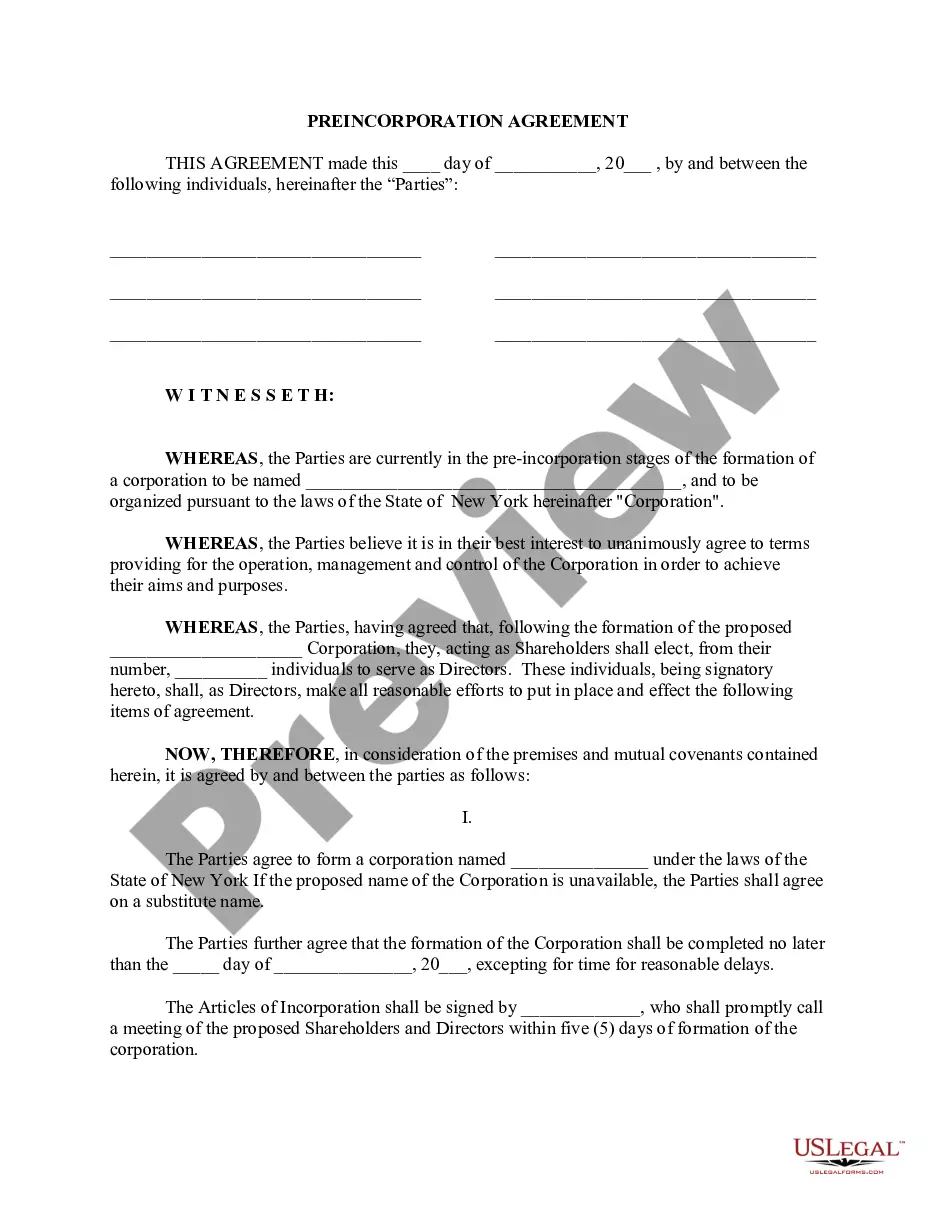

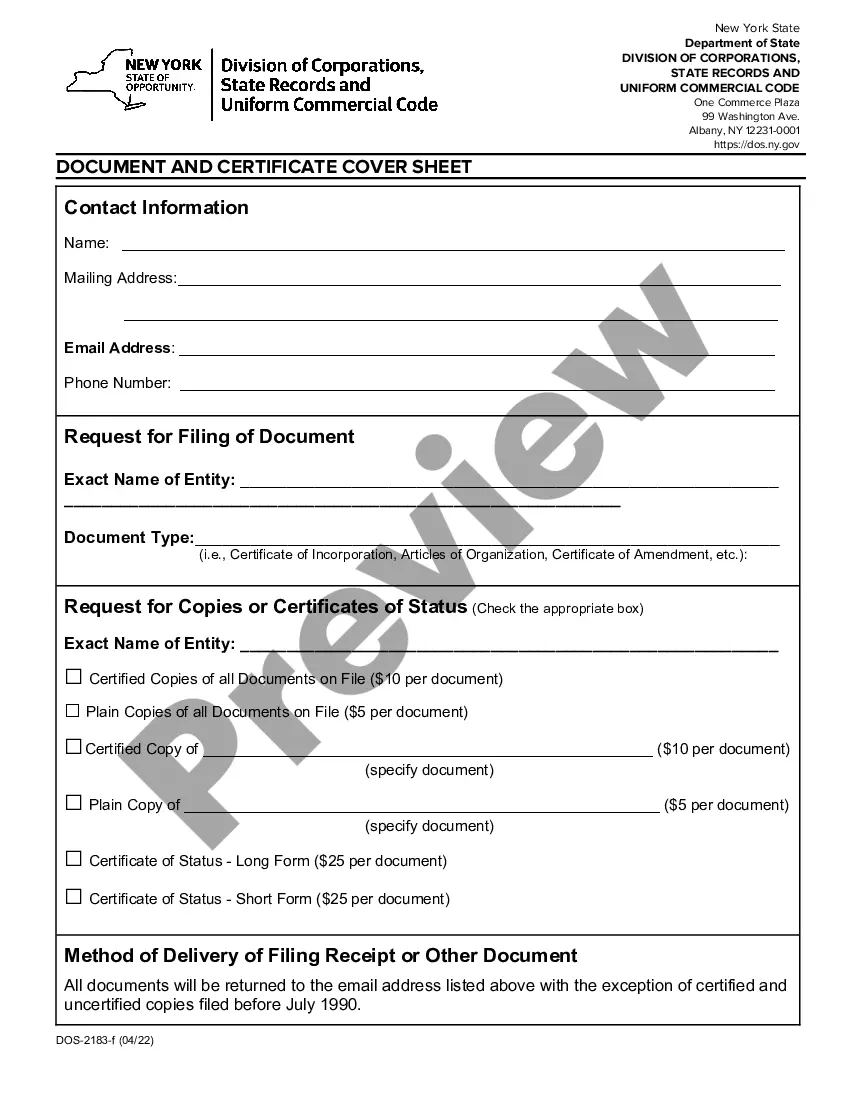

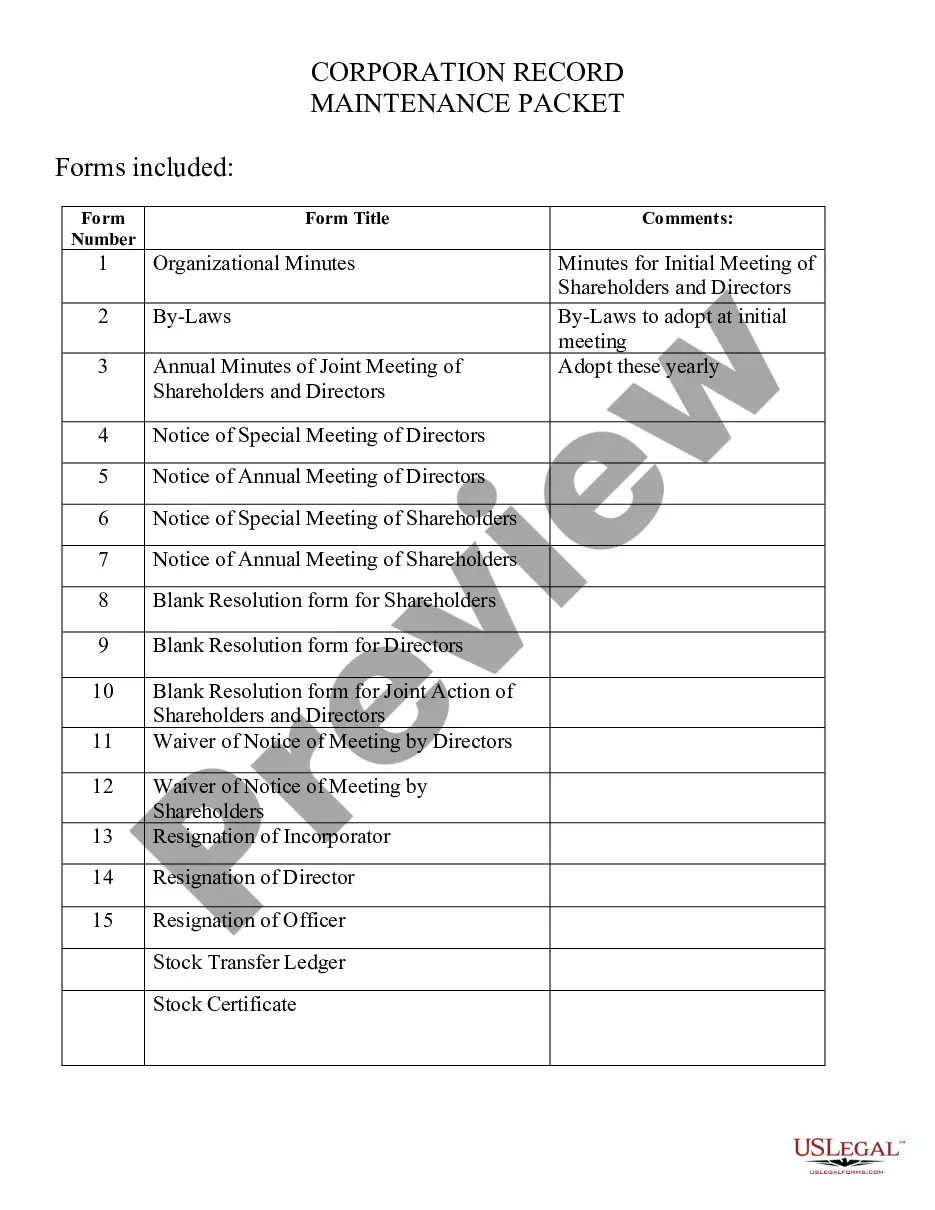

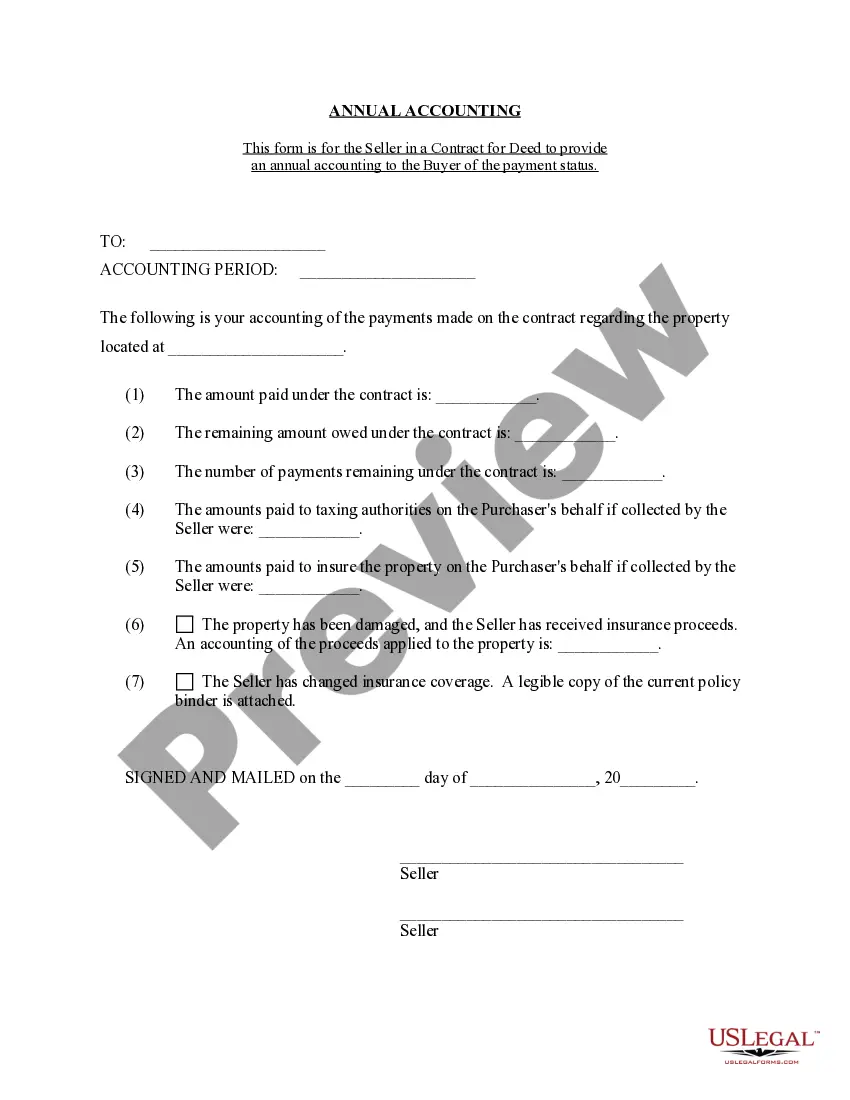

Kings Professional Corporation offers a comprehensive package specifically designed for businesses and individuals in New York. With our expertise in the field of corporate law and our deep understanding of the legal landscape in New York, we provide a range of services to cater to the specific needs of our clients. Our New York Professional Corporation Package includes a variety of services that aim to establish and maintain a strong legal foundation for our clients. These services encompass legal consultation, structuring and registration of new professional corporations, compliance with state regulations and requirements, as well as ongoing support and advisory services. One of the key features of our package is legal consultation. Our team of experienced attorneys specializing in corporate law in New York provides in-depth guidance and advice on the best strategies to establish and manage professional corporations. We ensure that our clients have a clear understanding of the legal requirements and obligations they need to fulfill to operate their businesses in compliance with state regulations. Another crucial aspect of our package is the structuring and registration of new professional corporations. We assist our clients in determining the most suitable legal structure for their businesses, whether it be a