Kings New York Quitclaim Deed from Corporation to Individual

Description

How to fill out New York Quitclaim Deed From Corporation To Individual?

We consistently seek to minimize or avert legal repercussions when navigating subtle legal or financial matters.

To achieve this, we enlist attorney services that are typically quite costly.

Nonetheless, not all legal issues are of the same complexity. Many of them can be managed independently.

US Legal Forms is an online repository of current DIY legal documents covering everything from wills and power of attorney to articles of incorporation and petitions for dissolution. Our service empowers you to handle your affairs without resorting to a lawyer.

Be sure to verify that the Kings New York Quitclaim Deed from Corporation to Individual complies with the laws and regulations of your state and locality.

- Benefit from US Legal Forms whenever you require obtaining and downloading the Kings New York Quitclaim Deed from Corporation to Individual or any other document easily and securely.

- Simply Log In to your account and click the Get button next to it.

- If you happen to misplace the document, you can always retrieve it again from the My documents tab.

- The process is just as straightforward if you’re a newcomer to the platform!

Form popularity

FAQ

Yes, you can gift a house to someone in New York State using a quitclaim deed, specifically the Kings New York Quitclaim Deed from Corporation to Individual. This deed allows the owner to transfer their property rights without the complications of a sale. Ensure that both parties understand the implications of the gift, and remember to consult with tax professionals to address any potential gift tax obligations.

Removing someone from a deed in New York State involves executing a Kings New York Quitclaim Deed from Corporation to Individual. The current property owner can fill out this deed to transfer their interest away from the individual being removed. It’s vital to follow the proper legal steps for this process, including ensuring the deed is signed and notarized before submission to the county office.

To obtain a quitclaim deed in New York, begin by visiting the US Legal Forms platform. They provide templates for the Kings New York Quitclaim Deed from Corporation to Individual, making it easy to fill out the required information accurately. After completing the form, you will need to have it notarized before filing it with the county clerk's office to finalize the transfer.

To transfer property to a family member in New York, you can use a Kings New York Quitclaim Deed from Corporation to Individual. This deed simplifies the process by allowing the current owner to convey their interest directly to the family member, without involving a lengthy process. Ensure all parties involved understand the implications of the transfer and consider consulting with a legal professional for guidance.

