The Nassau New York Articles of Incorporation Certificate — NonprofiCorporationio— - Tax Exempt is a legal document that confirms the formation of a nonprofit organization in Nassau, New York, and grants it tax-exempt status. This certificate is required by the state government and serves as official proof of the organization's establishment and its eligibility for tax benefits. The Articles of Incorporation Certificate outlines various important details about the nonprofit entity, ensuring its compliance with statutory regulations. It typically includes the following key information: 1. Organization Name: The certificate mentions the legal name of the nonprofit corporation, which must be unique and distinguishable from other registered entities. It could be something like "Nassau Community Foundation for Education and Welfare." 2. Purpose: The certificate outlines the specific purpose and mission of the nonprofit organization. This section emphasizes the organization's commitment to charitable, educational, religious, scientific, or other qualifying activities that benefit the community. 3. Registered Agent: The certificate provides the name and address information of the registered agent who acts as the point of contact for legal matters. The registered agent must have a physical location within Nassau County and be available during regular business hours. 4. Board of Directors: The certificate may require the nonprofit corporation to state the initial members of its board of directors. These individuals oversee the organization's affairs, develop policies, and make crucial decisions. 5. Term: The certificate may indicate the duration of the nonprofit corporation, which is typically perpetual unless otherwise specified. 6. Bylaws: While not always included in the certificate itself, the nonprofit corporation's bylaws are an essential accompanying document. Bylaws outline the internal rules and procedures the organization will follow, covering areas such as governance, membership, meetings, and voting. Different types of Nassau New York Articles of Incorporation Certificate — NonprofiCorporationio— - Tax Exempt may include the following classifications: 1. Charitable Organizations: These nonprofits focus on providing public benefits to relieve poverty, advance education, promote religion, or support other charitable causes. 2. Educational Institutions: Nonprofit organizations dedicated to education, such as schools, colleges, or universities, fall under this classification. 3. Religious Organizations: These nonprofits engage in spiritual or religious activities, including churches, mosques, synagogues, or temples. 4. Scientific and Research Organizations: Nonprofits that contribute to scientific research, medical discovery, or technological advancements come under this category. 5. Healthcare and Human Services Organizations: Nonprofits that provide healthcare services, social services, or assistance to vulnerable populations, such as homeless shelters or healthcare clinics, fall under this classification. It's important to note that these are general categories, and there may be more specific or specialized types of nonprofit organizations eligible for tax-exempt status in Nassau, New York. It is advisable to consult legal professionals or the appropriate government agency for accurate guidance on the specific requirements and classifications relevant to a particular nonprofit corporation.

Nassau New York Articles of Incorporation Certificate - Nonprofit Corporation - Tax Exempt

