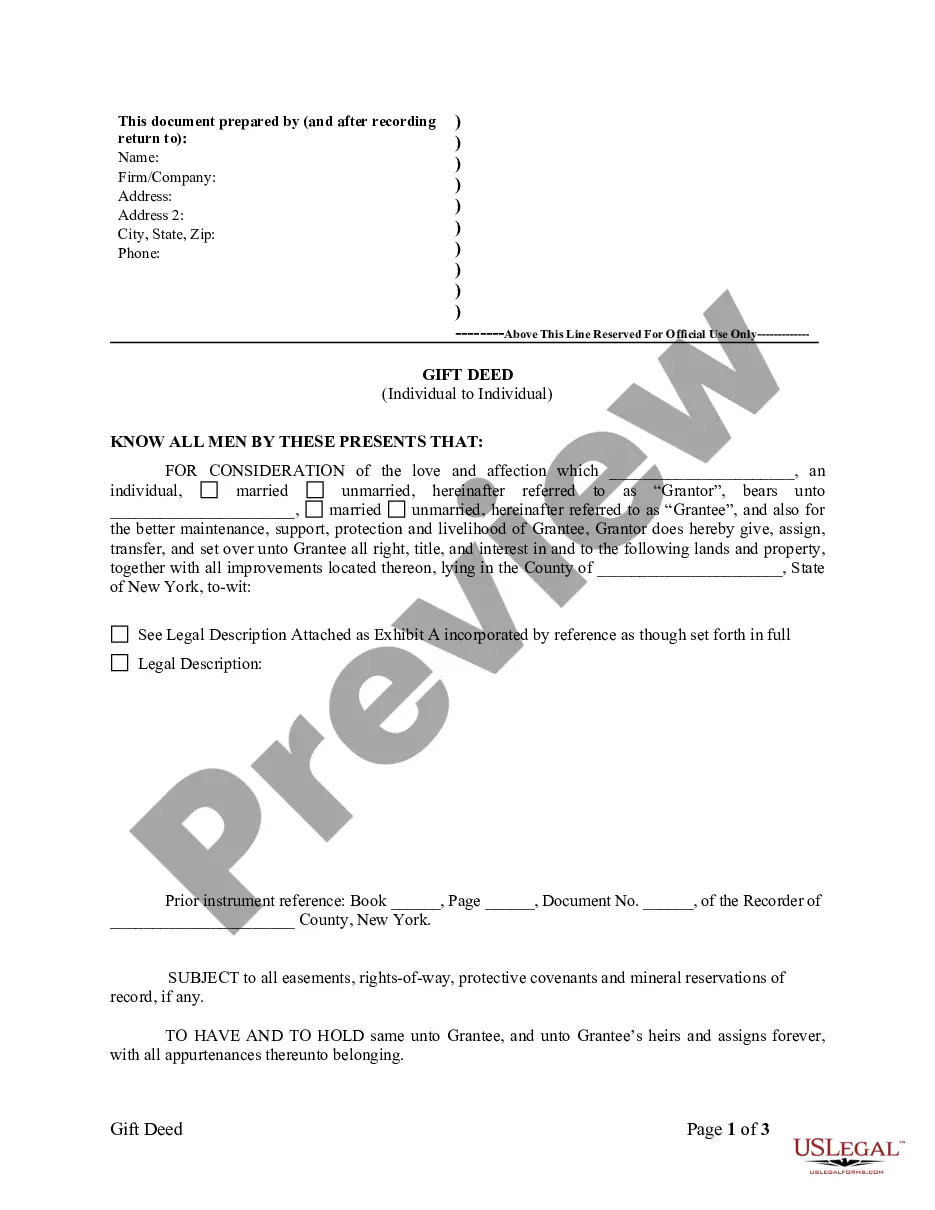

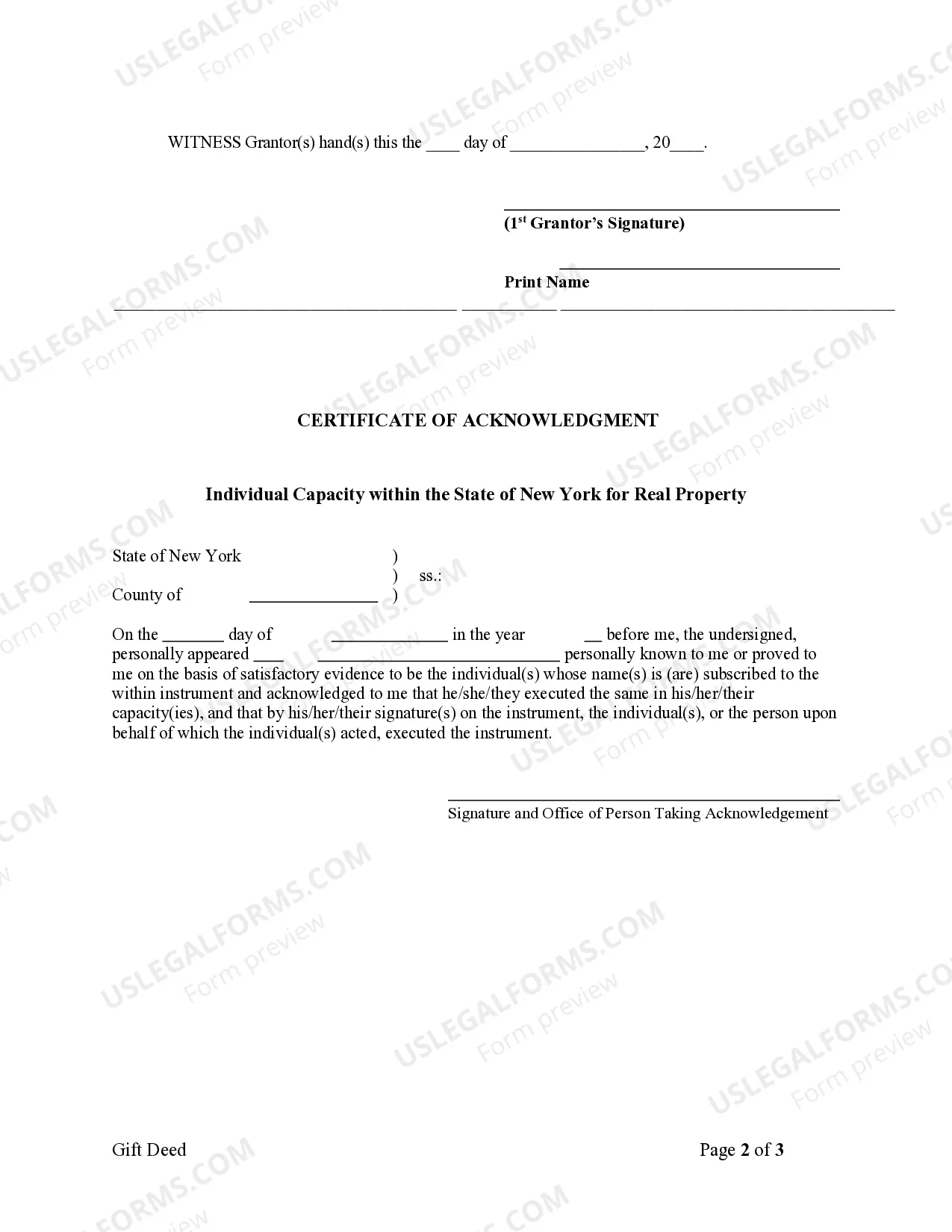

A Queens New York Gift Deed for Individual to Individual is a legal document used to transfer ownership of real estate between individuals without any exchange of consideration or payment. The gift deed is commonly utilized in situations where a person wishes to gift their property to a family member, friend, or any other individual. The process of transferring property through a gift deed involves the donor, the person giving the property, and the done, the person receiving the property. The deed must be voluntarily executed by the donor, clearly expressing their intention to gift the property to the done. It is essential to have the gift deed notarized and recorded with the appropriate local government agency, such as the Queens County Clerk's office, to ensure its legality and validity. Some keywords relevant to Queens New York Gift Deed for Individual to Individual include: 1. Gift Deed: A legal document used to transfer ownership of property as a gift without any payment involved. 2. Queens, New York: The specific location in New York State where the gift deed is being executed. 3. Individual to Individual: The type of transfer occurring between two individuals without involving any entities or organizations. 4. Real Estate: The type of property being transferred, typically land or buildings, situated within Queens, New York. 5. Ownership Transfer: The process of transferring legal rights and interests of the property from the donor to the done. 6. Consideration: Emphasizing that no money or other form of payment is involved in the transfer. 7. Family Member: Examples of done BS could include spouses, children, parents, or siblings. 8. Recording: The requirement to record the gift deed with the Queens County Clerk's office to provide notice to the public about the change in ownership. Types of Queens New York Gift Deed for Individual to Individual may include: 1. Residential Gift Deed: Used when gifting a residential property, such as a house or condominium unit, located in Queens, New York. 2. Commercial Gift Deed: Applicable when gifting a commercial property, including office