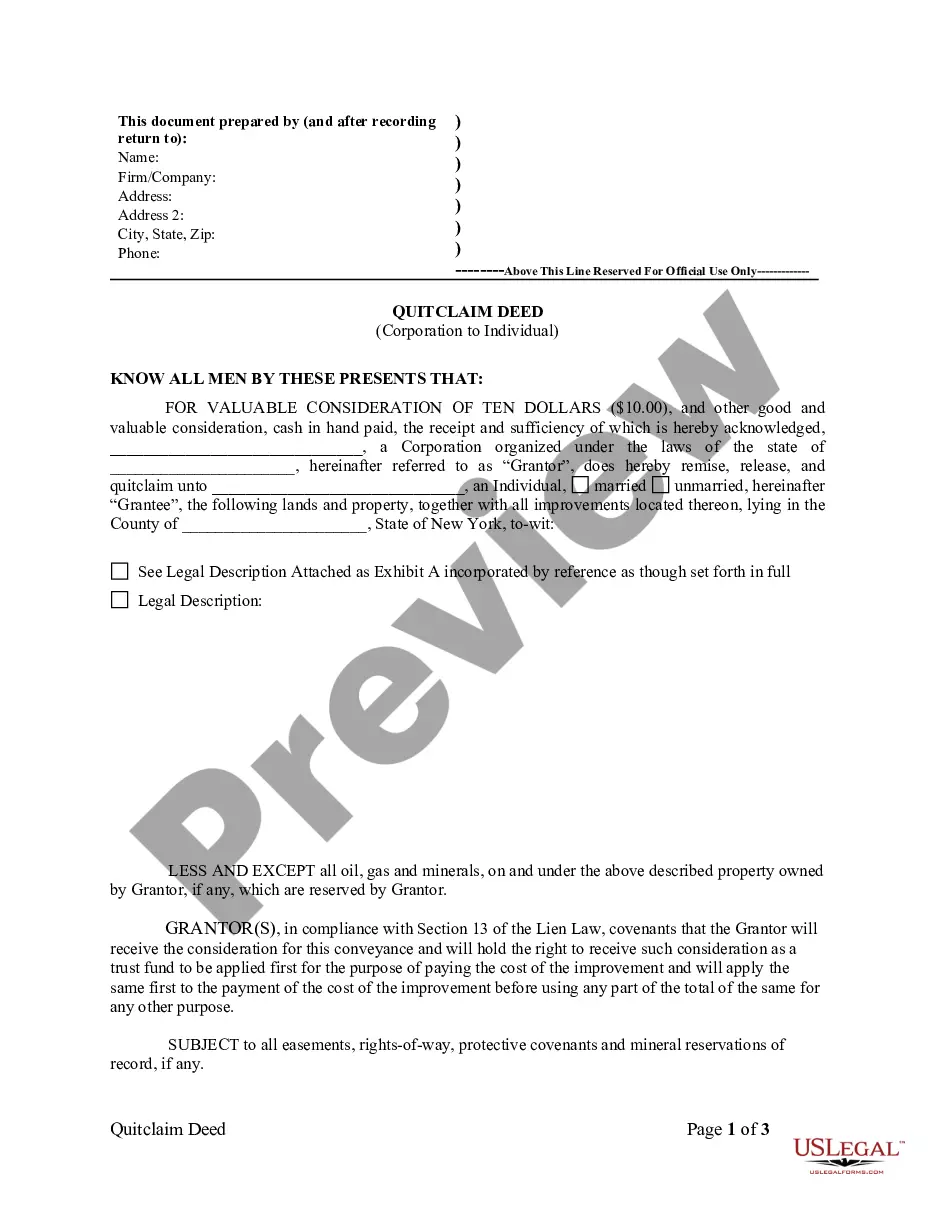

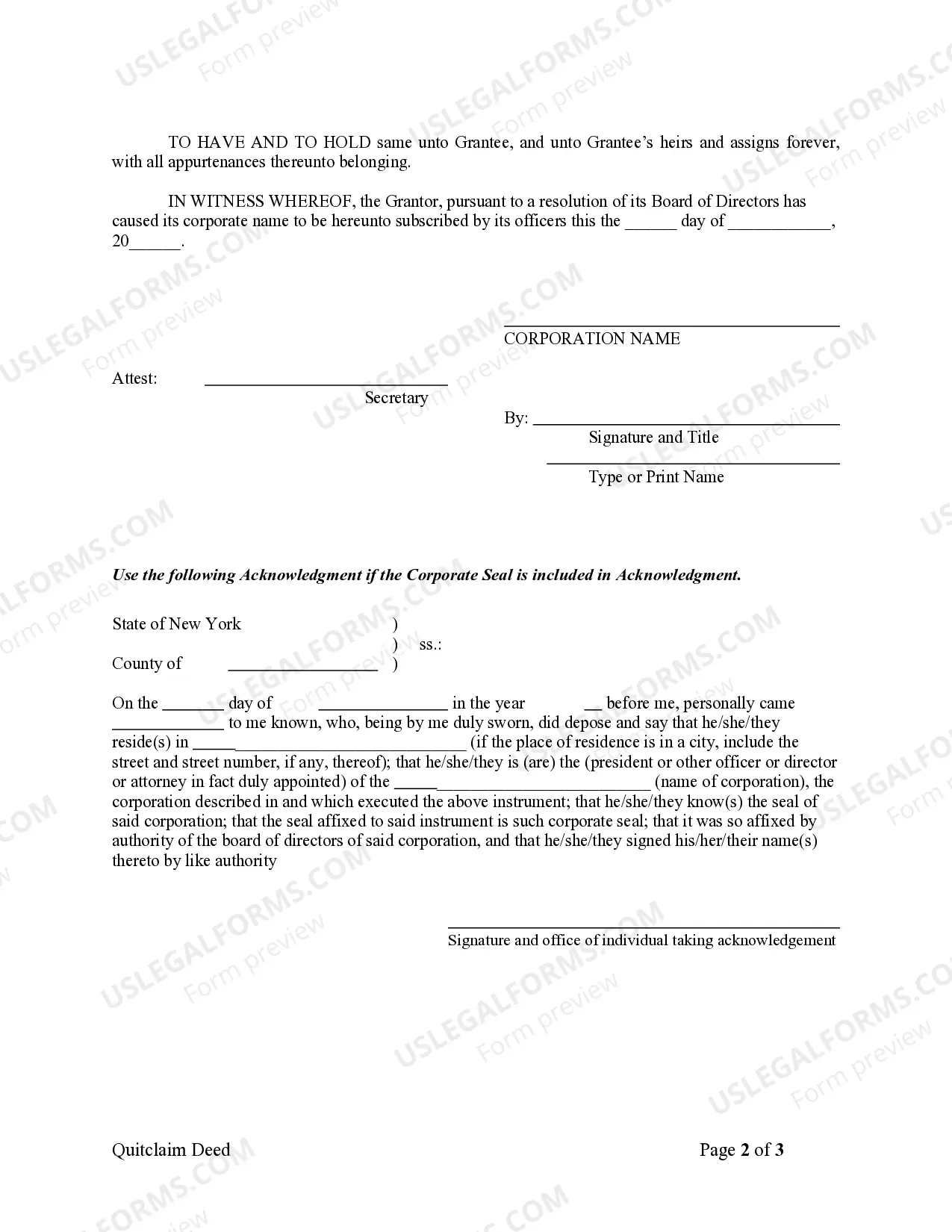

Doing a quitclaim deed in New York involves several important steps. You will need to draft the Kings New York Quitclaim Deed from Corporation to Individual, making sure to include the names of all parties involved. Next, have the deed signed and notarized to validate the transfer. Finally, file the completed deed with the appropriate county office to ensure legal recognition.

