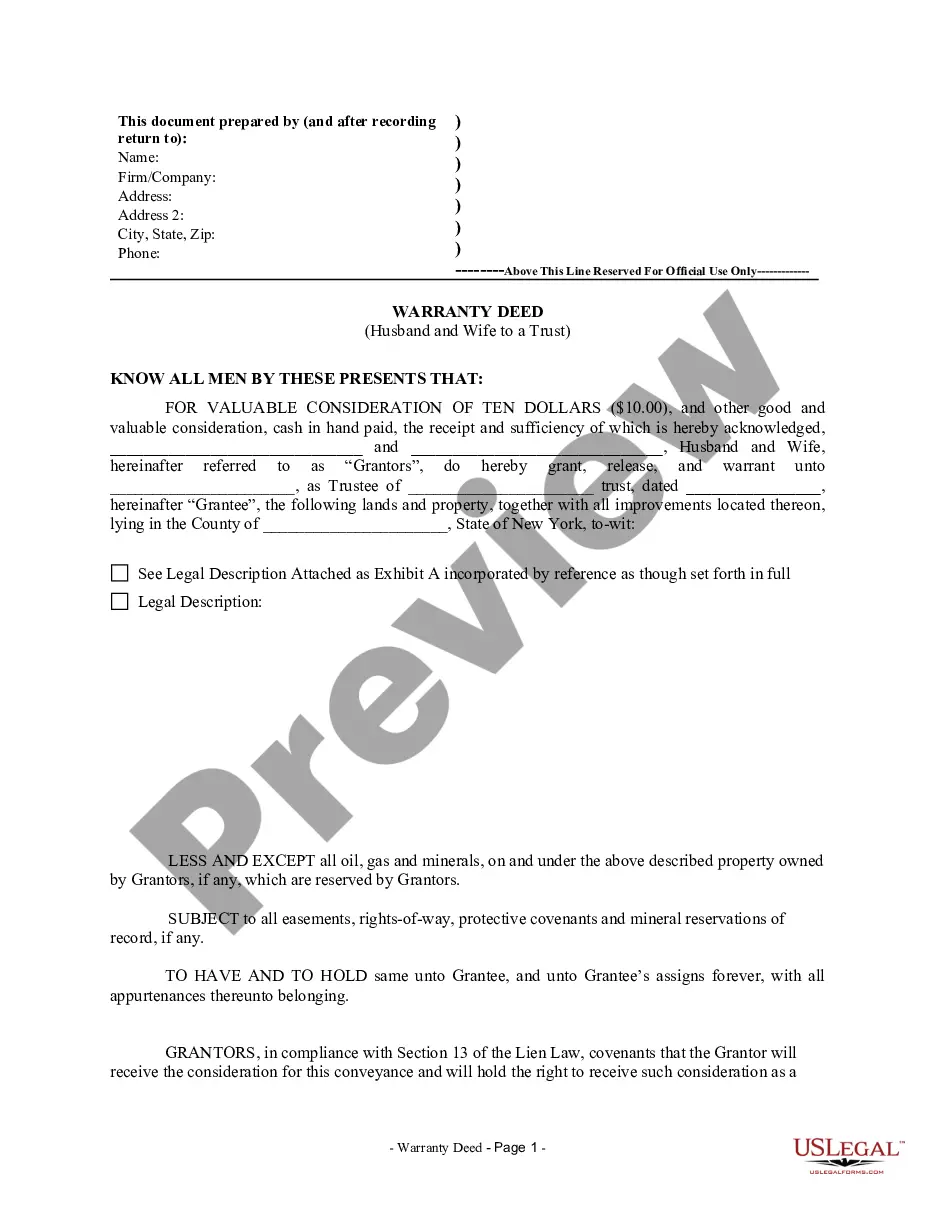

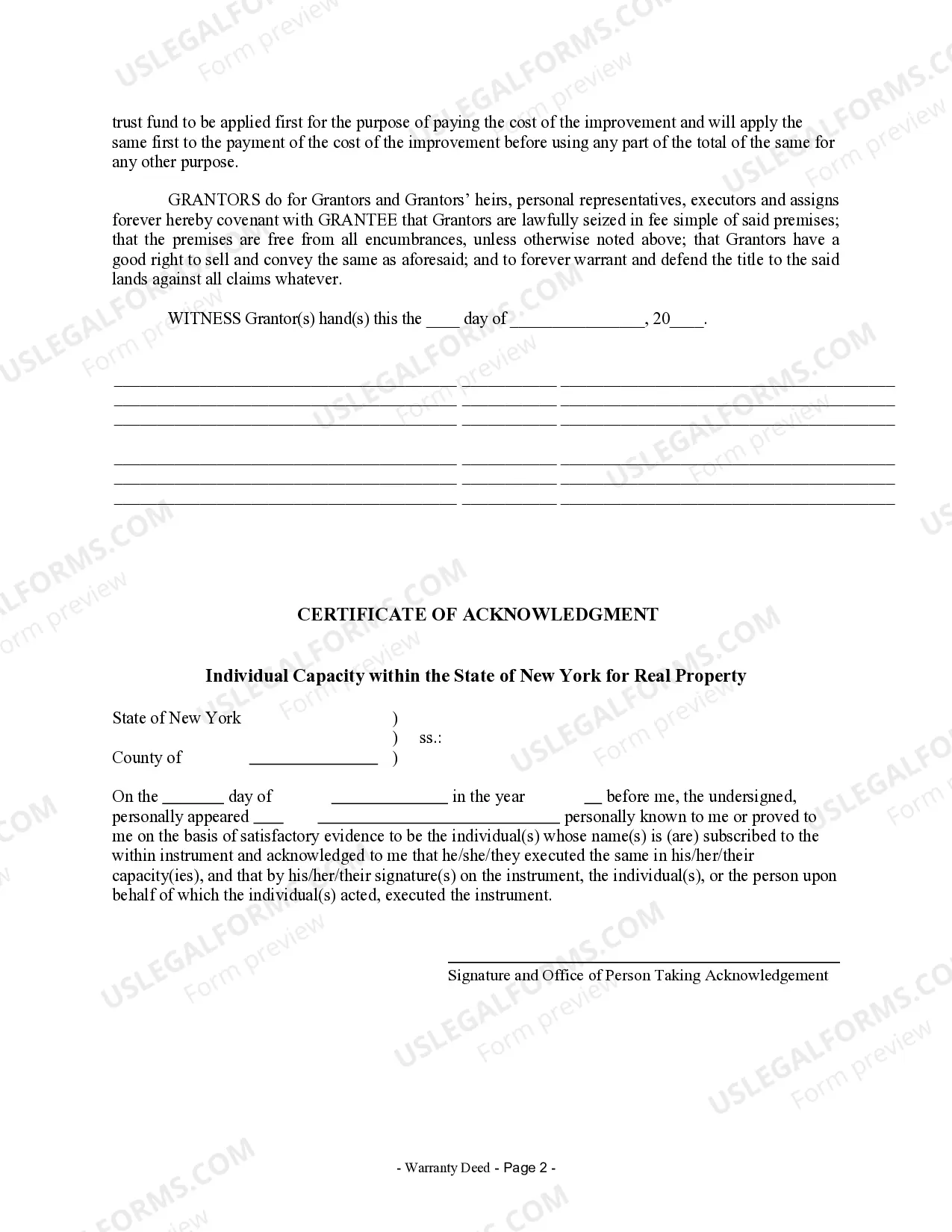

A Kings New York Warranty Deed from Husband and Wife to a Trust is a legal document that enables a married couple to transfer their ownership of real estate property to a trust, ensuring clarity and protection of their assets. This type of deed is commonly used in estate planning and asset protection strategies. Keywords: — Kings New York: Refers to the location where this specific type of warranty deed is executed, which is in Kings County (Brooklyn), New York. — Warranty Deed: A legal document that guarantees the granter (the husband and wife) have clear title to the property and transfers it to the grantee (the trust) without any liens or encumbrances, ensuring the property rights are secure. — Husband and Wife: Denotes that thgrantersrs of the deed are a married couple who jointly own the property. — Trust: In this context, refers to a legal entity that holds the property for the benefit of one or more beneficiaries, as specified in the trust agreement. — Transfer of Ownership: Indicates the legal process through which the title to the property is transferred from the granters to the trust, ensuring legal validity of the transaction. Types of Kings New York Warranty Deed from Husband and Wife to a Trust: 1. Revocable Living Trust: A common form of trust used for estate planning purposes. In this case, the husband and wife create the trust and serve as trustees during their lifetime, with the ability to amend or revoke the trust at any time. The deed transfers the property ownership from the couple to the trust, allowing them to enjoy the benefits and control over the property while alive and ensuring a smooth transition of assets upon their death. 