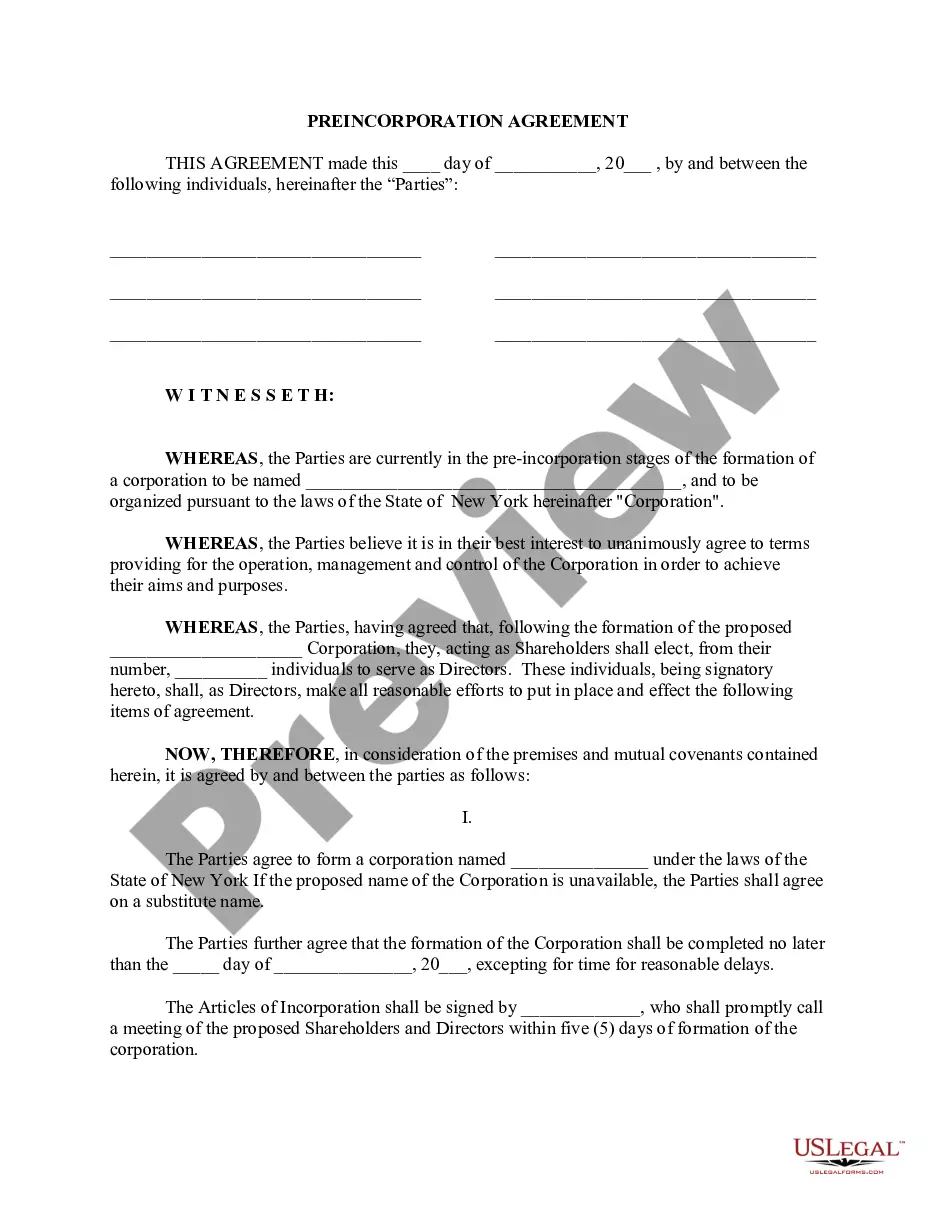

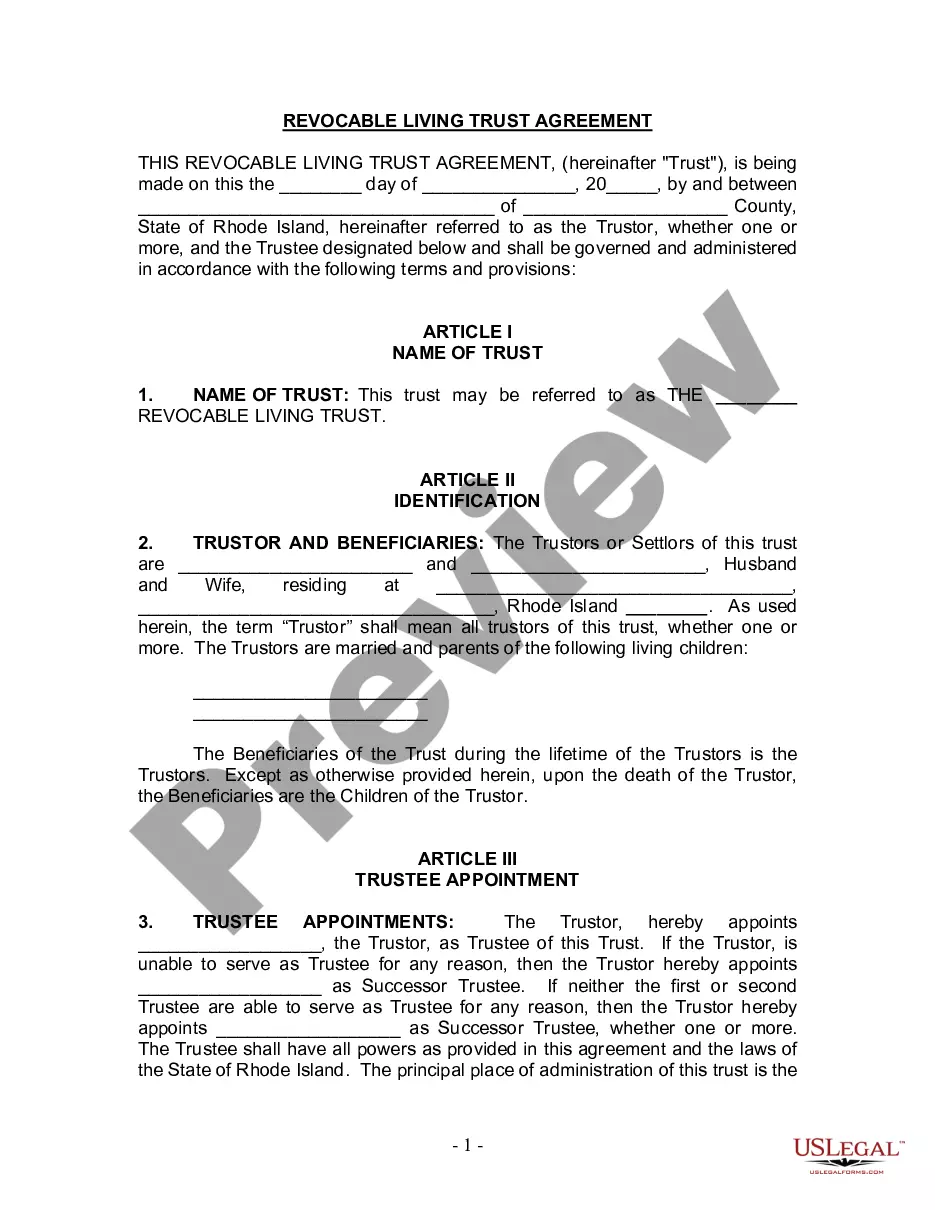

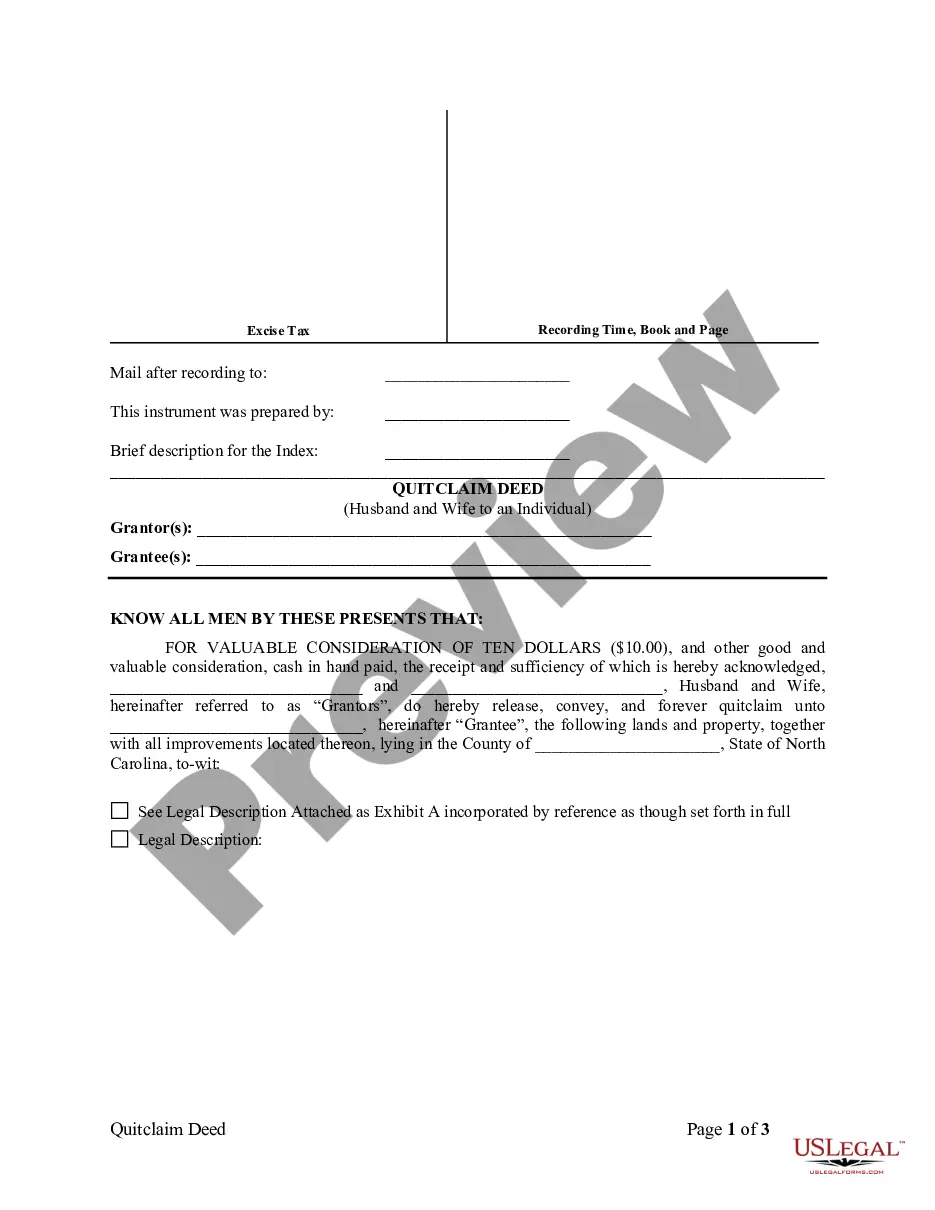

Bronx New York Articles of Incorporation Certificate — NonprofiCorporationio— - Tax Exempt The Bronx New York Articles of Incorporation Certificate is a legal document that serves as official proof of the formation and existence of a nonprofit corporation within the Bronx, New York. This certificate is essential for nonprofits seeking tax-exempt status from the Internal Revenue Service (IRS). To apply for this certificate, nonprofit organizations in the Bronx must fulfill specific requirements and follow a rigorous process. The following are the key details and steps to obtain the Bronx New York Articles of Incorporation Certificate for a nonprofit corporation seeking tax-exempt status: 1. Nonprofit Corporation Formation: The organization must first establish itself as a nonprofit corporation by completing the necessary paperwork, including drafting the articles of incorporation. These articles define the nonprofit's purpose, structure, and operational guidelines. 2. Bronx New York Articles of Incorporation: After the nonprofit corporation is established, the next step is to file the "Articles of Incorporation" with the New York Secretary of State. These articles officially document the nonprofit's legal existence and include details such as the organization's name, purpose, registered agent, and initial board of directors. 