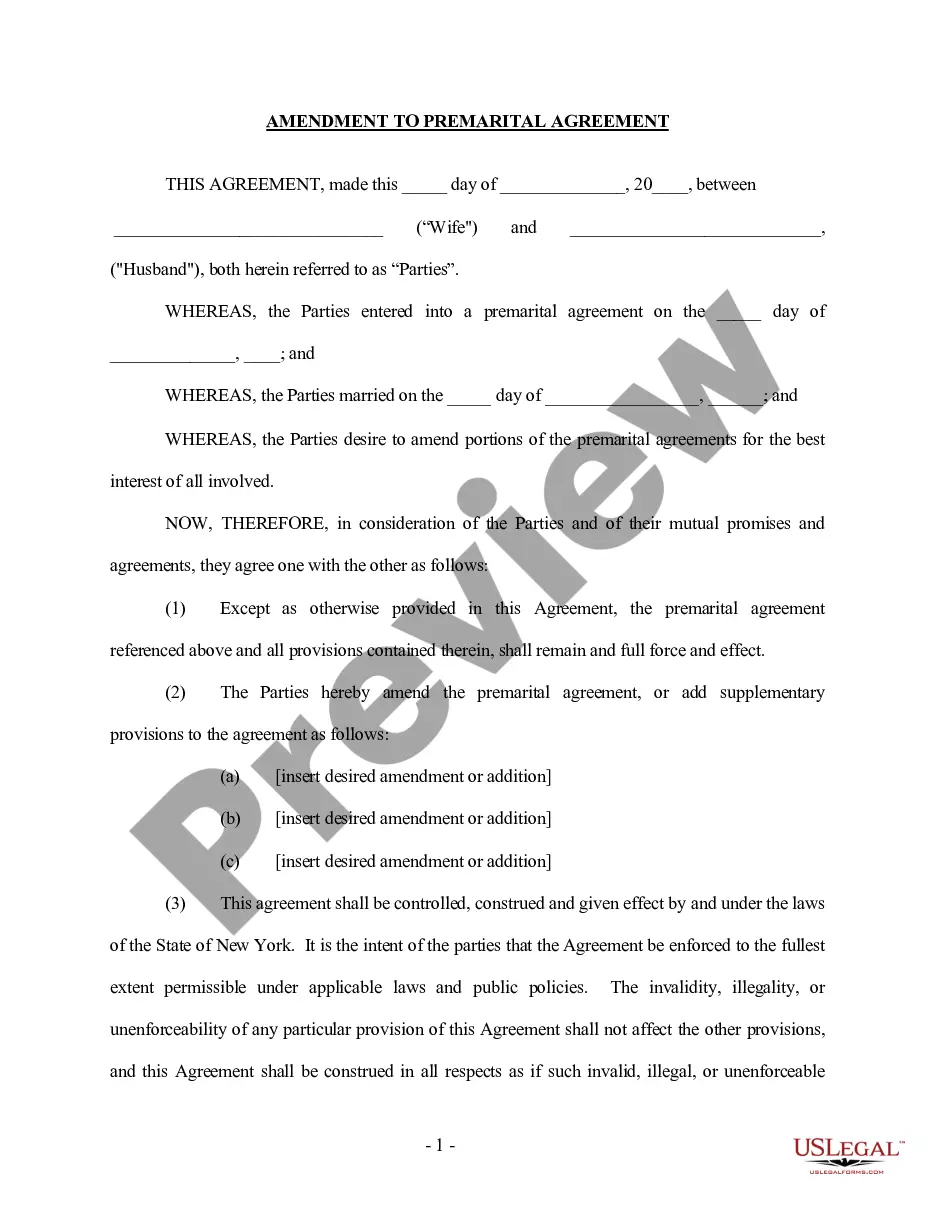

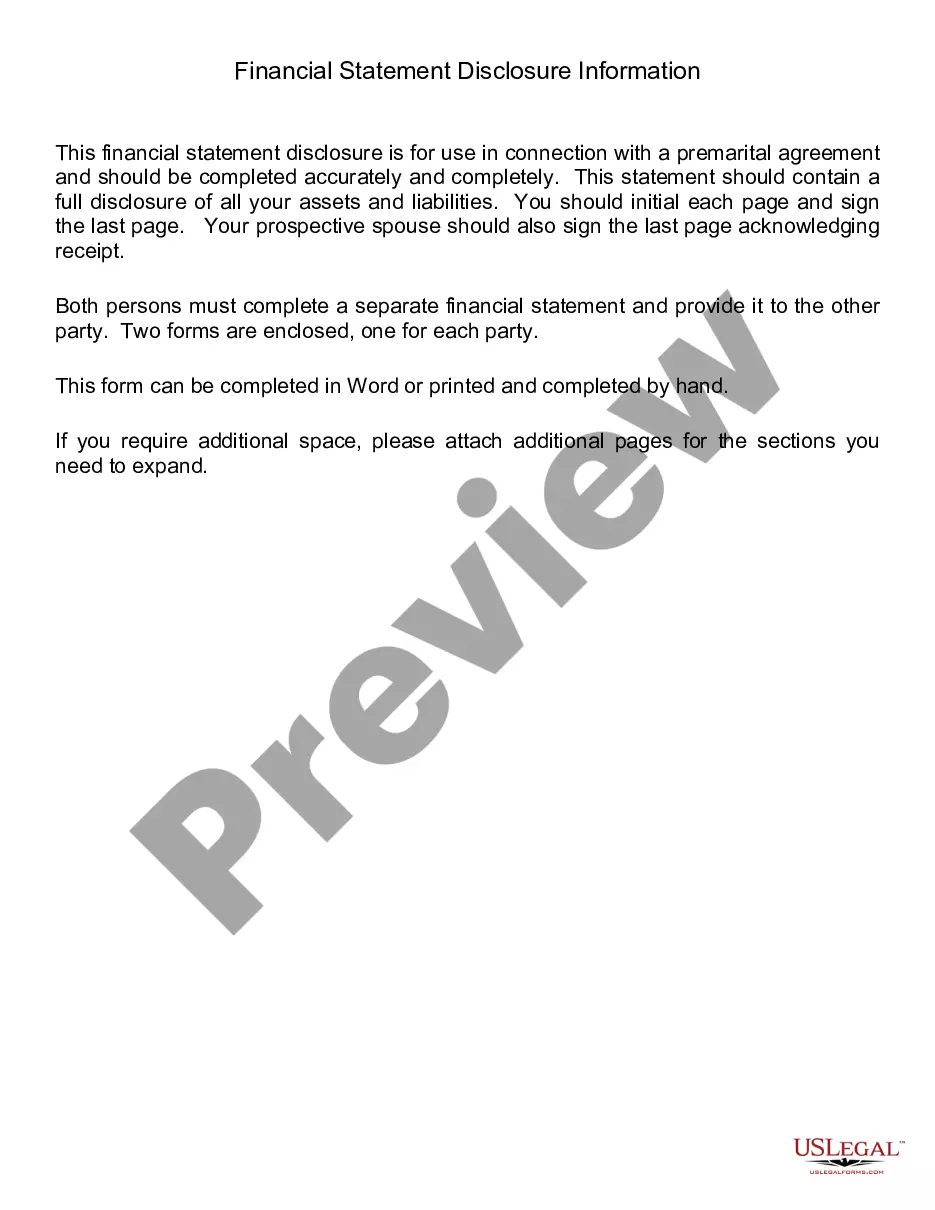

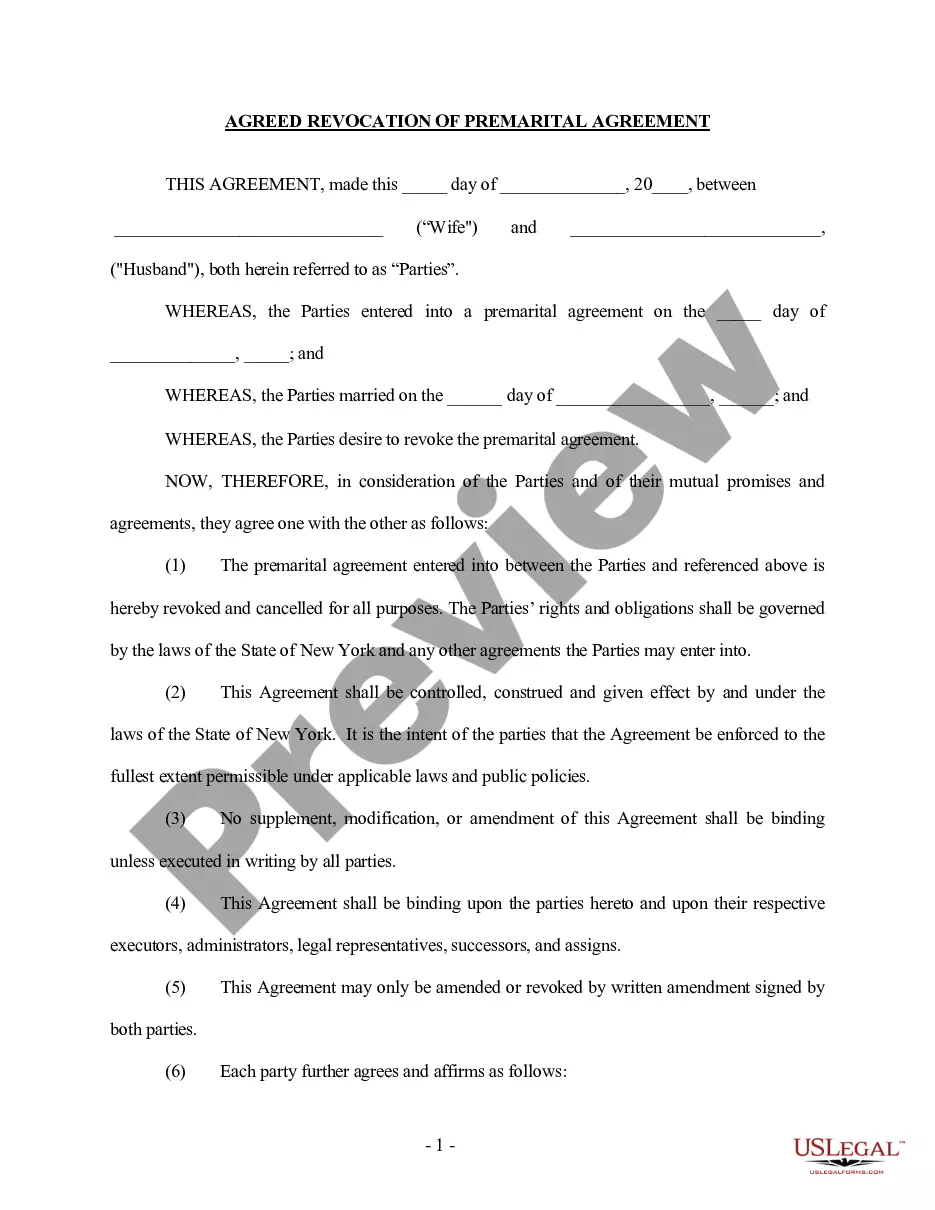

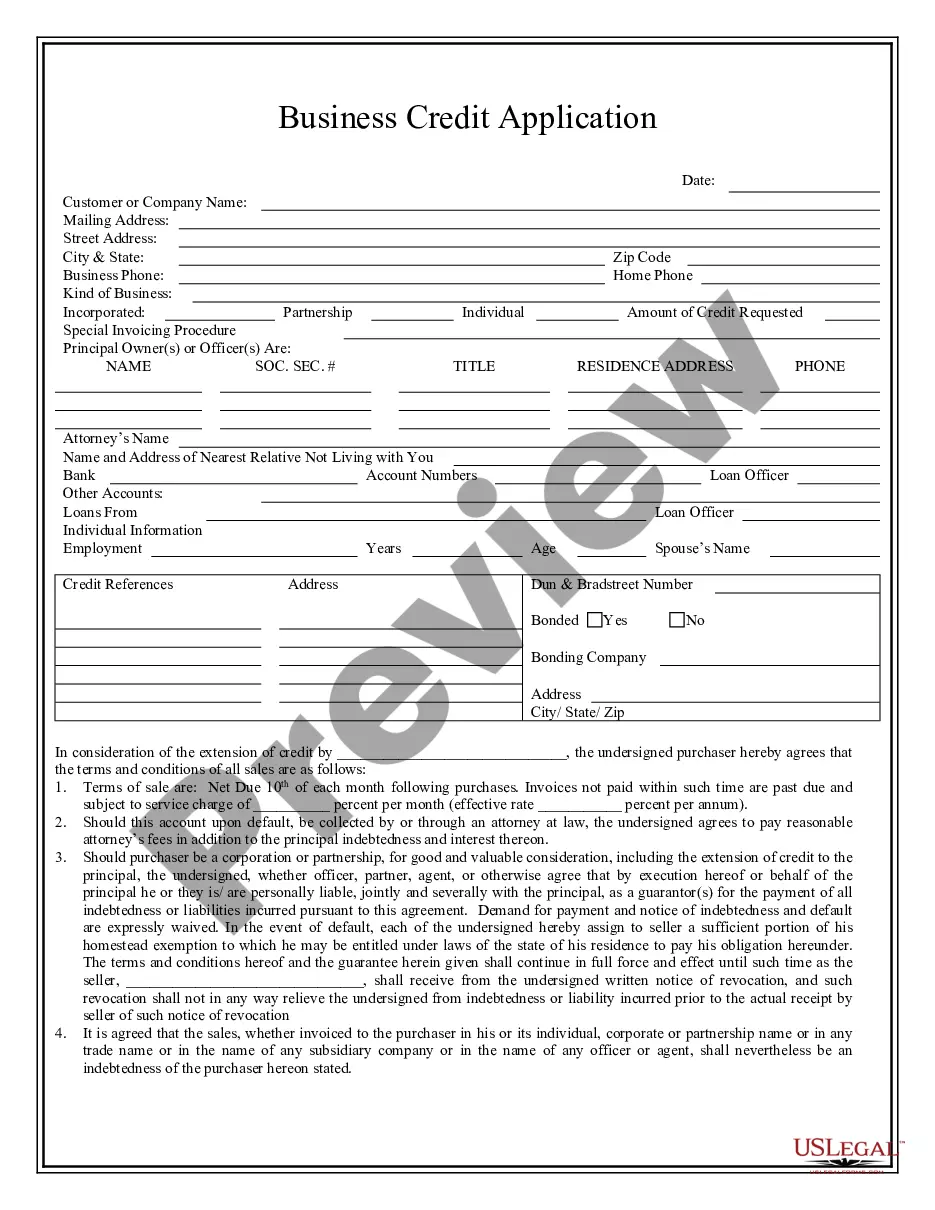

A Suffolk New York Prenuptial Premarital Agreement with Financial Statements, also known as a prenup, is a legal document that outlines the financial arrangements and provisions agreed upon by both parties before getting married or entering into a civil partnership. It serves to protect the assets and interests of each partner should their relationship end in divorce or separation. In Suffolk New York, there are different types of prenuptial agreements that individuals can consider based on their unique