The Queens New York Articles of Incorporation Certificate is a legal document that establishes the formation of a nonprofit corporation in the borough of Queens, New York. This certificate is specifically designed for organizations seeking tax-exempt status. By obtaining this certificate, organizations demonstrate their commitment to serving the community and their compliance with state and federal regulations. The Articles of Incorporation serve as the foundational document for the nonprofit corporation and include vital information such as the corporation's name, purpose, registered agent, and business address. This certificate is crucial for nonprofits as it provides legal protection and credibility, allowing them to operate effectively within the Queens community. The Queens New York Articles of Incorporation Certificate for Nonprofit Corporation-Tax Exempt category may include different types or variations based on specific requirements or purposes of the organization. Some possible variations include: 1. Public Benefit Corporation: This type of nonprofit corporation is formed to provide services or benefits to an identified segment of the public, such as education, healthcare, or environmental conservation. 2. Religious Corporation: Nonprofit organizations with religious or spiritual purposes may choose to incorporate under this category to receive tax-exempt status. 3. Mutual Benefit Corporation: These nonprofits are formed to benefit a select group of individuals, such as members of an association or club, rather than the public. 4. Charitable Organization: Nonprofits focused on charitable activities like poverty alleviation, disaster relief, or research can choose this category to obtain tax-exempt status as charities. 5. Educational Organization: Nonprofits dedicated to educational endeavors, such as schools, colleges, or research institutions, can incorporate under this category to obtain tax-exempt status. 6. Arts and Cultural Organization: Nonprofit corporations that promote arts, culture, or heritage preservation can opt for this category to seek tax-exempt status and enjoy specialized benefits. 7. Environmental Organization: Nonprofits devoted to environmental conservation, sustainability, or advocacy may incorporate under this category and thereby secure tax-exempt status. These categories represent a few examples of the different types of Queens New York Articles of Incorporation Certificate for Nonprofit Corporation-Tax Exempt available to aspiring nonprofits in Queens. The specific category chosen will depend on the primary goals and objectives of the organization. Overall, this certificate plays a crucial role in establishing the legal framework for nonprofit corporations, enabling them to pursue their missions effectively while enjoying tax benefits and community support.

Queens New York Articles of Incorporation Certificate - Nonprofit Corporation - Tax Exempt

