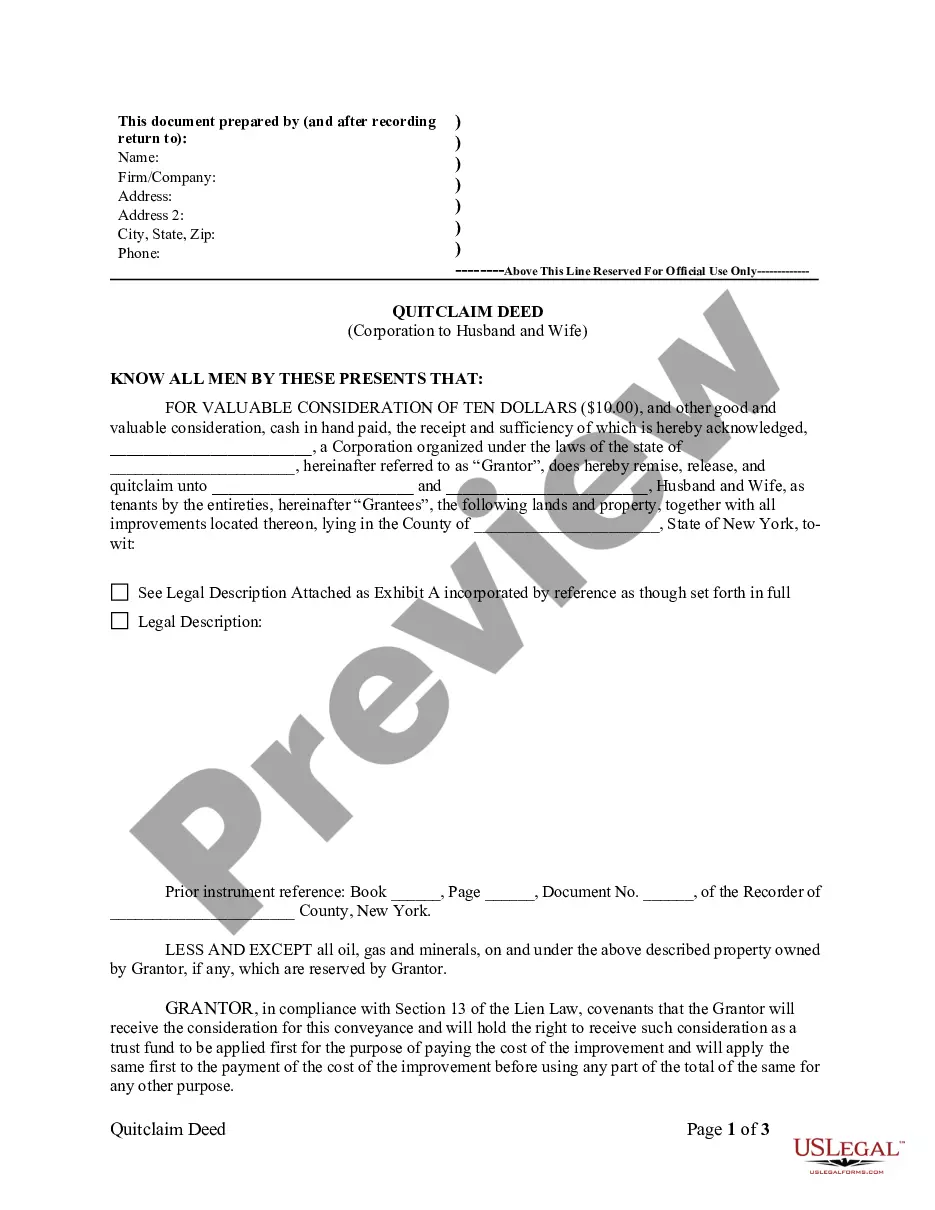

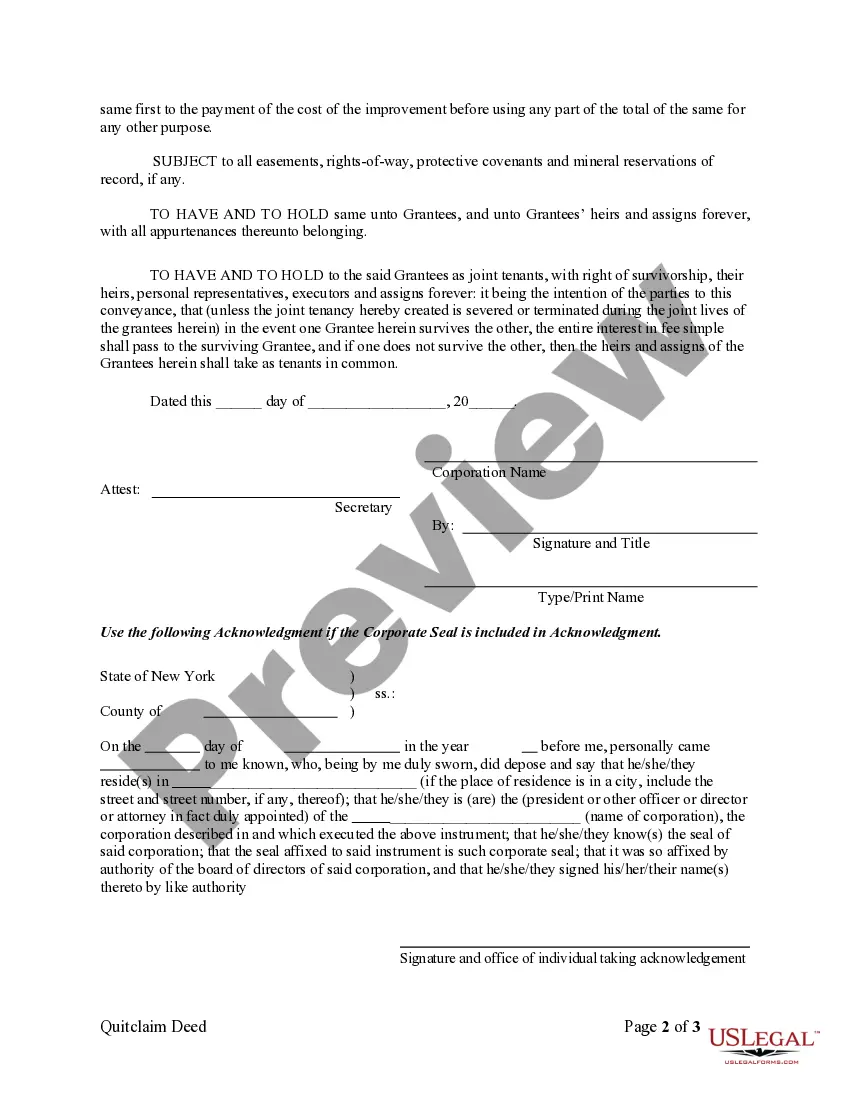

The Kings New York Quitclaim Deed from Corporation to Husband and Wife is a legal document used to transfer property ownership rights from a corporation to a married couple in Kings County, New York. This type of deed grants the corporation's interest or claim to the property to the husband and wife, effectively releasing any further claim or guarantee of ownership. The Kings New York Quitclaim Deed from Corporation to Husband and Wife is a specific type of quitclaim deed that focuses on a transfer of property ownership between a corporation and a couple. It is essential for individuals to understand the intricacies and various types of quitclaim deeds available in Kings County to ensure a smooth and lawful transfer process. Some different types of Kings New York Quitclaim Deeds from Corporation to Husband and Wife include: 1. Sole Proprietorship Quitclaim Deed: This deed type is used when a husband and wife are the sole owners of a corporation and want to transfer the property to themselves individually or jointly. 2. Partnership Quitclaim Deed: If the corporation being dissolved is a partnership, this type of deed allows for the property to be passed on to the husband and wife as partners. 3. Limited Liability Company (LLC) Quitclaim Deed: In the case where the corporation is structured as an LLC, this deed transfers the property from the corporation to the husband and wife as members of the LLC. 4. Close Corporation Quitclaim Deed: If the corporation in question is a close corporation, this deed is used to convey the property to the husband and wife as close corporation shareholders. 5. Non-Profit Corporation Quitclaim Deed: In situations where the corporation is a non-profit organization, this type of deed facilitates the transfer of property ownership rights to the husband and wife, enabling them to become the lawful owners. When executing a Kings New York Quitclaim Deed from Corporation to Husband and Wife, it is crucial to consult with legal professionals and ensure that all necessary information is accurately included. This may involve identifying the corporation's details, the specific property being transferred, and any outstanding liens or encumbrances. Overall, this deed plays a vital role in legally transferring property ownership between a corporation and a husband and wife in Kings County, New York.