limited liability company (LLC), partnership, or sole proprietorship. We handle all the necessary paperwork and filings to register the professional corporation with the appropriate New York state authorities. Compliance with state regulations is of utmost importance when operating a professional corporation in New York. Our package includes ongoing support to ensure our clients remain compliant with all the legal obligations, such as maintaining the necessary licenses and permits, filing annual reports, and fulfilling tax obligations. Our team stays up-to-date with the latest changes in the legal landscape, providing our clients with the peace of mind that their businesses are always in good standing. Additionally, we offer advisory services to address any legal challenges or concerns that may arise during the course of operating a professional corporation in New York. Our attorneys have a deep understanding of the intricacies of the local legal system and can provide tailored solutions to protect our clients' interests and mitigate any potential risks. In summary, Kings Professional Corporation Package for New York is a comprehensive suite of services aimed at establishing and maintaining a solid legal foundation for businesses and individuals in the state. It includes legal consultation, structuring and registration of professional corporations, compliance support, and ongoing advisory services. Our team of experienced attorneys ensures that our clients receive the highest level of expertise and guidance to navigate the complex legal landscape in New York.

Kings Professional Corporation offers a comprehensive package specifically designed for businesses and individuals in New York. With our expertise in the field of corporate law and our deep understanding of the legal landscape in New York, we provide a range of services to cater to the specific needs of our clients. Our New York Professional Corporation Package includes a variety of services that aim to establish and maintain a strong legal foundation for our clients. These services encompass legal consultation, structuring and registration of new professional corporations, compliance with state regulations and requirements, as well as ongoing support and advisory services. One of the key features of our package is legal consultation. Our team of experienced attorneys specializing in corporate law in New York provides in-depth guidance and advice on the best strategies to establish and manage professional corporations. We ensure that our clients have a clear understanding of the legal requirements and obligations they need to fulfill to operate their businesses in compliance with state regulations. Another crucial aspect of our package is the structuring and registration of new professional corporations. We assist our clients in determining the most suitable legal structure for their businesses, whether it be a limited liability company (LLC), partnership, or sole proprietorship. We handle all the necessary paperwork and filings to register the professional corporation with the appropriate New York state authorities. Compliance with state regulations is of utmost importance when operating a professional corporation in New York. Our package includes ongoing support to ensure our clients remain compliant with all the legal obligations, such as maintaining the necessary licenses and permits, filing annual reports, and fulfilling tax obligations. Our team stays up-to-date with the latest changes in the legal landscape, providing our clients with the peace of mind that their businesses are always in good standing. Additionally, we offer advisory services to address any legal challenges or concerns that may arise during the course of operating a professional corporation in New York. Our attorneys have a deep understanding of the intricacies of the local legal system and can provide tailored solutions to protect our clients' interests and mitigate any potential risks. In summary, Kings Professional Corporation Package for New York is a comprehensive suite of services aimed at establishing and maintaining a solid legal foundation for businesses and individuals in the state. It includes legal consultation, structuring and registration of professional corporations, compliance support, and ongoing advisory services. Our team of experienced attorneys ensures that our clients receive the highest level of expertise and guidance to navigate the complex legal landscape in New York.