Description

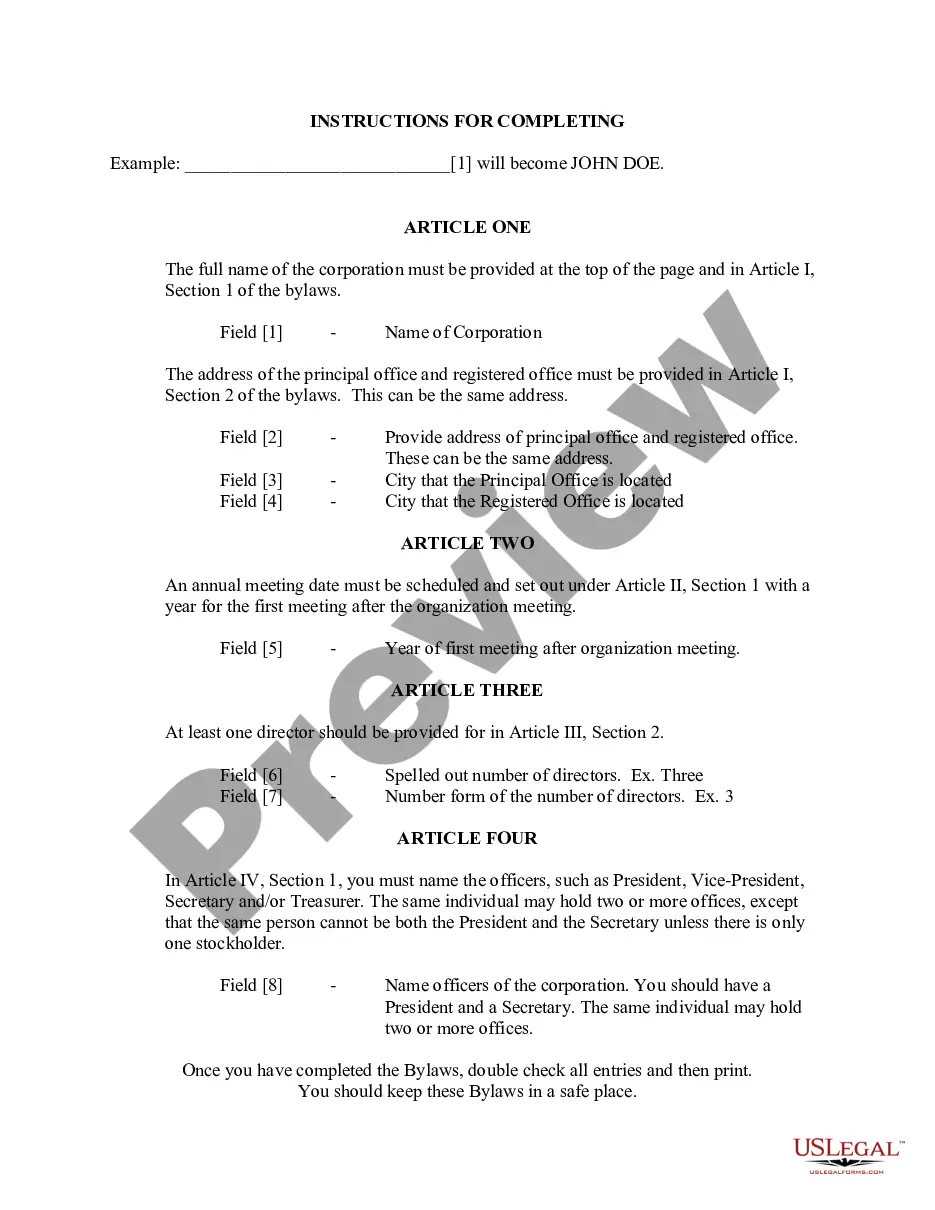

How to fill out Queens New York Articles Of Incorporation Certificate - Nonprofit Corporation - Tax Exempt?

Getting verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Queens New York Articles of Incorporation Certificate - Nonprofit Corporation - Tax Exempt becomes as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, obtaining the Queens New York Articles of Incorporation Certificate - Nonprofit Corporation - Tax Exempt takes just a few clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. The process will take just a couple of more steps to make for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make sure you’ve picked the right one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, utilize the Search tab above to get the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Queens New York Articles of Incorporation Certificate - Nonprofit Corporation - Tax Exempt. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!

