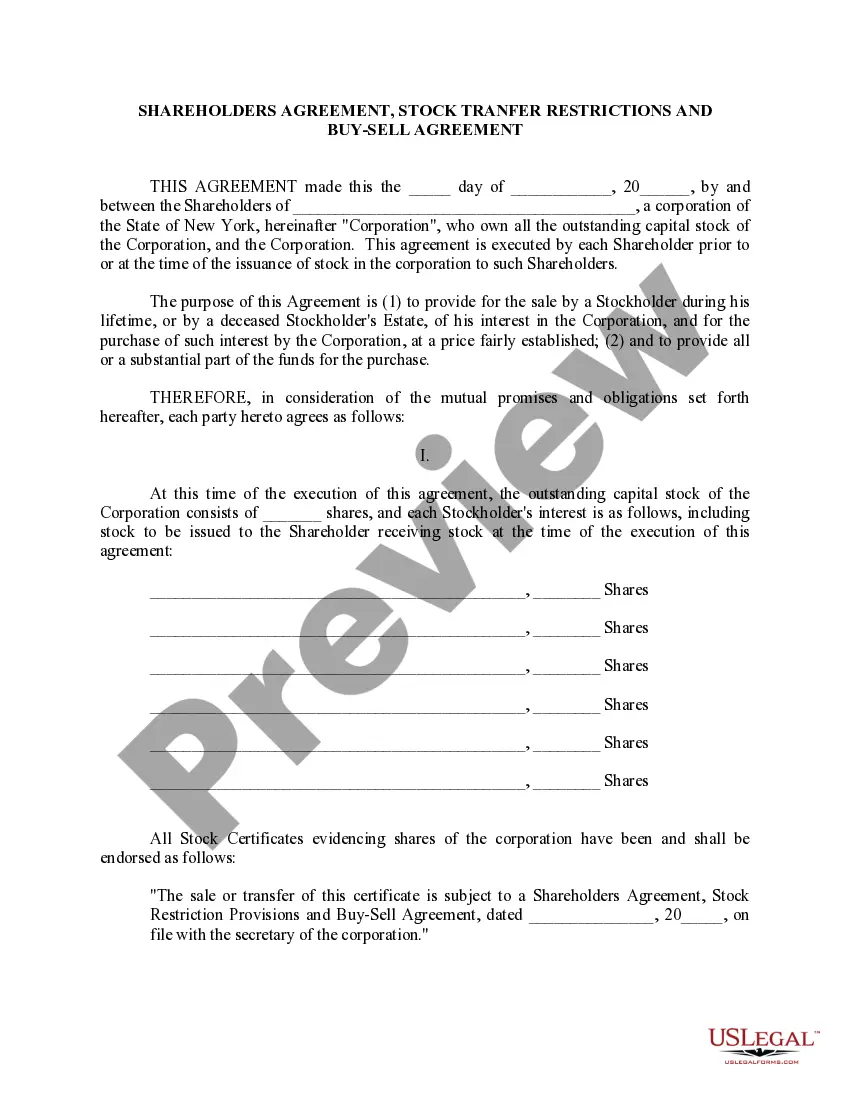

The Shareholders Agreement is signed by the shareholders to agree on how the shares of a deceased shareholder may be purchased and how shares of a person who desires to sell their stock may be obtained by the other shareholders or the corporation. Restrictions on the Sale of stock are included to accomplish the goals of the shareholders to keep the corporation under the control of the existing shareholders.

The Confidentiality Agreement is made between the shareholders wherein they agree to keep confidential certain corporate matters. Nassau New York Pre-Incorporation Agreement: A Nassau New York Pre-Incorporation Agreement refers to a legal agreement signed between individuals or parties who are planning to establish a corporation in Nassau, New York. This agreement outlines the terms and conditions agreed upon by the potential shareholders of the future corporation before its formal incorporation. The purpose of this agreement is to define each party's rights, responsibilities, and obligations during the pre-incorporation phase. The agreement usually covers various aspects such as the business objective, initial capital contributions, division of shares, management structure, and potential liabilities. Nassau New York Shareholders Agreement: A Nassau New York Shareholders Agreement is a critical legal document that lays out the rules, regulations, and rights of individuals or entities who hold shares in a corporation based in Nassau, New York. This agreement outlines the relationship and responsibilities between shareholders and the corporation, including voting rights, dividend distribution, transfer of shares, shareholder disputes, and exit strategies. Different types of Nassau New York Shareholders Agreements may include provisions for preferred shareholders, minority shareholder protection, drag-along or tag-along rights, anti-dilution provisions, or shareholder buyback options. Nassau New York Confidentiality Agreement: A Nassau New York Confidentiality Agreement, also known as a non-disclosure agreement (NDA), is a legally binding contract that safeguards confidential and proprietary information shared between parties located in Nassau, New York. This agreement ensures that sensitive information, such as trade secrets, financial data, business strategies, or customer information, remains confidential and protected from unauthorized disclosure or use. It establishes the obligations and responsibilities of the involved parties to maintain the confidentiality of the shared information. Different types of Nassau New York Confidentiality Agreements may include unilateral NDAs (one party disclosing), mutual NDAs (both parties disclosing), or specific industry-focused NDAs. Keywords: Nassau New York, Pre-Incorporation Agreement, Shareholders Agreement, Confidentiality Agreement, corporation, legal, shareholders, rights, obligations, rules, regulations, voting rights, dividend distribution, transfer of shares, shareholder disputes, exit strategies, preferred shareholders, minority shareholder protection, drag-along rights, tag-along rights, anti-dilution provisions, shareholder buyback options, non-disclosure agreement, NDA, sensitive information, trade secrets, financial data, business strategies, customer information, confidentiality

