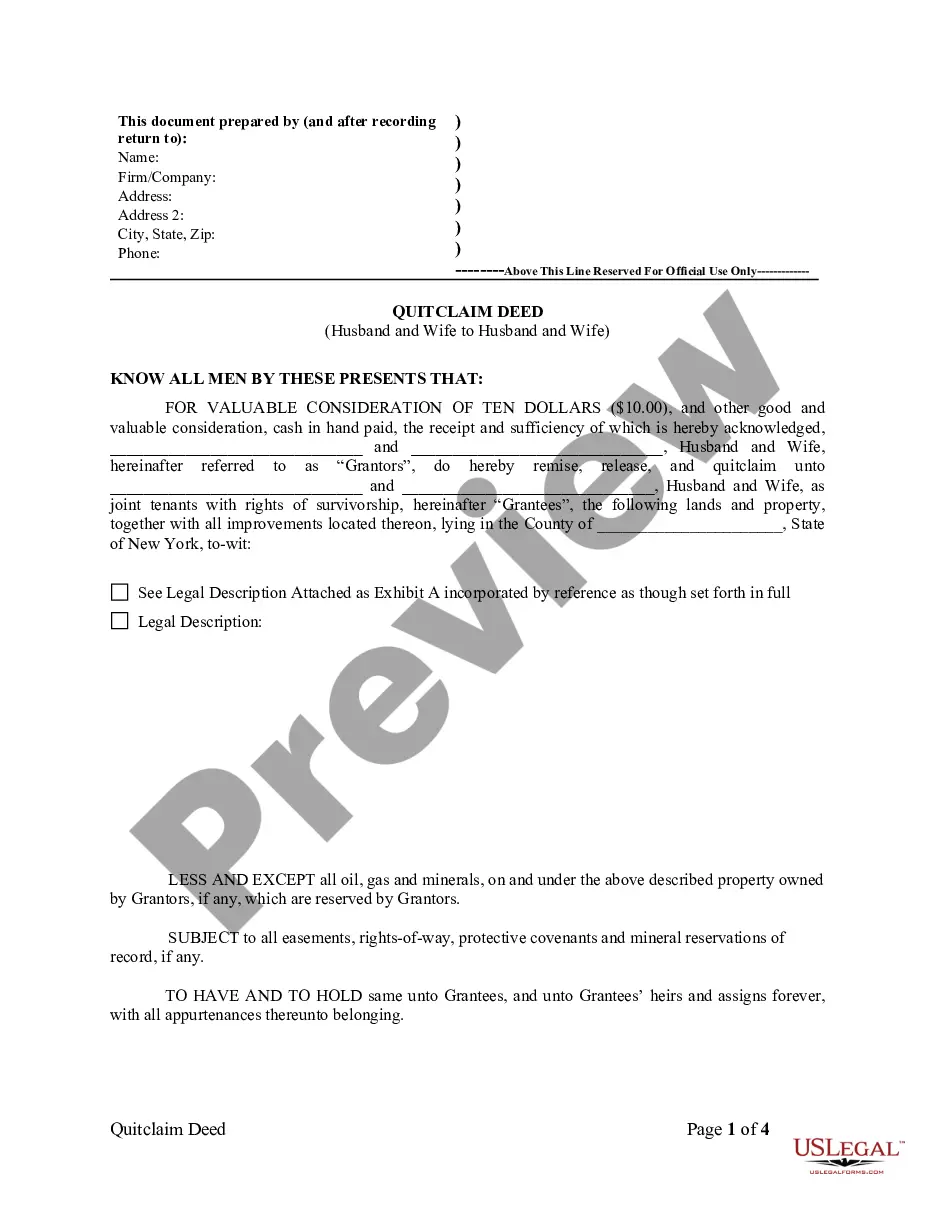

A Kings New York Quitclaim Deed from Husband and Wife to Husband and Wife is a legally binding document used in the state of New York to transfer the ownership of a property from a married couple to the same couple. This type of deed ensures that both spouses have equal rights and interests over the property. The Quitclaim Deed is a common form of property transfer where one party (the granter) relinquishes their claim or interest in the property to another party (the grantee). This type of deed does not guarantee that the property is free of liens or encumbrances. It simply transfers whatever ownership interest the granter has to the grantee. In terms of variations, there are no specific types of Kings New York Quitclaim Deed from Husband and Wife to Husband and Wife. However, it is worth noting that there can be different scenarios under which such a deed may be used, including: 1. Joint Tenancy: In this scenario, the property is owned by both spouses with the right of survivorship. This means that if one spouse passes away, the surviving spouse automatically becomes the sole owner of the property. 2. Tenancy by the Entirety: This form of ownership is only available to married couples. It provides similar rights as joint tenancy, but with the added protection that creditors of one spouse cannot take the property to satisfy their debts. 3. Community Property: Although community property laws do not apply in New York, a couple relocating from a community property state may choose to use a Kings New York Quitclaim Deed from Husband and Wife to Husband and Wife to maintain their existing ownership structure. When executing a Kings New York Quitclaim Deed from Husband and Wife to Husband and Wife, it is crucial to include specific keywords to ensure the document's relevance and legal accuracy. Some relevant keywords to consider include: Kings County, New York, Quitclaim Deed, Husband and Wife, real estate transfer, property ownership, joint tenancy, tenancy by the entirety, community property, marital property, legal document, granter, grantee, warranty, encumbrances, liens, rights of survivorship. It is important to consult with a qualified real estate attorney to draft and execute this type of deed accurately and according to the laws and requirements of Kings County, New York.

Kings New York Quitclaim Deed from Husband and Wife to Husband and Wife

Description

How to fill out Kings New York Quitclaim Deed From Husband And Wife To Husband And Wife?

Locating verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Kings New York Quitclaim Deed from Husband and Wife to Husband and Wife gets as quick and easy as ABC.

For everyone already familiar with our library and has used it before, obtaining the Kings New York Quitclaim Deed from Husband and Wife to Husband and Wife takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a few additional steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make certain you’ve picked the right one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, use the Search tab above to get the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Kings New York Quitclaim Deed from Husband and Wife to Husband and Wife. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!

Form popularity

FAQ