circumstances. Some of these variations may include: 1. Traditional Prenuptial Agreement: This is the most common type of prenup, which addresses the division of assets, debts, and spousal support in the event of a divorce or legal separation. It typically includes details on property ownership, retirement accounts, alimony, and the handling of joint finances. 2. Prenuptial Agreement with Business Assets: This type of prenup is specifically designed to protect the interests of individuals who own businesses or have significant ownership in a company. It outlines how the business or business assets will be treated during the division of assets in case of a divorce. 3. Prenuptial Agreement with Real Estate Assets: This type of prenup focuses on the division of real estate properties, such as houses, apartments, land, or vacation homes, in the event of a divorce. It ensures that both parties are aware of their rights and responsibilities regarding the real estate properties they own individually or jointly. 4. Prenuptial Agreement with Financial Statements: This type of prenup goes beyond just outlining the financial arrangements and provisions. It includes the submission of detailed financial statements from both parties, providing a thorough overview of their individual assets, debts, incomes, and expenditures. This transparency helps in creating a fair and equitable financial agreement. In Suffolk New York, it is essential to consult with an experienced family law attorney to ensure that your prenuptial agreement complies with the state's legal requirements. The attorney can assist in drafting a comprehensive document that protects the rights and interests of both parties while addressing individual financial circumstances and goals. Keywords: Suffolk New York, Prenuptial Agreement, Premarital Agreement, Financial Statements, Divorce, Separation, Assets, Debts, Spousal Support, Property Ownership, Retirement Accounts, Alimony, Joint Finances, Business Assets, Real Estate Assets, Family Law Attorney, Legal Requirements.