3. Tax-Exempt Status: Once the nonprofit corporation receives confirmation of its incorporation from the state, it can apply for federal tax-exempt status with the IRS. This status grants the organization exemption from certain federal tax obligations and allows donors to claim deductions for their contributions. Types of Bronx New York Articles of Incorporation Certificate — NonprofiCorporationio— - Tax Exempt: 1. 501(c)(3) Public Charity: One type of Bronx New York Articles of Incorporation Certificate is issued to nonprofits seeking tax-exempt status under the IRS section 501(c)(3). These organizations primarily operate for charitable, educational, religious, scientific, literary, or humanitarian purposes. Donors to such nonprofits may receive tax deductions on their contributions. 2. 501(c)(4) Social Welfare Organization: Another type of Bronx New York Articles of Incorporation Certificate may be issued to nonprofits seeking tax-exempt status under the IRS section 501(c)(4). These organizations primarily work for the improvement of the community's social and welfare conditions. While donations to 501(c)(4) organizations are not tax-deductible, they enjoy certain exemptions, including limited political campaign involvement. 3. 501(c)(6) Business League: Bronx New York Articles of Incorporation Certificate for nonprofits seeking tax-exempt status as a 501(c)(6) organization is geared towards business leagues, chambers of commerce, real estate boards, and professional associations. These organizations promote the common interests of their members and may engage in lobbying