Description

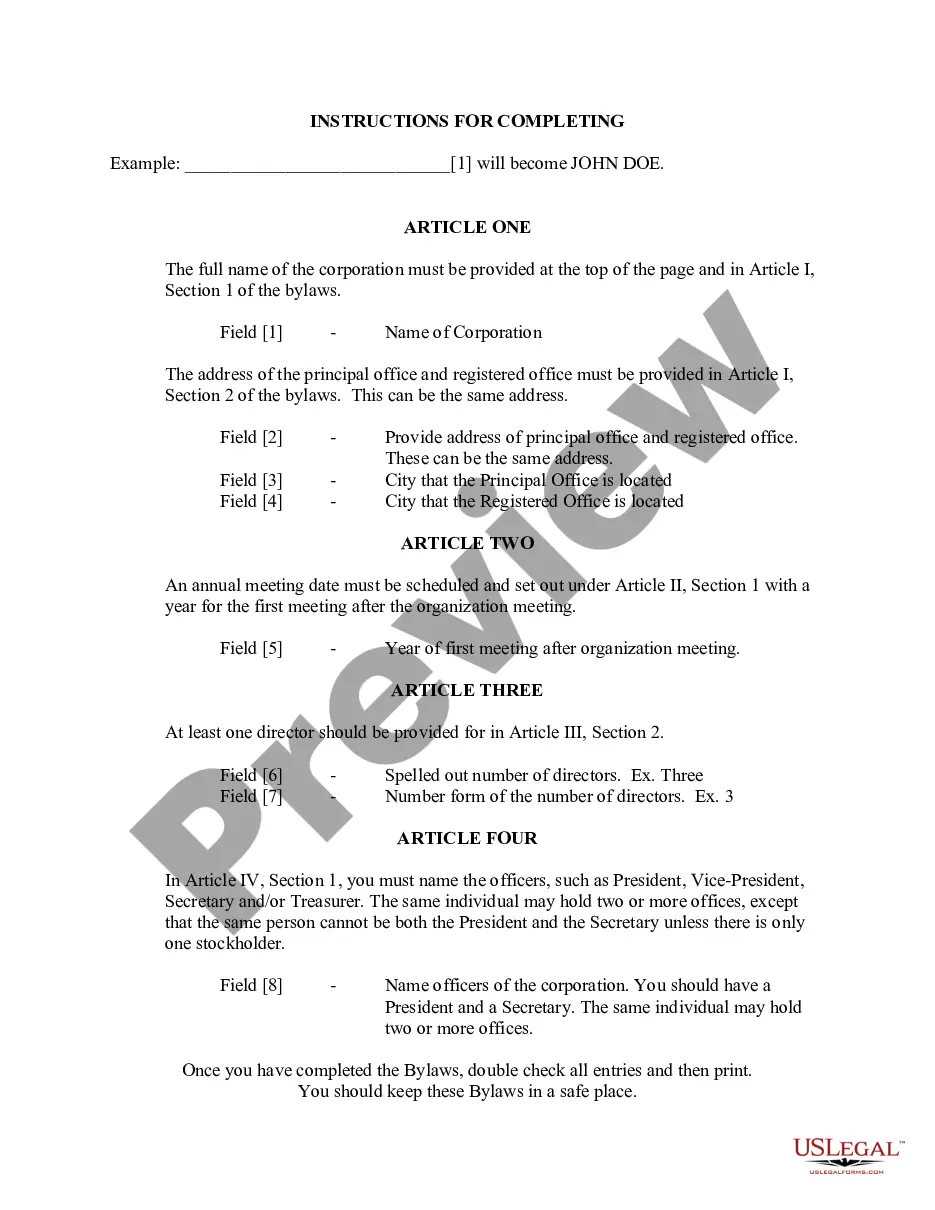

How to fill out Nassau New York Articles Of Incorporation Certificate - Nonprofit Corporation - Tax Exempt?

