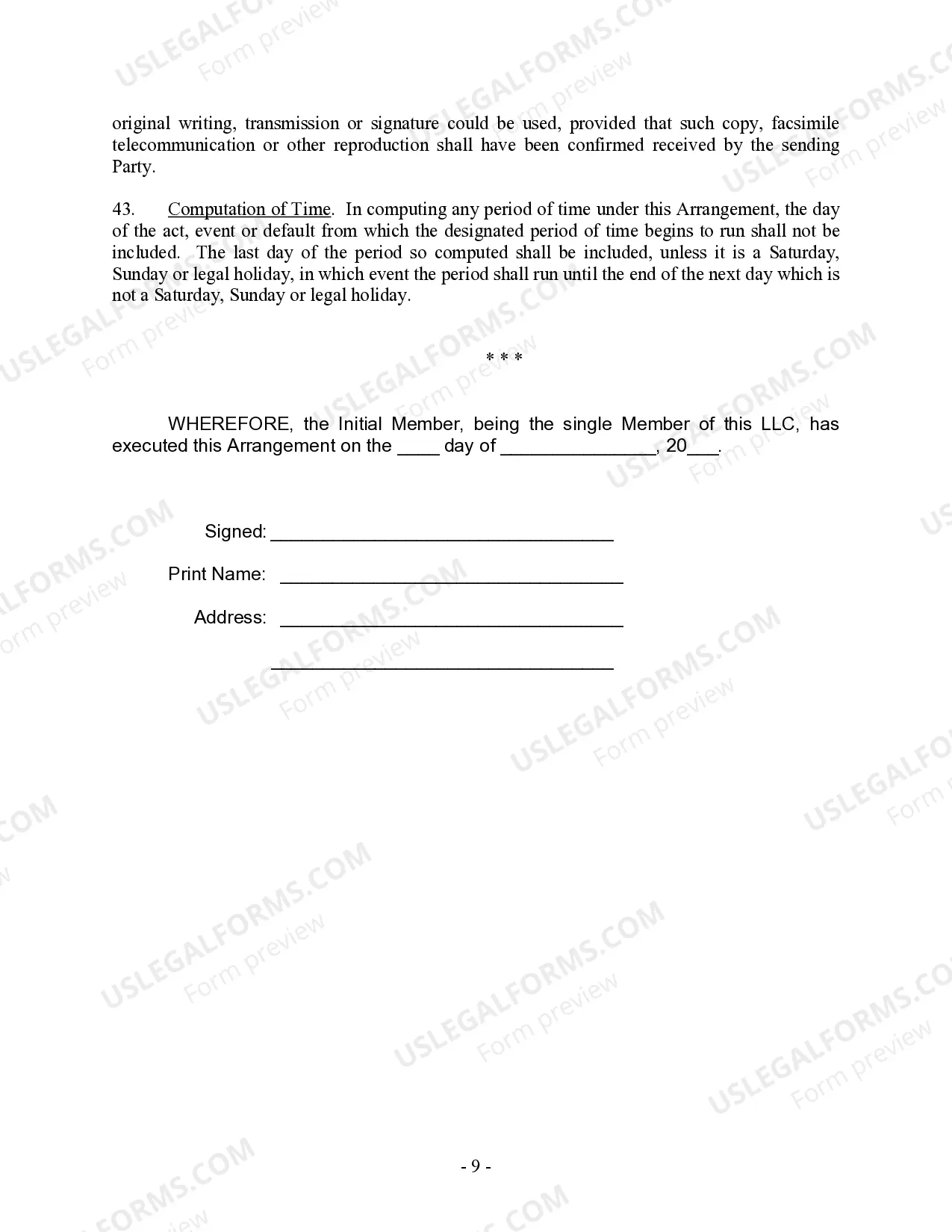

Yonkers New York Single Member Limited Liability Company LLC Operating Agreement

Description

How to fill out Yonkers New York Single Member Limited Liability Company LLC Operating Agreement?

