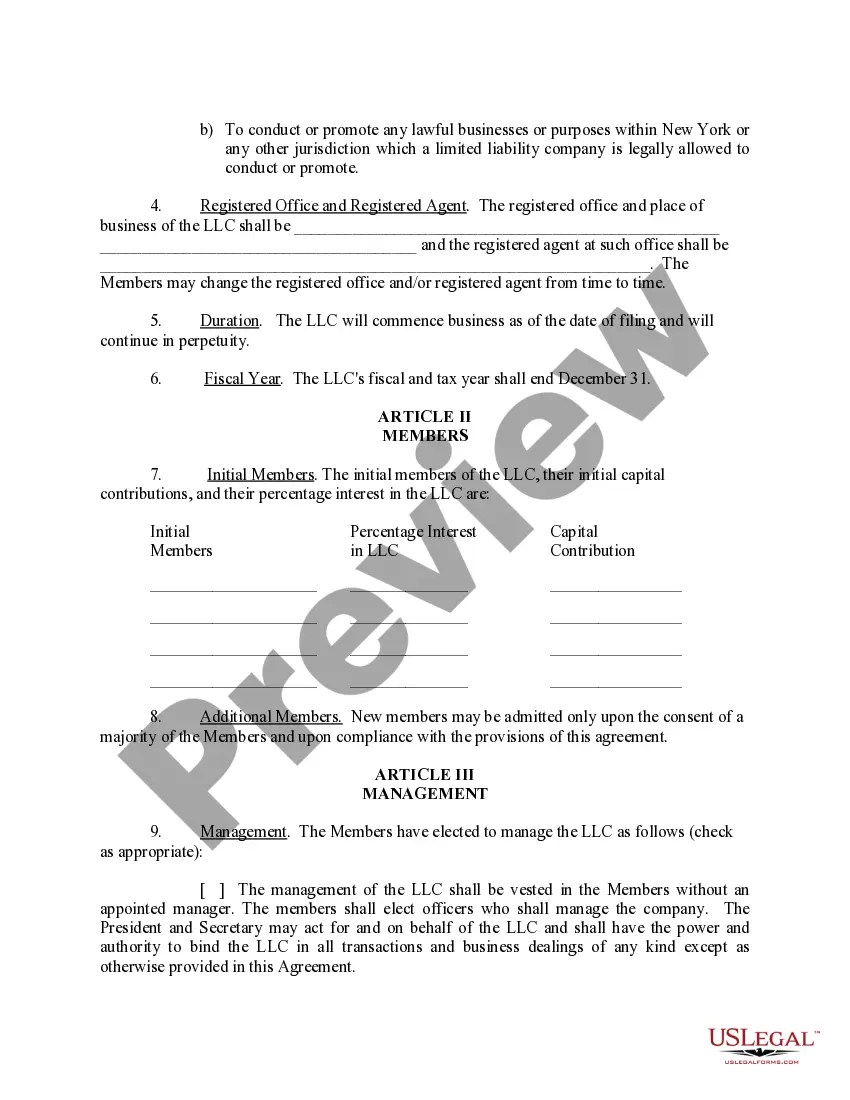

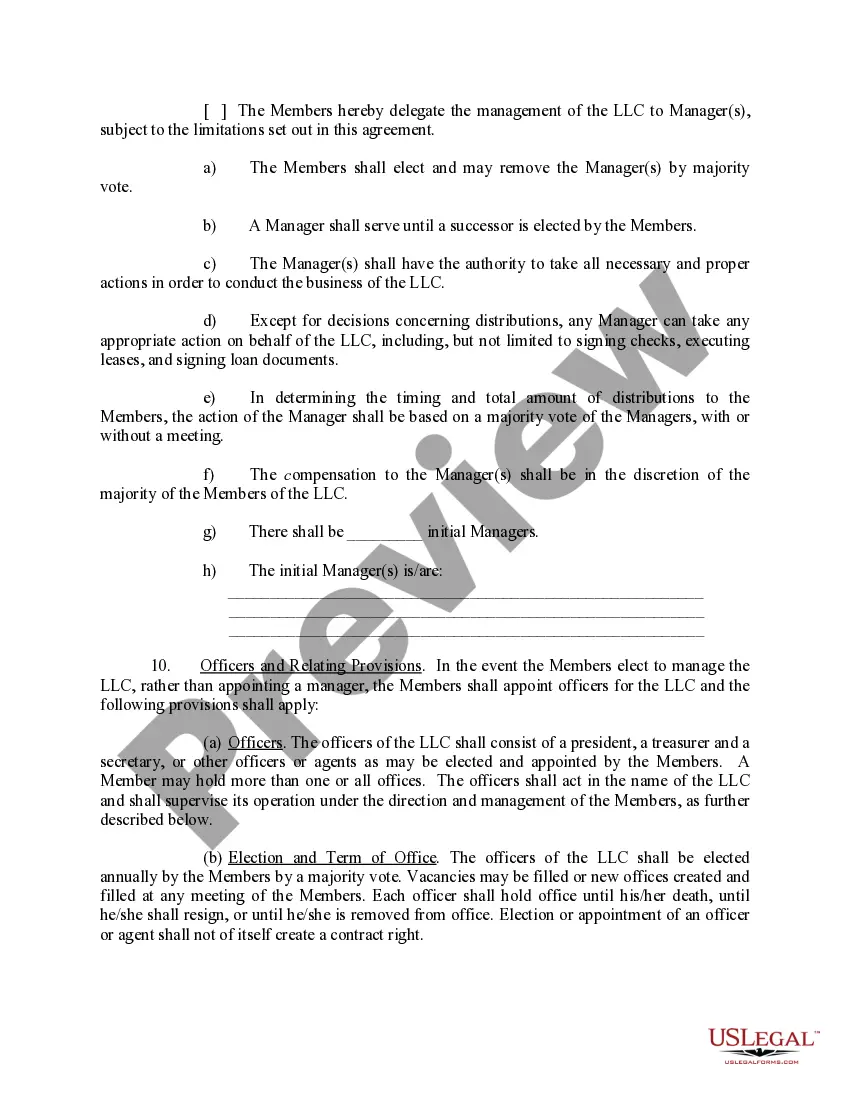

The Syracuse New York Limited Liability Company (LLC) Operating Agreement is a legal document that outlines the internal operations, management structure, and ownership rights of a Syracuse-based LLC. It serves as a vital governing document that establishes the rules and regulations the LLC members must adhere to in their business operations. An LLC Operating Agreement is crucial for providing clarity, preventing disputes, and maintaining the limited liability protection enjoyed by LLC owners. The Syracuse New York LLC Operating Agreement typically includes key provisions such as the LLC's name, purpose, principal place of business, duration, and the identities of the members and their respective ownership interests. Additionally, it lays out the procedures for decision-making, voting rights, profit and loss allocations, distribution of assets, admission and withdrawal of members, and succession planning. There may be different variations of the Syracuse New York LLC Operating Agreement depending on the nature and industry of the LLC. For instance, a real estate LLC operating agreement might include specific provisions related to property management, lease agreements, and asset acquisitions. On the other hand, an LLC operating in the service industry might focus more on detailing client contracts, service agreements, and liability limitations. Another type of Syracuse New York LLC Operating Agreement could be specific to single-member LCS. While similar in structure to a multi-member agreement, a single-member LLC operating agreement clarifies that the LLC is owned by only one individual and outlines the member's rights, responsibilities, and decision-making authority. It is important to note that LLC Operating Agreements can be customized according to the specific needs and preferences of the members. Consulting with a qualified business attorney is highly recommended when drafting or reviewing an LLC Operating Agreement to ensure compliance with state laws and to protect the interests of all parties involved.

Syracuse New York Limited Liability Company LLC Operating Agreement

Description

How to fill out Syracuse New York Limited Liability Company LLC Operating Agreement?

If you are searching for a valid form, it’s impossible to choose a more convenient place than the US Legal Forms website – one of the most considerable online libraries. With this library, you can get a large number of document samples for company and individual purposes by types and states, or key phrases. With our advanced search function, getting the most up-to-date Syracuse New York Limited Liability Company LLC Operating Agreement is as easy as 1-2-3. Moreover, the relevance of each and every file is proved by a group of expert attorneys that regularly review the templates on our platform and revise them according to the most recent state and county laws.

If you already know about our system and have a registered account, all you need to receive the Syracuse New York Limited Liability Company LLC Operating Agreement is to log in to your user profile and click the Download option.

