Yonkers New York Articles of Incorporation Certificate - Nonprofit Corporation - Tax Exempt

Description

How to fill out Yonkers New York Articles Of Incorporation Certificate - Nonprofit Corporation - Tax Exempt?

If you’ve previously utilized our service, sign in to your account and retrieve the Yonkers New York Articles of Incorporation Certificate - Nonprofit Corporation - Tax Exempt on your device by selecting the Download button. Ensure your subscription is active. If it’s not, renew it according to your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to obtain your document.

You have ongoing access to all documents you have purchased: you can find it in your profile within the My documents section whenever you need to reuse it. Take advantage of US Legal Forms service to swiftly find and store any template for your personal or business needs!

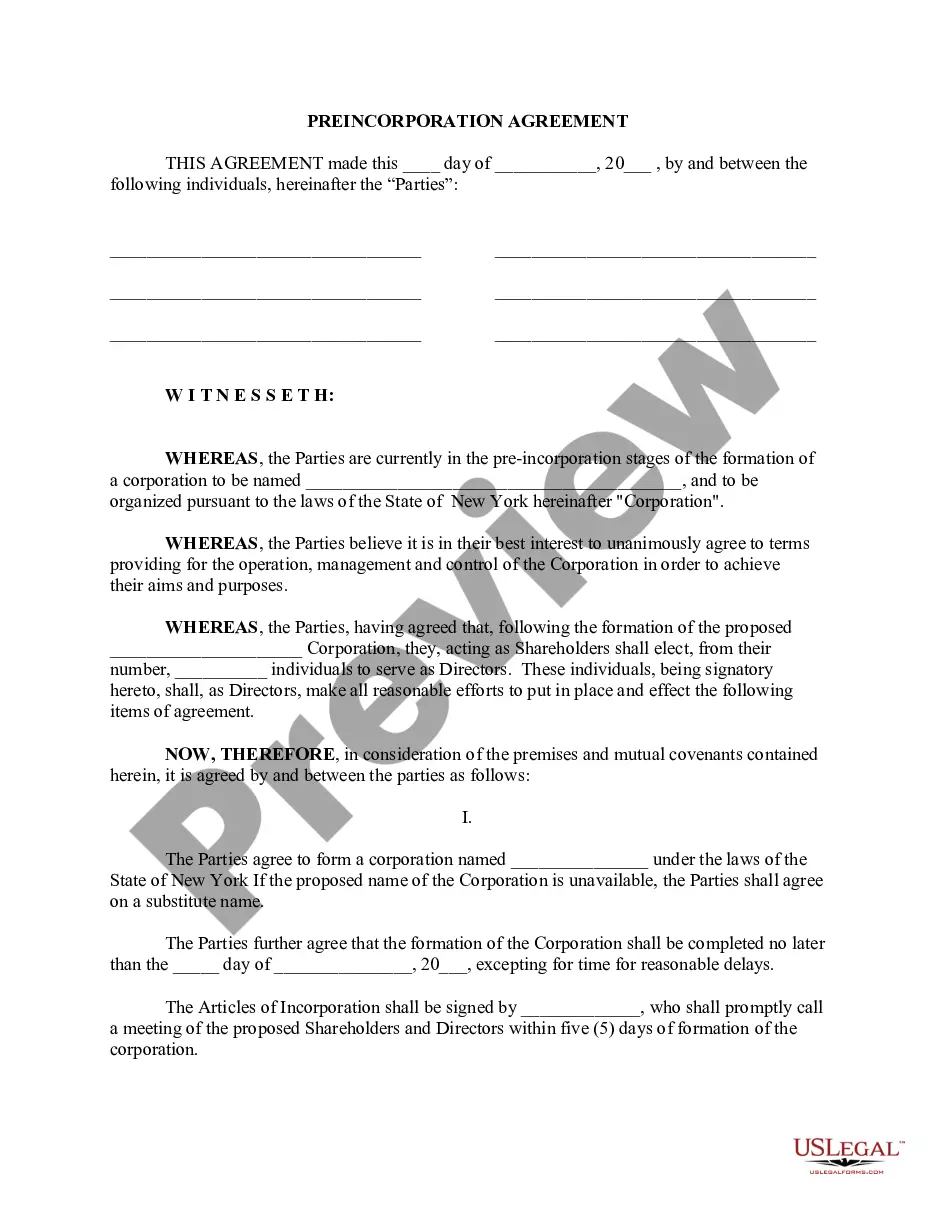

- Ensure you’ve located the correct document. Review the description and utilize the Preview feature, if available, to verify it aligns with your needs. If it doesn’t suit you, employ the Search tab above to find the suitable one.

- Acquire the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Establish an account and make a payment. Enter your credit card information or use the PayPal option to finalize the transaction.

- Receive your Yonkers New York Articles of Incorporation Certificate - Nonprofit Corporation - Tax Exempt. Choose the file format for your document and save it to your device.

- Complete your form. Print it out or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

Exempt status in New York refers to a nonprofit organization’s eligibility to be recognized as tax-exempt under both federal and state laws. This status allows the nonprofit to avoid certain taxes, which can enhance its financial resources for charitable work. To achieve this, you must complete the Yonkers New York Articles of Incorporation Certificate - Nonprofit Corporation - Tax Exempt, ensuring you comply with all necessary regulations. Using platforms like uslegalforms can streamline this process by providing templates and guidance for successful application.

