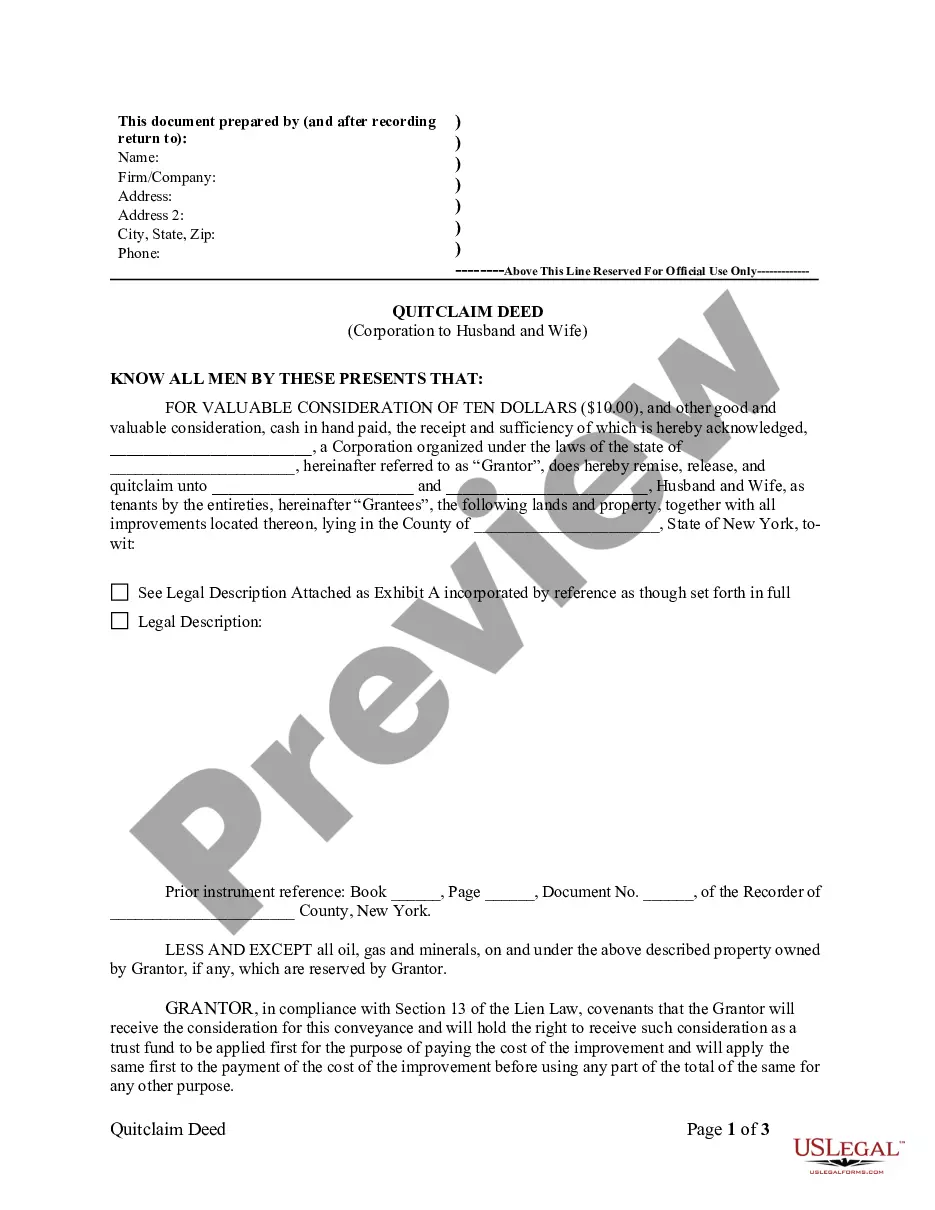

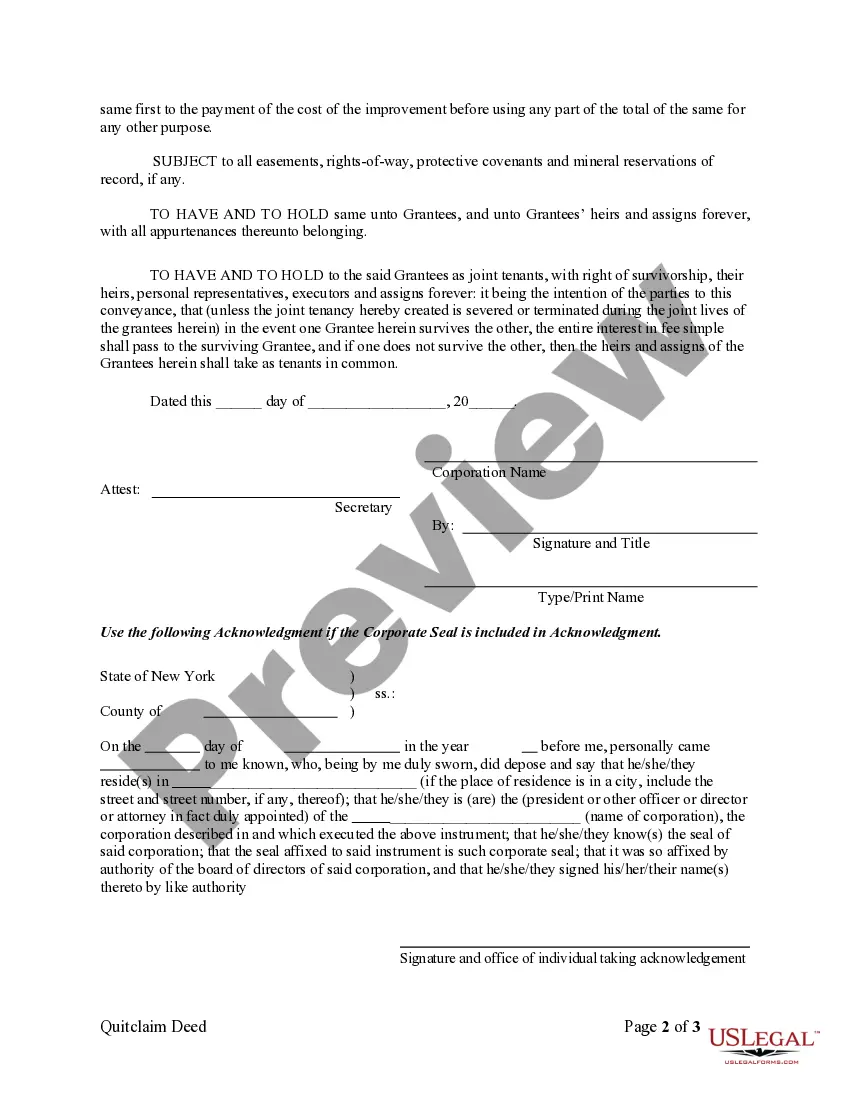

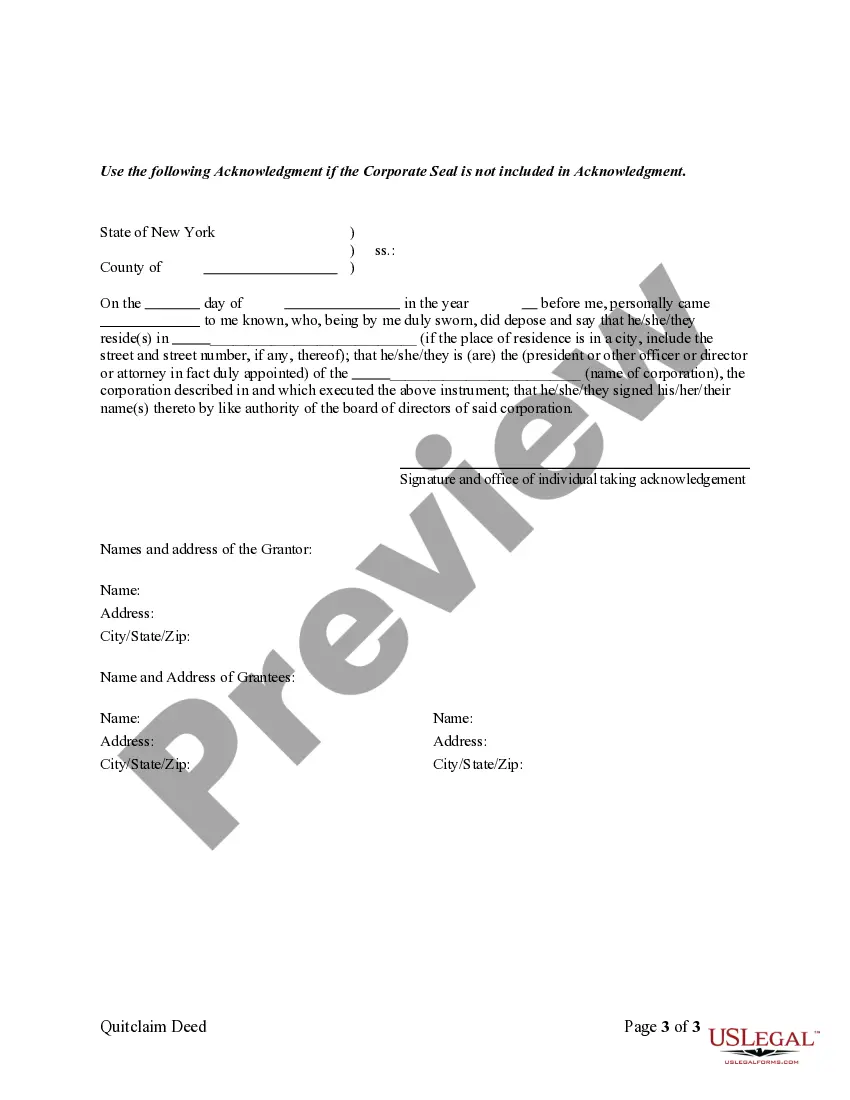

A Suffolk New York Quitclaim Deed from Corporation to Husband and Wife is a legal document that transfers ownership of real property from a corporation to a married couple. This type of deed is commonly used when a corporation wishes to transfer property rights to a husband and wife without making any warranties or guarantees about the property's title. It is important to note that a quitclaim deed only transfers whatever interest the corporation has in the property, if any, and does not provide any assurances regarding the property's history or potential liens. There are different types of Suffolk New York Quitclaim Deeds that can be used when transferring property from a corporation to a husband and wife. One common type is a Simple Quitclaim Deed, which solely transfers the corporation's interest in the property to the couple without any additional conditions or considerations. Another type is a Joint Tenancy with Right of Survivorship Quitclaim Deed, which transfers the property to the couple as joint tenants with the right of survivorship. This means that if one spouse passes away, the other spouse automatically becomes the sole owner of the property. In a Suffolk New York Quitclaim Deed from Corporation to