The Rochester New York Articles of Incorporation Certificate is a legal document that signifies the establishment of a nonprofit corporation in the state of New York. This certificate confirms the corporation's compliance with state laws and regulations, allowing it to operate as a tax-exempt organization. Keywords: Rochester New York, Articles of Incorporation Certificate, nonprofit corporation, tax-exempt. The Articles of Incorporation Certificate for a nonprofit corporation in Rochester, New York, is an essential document for organizations seeking to operate without profit. This certificate serves as proof of the corporation's legal formation, outlining its purpose, structure, and tax-exempt status under the state's laws. It is important to note that there are different types of Rochester New York Articles of Incorporation Certificates — NonprofiCorporationio— - Tax Exempt, based on the specific nature of the organization: 1. 501(c)(3) Nonprofit Corporation: This type of certificate is the most common for tax-exempt organizations. It allows nonprofit corporations to operate under section 501(c)(3) of the Internal Revenue Code, entitling them to exemption from federal income tax and enabling donors to claim tax deductions for their contributions. 2. 501(c)(4) Nonprofit Corporation: This certificate is applicable to social welfare organizations, civic leagues, and local associations of employees. While these organizations may also have tax-exempt status, donations made to them are generally not tax-deductible. 3. 501(c)(6) Nonprofit Corporation: This type of certificate is suitable for business leagues, chambers of commerce, and similar organizations that primarily serve their members' interests. Like the previous category, these organizations may be tax-exempt, but donations are typically not tax-deductible. The Rochester New York Articles of Incorporation Certificate — NonprofiCorporationio— - Tax Exempt provides legal recognition to nonprofit organizations, offering them various advantages such as limited liability protection for directors and officers, eligibility for government grants, and exemption from certain taxes.

Rochester New York Articles of Incorporation Certificate - Nonprofit Corporation - Tax Exempt