Form popularity

FAQ

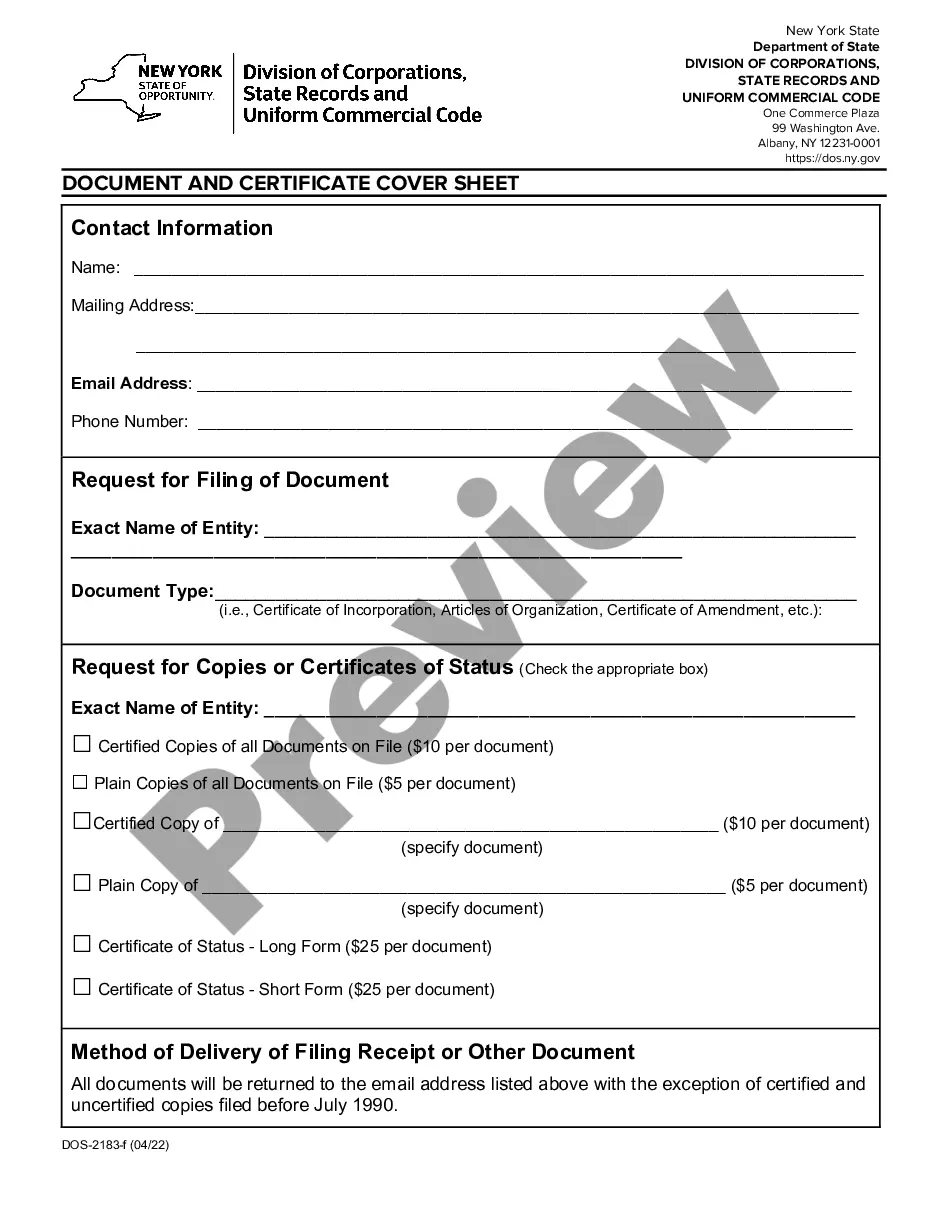

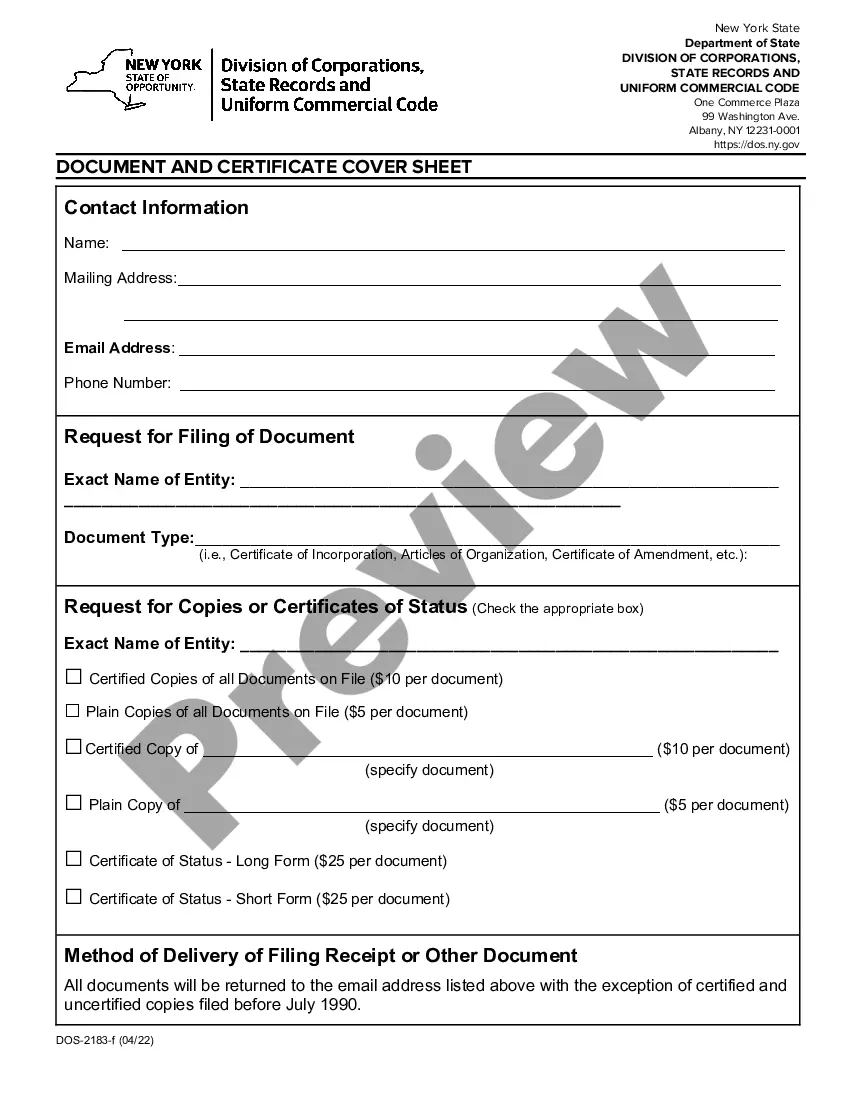

Copies of any documents filed with the Department of State's Division of Corporations may be obtained by submitting a written request to the New York State Department of State, Division of Corporations, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231.

501(c)(3) organizations are nonprofit groups with a dedicated mission. Most people are familiar with them as churches and charities, but they also include private foundations. As long as they operate to support their mission, they receive favorable tax treatment, such as avoiding federal income and unemployment taxes.

There Are Three Main Types of Charitable Organizations Most organizations are eligible to become one of the three main categories, including public charities, private foundations and private operating foundations.

