Rochester New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract: Explained In Rochester, New York, individuals may come across situations where they need to renounce or disclaim their property rights in a life insurance or annuity contract. This legal process allows individuals to relinquish their claims to property, ensuring it is transferred to another party or disposed of as per the contract's terms. Here, we provide a detailed description of the Rochester New York renunciation and disclaimer of property from life insurance or annuity contract, shedding light on its various types and implications. Types of Renunciation and Disclaimer of Property: 1. Absolute Renunciation: Under this type, an individual completely waives their rights to the property mentioned in the life insurance or annuity contract. This means that the person renouncing the property will have no future claims or interest in it. 2. Partial Renunciation: In certain cases, individuals may choose to renounce only a portion of their property rights from the life insurance or annuity contract. This allows them to retain some interest while transferring the remaining portion to another designated party. 3. Conditional Renunciation: Conditional renunciation occurs when an individual renounces their rights to the property under specific circumstances. The conditions could be related to the occurrence of a particular event or meeting certain criteria outlined in the contract. Process of Renunciation and Disclaimer in Rochester, New York: 1. Consultation: Before initiating the renunciation or disclaimer process, it is advisable to consult with a legal professional experienced in estate planning and insurance laws. They can guide individuals through the complexities of the process and ensure compliance with applicable regulations. 2. Reviewing the Contract: It is essential to thoroughly review the life insurance or annuity contract in question. This step involves understanding the terms, conditions, and provisions related to the renunciation or disclaimer of property. Identifying any restrictions or limitations can help determine the feasibility of renunciation. 3. Drafting the Renunciation Document: Working closely with an attorney, individuals can prepare a formal renunciation document. This document must clearly state the intent to renounce or disclaim property rights mentioned in the life insurance or annuity contract. It should also outline the renouncing party's details, the property being disclaimed, and any specific conditions, if applicable. 4. Notarization and Filing: The renunciation document must be notarized to establish its legal validity. Subsequently, it should be filed with the appropriate legal authorities, adhering to the procedures and timelines mandated by Rochester, New York laws. 5. Notification to Relevant Parties: To ensure smooth transfer or disposition of the property, it is crucial to notify all parties involved, including the insurance company, beneficiaries, and executors of the renunciation. This step avoids potential confusion or legal disputes that may arise due to the reluctant's actions. Benefits and Considerations: The renunciation and disclaimer of property offer individuals several benefits, such as estate planning flexibility, avoidance of tax liabilities, and ensuring smooth wealth transfer. However, it's important to carefully consider the implications, seek professional advice, and consider any possible alternative solutions before proceeding with renunciation. In conclusion, understanding the intricacies of Rochester New York renunciation and disclaimer of property from a life insurance or annuity contract is crucial for individuals navigating such situations. By being aware of the various types, steps involved, and legal considerations, individuals can effectively renounce their property rights while complying with applicable laws and protecting their best interests.

Rochester New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract

Description

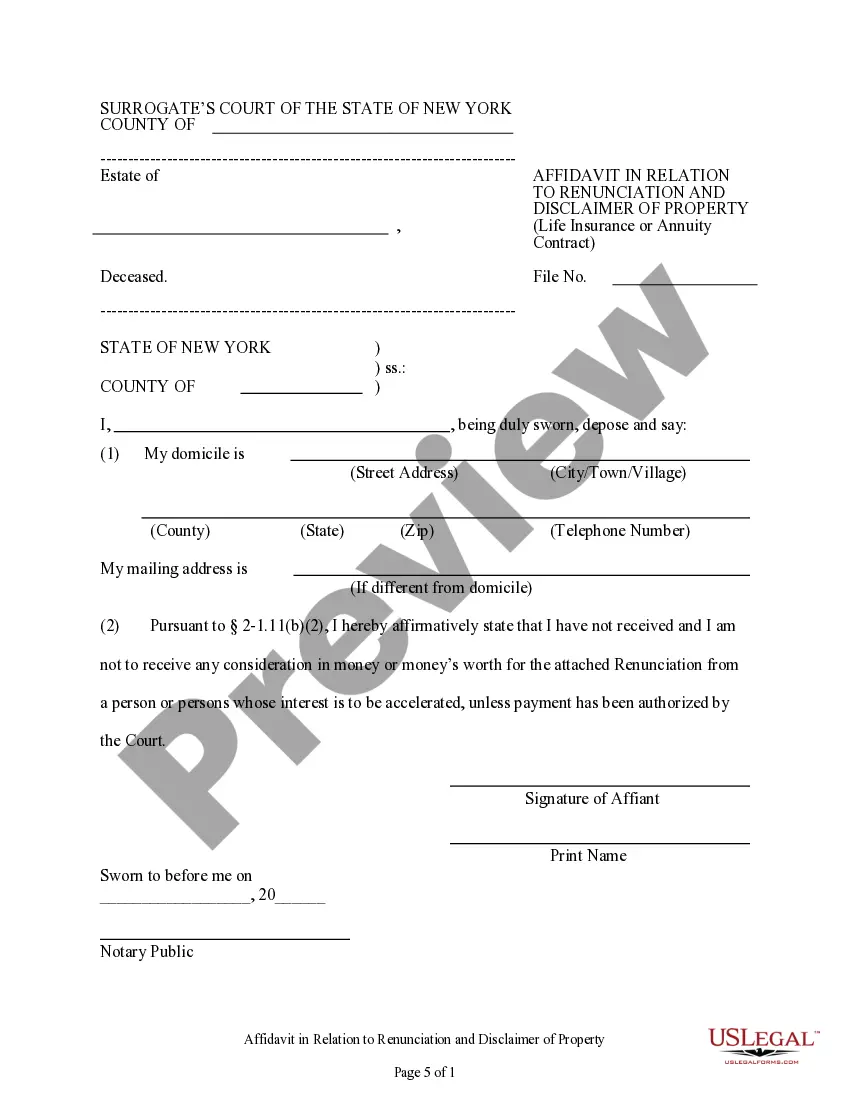

How to fill out Rochester New York Renunciation And Disclaimer Of Property From Life Insurance Or Annuity Contract?

If you are looking for a relevant form template, it’s difficult to find a better place than the US Legal Forms site – probably the most considerable libraries on the internet. Here you can get thousands of form samples for business and personal purposes by categories and regions, or key phrases. Using our high-quality search function, getting the latest Rochester New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract is as easy as 1-2-3. In addition, the relevance of each and every file is proved by a group of skilled lawyers that regularly check the templates on our website and revise them based on the newest state and county laws.

If you already know about our system and have an account, all you need to get the Rochester New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract is to log in to your account and click the Download button.

If you use US Legal Forms for the first time, just follow the guidelines below:

- Make sure you have chosen the form you need. Read its information and make use of the Preview option to check its content. If it doesn’t meet your needs, use the Search field near the top of the screen to find the appropriate document.

- Confirm your decision. Choose the Buy now button. Next, select your preferred pricing plan and provide credentials to register an account.

- Make the financial transaction. Use your credit card or PayPal account to complete the registration procedure.

- Get the template. Indicate the file format and save it on your device.

- Make adjustments. Fill out, revise, print, and sign the obtained Rochester New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract.

Each template you add to your account does not have an expiration date and is yours permanently. You can easily gain access to them using the My Forms menu, so if you need to receive an extra duplicate for enhancing or printing, you can come back and save it once more whenever you want.

Take advantage of the US Legal Forms extensive catalogue to gain access to the Rochester New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract you were seeking and thousands of other professional and state-specific samples in a single place!