Husband and Wife, it is crucial to include relevant keywords to provide a comprehensive understanding of the document. Some keywords to include may be: Suffolk County, New York, quitclaim deed, corporation, husband and wife, real property, transfer of ownership, warranties, guarantees, property rights, titled, interest, history, liens, simple quitclaim deed, joint tenancy, right of survivorship. Overall, a Suffolk New York Quitclaim Deed from Corporation to Husband and Wife is a legal instrument used to transfer ownership of real property from a corporation to a married couple. It is essential to consult with a legal professional or attorney experienced in real estate matters to ensure accurate and valid transfer of property rights.

A Suffolk New York Quitclaim Deed from Corporation to Husband and Wife is a legal document that transfers ownership of real property from a corporation to a married couple. This type of deed is commonly used when a corporation wishes to transfer property rights to a husband and wife without making any warranties or guarantees about the property's title. It is important to note that a quitclaim deed only transfers whatever interest the corporation has in the property, if any, and does not provide any assurances regarding the property's history or potential liens. There are different types of Suffolk New York Quitclaim Deeds that can be used when transferring property from a corporation to a husband and wife. One common type is a Simple Quitclaim Deed, which solely transfers the corporation's interest in the property to the couple without any additional conditions or considerations. Another type is a Joint Tenancy with Right of Survivorship Quitclaim Deed, which transfers the property to the couple as joint tenants with the right of survivorship. This means that if one spouse passes away, the other spouse automatically becomes the sole owner of the property. In a Suffolk New York Quitclaim Deed from Corporation to Husband and Wife, it is crucial to include relevant keywords to provide a comprehensive understanding of the document. Some keywords to include may be: Suffolk County, New York, quitclaim deed, corporation, husband and wife, real property, transfer of ownership, warranties, guarantees, property rights, titled, interest, history, liens, simple quitclaim deed, joint tenancy, right of survivorship. Overall, a Suffolk New York Quitclaim Deed from Corporation to Husband and Wife is a legal instrument used to transfer ownership of real property from a corporation to a married couple. It is essential to consult with a legal professional or attorney experienced in real estate matters to ensure accurate and valid transfer of property rights.