2. Irrevocable Trust: This type of trust, once created, cannot be easily altered or revoked by the granter. The deed transfers the property ownership to the trust permanently, relinquishing control over the property. Irrevocable trusts are often used for asset protection, tax planning, or to qualify for Medicaid benefits. 3. Testamentary Trust: Unlike the revocable and irrevocable trusts, which are created during the lifetime of the granters, a testamentary trust is established through a person's last will and testament. The Kings New York Warranty Deed from Husband and Wife to a Testamentary Trust comes into effect upon the passing of the granters, and the property is then transferred to the trust as a result of their will. Note: It is important to consult with a qualified attorney or legal professional for accurate and personalized advice regarding the creation and execution of a Kings New York Warranty Deed from Husband and Wife to a Trust, as well as to understand the specific implications based on individual circumstances.

A Kings New York Warranty Deed from Husband and Wife to a Trust is a legal document that enables a married couple to transfer their ownership of real estate property to a trust, ensuring clarity and protection of their assets. This type of deed is commonly used in estate planning and asset protection strategies. Keywords: — Kings New York: Refers to the location where this specific type of warranty deed is executed, which is in Kings County (Brooklyn), New York. — Warranty Deed: A legal document that guarantees the granter (the husband and wife) have clear title to the property and transfers it to the grantee (the trust) without any liens or encumbrances, ensuring the property rights are secure. — Husband and Wife: Denotes that thgrantersrs of the deed are a married couple who jointly own the property. — Trust: In this context, refers to a legal entity that holds the