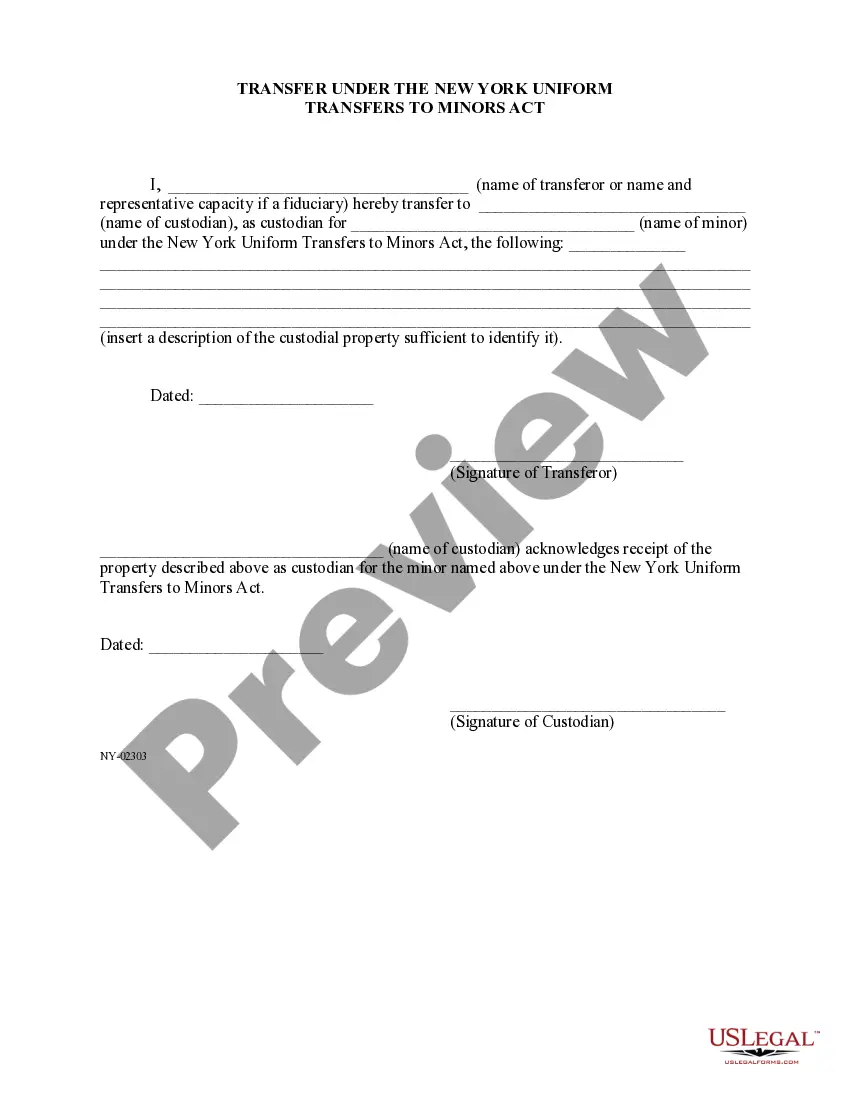

Nassau Transfer Under The New York Uniform Transfers to Minors Act is a legal provision that facilitates the seamless transfer of assets and property to minors in Nassau County, New York. Under this act, a guardian or custodian is designated to manage the transferred assets until the minor reaches the age of majority. The New York Uniform Transfers to Minors Act (TMA) is a comprehensive set of laws that governs the transfer and management of assets to minors throughout the state. Nassau County has adopted this act, empowering parents or legal guardians to make prudent financial decisions on behalf of their children. There are different types of Nassau Transfer Under The New York Uniform Transfers to Minors Act depending on the nature of the assets being transferred. These may include financial assets such as savings accounts, stocks, bonds, and mutual funds, as well as tangible assets like real estate or valuable personal property. Each type of transfer may have specific regulations and requirements that must be followed. To initiate a transfer under the Nassau Transfer Under The New York Uniform Transfers to Minors Act, the transferor must first establish a custodial account or trust for the benefit of the minor. This can be done through a formal legal process, involving documentation and the appointment of a custodian or guardian. The custodian is responsible for managing and protecting the assets until the minor reaches the designated age of majority, which is typically 18 or 21 years old. The Nassau Transfer Under The New York Uniform Transfers to Minors Act provides important benefits to both transferors and minors. Transferors can ensure that their assets are properly managed and preserved for the minor's future benefit, while minors receive financial security and a head start towards their financial independence. In addition, this act offers tax advantages, as it allows for potential tax exemptions or lower tax rates for income generated from the transferred assets. It is crucial to understand that the Nassau Transfer Under The New York Uniform Transfers to Minors Act imposes legal responsibilities and limitations on the custodian. The custodian must act in the best interests of the minor, making sound investment decisions, and using the transferred assets solely for the minor's benefit. They must also maintain accurate records and provide periodic reports to ensure transparency and compliance with the act. In conclusion, Nassau Transfer Under The New York Uniform Transfers to Minors Act provides a legal framework for the transfer and management of assets to minors in Nassau County. It allows parents or guardians to establish custodial accounts or trusts, ensuring the protection and growth of assets until the minor reaches legal age. By understanding the various types of transfers and complying with the act's requirements, individuals can make informed decisions about transferring assets to minors in Nassau County under this beneficial legal provision.

Nassau Transfer Under The New York Uniform Transfers to Minors Act

Description

How to fill out Nassau Transfer Under The New York Uniform Transfers To Minors Act?

We always strive to minimize or avoid legal damage when dealing with nuanced law-related or financial affairs. To do so, we apply for attorney solutions that, as a rule, are extremely expensive. However, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online library of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without turning to legal counsel. We offer access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Nassau Transfer Under The New York Uniform Transfers to Minors Act or any other form easily and safely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it from within the My Forms tab.