spaces, retail stores, or industrial buildings within Queens, New York. 3. Vacant Land Gift Deed: Used for gifting undeveloped land or empty lots located in Queens, New York. 4. Multiple Properties Gift Deed: When gifting multiple properties simultaneously, such as more than one house or a mix of residential and commercial properties within Queens, New York. Note: It is important to consult a qualified attorney or legal professional to obtain guidance specific to individual circumstances and to ensure compliance with all relevant laws and regulations.

Queens New York Gift Deed for Individual to Individual

Description

How to fill out Queens New York Gift Deed For Individual To Individual?

Are you looking for a trustworthy and inexpensive legal forms provider to get the Queens New York Gift Deed for Individual to Individual? US Legal Forms is your go-to option.

No matter if you need a basic agreement to set rules for cohabitating with your partner or a package of forms to move your separation or divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t universal and frameworked in accordance with the requirements of separate state and county.

To download the document, you need to log in account, locate the needed template, and hit the Download button next to it. Please take into account that you can download your previously purchased document templates at any time from the My Forms tab.

Is the first time you visit our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Queens New York Gift Deed for Individual to Individual conforms to the laws of your state and local area.

- Go through the form’s description (if provided) to learn who and what the document is intended for.

- Start the search over in case the template isn’t good for your specific scenario.

Now you can register your account. Then choose the subscription option and proceed to payment. Once the payment is done, download the Queens New York Gift Deed for Individual to Individual in any provided format. You can return to the website when you need and redownload the document without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about wasting hours researching legal paperwork online once and for all.