property for the benefit of one or more beneficiaries, as specified in the trust agreement. — Transfer of Ownership: Indicates the legal process through which the title to the property is transferred from the granters to the trust, ensuring legal validity of the transaction. Types of Kings New York Warranty Deed from Husband and Wife to a Trust: 1. Revocable Living Trust: A common form of trust used for estate planning purposes. In this case, the husband and wife create the trust and serve as trustees during their lifetime, with the ability to amend or revoke the trust at any time. The deed transfers the property ownership from the couple to the trust, allowing them to enjoy the benefits and control over the property while alive and ensuring a smooth transition of assets upon their death. 2. Irrevocable Trust: This type of trust, once created, cannot be easily altered or revoked by the granter. The deed transfers the property ownership to the trust permanently, relinquishing control over the property. Irrevocable trusts are often used for asset protection, tax planning, or to qualify for Medicaid benefits. 3. Testamentary Trust: Unlike the revocable and irrevocable trusts, which are created during the lifetime of the granters, a testamentary trust is established through a person's last will and testament. The Kings New York Warranty Deed from Husband and Wife to a Testamentary Trust comes into effect upon the passing of the granters, and the property is then transferred to the trust as a result of their will. Note: It is important to consult with a qualified attorney or legal professional for accurate and personalized advice regarding the creation and execution of a Kings New York Warranty Deed from Husband and Wife to a Trust, as well as to understand the specific implications based on individual circumstances.