To file a quitclaim deed in New York, you must first complete the necessary paperwork. Ensure that the Kings New York Quitclaim Deed from Corporation to Individual is filled out accurately with all required details. After completing the deed, take it to your local county clerk's office for recording. This filing officially transfers ownership and protects your rights.

While quitclaim deeds can simplify property transfers, they come with risks. For example, a Kings New York Quitclaim Deed from Corporation to Individual does not guarantee property title or address existing liens. It's important to perform due diligence on the property and seek legal advice, especially if there are complexities involved in the ownership.

Yes, you can create a quitclaim deed yourself. Using resources like the Kings New York Quitclaim Deed from Corporation to Individual, you can fill out the form accurately. However, consider consulting with a legal professional to ensure compliance with local laws, as this may save you potential issues later on.

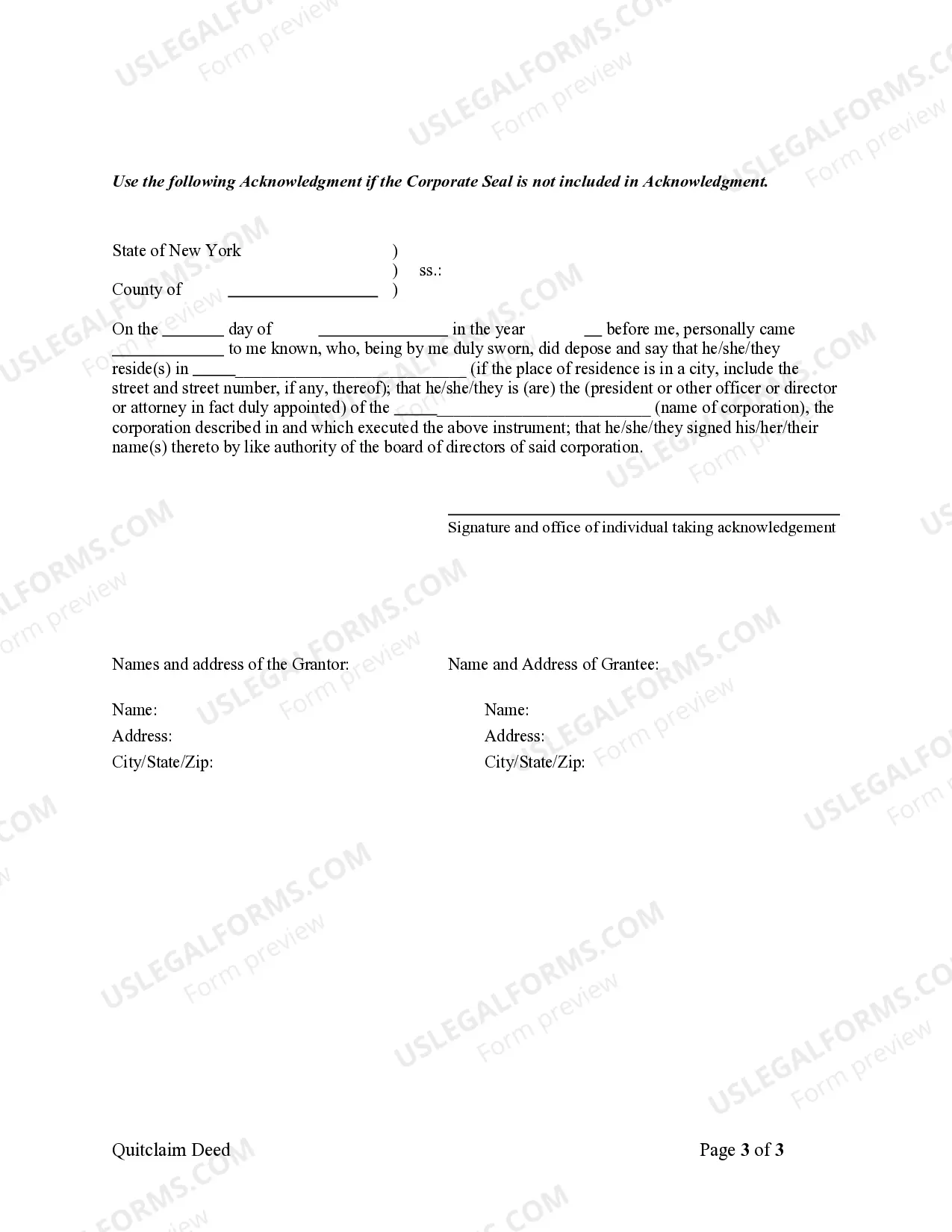

Filling out the quitclaim deed form requires attention to detail. Begin by inputting the grantor's and grantee's full names, ensuring clarity in the property description. Follow with the proper execution date, then sign in the presence of a notary. Finally, submit the Kings New York Quitclaim Deed from Corporation to Individual to the county clerk to make it official.

To fill out a quitclaim deed in New York, start by obtaining the correct form, such as the Kings New York Quitclaim Deed from Corporation to Individual. Clearly enter the names of the parties involved, the property's legal description, and specify the transfer details. After reviewing your entries for accuracy, sign the deed in front of a notary and ensure it is filed with your local county office.