Suffolk New York Prenuptial Premarital Agreement with Financial Statements

Description

How to fill out Suffolk New York Prenuptial Premarital Agreement With Financial Statements?

No matter what social or professional status, filling out legal forms is an unfortunate necessity in today’s professional environment. Very often, it’s virtually impossible for a person with no legal background to create this sort of paperwork cfrom the ground up, mainly due to the convoluted jargon and legal subtleties they entail. This is where US Legal Forms comes to the rescue. Our service offers a huge library with over 85,000 ready-to-use state-specific forms that work for practically any legal case. US Legal Forms also is an excellent asset for associates or legal counsels who want to to be more efficient time-wise using our DYI tpapers.

Whether you need the Suffolk New York Prenuptial Premarital Agreement with Financial Statements or any other document that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how to get the Suffolk New York Prenuptial Premarital Agreement with Financial Statements in minutes using our trusted service. If you are presently an existing customer, you can go on and log in to your account to download the appropriate form.

Nevertheless, if you are unfamiliar with our platform, ensure that you follow these steps before downloading the Suffolk New York Prenuptial Premarital Agreement with Financial Statements:

- Be sure the form you have chosen is specific to your location because the rules of one state or county do not work for another state or county.

- Review the document and read a short outline (if available) of scenarios the document can be used for.

- If the one you picked doesn’t meet your requirements, you can start over and look for the suitable document.

- Click Buy now and pick the subscription plan that suits you the best.

- Log in to your account credentials or create one from scratch.

- Select the payment gateway and proceed to download the Suffolk New York Prenuptial Premarital Agreement with Financial Statements once the payment is completed.

You’re all set! Now you can go on and print the document or complete it online. If you have any problems getting your purchased forms, you can easily find them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.

Form popularity

FAQ

A prenuptial agreement does not cover the following: Child custody or visitation matters. Child support. Alimony in the event of a divorce. Day-to-day household matters. Anything prohibited by the law.

A prenup can also protect any income or assets that you earn during the marriage, as well as unearned income from a bequest or a trust distribution. Without a prenup, you may be required to pay alimony to your ex-spouse. However, with a prenup, you can predetermine a specific alimony amount or even eliminate it.