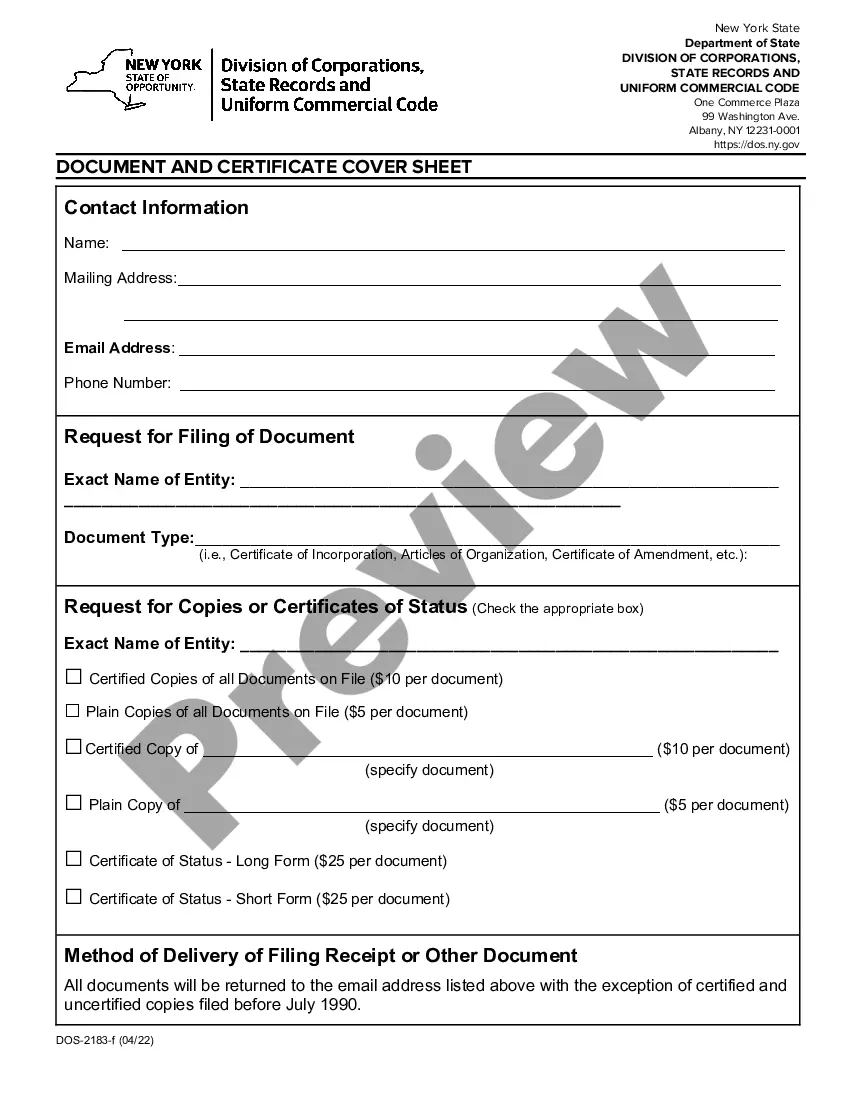

To establish a tax-exempt nonprofit organization in New York City, you need to file the appropriate forms with both the Internal Revenue Service and the New York State Department of State. Specifically, the IRS Form 1023 is required for federal tax exemption, while New York may require additional documents. Obtaining the Yonkers New York Articles of Incorporation Certificate - Nonprofit Corporation - Tax Exempt is crucial in this process, as it serves as a foundational document for your nonprofit's legal status.

The time to incorporate in New York can vary, generally taking between 2 to 4 weeks after submitting your Articles of Incorporation Certificate. If you choose expedited processing, it can be faster, often within a few days. After incorporation, ensuring your nonprofit corporation receives any tax exemptions can require additional time. For assistance in managing these timelines, USLegalForms can offer valuable resources.

Filing a Certificate of Incorporation in New York involves completing the necessary documents and submitting them to the New York Department of State. This certificate establishes your nonprofit corporation and should detail your organization’s purpose and structure. You can also specify tax-exempt status in this document. For ease, consider using USLegalForms to access forms and expert guidance.

To obtain a certificate of authority in New York, you need to file an Application for Authority with the New York Department of State. This applies if your nonprofit corporation plans to operate in New York but was incorporated elsewhere. Ensure your application is complete and includes supporting documents. USLegalForms offers a detailed solution to streamline this application process.

To file a 501(c)(3) in New York, you must first prepare and file your Articles of Incorporation Certificate as a Nonprofit Corporation with the New York Department of State. Make sure to include specific language about your tax-exempt purpose. Following this, you will need to apply for federal tax exemption with the IRS, which grants the 501(c)(3) status. Utilizing a platform like USLegalForms can simplify this process, providing guidance along the way.

