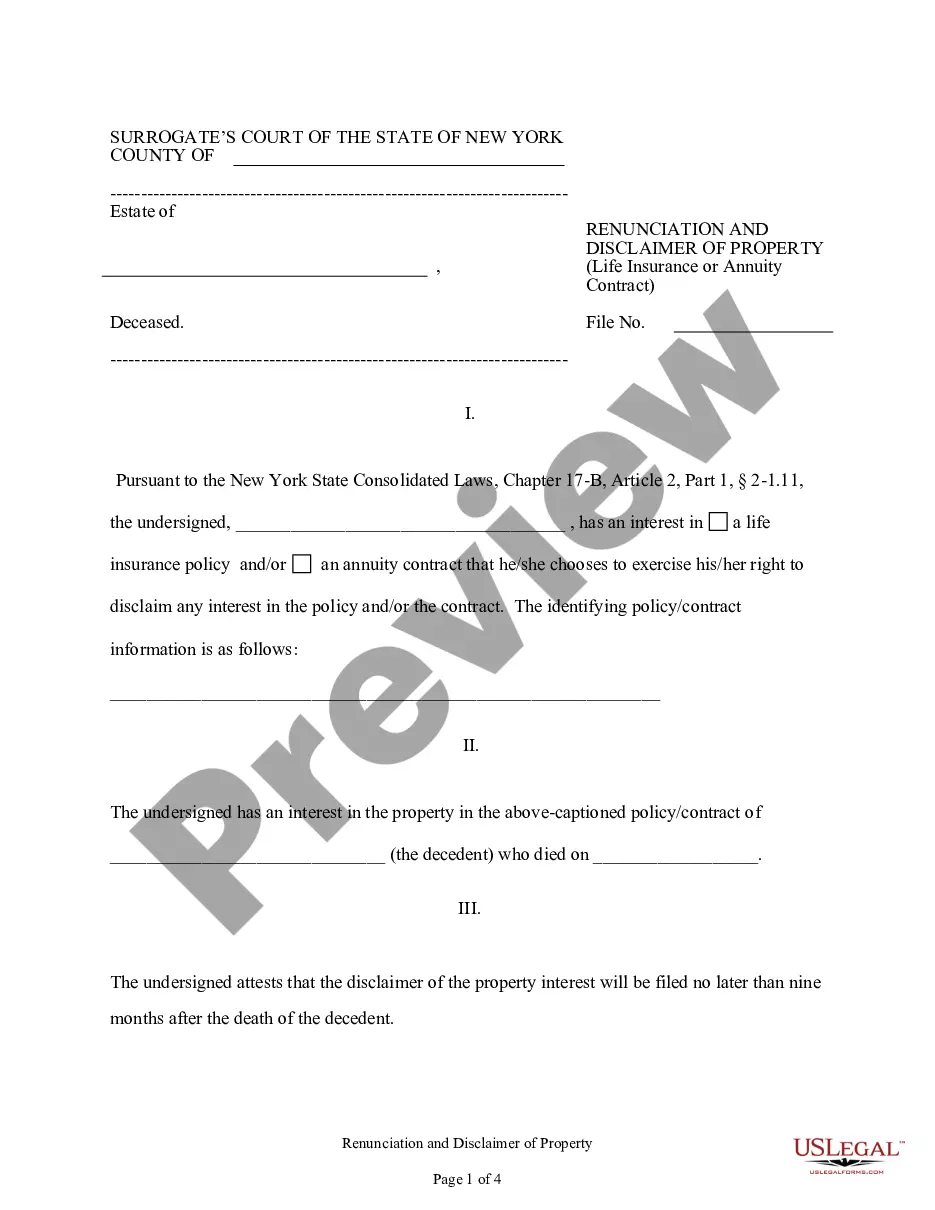

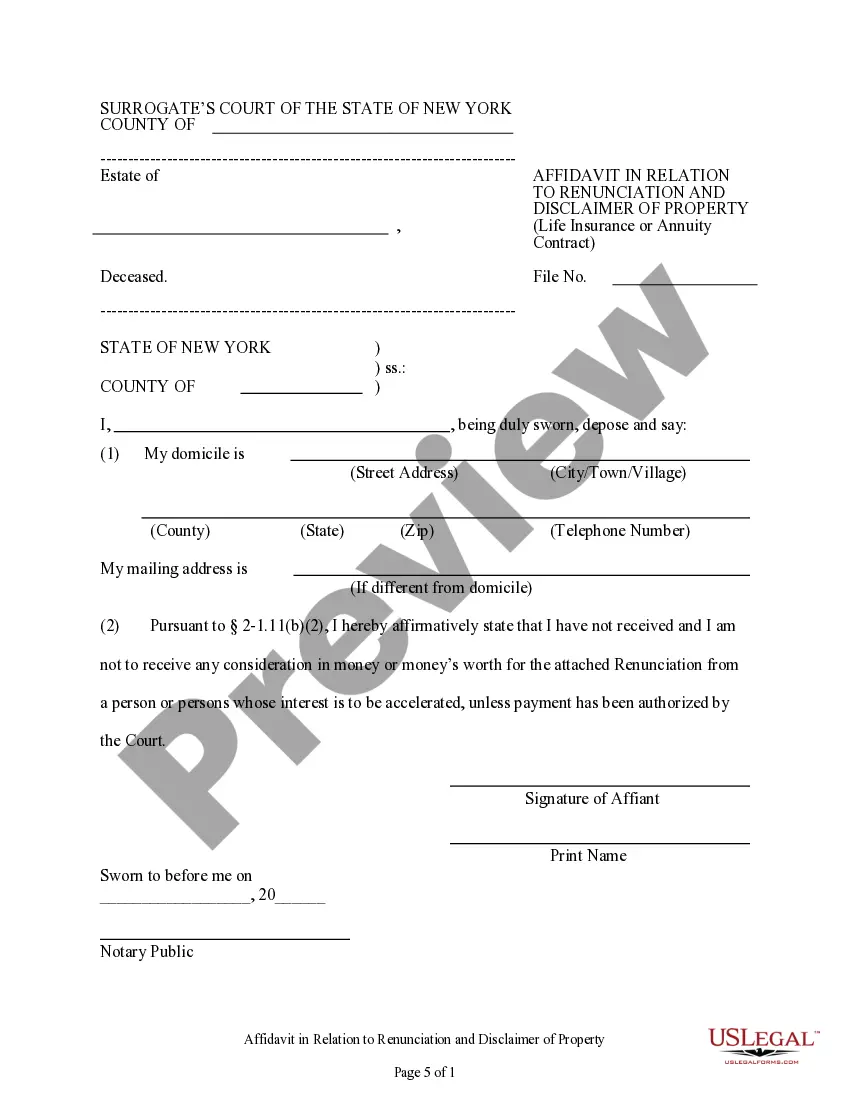

Rochester New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract

Description

How to fill out New York Renunciation And Disclaimer Of Property From Life Insurance Or Annuity Contract?

If you are searching for a suitable form template, it’s challenging to discover a superior location than the US Legal Forms site – likely the most extensive collections on the web.

Here you can obtain countless form examples for commercial and private uses categorized by type and location, or keywords.

Leveraging our premium search functionality, acquiring the latest Rochester New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract is as straightforward as 1-2-3.

Complete the payment process. Utilize your credit card or PayPal account to finalize the registration steps.

Retrieve the template. Specify the file format and store it on your device.

- Additionally, the appropriateness of each file is validated by a team of experienced attorneys who routinely review the templates on our site and update them according to the latest state and county regulations.

- If you are already familiar with our platform and possess an account, all you need to obtain the Rochester New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the instructions below.

- Verify that you have selected the form you require. Review its details and utilize the Preview feature to inspect its content. If it doesn’t serve your requirements, employ the Search field at the top of the screen to find the suitable document.

- Validate your choice. Click the Buy now button. Afterwards, select your desired pricing plan and provide the information necessary to create an account.

Form popularity

FAQ

In New York State, there is no inheritance tax, which means you can inherit any amount without direct tax implications. However, estate taxes may apply if the total estate value exceeds the state exemption limit. Utilizing the Rochester New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract can provide clarity on your specific situation and how to navigate estate taxes effectively. Understanding these nuances will help you make informed decisions regarding your inheritance.