Description

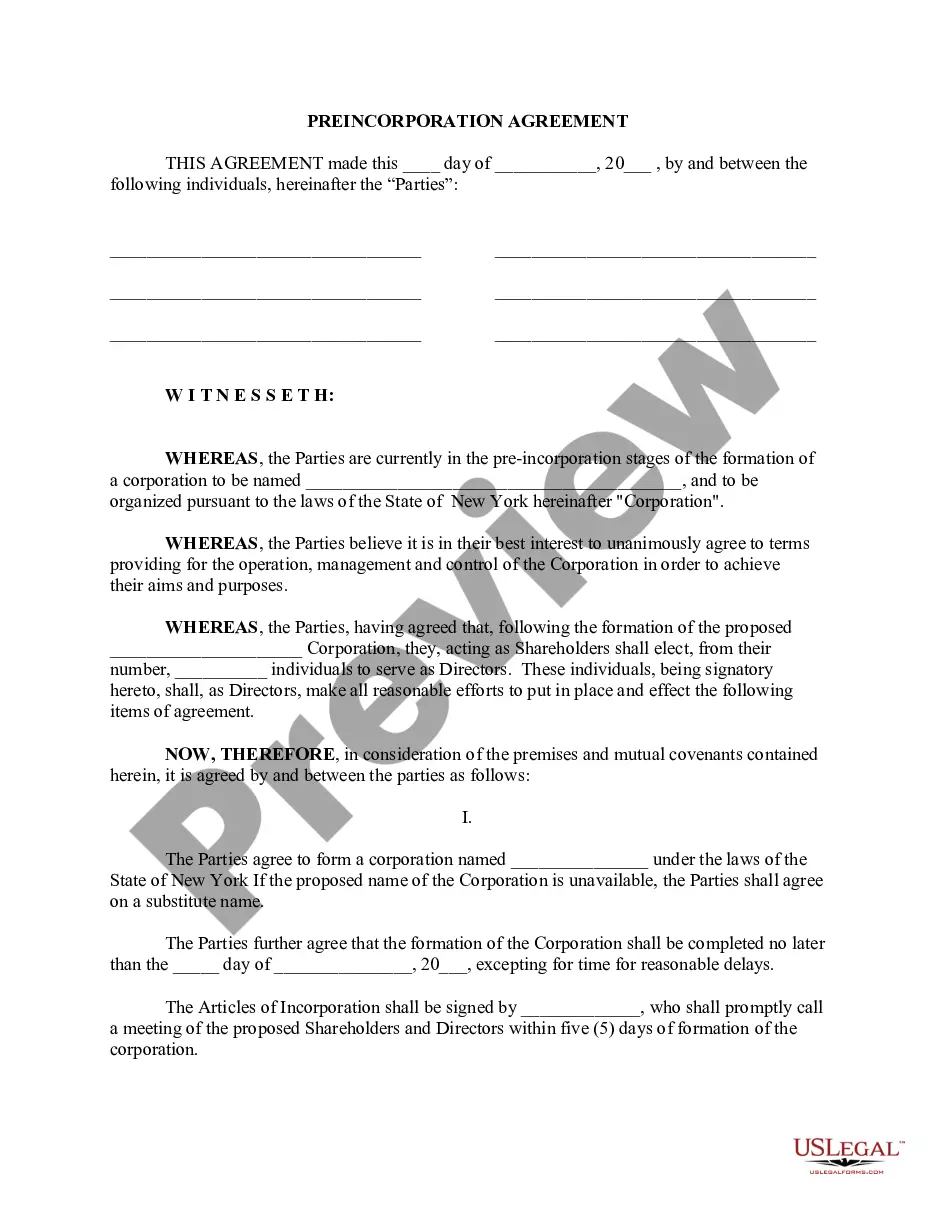

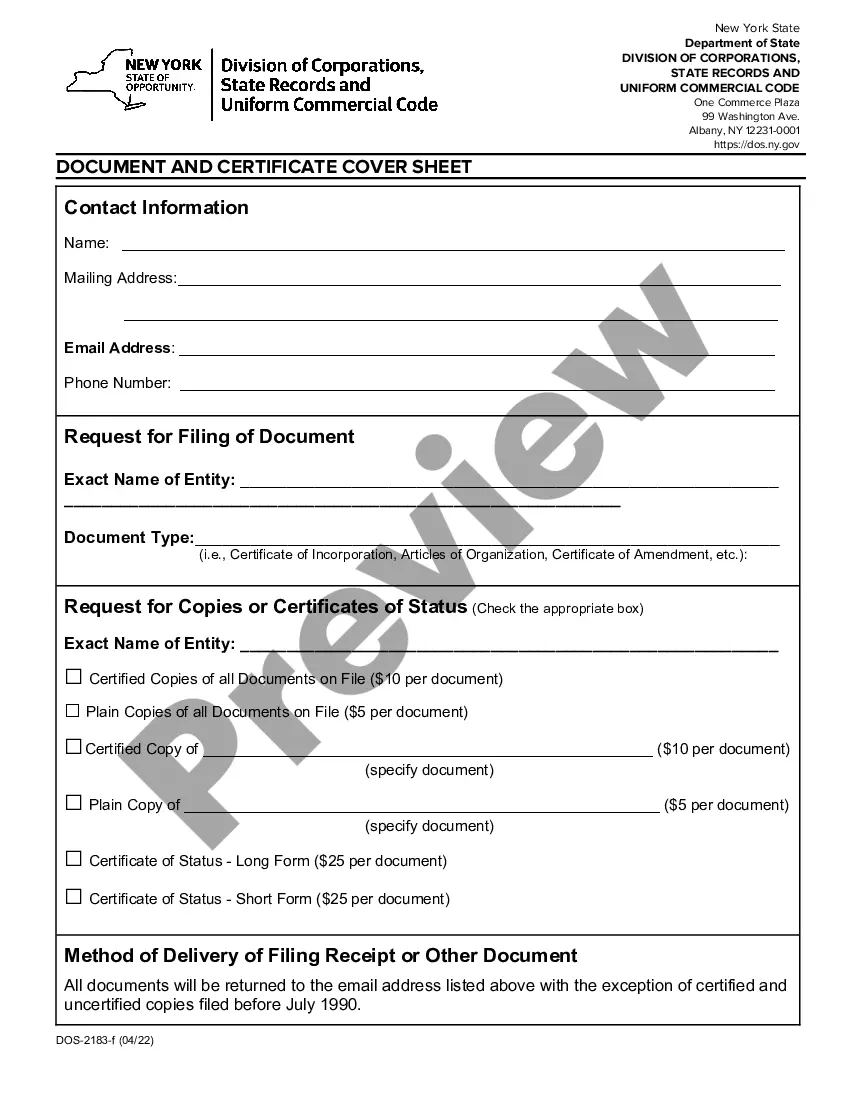

How to fill out Rochester New York Articles Of Incorporation Certificate - Nonprofit Corporation - Tax Exempt?

We always strive to reduce or prevent legal damage when dealing with nuanced legal or financial matters. To accomplish this, we apply for attorney services that, usually, are very expensive. Nevertheless, not all legal matters are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based library of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without using services of an attorney. We offer access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Rochester New York Articles of Incorporation Certificate - Nonprofit Corporation - Tax Exempt or any other document quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it in the My Forms tab.

The process is just as easy if you’re new to the website! You can register your account within minutes.

- Make sure to check if the Rochester New York Articles of Incorporation Certificate - Nonprofit Corporation - Tax Exempt adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Rochester New York Articles of Incorporation Certificate - Nonprofit Corporation - Tax Exempt is suitable for you, you can select the subscription plan and make a payment.

- Then you can download the form in any available file format.

For over 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!