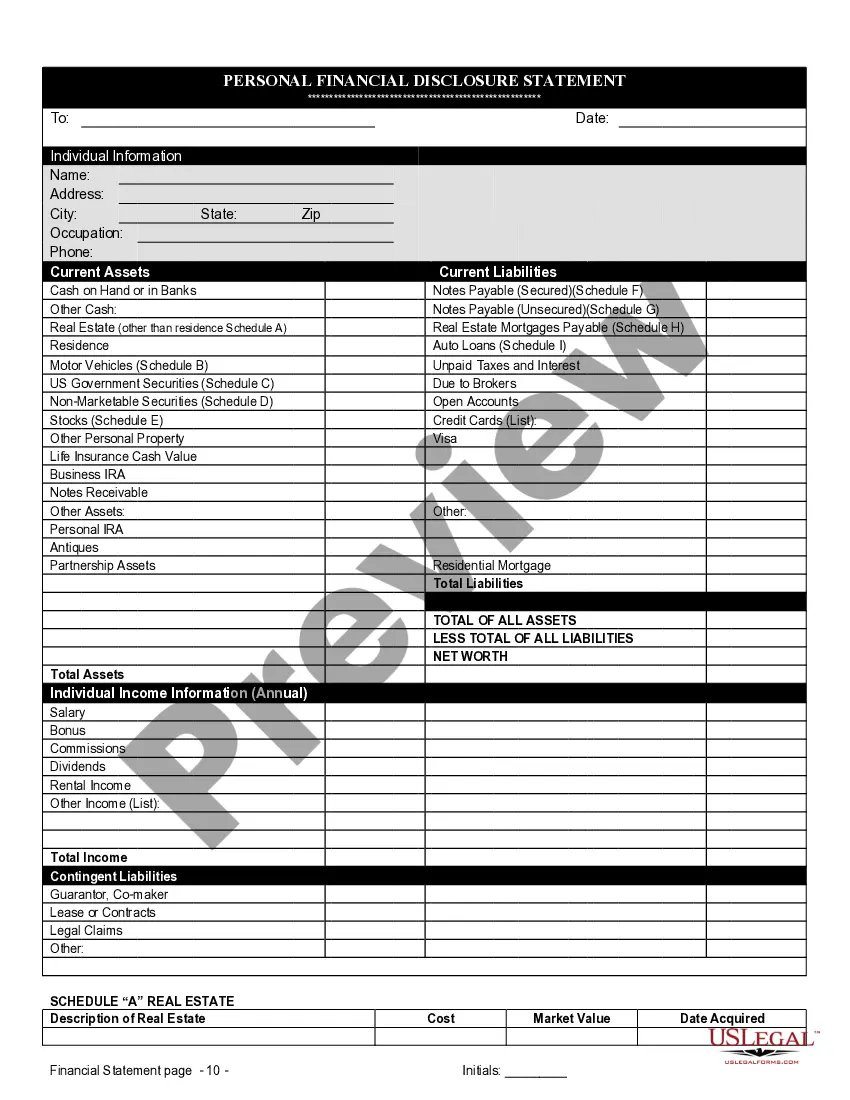

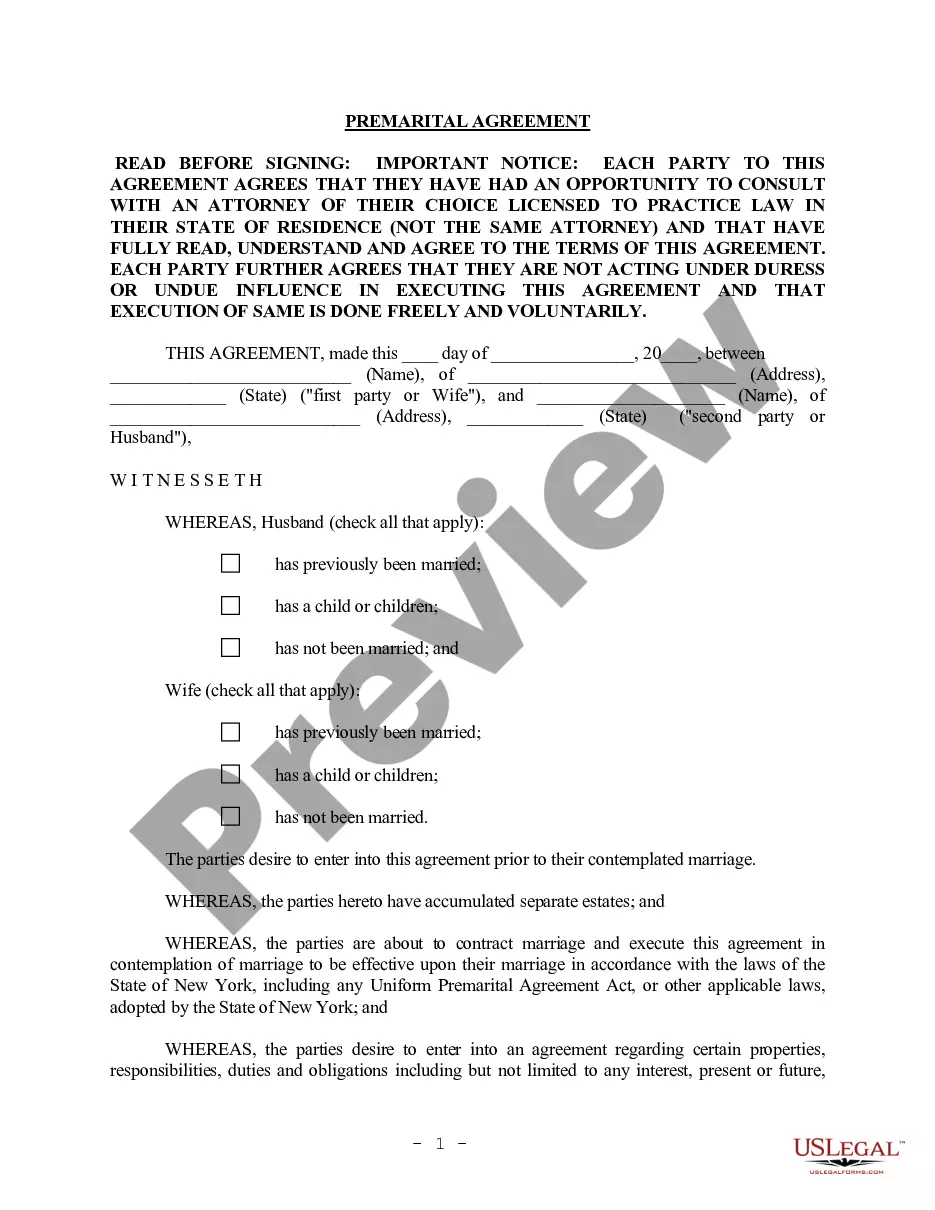

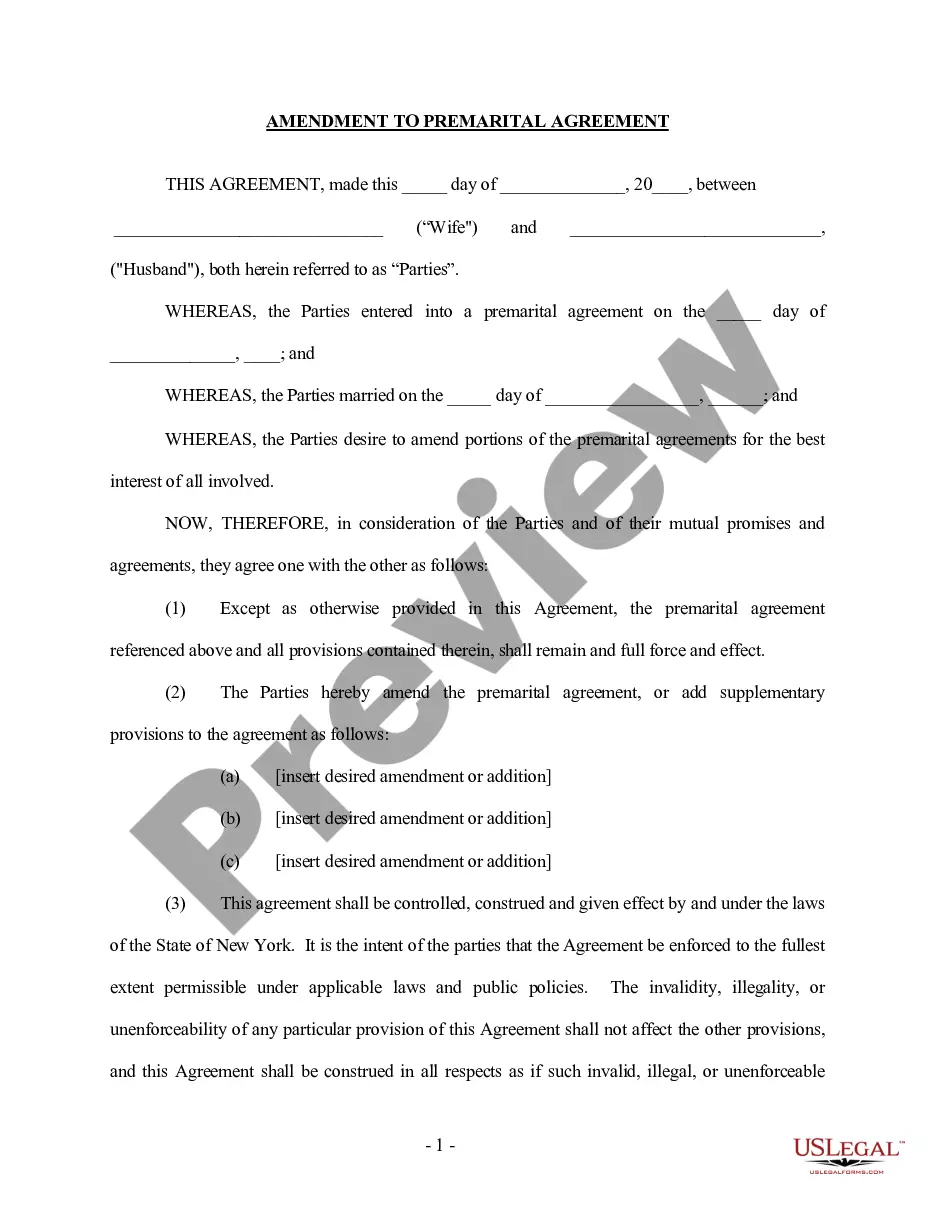

A Syracuse New York prenuptial premarital agreement with financial statements is a legally-binding contract that outlines the division of assets and property in the event of a divorce or separation. This document serves to protect the rights and interests of both parties involved before entering into a marriage or civil union. It is crucial for couples to consider drafting a prenuptial agreement to provide clarity and security regarding their financial future. In Syracuse, New York, there are various types of prenuptial premarital agreements with financial statements that individuals can choose from based on their specific needs and circumstances. Here are some of the different types: 1. Traditional Prenuptial Agreement: This is the most common type of premarital agreement, where couples outline the division of assets, debts, and spousal support in the event of a divorce or separation. It covers issues such as property rights, inheritances, business interests, and other financial matters. 2. Child Custody and Support Agreement: For couples who already have children or are planning to have children in the future, this type of agreement addresses child custody, visitation rights, and child support obligations. It ensures that the best interests of the child are considered and provides a clear plan for co-parenting responsibilities. 3. Business Protection Agreement: In cases where one or both parties own a business or have a substantial interest in a business, a business protection agreement can be included in the prenuptial agreement. This ensures that the business remains separate property and defines how it will be valued or divided in the event of a divorce. 