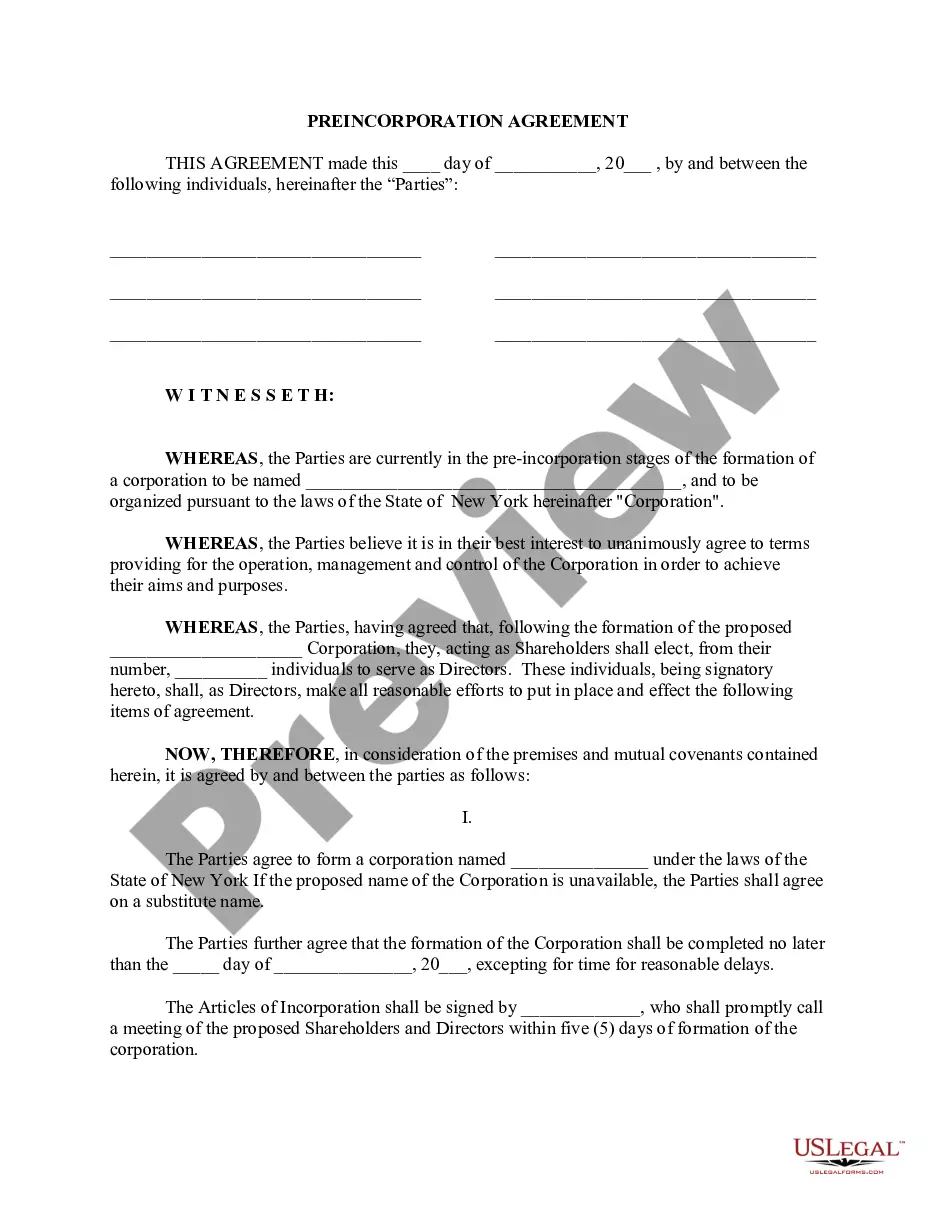

We always want to minimize or avoid legal damage when dealing with nuanced law-related or financial affairs. To do so, we apply for legal solutions that, usually, are very costly. Nevertheless, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based library of updated DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without the need of turning to an attorney. We offer access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Nassau New York Articles of Incorporation Certificate - Nonprofit Corporation - Tax Exempt or any other document quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again in the My Forms tab.

The process is just as effortless if you’re unfamiliar with the website! You can create your account in a matter of minutes.

- Make sure to check if the Nassau New York Articles of Incorporation Certificate - Nonprofit Corporation - Tax Exempt complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the Nassau New York Articles of Incorporation Certificate - Nonprofit Corporation - Tax Exempt would work for you, you can pick the subscription plan and proceed to payment.

- Then you can download the document in any suitable file format.

For more than 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!

Form popularity

FAQ

How to Start a Nonprofit in New York Name Your Organization.Choose a New York nonprofit corporation structure.Recruit Incorporators and Initial Directors.Appoint a Registered Agent.Prepare and File Articles of Incorporation.File Initial Report.Obtain an Employer Identification Number (EIN)Store Nonprofit Records.

The simple answer is that most authors agree that a typical nonprofit board of directors should comprise not less than 8-9 members and not more than 11-14 members. Some authors focusing on healthcare organizations indicate a board size up to 19 members is acceptable, though not optimal.

For corporations, limited partnerships and limited liability companies, who must file with the State, the filing fee is $25, though corporations must also pay an additional county- specific fee. The corporation county fee is $100 for any county in New York City and $25 for any other county in New York State.

How to Amend Articles of Incorporation Review the bylaws of the corporation.A board of directors meeting must be scheduled.Write the proposed changes.Confirm that the board meeting has enough members attending to have a quorum so the amendment can be voted on. Propose the amendment during the board meeting.

