Queens New York Registration of Foreign Corporation

Description

How to fill out New York Registration Of Foreign Corporation?

Irrespective of social or professional standing, filling out legal documents is an unfortunate requirement in today's society.

Frequently, it’s nearly unattainable for an individual lacking legal training to create such documents independently, primarily due to the intricate language and legal subtleties they contain.

This is where US Legal Forms steps in to assist.

Confirm that the template you have chosen is tailored to your location since the laws of one state or region do not apply to another.

Review the document and examine a brief summary (if available) of scenarios for which the document can be utilized.

- Our service provides a vast collection of over 85,000 state-specific templates suitable for nearly any legal matter.

- US Legal Forms is also an excellent asset for associates or legal advisors aiming to enhance their efficiency with our DIY forms.

- Regardless of whether you need the Queens New York Registration of Foreign Corporation or any other document recognized in your state or region, US Legal Forms has everything accessible.

- Here's how to swiftly acquire the Queens New York Registration of Foreign Corporation utilizing our reliable service.

- If you are currently a subscriber, feel free to Log In to your account to access the required form.

- However, if you're new to our platform, be sure to follow these instructions before acquiring the Queens New York Registration of Foreign Corporation.

Form popularity

FAQ

To register a foreign business in the US, you need to file the appropriate paperwork with the state where you plan to operate. Specifically, for Queens New York Registration of Foreign Corporation, complete the application and submit it along with any required fees to the New York Department of State. Make sure you have a registered agent in New York who can receive legal documents on behalf of your business. Using platforms like US Legal Forms can simplify this process, providing you with the necessary forms and guidance to ensure compliance.

You can check if a company is legally registered in New York through the New York State Division of Corporations' online database. This tool allows you to search for corporations by name, providing you with essential details about their registration status. Utilizing the Queens New York Registration of Foreign Corporation information can help you verify a company's legitimacy before engaging in business. For a more comprehensive search, you may also consider using services like uslegalforms, which can streamline the process.

Yes, a foreign corporation must register in New York to conduct business legally in the state. This process ensures that your corporation complies with local laws, protects your interests, and establishes your credibility. The Queens New York Registration of Foreign Corporation is an essential step for any business planning to operate in this vibrant marketplace. By registering, you also gain access to various business resources and networking opportunities.

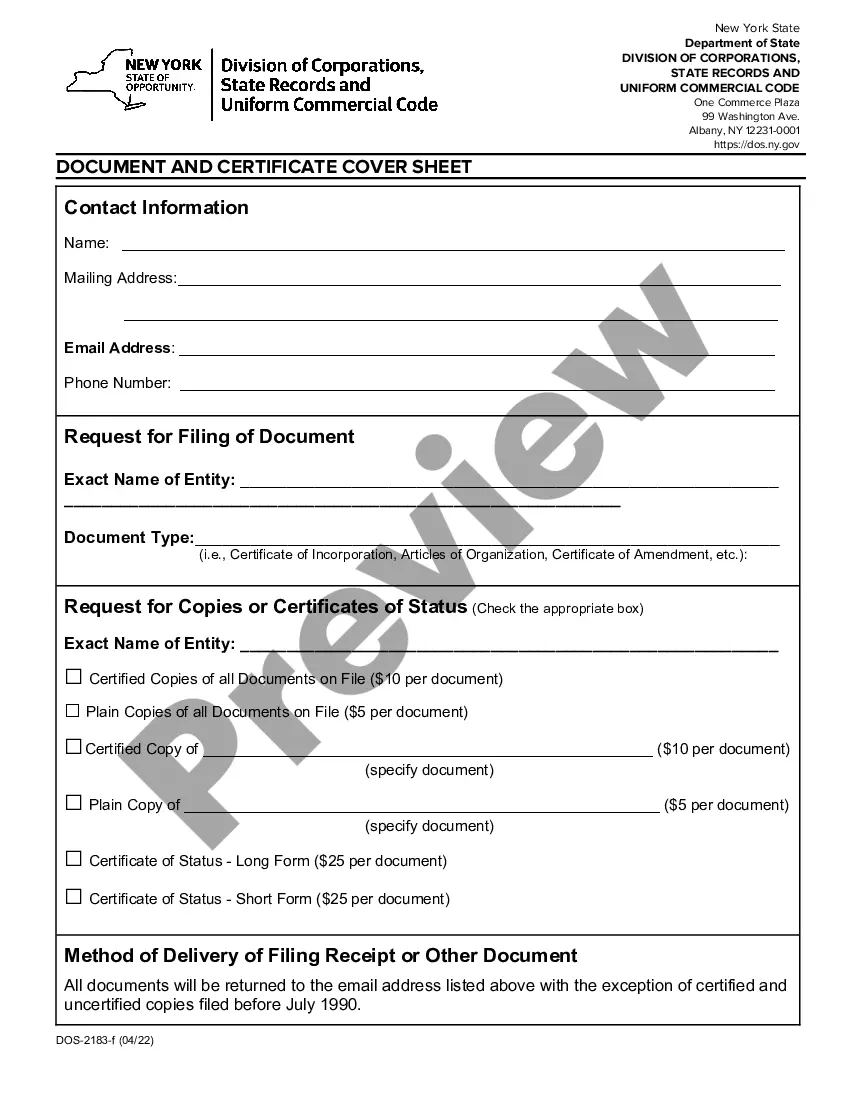

Registering a foreign corporation in New York requires submitting an application for a Certificate of Authority and including necessary documentation, such as a certificate of good standing from your home state. This process is essential for the Queens New York Registration of Foreign Corporation, enabling your business to engage in commerce legally in the state. Consider leveraging services like USLegalForms to help ensure you meet all legal criteria, making the registration smooth and efficient.

To register as a foreign entity in New York, you must first obtain a Certificate of Authority from the New York Department of State. This involves submitting an application along with the appropriate fees and supporting documents. The process is a crucial step in the Queens New York Registration of Foreign Corporation, allowing your business to operate legally within the state. Utilizing platforms like USLegalForms can streamline this procedure, ensuring you meet all requirements efficiently.

In New York, foreign LLCs must fulfill a publication requirement to complete the registration process. This involves publishing a notice in two local newspapers for six consecutive weeks, informing the public of the LLC's registration. Such a requirement is integral to the Queens New York Registration of Foreign Corporation, ensuring transparency and adherence to local laws. By following this guideline, you strengthen your LLC's compliance and credibility in New York.

The 1304 BCL refers to a section of the New York Business Corporation Law that outlines the requirements for foreign corporations wishing to conduct business in the state. This section provides essential guidelines for the Queens New York Registration of Foreign Corporation, ensuring compliance with local regulations. By understanding the 1304 BCL, you can smoothly navigate the registration process, minimizing potential setbacks. It is vital for foreign entities to adhere to these guidelines to operate legally in New York.