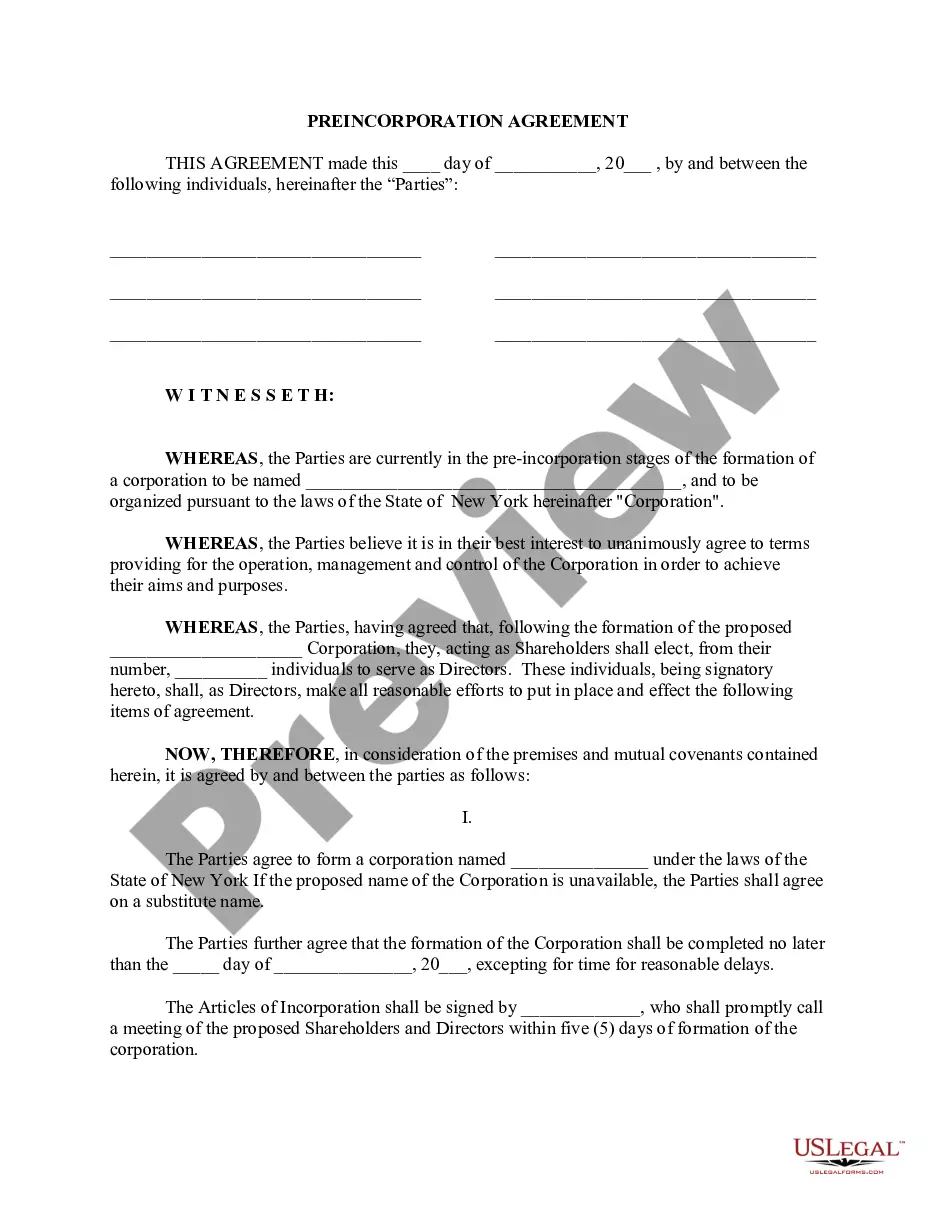

How to Start a Nonprofit in New York Name Your Organization.Choose a New York nonprofit corporation structure.Recruit Incorporators and Initial Directors.Appoint a Registered Agent.Prepare and File Articles of Incorporation.File Initial Report.Obtain an Employer Identification Number (EIN)Store Nonprofit Records.

