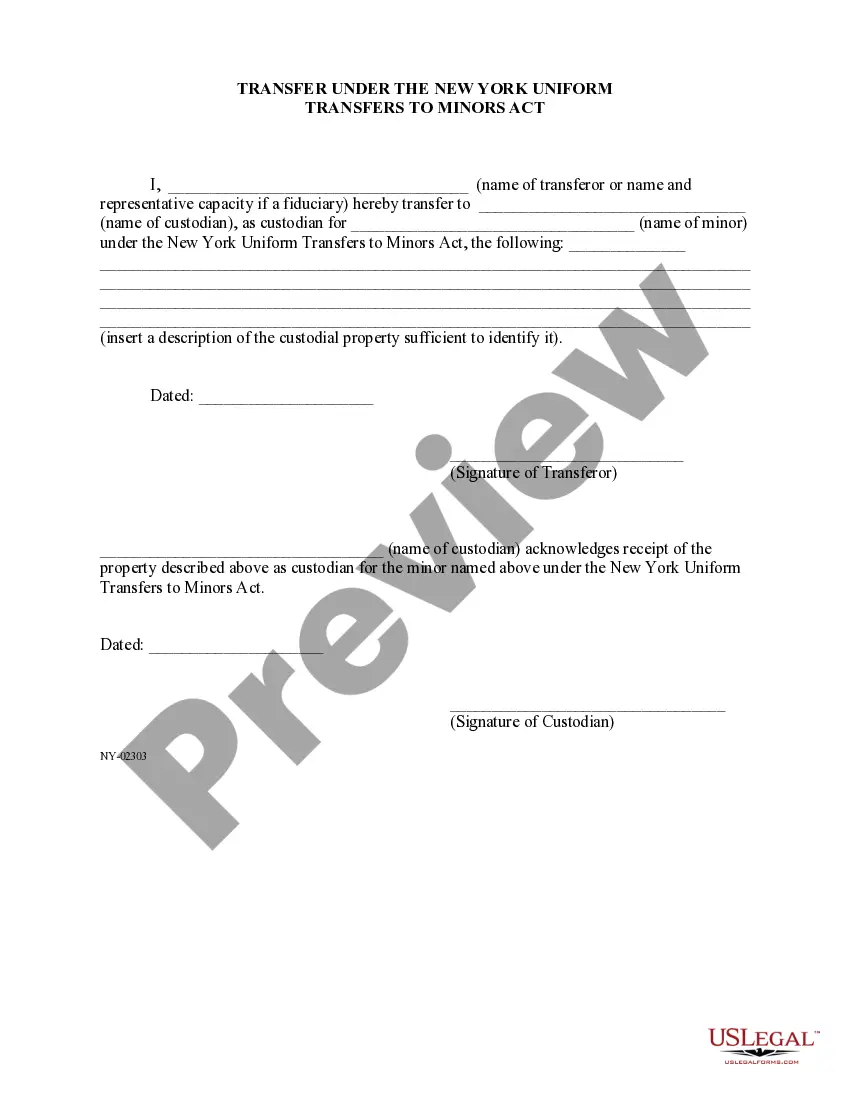

Kings Transfer Under The New York Uniform Transfers to Minors Act, also known as the NY TMA, is a legal provision that allows individuals to transfer assets to minors while maintaining control over the distribution of those assets. The Act is designed to protect the interests of minors and provide a legal framework for managing their assets until they reach adulthood. Under this Act, a "Kings Transfer" refers to the transfer of assets, such as real estate, financial securities, or other valuable property, from an adult to a minor. The adult, also known as the custodian, is responsible for managing the assets on behalf of the minor until they reach the age of majority, which is typically 18 or 21, depending on the jurisdiction. The Kings Transfer Under The New York TMA offers several benefits for both the transferor and the minor. For the transferor, it allows them to pass on their assets to the next generation while minimizing estate taxes and maintaining control over the assets until the minor reaches' adulthood. It also provides a level of protection against creditors, as the assets are held in a custodial account and may only be used for the minor's benefit. For the minor, this Act ensures that their assets are managed responsibly and are not subject to mismanagement or misuse by others. It provides a smooth transition of wealth and assets as the minor reaches' adulthood, allowing them to have financial stability and the opportunity to use the assets for education, healthcare, or any other purpose deemed necessary for their well-being. Despite being referred to as the "Kings Transfer Under The New York TMA," the Act is not limited to a specific type of transfer. It can apply to various types of assets, including bank accounts, stocks, bonds, mutual funds, real estate, and intellectual property. Furthermore, the Act allows for both irrevocable and revocable transfers, depending on the preferences and circumstances of the transferor. In summary, Kings Transfer Under The New York Uniform Transfers to Minors Act provides a comprehensive framework for transferring assets to minors in a controlled and protected manner. It offers significant advantages for both the transferor and the minor, ensuring that assets are managed effectively and safeguarded until the minor reaches' adulthood.