If you utilize US Legal Forms for the first time, just refer to the instructions below:

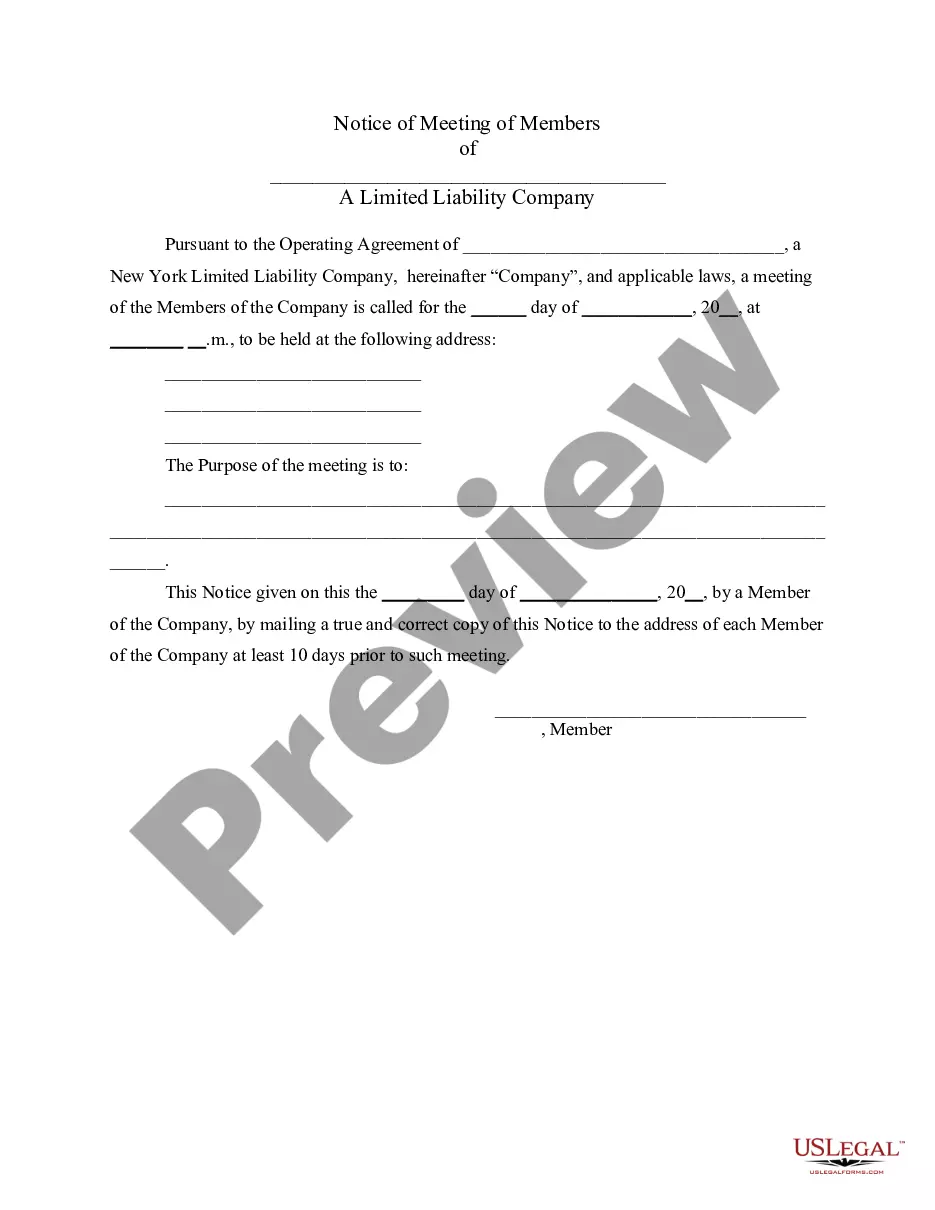

- Make sure you have chosen the sample you require. Read its information and use the Preview feature (if available) to check its content. If it doesn’t suit your needs, utilize the Search option at the top of the screen to find the needed document.

- Confirm your choice. Choose the Buy now option. Following that, select the preferred pricing plan and provide credentials to sign up for an account.

- Make the transaction. Use your credit card or PayPal account to complete the registration procedure.

- Get the form. Select the format and download it to your system.

- Make changes. Fill out, edit, print, and sign the received Syracuse New York Limited Liability Company LLC Operating Agreement.

Every form you add to your user profile does not have an expiration date and is yours forever. You can easily access them via the My Forms menu, so if you want to get an additional copy for modifying or printing, you can return and download it once again at any moment.

Make use of the US Legal Forms extensive library to gain access to the Syracuse New York Limited Liability Company LLC Operating Agreement you were looking for and a large number of other professional and state-specific templates on one platform!