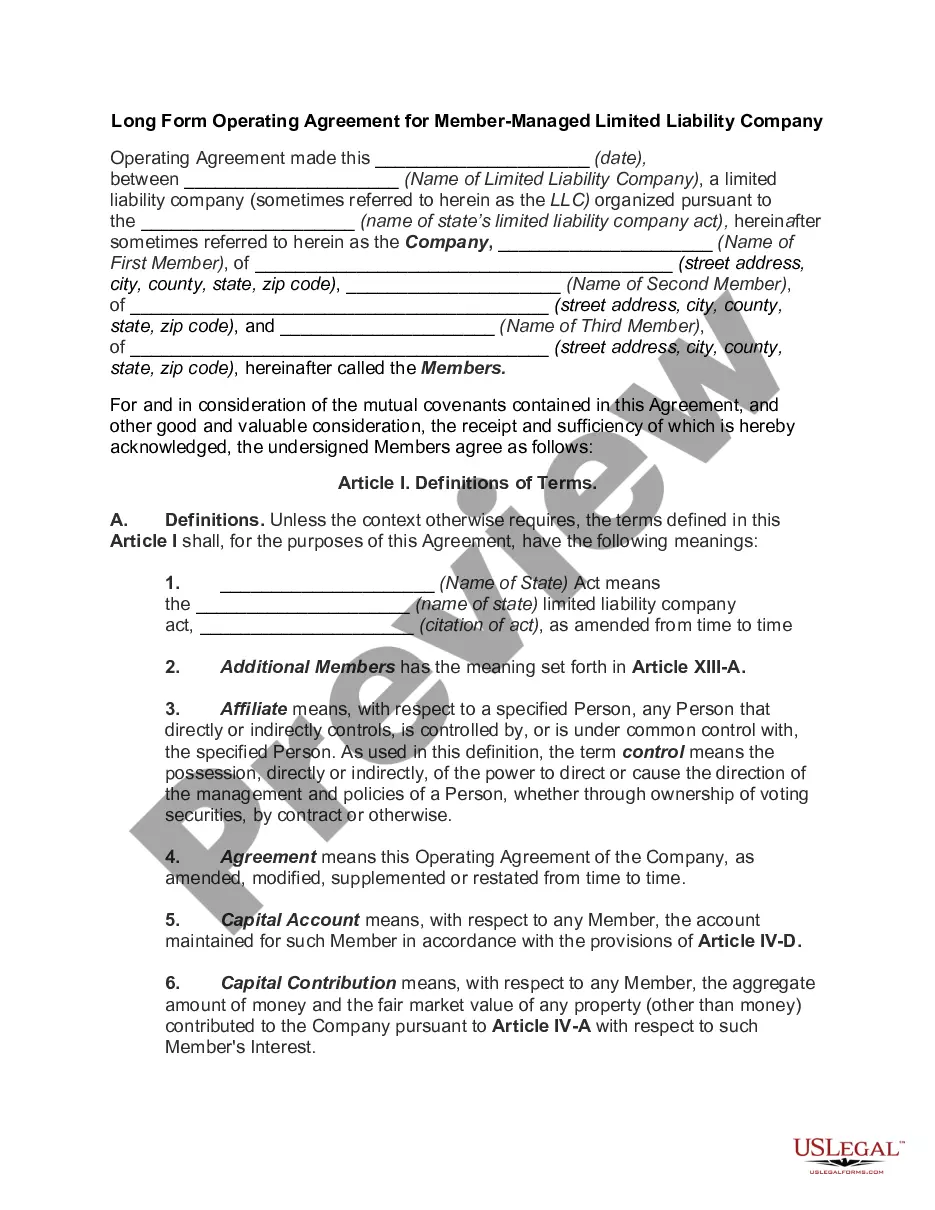

Articles of organization (known as certificate of formation in other jurisdictions) to form a New York limited liability company (LLC). This Standard Document contains the information required by the New York Limited Liability Company Law (NY LLCL) and must be filed with the New York State Department of State (DOS).

Duplicate Certificate of Authority If you are already registered for sales tax with the Tax Department but need a duplicate copy of your Certificate of Authority because the original was misplaced or destroyed, you can call us at (518) 485-2889.

Obtaining a copy of your Articles of Organization If you have misplaced your articles of organization, you can find a copy on the Department or Secretary of State website for the state under which your company is filed. This is done through a business entity search.

Nonprofit vs not-for-profit organizations Nonprofits are formed explicitly to benefit the public good; not-for-profits exist to fulfill an owner's organizational objectives. Nonprofits can have a separate legal entity; not-for-profits cannot have a separate legal entity.

Copies of any documents filed with the Department of State's Division of Corporations may be obtained by submitting a written request to the New York State Department of State, Division of Corporations, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231.

Association, Trust, or Corporation A nonprofit organization can organize itself in four ways: an unincorporated association, a trust, a corporation, or a limited liability company.

Interesting Questions

More info

New HUD technical assistance products available to tribes. Please call our Brooklyn office at for a HUD case management and consultation. More Housing HUD is taking actions against NYC HA and Tenant Resource Center and other landlord-tenant practices. Read the HUD announcement here. Read more about what NYC HA is doing here. Finance A bill introduced in State Congress that would prevent predatory lenders from evicting tenants to make way for predatory investors. Learn more about it here. Health Care A bipartisan bill was introduced in State Congress that would increase the minimum wage, establish a per hour minimum, create 35 billion in grants for community health centers, and eliminate co-pays for primary care. Read the bill here, or join our call to action here. More Worker Protections Workers who are fired or laid off by a landlord for any reason will have to apply for unemployment benefits. Read more about the bill here.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.