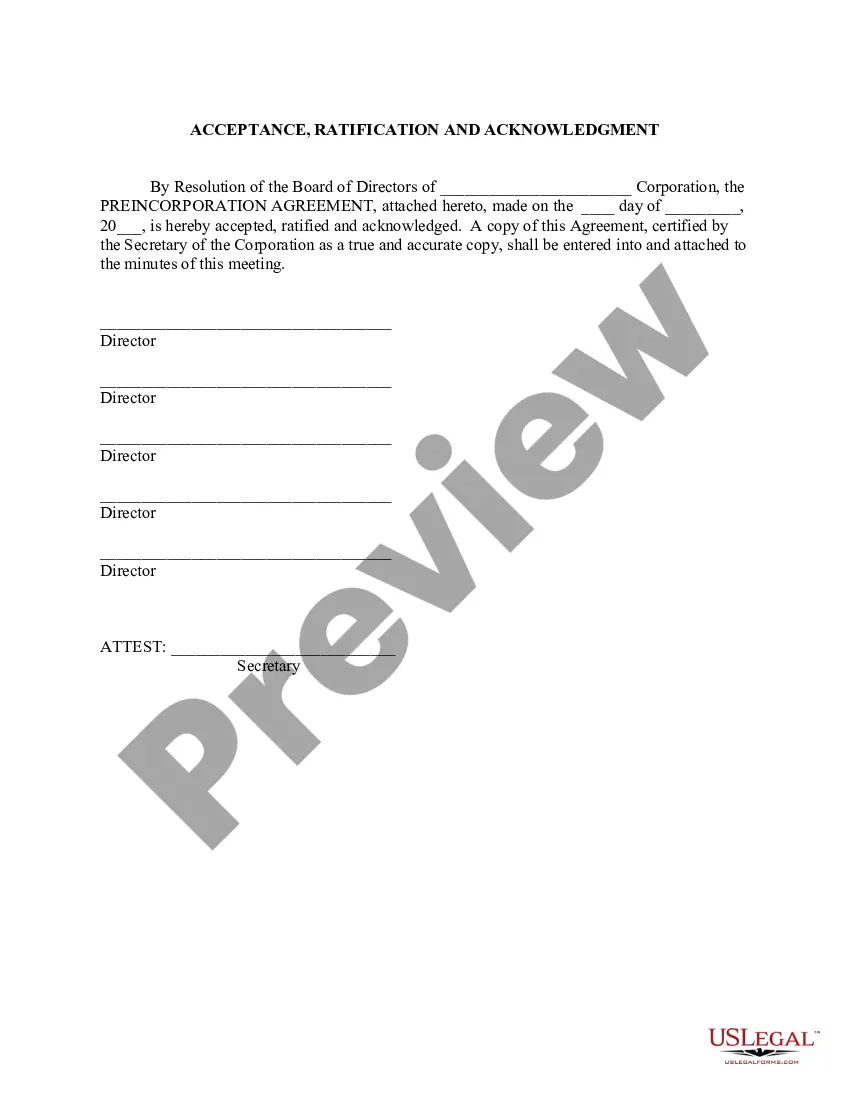

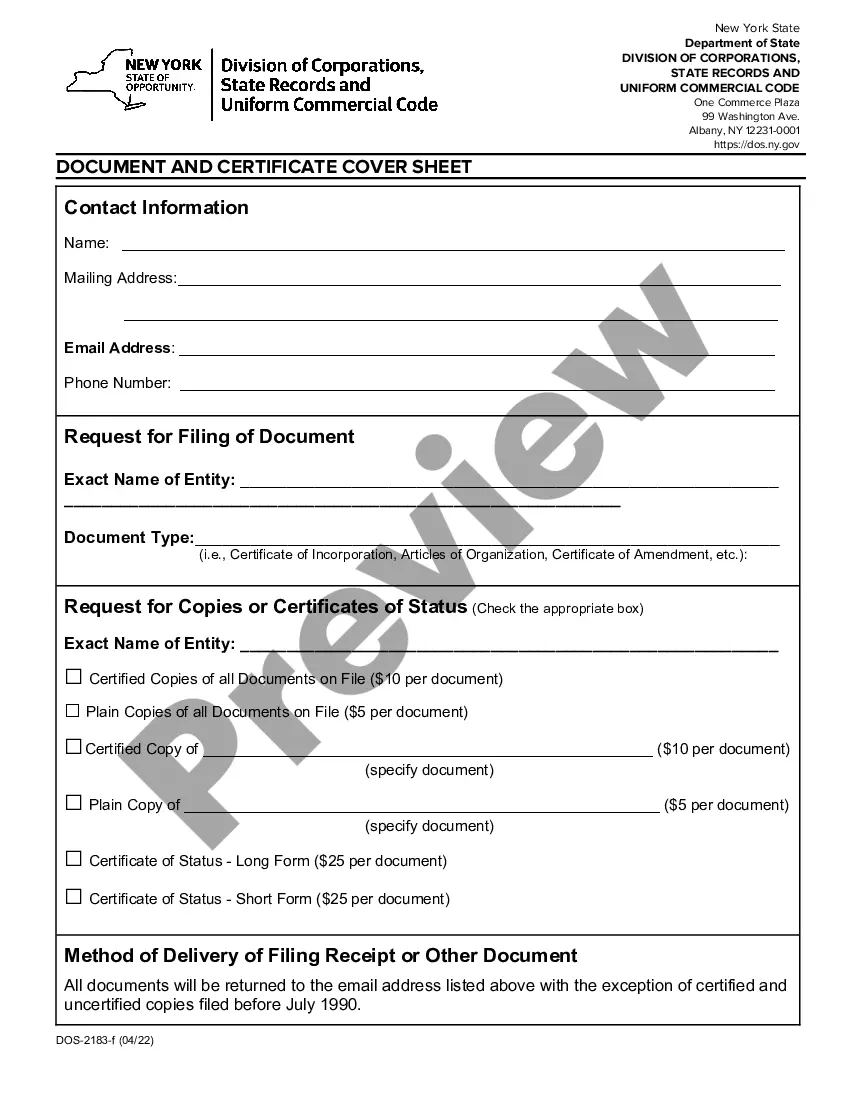

Nassau New York Pre-Incorporation Agreement: A Nassau New York Pre-Incorporation Agreement refers to a legal agreement signed between individuals or parties who are planning to establish a corporation in Nassau, New York. This agreement outlines the terms and conditions agreed upon by the potential shareholders of the future corporation before its formal incorporation. The purpose of this agreement is to define each party's rights, responsibilities, and obligations during the pre-incorporation phase. The agreement usually covers various aspects such as the business objective, initial capital contributions, division of shares, management structure, and potential liabilities. Nassau New York Shareholders Agreement: A Nassau New York Shareholders Agreement is a critical legal document that lays out the rules, regulations, and rights of individuals or entities who hold shares in a corporation based in Nassau, New York. This agreement outlines the relationship and responsibilities between shareholders and the corporation, including voting rights, dividend distribution, transfer of shares, shareholder disputes, and exit strategies. Different types of Nassau New York Shareholders Agreements may include provisions for preferred shareholders, minority shareholder protection, drag-along or tag-along rights, anti-dilution provisions, or shareholder buyback options. Nassau New York Confidentiality Agreement: A Nassau New York Confidentiality Agreement, also known as a non-disclosure agreement (NDA), is a legally binding contract that safeguards confidential and proprietary information shared between parties located in Nassau, New York. This agreement ensures that sensitive information, such as trade secrets, financial data, business strategies, or customer information, remains confidential and protected from unauthorized disclosure or use. It establishes the obligations and responsibilities of the involved parties to maintain the confidentiality of the shared information. Different types of Nassau New York Confidentiality Agreements may include unilateral NDAs (one party disclosing), mutual NDAs (both parties disclosing), or specific industry-focused NDAs. Keywords: Nassau New York, Pre-Incorporation Agreement, Shareholders Agreement, Confidentiality Agreement, corporation, legal, shareholders, rights, obligations, rules, regulations, voting rights, dividend distribution, transfer of shares, shareholder disputes, exit strategies, preferred shareholders, minority shareholder protection, drag-along rights, tag-along rights, anti-dilution provisions, shareholder buyback options, non-disclosure agreement, NDA, sensitive information, trade secrets, financial data, business strategies, customer information, confidentiality