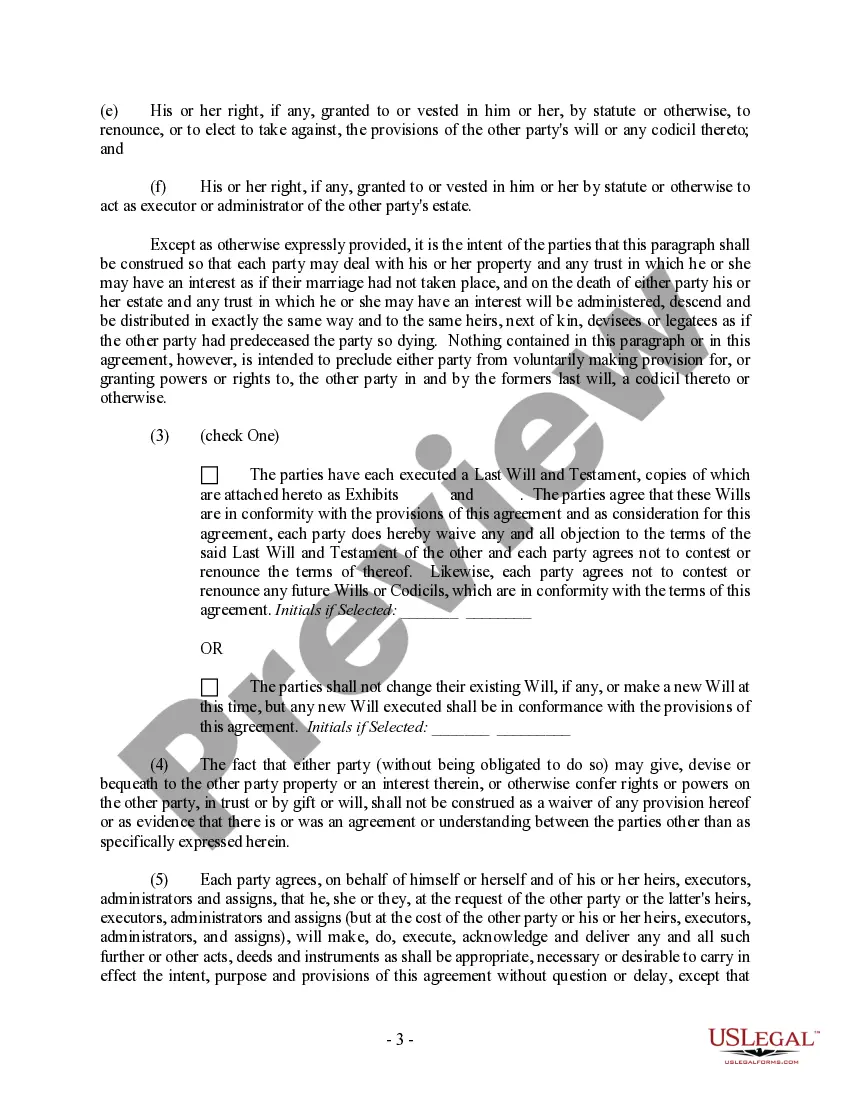

If the court examines a prenup and determines that the document itself seems suspect, or one of the parties presents evidence that the prenup was signed under threat or coercion, the court will deem it invalid. Additionally, both parties must have at least seven days to consider the terms of the prenup before signing.

In New York, a prenuptial agreement is made before marriage and will take effect as soon as the couple marries. Prenuptial agreements must be in writing and signed by both future spouses before a notary public. The court won't accept an oral antenuptial agreement or an unsigned agreement.

Prenuptial agreements must be in writing and signed by both future spouses before a notary public. The court won't accept an oral antenuptial agreement or an unsigned agreement. Whatever the circumstance, a prenuptial agreement can protect an individual's assets and simplify property division in a divorce.

Prenuptial agreements can't include terms that are considered unconscionable at the time it was signed. This includes provisions that unfairly indulge one spouse or excessively penalize one spouse.

Separate Attorneys ? you and your spouse should have separate attorneys if you are going to enter into a prenuptial agreement. If you do not have separate attorneys, the court will look at your prenuptial agreement more closely for unfairness and may not enforce the prenuptial agreement.

A: The cost of a prenup in NYC is a minimum fee$3,500 But if time/work exceeds 6 hours billed at $600 per hour.

Does A Prenup Protect Future Earnings? The short answer is yes, you can retain assets of your future earnings in a divorce if that condition has been outlined in your prenup.

Can You Write Your Own Prenup Agreement? The UPAA (California's Uniform Premarital Agreement Act) outlines the abilities and restrictions of prenups in this state. The law allows couples in California to draft their own prenuptial agreements.

Interesting Questions

More info

The only way you could get an order of protection isis to go to jail”. How to get an order of protection in a State, County or a City court. For those who live in a State like New York, there are some advantages associated with a formal prenup. It is easier to get an order, and there are more protections for prenups in this way. It is no longer necessary for both parties to be married to use legal or other means of protection for the children and the wife, but it is possible that both may be married even though they do not have a formal prenup. Prenuptial and postnuptial agreements. To understand what a prenup is, what it does and why it is important, you will have to review some basics of marriage and divorce legal theory and practice. If you want to make your own prenup, you can do it by filling out a prenuptial agreement, or by using a template. It is also possible to have an informal prenup based on family history or financial circumstances.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.