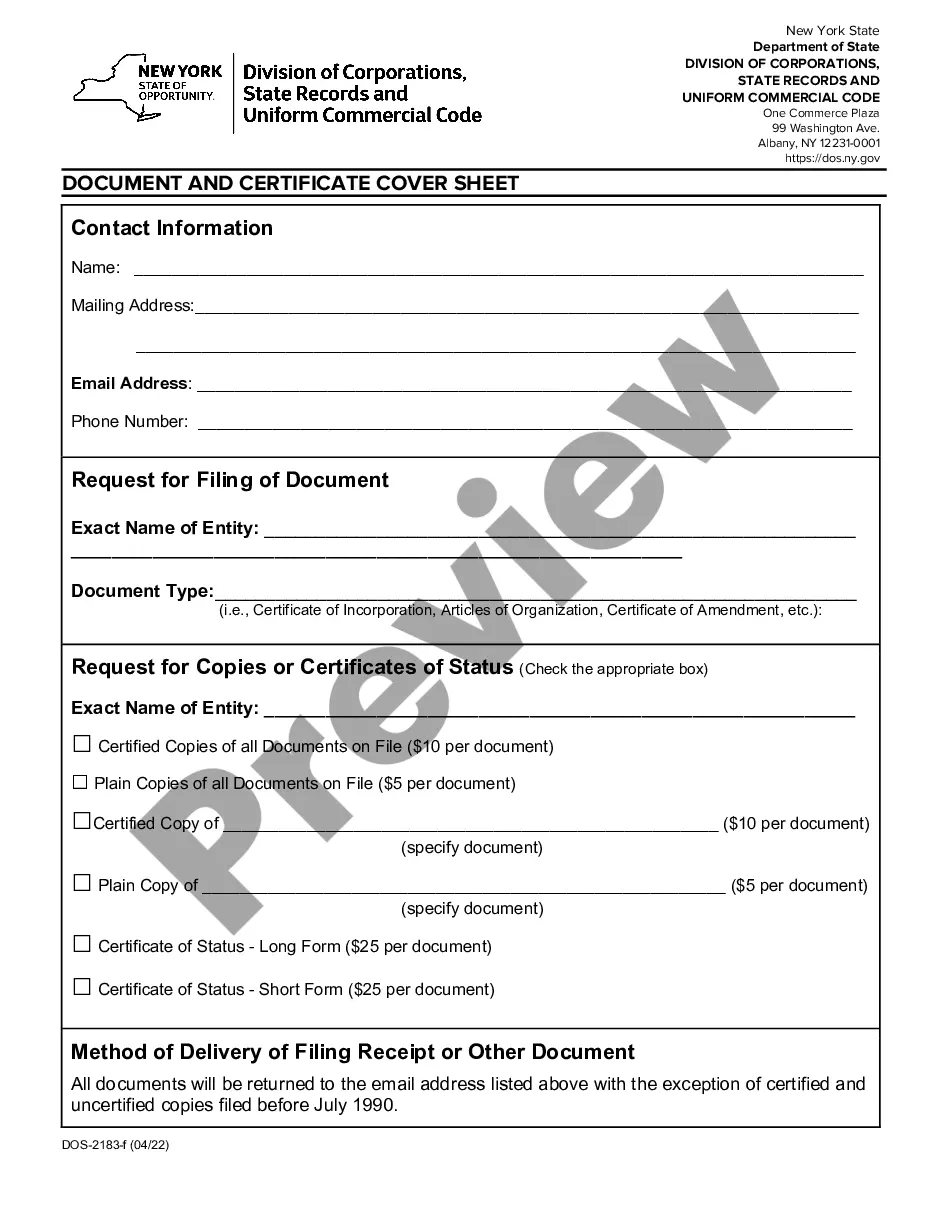

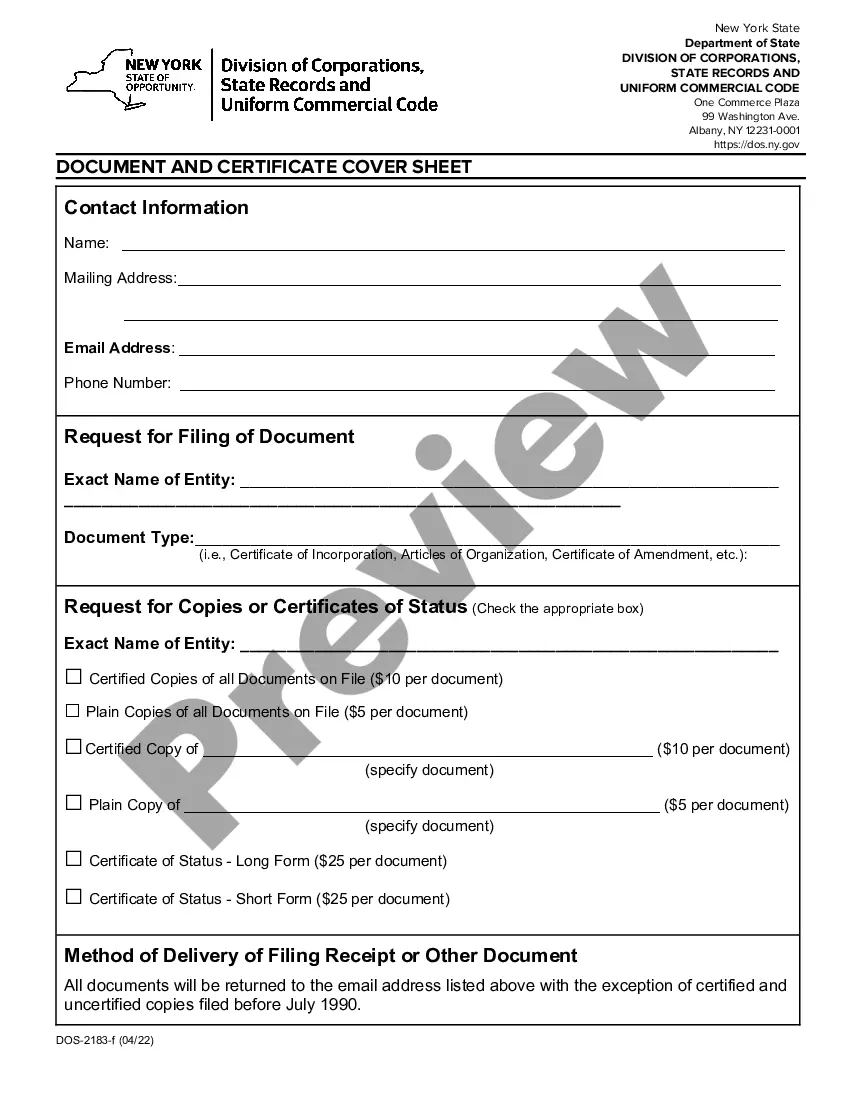

The completed Certificate of Amendment, together with the statutory filing fee of $30, should be forwarded to: New York State Department of State, Division of Corporations, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231.

The completed Certificate of Incorporation, together with the statutory filing fee of $75, should be forwarded to: Department of State, Division of Corporations, State Records and Uniform Commercial Code, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231.

A. A corporation formed in New York must have at least three board members. Q.

Nonprofit vs not-for-profit organizations Nonprofits are formed explicitly to benefit the public good; not-for-profits exist to fulfill an owner's organizational objectives. Nonprofits can have a separate legal entity; not-for-profits cannot have a separate legal entity.

Three board members is the most common minimum number for a board, and the max can range to 15. While this is not legally mandated, most nonprofits adhere to these limits since boards larger than 15 can make decision-making difficult and nonprofit boards smaller than three might not include diverse perspectives.

How much does it cost to start a New York nonprofit organization? The filing fee for NY Nonprofit Certificate of Incorporation is $75. The NY Division of Corporations accepts check, money order or credit card. If faxing, use the Credit Card Authorization form.