activities. Donations to 501(c)(6) organizations are generally not tax-deductible. In summary, the Bronx New York Articles of Incorporation Certificate for a nonprofit corporation seeking tax-exempt status is a crucial document that establishes the nonprofit's legal existence and eligibility for tax benefits. Nonprofits can pursue different types of tax-exempt status based on their mission and purpose, such as 501(c)(3) public charity, 501(c)(4) social welfare organization, or 501(c)(6) business league.

Bronx New York Articles of Incorporation Certificate - Nonprofit Corporation - Tax Exempt

Description

How to fill out Bronx New York Articles Of Incorporation Certificate - Nonprofit Corporation - Tax Exempt?

Take advantage of the US Legal Forms and have immediate access to any form you want. Our helpful platform with a large number of documents makes it simple to find and get virtually any document sample you want. You can export, fill, and certify the Bronx New York Articles of Incorporation Certificate - Nonprofit Corporation - Tax Exempt in just a matter of minutes instead of browsing the web for several hours searching for the right template.

Using our collection is a wonderful way to raise the safety of your document filing. Our experienced attorneys on a regular basis review all the documents to make sure that the templates are relevant for a particular region and compliant with new laws and polices.

How can you get the Bronx New York Articles of Incorporation Certificate - Nonprofit Corporation - Tax Exempt? If you already have a subscription, just log in to the account. The Download option will be enabled on all the documents you view. Moreover, you can get all the previously saved documents in the My Forms menu.

If you haven’t registered an account yet, follow the tips listed below:

- Open the page with the template you require. Make sure that it is the form you were hoping to find: check its title and description, and utilize the Preview option when it is available. Otherwise, make use of the Search field to find the needed one.

- Start the saving procedure. Click Buy Now and choose the pricing plan you like. Then, create an account and process your order utilizing a credit card or PayPal.

- Download the file. Choose the format to obtain the Bronx New York Articles of Incorporation Certificate - Nonprofit Corporation - Tax Exempt and revise and fill, or sign it according to your requirements.

US Legal Forms is probably the most significant and reliable template libraries on the web. We are always happy to assist you in virtually any legal procedure, even if it is just downloading the Bronx New York Articles of Incorporation Certificate - Nonprofit Corporation - Tax Exempt.

Feel free to take full advantage of our form catalog and make your document experience as efficient as possible!

Form popularity

FAQ

New York's Department of State, Division of Corporations charges a $75 filing fee for nonprofit Articles of Incorporation. A name reservation fee is $10. A certificate of type fee is $30.