We consistently aim to lessen or avert legal repercussions when navigating intricate legal or financial situations.

To achieve this, we seek legal assistance that is often quite expensive.

Nevertheless, not all legal issues are equally intricate; many can be managed independently.

US Legal Forms is an online repository of updated DIY legal templates covering everything from wills and power of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button next to it. If you misplace the document, you can always re-download it in the My documents section. The process remains simple even if you’re a newcomer to the website! You can create an account in just a few minutes. Ensure that the Yonkers New York Single Member Limited Liability Company LLC Operating Agreement adheres to the regulations and laws of your state and area. Additionally, it’s essential to review the form’s outline (if available), and if you notice any inconsistencies with what you initially sought, look for an alternative form. Once you confirm that the Yonkers New York Single Member Limited Liability Company LLC Operating Agreement is suitable for you, you can select the subscription option and move forward to payment. You can then download the document in any appropriate format. Over the past 24 years, we have assisted millions by offering ready-to-customize and current legal forms. Take full advantage of US Legal Forms now to conserve time and resources!

- Our platform enables you to handle your affairs autonomously without hiring an attorney.

- We offer access to legal form templates that aren’t always readily accessible.

- Our templates are specific to states and regions, which greatly eases the search process.

- Utilize US Legal Forms whenever you need to quickly and securely find and download the Yonkers New York Single Member Limited Liability Company LLC Operating Agreement or any other form.