The Kings New York Quitclaim Deed from Corporation to Husband and Wife is a legal document used to transfer property ownership rights from a corporation to a married couple in Kings County, New York. This type of deed grants the corporation's interest or claim to the property to the husband and wife, effectively releasing any further claim or guarantee of ownership. The Kings New York Quitclaim Deed from Corporation to Husband and Wife is a specific type of quitclaim deed that focuses on a transfer of property ownership between a corporation and a couple. It is essential for individuals to understand the intricacies and various types of quitclaim deeds available in Kings County to ensure a smooth and lawful transfer process. Some different types of Kings New York Quitclaim Deeds from Corporation to Husband and Wife include: 1. Sole Proprietorship Quitclaim Deed: This deed type is used when a husband and wife are the sole owners of a corporation and want to transfer the property to themselves individually or jointly. 2. Partnership Quitclaim Deed: If the corporation being dissolved is a partnership, this type of deed allows for the property to be passed on to the husband and wife as partners. 3. Limited Liability Company (LLC) Quitclaim Deed: In the case where the corporation is structured as an LLC, this deed transfers the property from the corporation to the husband and wife as members of the LLC. 4. Close Corporation Quitclaim Deed: If the corporation in question is a close corporation, this deed is used to convey the property to the husband and wife as close corporation shareholders. 5. Non-Profit Corporation Quitclaim Deed: In situations where the corporation is a non-profit organization, this type of deed facilitates the transfer of property ownership rights to the husband and wife, enabling them to become the lawful owners. When executing a Kings New York Quitclaim Deed from Corporation to Husband and Wife, it is crucial to consult with legal professionals and ensure that all necessary information is accurately included. This may involve identifying the corporation's details, the specific property being transferred, and any outstanding liens or encumbrances. Overall, this deed plays a vital role in legally transferring property ownership between a corporation and a husband and wife in Kings County, New York.