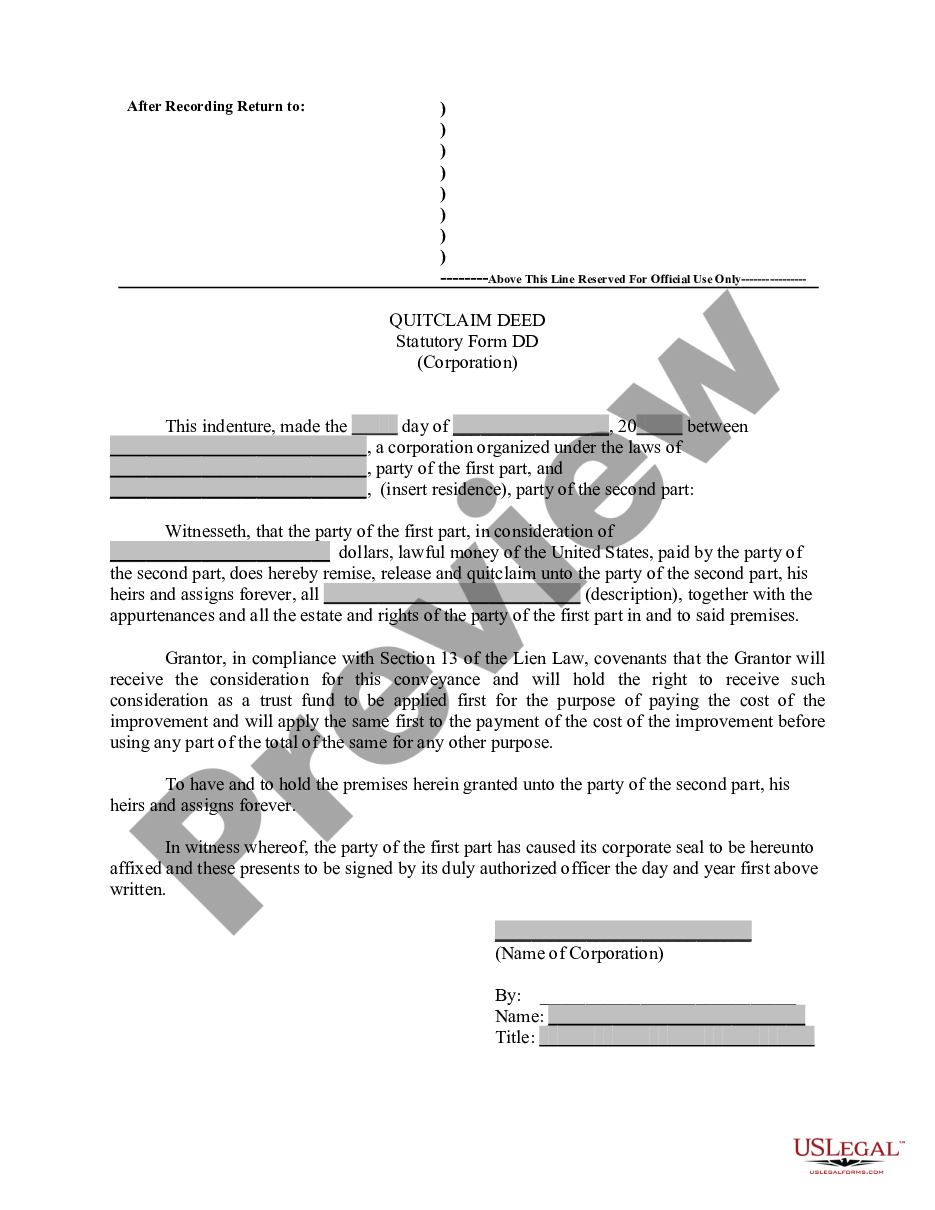

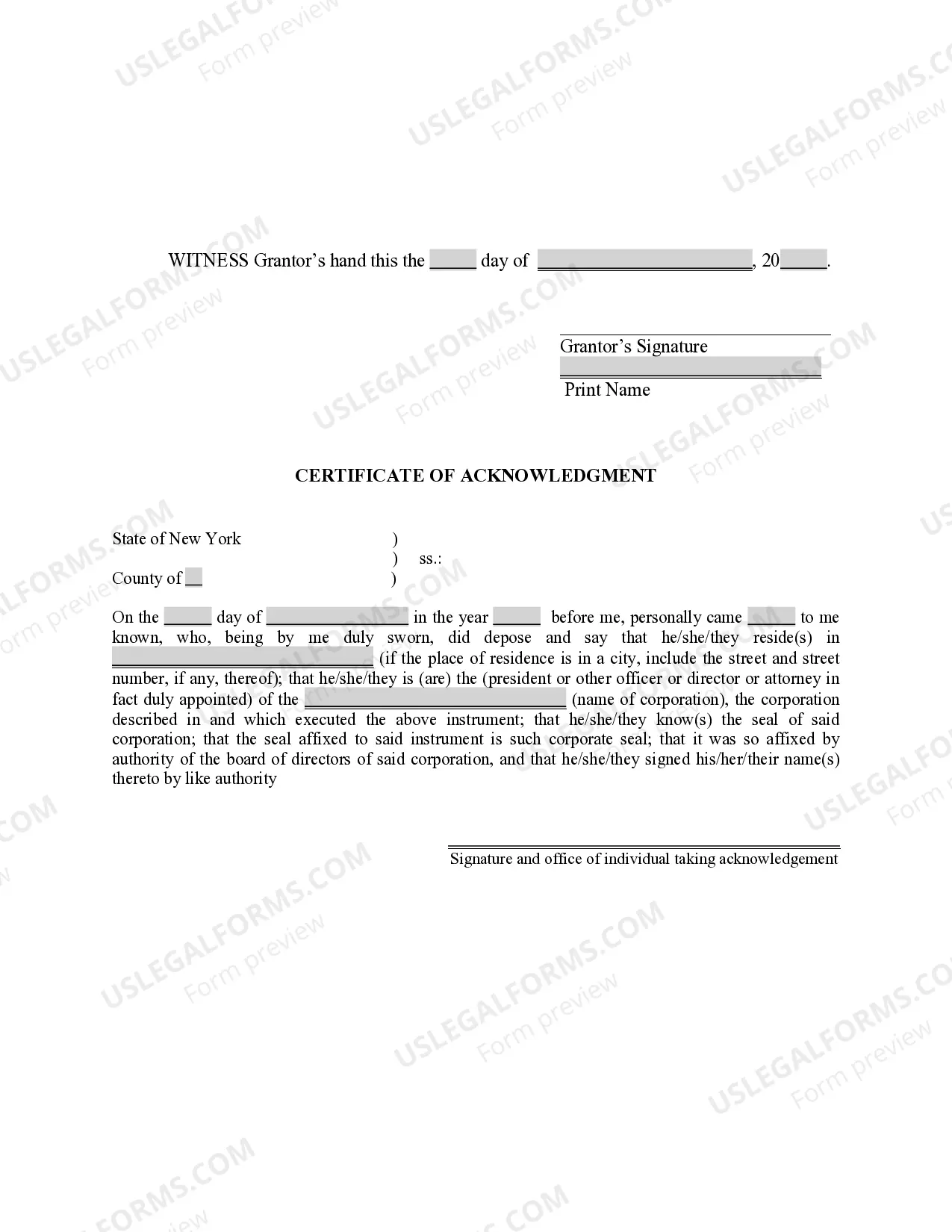

A Yonkers New York Quitclaim Deed by Corporation is a legal document that allows a corporation or business entity to transfer its interest or ownership of a property in Yonkers, New York to another party. This type of deed is commonly used in real estate transactions where the corporation wishes to relinquish any rights or claims it may have on the property, without making any warranties or guarantees about the property's title or condition. The Yonkers New York Quitclaim Deed by Corporation is used to transfer ownership in situations such as a corporation selling a property, transferring it into a trust, or distributing it as part of a merger or acquisition. It is essential to understand that in a quitclaim deed, the corporation does not make any guarantees or representations about the quality and marketability of the title. The buyer acquires the property "as is," assuming all risks associated with the title. There might be different types or variations of Yonkers New York Quitclaim Deeds by Corporation, although the fundamental purpose remains the same. Some possible subtypes of this deed may include: 1. Corporate Transfer Quitclaim Deed: This type of quitclaim deed is used when a corporation wishes to transfer its property to another corporation or business entity. It allows for a seamless transfer of ownership without warranties or guarantees. 2. Corporate Trust Quitclaim Deed: In cases where a corporation wants to transfer the property into a trust, a Corporate Trust Quitclaim Deed is used. This document ensures that the property is transferred into the trust's legal ownership. 3. Corporate Merger or Acquisition Quitclaim Deed: When a corporation merges with or acquires another corporation, a Quitclaim Deed can be executed to transfer the property to the surviving or acquiring corporation. This type of deed helps facilitate the seamless transfer of ownership during corporate restructuring. It is crucial to consult with legal professionals or real estate experts experienced in Yonkers, New York property transactions when dealing with Quitclaim Deeds by Corporation. These experts can provide guidance and ensure all necessary procedures and legal requirements are met to protect the interests of both parties involved in the transfer of the property.