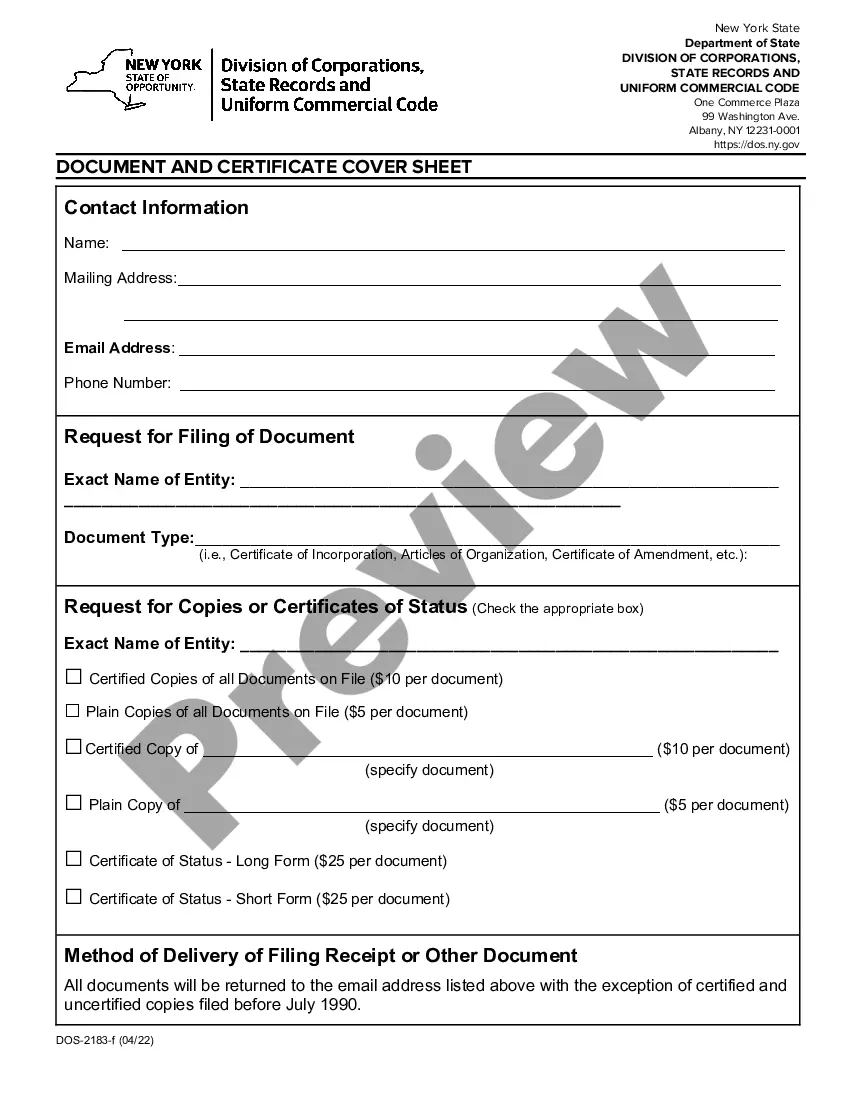

Copies of any documents filed with the Department of State's Division of Corporations may be obtained by submitting a written request to the New York State Department of State, Division of Corporations, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231.

How to Form a New York Nonprofit Corporation Choose directors for your nonprofit. Choose a name for your nonprofit. Appoint a registered agent. File New York nonprofit Articles of Organization. Prepare nonprofit bylaws. Hold a meeting of your board of directors. Obtain an employer identification number (EIN).

Copies of any documents filed with the Department of State's Division of Corporations may be obtained by submitting a written request to the New York State Department of State, Division of Corporations, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231.

The completed Certificate of Incorporation, together with the statutory filing fee of $75, should be forwarded to: Department of State, Division of Corporations, State Records and Uniform Commercial Code, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231.

Articles of organization (known as certificate of formation in other jurisdictions) to form a New York limited liability company (LLC). This Standard Document contains the information required by the New York Limited Liability Company Law (NY LLCL) and must be filed with the New York State Department of State (DOS).

How to Start a Nonprofit in New York Name Your Organization.Choose a New York nonprofit corporation structure.Recruit Incorporators and Initial Directors.Appoint a Registered Agent.Prepare and File Articles of Incorporation.File Initial Report.Obtain an Employer Identification Number (EIN)Store Nonprofit Records.

Duplicate Certificate of Authority If you are already registered for sales tax with the Tax Department but need a duplicate copy of your Certificate of Authority because the original was misplaced or destroyed, you can call us at (518) 485-2889.

Obtaining a copy of your Articles of Organization If you have misplaced your articles of organization, you can find a copy on the Department or Secretary of State website for the state under which your company is filed. This is done through a business entity search.

Interesting Questions

More info

This is an extensive area. I know these pictures are not the best, but it has been the last 7 years. I don't have a puppy but have always loved your website. Don't forget to check other sites that I am adding.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.