The process is equally easy if you’re new to the platform! You can register your account in a matter of minutes.

- Make sure to check if the Nassau Transfer Under The New York Uniform Transfers to Minors Act adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Nassau Transfer Under The New York Uniform Transfers to Minors Act would work for your case, you can select the subscription plan and make a payment.

- Then you can download the document in any available file format.

For more than 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!

Form popularity

FAQ

UTMA allows the property to be gifted to a minor without establishing a formal trust. The donor or a custodian manages the property for the minor's benefit until the minor reaches a certain age. Once the child reaches a specified age set by the state, the child will have full control over the property.

When the minor beneficiary of an UTMA custodial account reaches the age of majority, the custodianship is over, and they get legal control over everything that's in the account. It's important to note that the age of majority is slightly different in each state. In most cases, it's either 18 or 21.

The minor does have to pay taxes, as they are the owner of the UTMA account. However, there are some benefits of the account belonging to the child and not the custodian. First, as of 2021, the IRS exempts $1,100 of the account's passive income or gains from taxes each year.

UTMA assets can be used for college costs, and that's one common goal. But the funds also could be used to pay for a trip to Europe, a wedding, a honeymoon, a down payment on a home?or a Corvette.?

Because money placed in an UGMA/UTMA account is owned by the child, earnings are generally taxed at the child's?usually lower?tax rate, rather than the parent's rate. For some families, this savings can be significant. Up to $1,050 in earnings tax-free. The next $1,050 is taxable at the child's tax rate.

What Happens to an UTMA When a Child Turns 21? When the child beneficiary of a custodial account reaches the age of majority in your state, everything in the account will pass onto them.

When the minor beneficiary of an UTMA custodial account reaches the age of majority, the custodianship is over, and they get legal control over everything that's in the account. It's important to note that the age of majority is slightly different in each state.

Key Takeaways The Uniform Transfers to Minors Act (UTMA) allows a minor to receive gifts without the aid of a guardian or trustee. The law is an extension of the Uniform Gift to Minors Act. The minor named in the UTMA can avoid tax consequences until they attain legal age for the state in which the account is set up.

The Uniform Transfers to Minors Act (UTMA) allows an adult to transfer assets to a minor by opening a custodial account for them. This type of account is managed by an adult ? the custodian ? who holds onto the assets until the minor reaches a certain age, usually 18 or 21.

Custodians of Uniform Gifts to Minors Act (UGMA) and Uniform Transfers to Minors Act (UTMA) accounts are responsible for transferring assets to the beneficiaries when they reach the age of majority. In many states, that's at age 21, but the rules vary.