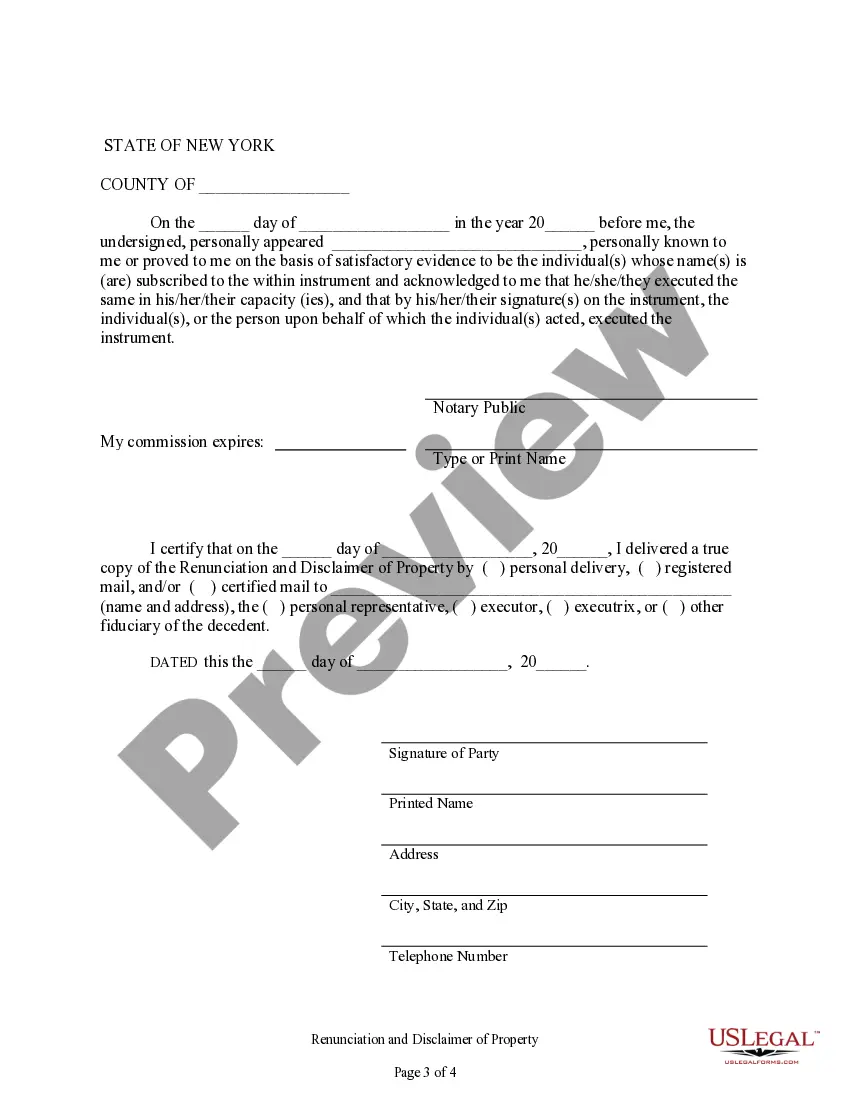

To disclaim an inheritance in New York, you must file a written disclaimer with the executor of the estate, stating your intention clearly. The Rochester New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract is a helpful tool in this process. Ensure that you do this within nine months of the individual's death, as this is typically the timeframe allotted under New York law. Taking the right steps is essential for ensuring proper legal procedure is followed.

In New York, certain assets are exempt from probate, including life insurance policies with designated beneficiaries, retirement accounts, and jointly owned property. Utilizing the Rochester New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract can further clarify the handling of such assets. This exemption allows for a quicker transfer of property without the costs and delays associated with probate. It's beneficial to know which of your assets may bypass this process.

In New York, an inheritance tax waiver form is not typically required, as the state does not impose an inheritance tax. However, if you are dealing with life insurance, it's vital to understand how the Rochester New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract could apply. This can streamline any implications regarding property you have chosen to disclaim. Staying informed can ease the process of managing your inheritance.