4. Debt and Liability Agreement: This type of agreement addresses the division of debts and liabilities acquired during the marriage. It outlines how shared debts, such as mortgages, loans, or credit card debts, will be distributed in case of a separation. 5. Retirement and Investment Agreement: For couples with substantial retirement savings, investments, or other financial assets, this agreement clarifies how these assets will be divided in the event of a divorce or separation. It may include provisions regarding the division of retirement accounts, stocks, bonds, and other investment portfolios. Syracuse's residents considering a prenuptial premarital agreement with financial statements should consult with an experienced family law attorney to ensure that the agreement complies with New York state laws. These agreements require full financial disclosure from both parties, and the terms must be fair and reasonable to be enforceable. By creating a comprehensive prenuptial agreement, couples can establish a solid foundation and mitigate potential conflicts that may arise in the future, providing them with peace of mind as they embark on their marital journey.

Syracuse New York Prenuptial Premarital Agreement with Financial Statements

Description

How to fill out Syracuse New York Prenuptial Premarital Agreement With Financial Statements?

If you are searching for a valid form template, it’s impossible to find a better place than the US Legal Forms website – one of the most comprehensive libraries on the web. Here you can get a large number of templates for organization and individual purposes by types and regions, or keywords. Using our advanced search feature, getting the most recent Syracuse New York Prenuptial Premarital Agreement with Financial Statements is as easy as 1-2-3. Furthermore, the relevance of every document is verified by a group of expert attorneys that on a regular basis check the templates on our platform and update them based on the most recent state and county demands.

If you already know about our system and have a registered account, all you should do to receive the Syracuse New York Prenuptial Premarital Agreement with Financial Statements is to log in to your profile and click the Download option.

If you make use of US Legal Forms the very first time, just follow the instructions below:

- Make sure you have chosen the form you need. Look at its explanation and make use of the Preview feature (if available) to check its content. If it doesn’t meet your requirements, utilize the Search field at the top of the screen to discover the needed file.

- Affirm your selection. Select the Buy now option. Following that, pick the preferred subscription plan and provide credentials to sign up for an account.

- Make the financial transaction. Make use of your credit card or PayPal account to complete the registration procedure.

- Receive the template. Choose the file format and save it to your system.

- Make modifications. Fill out, modify, print, and sign the acquired Syracuse New York Prenuptial Premarital Agreement with Financial Statements.

Every single template you save in your profile has no expiry date and is yours permanently. It is possible to gain access to them via the My Forms menu, so if you need to receive an extra version for editing or printing, you may come back and save it once again at any time.

Take advantage of the US Legal Forms extensive collection to get access to the Syracuse New York Prenuptial Premarital Agreement with Financial Statements you were looking for and a large number of other professional and state-specific samples in one place!