In New York, a not-for-profit corporation is a specific type of corporation formed for purposes other than generating profit. This includes charities, educational organizations, and religious groups. Not-for-profit corporations can apply for tax exemption under various IRS classifications, making them more appealing for fundraising. To ensure compliance and proper formation, consider using UsLegalForms, which offers tailored solutions for setting up your nonprofit corporation.

In New York, while a nonprofit organization usually takes the form of a corporation, it is possible for a nonprofit to operate as a limited liability company (LLC). However, most nonprofits prefer the corporate structure due to ease of receiving tax-exempt status and public perception. If you are considering an LLC for your nonprofit, ensure that you understand the implications and requirements involved. UsLegalForms can guide you through the nuances of forming a nonprofit LLC.

The best corporate structure for a nonprofit organization is generally a nonprofit corporation. This structure not only provides limited liability protection for members and directors, but it also makes it easier to obtain tax-exempt status. Additionally, a nonprofit corporation can receive donations that are tax-deductible for the donor, enhancing fundraising efforts. Consider consulting UsLegalForms to choose the ideal structure for your nonprofit’s needs.

To obtain 501c3 status in New York, you must first establish your nonprofit corporation by filing the appropriate articles of incorporation. After your organization is officially incorporated, apply for federal tax exemption using IRS Form 1023. This form requires detailed information about your nonprofit's structure, purpose, and activities. Proper guidance from UsLegalForms can simplify this complicated process and increase your chances of approval.