Kings Transfer Under The New York Uniform Transfers to Minors Act

Description

How to fill out Kings Transfer Under The New York Uniform Transfers To Minors Act?

Make use of the US Legal Forms and get immediate access to any form template you require. Our helpful website with thousands of templates makes it simple to find and get virtually any document sample you require. You can save, complete, and certify the Kings Transfer Under The New York Uniform Transfers to Minors Act in just a matter of minutes instead of surfing the Net for several hours looking for the right template.

Utilizing our catalog is a great strategy to increase the safety of your document filing. Our experienced attorneys on a regular basis check all the records to ensure that the forms are appropriate for a particular region and compliant with new laws and regulations.

How do you get the Kings Transfer Under The New York Uniform Transfers to Minors Act? If you have a subscription, just log in to the account. The Download option will appear on all the documents you view. Additionally, you can find all the previously saved documents in the My Forms menu.

If you don’t have an account yet, follow the instruction below:

- Find the template you require. Make sure that it is the form you were looking for: verify its name and description, and make use of the Preview feature when it is available. Otherwise, utilize the Search field to look for the needed one.

- Launch the downloading procedure. Select Buy Now and select the pricing plan that suits you best. Then, sign up for an account and pay for your order utilizing a credit card or PayPal.

- Download the document. Indicate the format to obtain the Kings Transfer Under The New York Uniform Transfers to Minors Act and revise and complete, or sign it for your needs.

US Legal Forms is probably the most extensive and trustworthy form libraries on the internet. Our company is always happy to assist you in virtually any legal case, even if it is just downloading the Kings Transfer Under The New York Uniform Transfers to Minors Act.

Feel free to benefit from our form catalog and make your document experience as convenient as possible!

Form popularity

FAQ

Here are the basic steps for how to transfer UTMA account to a child! Step 1: set up a brokerage account. If you plan to invest cash or securities into a UTMA account for your child, start by opening a UTMA account at your banks or a local investment firm.Step 2: add assets.Step 3: use the funds.

Key Takeaways The Uniform Transfers to Minors Act (UTMA) allows a minor to receive gifts without the aid of a guardian or trustee. The law is an extension of the Uniform Gift to Minors Act. The minor named in the UTMA can avoid tax consequences until they attain legal age for the state in which the account is set up.

On January 1, 1997, UGMA was repealed in New York by the enactment of the Uniform Transfers to Minors Act (?UTMA?).

What Happens to an UTMA When a Child Turns 21? When the child beneficiary of a custodial account reaches the age of majority in your state, everything in the account will pass onto them.

UGMA/UTMA account assets can be transferred into a new account established by the now adult beneficiary as a sole or joint owner. To get an account application, contact your financial professional or find one by using our financial professional locator. For additional assistance, contact us.

Once the minor reaches the legal age of adulthood in their state, control of the account officially transfers from the custodian to the named beneficiary, at which point they claim full control and use of the funds.

Depending on the state a UTMA account is handed over to a child when they reach either age 18 or age 21. In some jurisdictions, at age 18 a UTMA account can only be handed over with the custodian's permission, and at 21 is transferred automatically.

Transferring an UTMA account Generally, the UTMA account transfers to the beneficiary when they become a legal adult, which is usually age 18 or 21, but it can be later. The age of adulthood may be defined differently for custodial accounts, like UTMAs or 529 plans, depending on your state.

The UTMA generally requires the custodian to transfer the custodial property to the minor when the minor reaches the age of 21 (unless the person creating the account, in designating the custodian, elects the age of 18 instead).

UTMA allows the property to be gifted to a minor without establishing a formal trust. The donor or a custodian manages the property for the minor's benefit until the minor reaches a certain age. Once the child reaches a specified age set by the state, the child will have full control over the property.

Interesting Questions

More info

A federal court ordered The Bank to reinstate retirement benefits to a bankrupt man whose savings had been seized. The man's bank accounts had been frozen. When the man had no money left, he called the bank and said, “It's all gone.” The employee told him that if he wanted to access his accounts, he'd just have to call the local bank. So he did. He was told then to come to the bank with his Social Security card and a check for 2, Instead, The Bank employees offered to let him call the local branch and get it for the money. Instead, the client took the bank to court seeking compensation. [Wax v. Bank & Trust Co., 918 1331 (Utah 1994)). See also, State v. White, 99 723, 745 891 ×1985) (restraining order for money not returned after 10 years, because bank was too far away to hear client's phone calls.×. 8 How is the TMA applied? A minor is not limited to what the law says is allowed in passing on assets.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.