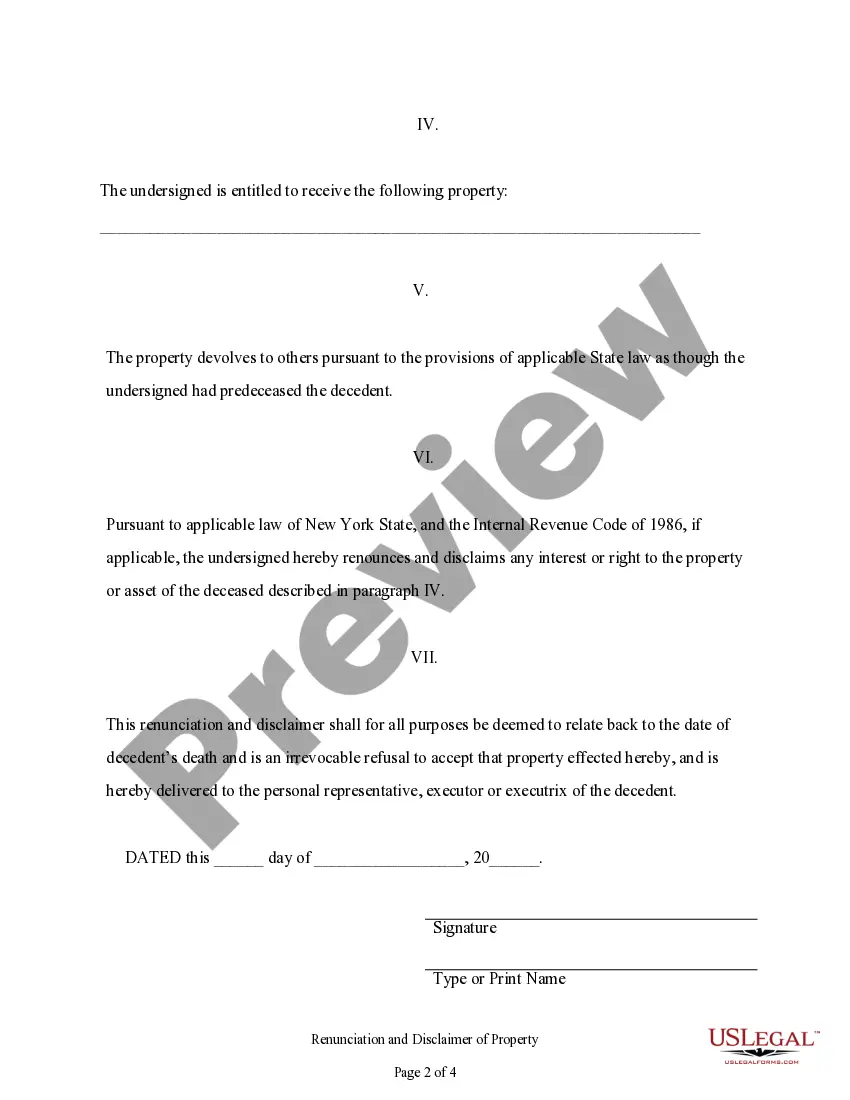

If you refuse your inheritance, it will generally pass to other beneficiaries as specified in the estate plan or the laws of succession in Rochester. This process is often managed through the Rochester New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract. By formally renouncing your inheritance, you step aside, allowing the property to go to the next in line. It's essential to follow legal procedures to ensure the inheritance is correctly redistributed.

Inheritance laws in New York dictate how property is distributed when a person passes away. These laws include provisions for wills, intestate succession, and various disclaimers, including the Rochester New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract. It is essential to understand these laws to determine how assets will be divided among heirs and beneficiaries. Consulting resources, such as uslegalforms, can provide valuable information and assistance for navigating these regulations effectively.

Beneficiaries in New York typically have the power to receive their inheritance according to the terms of the will or the laws of intestacy. They can also challenge the validity of the will if they believe there are grounds for contesting it. Moreover, understanding the Rochester New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract can provide beneficiaries with insights regarding their options to disclaim property they do not wish to inherit. This choice allows beneficiaries to make decisions that align with their financial goals.

In New York, beneficiaries have the right to request a copy of the will once it has been admitted to probate. This transparency ensures that beneficiaries understand their rights and interests in the estate. By being informed, beneficiaries can better navigate the Rochester New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract processes if needed. Overall, having access to the will aids beneficiaries in making educated decisions regarding their inheritance.

In New York, a beneficiary has specific rights concerning life insurance or annuity contracts. Once a policy is in force and the insured individual passes away, the beneficiary is entitled to receive the benefits unless they have legally renounced their rights. The process for Rochester New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract allows beneficiaries to refuse the benefits legally. This option can help individuals manage their estate according to their wishes, providing clarity in complex family situations.