Form popularity

FAQ

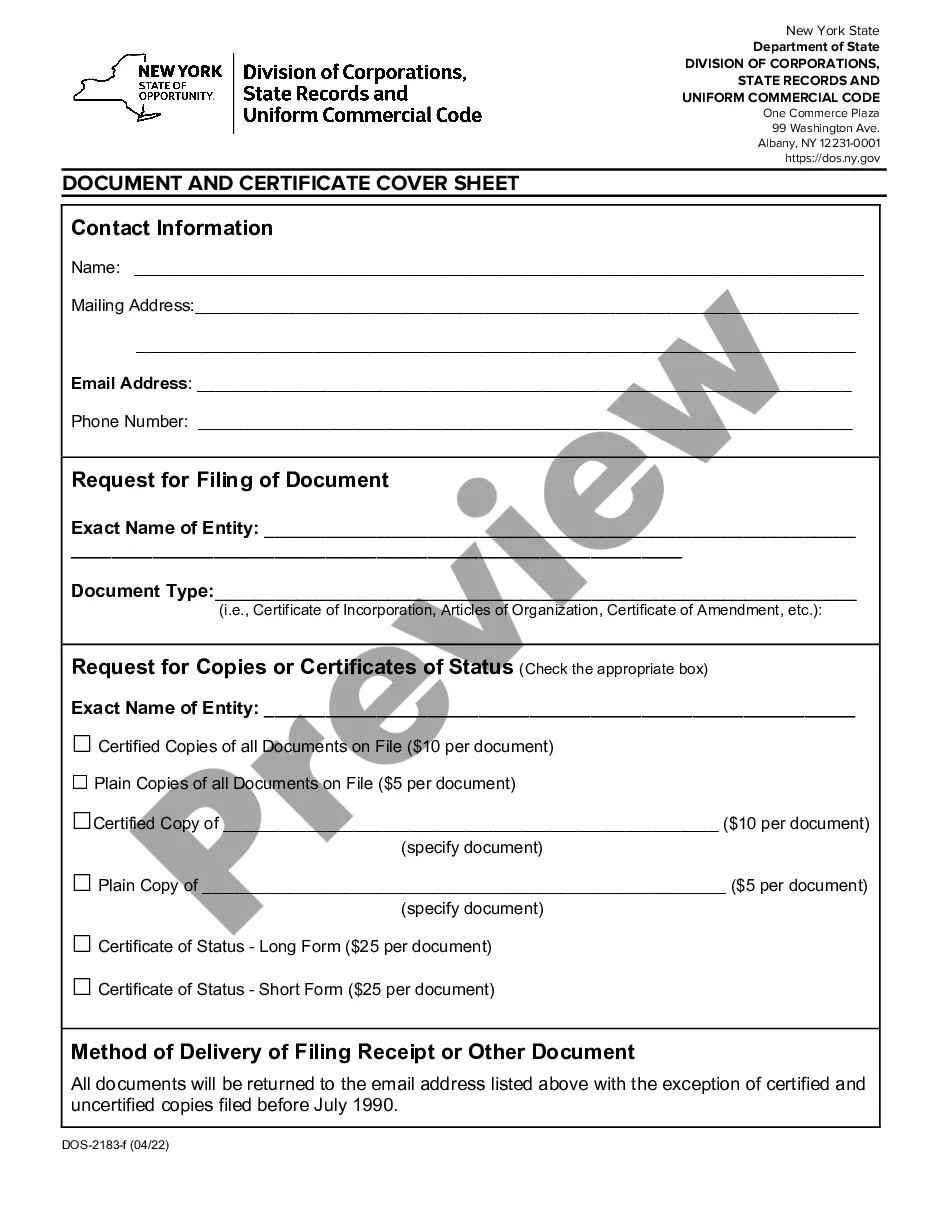

To start a single member LLC in New York, you first need to choose a name that complies with state regulations. After selecting the name, file the Articles of Organization with the New York Department of State. Next, create an operating agreement, which outlines the management structure and operational procedures of your Yonkers New York Single Member Limited Liability Company LLC. Finally, obtain any necessary licenses and permits, ensuring your business is fully compliant.

While New York does not legally require an operating agreement for a single member LLC, it is highly recommended to have one. An operating agreement clarifies the management structure and operational processes for your business. This becomes particularly useful if you ever face legal challenges or need to prove the legitimacy of your LLC. A well-drafted Yonkers New York Single Member Limited Liability Company LLC Operating Agreement will strengthen your business foundation.

Yes, having a Registered Agent is a requirement for LLCs in New York. Your Registered Agent acts as your official point of contact, receiving legal documents and important notices on behalf of your business. This is essential for maintaining compliance and ensuring you do not miss critical communications. Consider utilizing US Legal Forms for help in selecting a Registered Agent.

Yes, you can write your own operating agreement for your single member LLC. Crafting your own agreement gives you flexibility to set specific terms that suit your business needs. However, using a template can ensure that all essential elements are included, balancing customization with compliance. The Yonkers New York Single Member Limited Liability Company LLC Operating Agreement is a great starting reference.

New York does recognize single member LLCs, allowing individuals to operate their businesses under this structure. This legal recognition provides you with a way to protect your personal assets while conducting business in Yonkers. Having a Yonkers New York Single Member Limited Liability Company LLC Operating Agreement is key to outlining your rights and responsibilities in this arrangement.

Yes, New York recognizes single member LLCs. This means you can establish a single member limited liability company in Yonkers, New York, and enjoy the benefits of limited liability protection. Your personal assets remain separate from your business liabilities, allowing for a safer business environment. The Yonkers New York Single Member Limited Liability Company LLC Operating Agreement can help clarify your business structure.

Sole-Proprietors and Single-member LLCs do not file a Schedule K-1. Instead, they report business income on a Schedule C of a Form 1040.

It can secure your liability protection. This is crucial to understand, as it's the primary main reason that your single-member LLC needs an operating agreement. Even if an operating agreement isn't required in your state, running your company without an operating agreement could jeopardize your LLC status.

Non-resident business entities that do business in New York State must have a registered agent for service of process in New York State. A resident agent is a contact person (e.g. New York State lawyer) or agent to receive legal papers when a corporation is served for a legal reason.

member LLC (SMLLC) that is treated as a disregarded entity for federal income tax purposes will be treated as a disregarded entity for New York tax purposes.