An interspousal transfer deed, more technically called an interspousal transfer grant deed, is a legal document used to give sole ownership of shared property, such as a house, to one person in a marriage. They are commonly employed in divorce cases to transfer community property to one spouse.

The quitclaim deed must be in writing. For real estate in New York City, quitclaim deeds typically require two main forms: Form RP-5217NYC and Form TP-584. Many parties hire attorneys to prepare these documents for them. Most quitclaim deeds in New York require the grantor's signature.

An interspousal transfer deed, more technically called an interspousal transfer grant deed, is a legal document used to give sole ownership of shared property, such as a house, to one person in a marriage. They are commonly employed in divorce cases to transfer community property to one spouse.

A quit claim deed, or what's also spelled as a quitclaim deed, is a New York legal document that transfers title to a real estate property but makes no promises at all about the owner's title.

New York law requires that the grantor/seller (the individual making the transfer) sign the deed. The deed must be signed and acknowledged before a qualified New York notary public. If signed and notarized outside the United States, except for Canada, the deed must include a certificate of authentication.

The most common way to transfer land ownership, especially residential property, is with a warranty deed. Warranty deeds not only make it possible for a property owner to transfer ownership to the buyer. But this type of deed also explicitly promises that the title is good and clear of all liens or other issues.

A spousal beneficiary rollover is a transfer of fund assets to the surviving spouse of the deceased account holder. Funds are either rolled over into the spouse's account or the decedent's account is renamed with the surviving spouse as the new owner.

Property can be transferred between two spouses to one spouse, or from one spouse to the other, by using this type of deed. Interspousal deeds can be used in other ways as well. For example, a mortgage lender may ask the spouse of the borrower to sign an interspousal transfer deed.

Fees to File a Quitclaim Deed in New York The fees to file a New York quitclaim deed vary from county to county, but some of the fees are similar. As of 2018, the basic fee for filing a quitclaim deed of residential or farm property is $125, while the fee for all other property is $250.

Interesting Questions

More info

Removing spouse from the mortgage. 2. II am her husband. No, it's not a divorce certificate. You can add or remove a spouse's name from the property title. Divorce cases: A reason to give a divorce. , your spouse will not oppose the divorce in any way,, the mortgage will be held by a third party, not you. , Your mortgage is more of a hold back. ., a spouse will not oppose the divorce in any way,, the mortgage will be held by a third party, not you. , Your mortgage is more of a hold back. The Mortgage: If you have more money than your spouse, you can pay in full up front. If you want to pay what the property is worth now, then they may be able to change the mortgage into a monthly payment plan. However, most mortgages cannot be changed because they are held by a third party, not the home buyer. Losses on Mortgage: If you fail to pay the mortgage on time, your spouse will be responsible for the mortgage.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.