Yonkers New York Quitclaim Deed by Corporation

Description

How to fill out Yonkers New York Quitclaim Deed By Corporation?

No matter what social or professional status, completing law-related documents is an unfortunate necessity in today’s professional environment. Too often, it’s practically impossible for someone with no legal background to create this sort of papers cfrom the ground up, mostly due to the convoluted terminology and legal nuances they come with. This is where US Legal Forms can save the day. Our platform provides a huge collection with more than 85,000 ready-to-use state-specific documents that work for pretty much any legal situation. US Legal Forms also is an excellent resource for associates or legal counsels who want to save time using our DYI tpapers.

Whether you require the Yonkers New York Quitclaim Deed by Corporation or any other document that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how to get the Yonkers New York Quitclaim Deed by Corporation quickly employing our trustworthy platform. If you are presently a subscriber, you can go on and log in to your account to get the needed form.

Nevertheless, if you are unfamiliar with our library, make sure to follow these steps before downloading the Yonkers New York Quitclaim Deed by Corporation:

- Ensure the template you have chosen is suitable for your area because the regulations of one state or county do not work for another state or county.

- Review the document and read a short description (if available) of scenarios the paper can be used for.

- In case the form you selected doesn’t suit your needs, you can start again and look for the necessary form.

- Click Buy now and pick the subscription plan that suits you the best.

- with your credentials or register for one from scratch.

- Select the payment gateway and proceed to download the Yonkers New York Quitclaim Deed by Corporation once the payment is through.

You’re all set! Now you can go on and print the document or complete it online. If you have any problems getting your purchased documents, you can easily access them in the My Forms tab.

Whatever case you’re trying to solve, US Legal Forms has got you covered. Try it out today and see for yourself.