Queens Transfer Under The New York Uniform Transfers to Minors Act, also known as TMA, is a legal provision that allows for the transfer of property or assets to a minor in Queens, New York. This act provides a mechanism for minors to receive and manage assets without the need for a formal trust. Below, we will delve into a detailed description of this act and its various types under the New York Uniform Transfers to Minors Act. The purpose of the Queens Transfer Under The New York Uniform Transfers to Minors Act is to facilitate the transfer of assets to minors while ensuring their best interests are protected. It allows for the establishment of custodial accounts, with a designated custodian who will manage the transferred property on behalf of the minor until they reach the age of majority. Under this act, various types of assets can be transferred to minors, including cash, real estate, stocks, bonds, and other securities. These assets are typically held in a custodial account, which the custodian manages for the benefit of the minor. The custodian acts as a fiduciary, making investment decisions and managing the assets until the minor reaches the age specified by the act, usually 18 or 21 years old. One of the key features of the Queens Transfer Under The New York Uniform Transfers to Minors Act is that it provides flexibility in how assets can be transferred. The act allows for both irrevocable and revocable transfers, depending on the preference of the transferor. Irrevocable transfers mean that once the assets are transferred to the minor, the transferor cannot change or revoke the transfer. On the other hand, revocable transfers allow the transferor to reclaim the assets if necessary. Additionally, the act allows for a custodian to make distributions from the custodial account for the minor's benefit. These distributions must be used for the minor's expenses, such as education, healthcare, and general welfare. However, the custodian must act in the minor's best interest and is required to keep accurate records of all transactions and distributions made from the account. While the Queens Transfer Under The New York Uniform Transfers to Minors Act primarily focuses on the transfer of assets to minors, it is important to note that the act also addresses certain tax implications. Any income generated from the transferred assets is generally taxable under the minor's name, which may have different tax implications compared to adult taxpayers. In conclusion, the Queens Transfer Under The New York Uniform Transfers to Minors Act provides a legal framework for the transfer of assets to minors in Queens, New York. It allows for the establishment of custodial accounts and enables the transferor to designate a custodian to manage the assets until the minor reaches the age of majority. By providing flexibility and ensuring the minor's best interests are protected, this act offers a practical solution for individuals seeking to transfer assets to minors under New York law.

Queens Transfer Under The New York Uniform Transfers to Minors Act

State:

New York

County:

Queens

Control #:

NY-02303

Format:

Word;

Rich Text

Instant download

Description

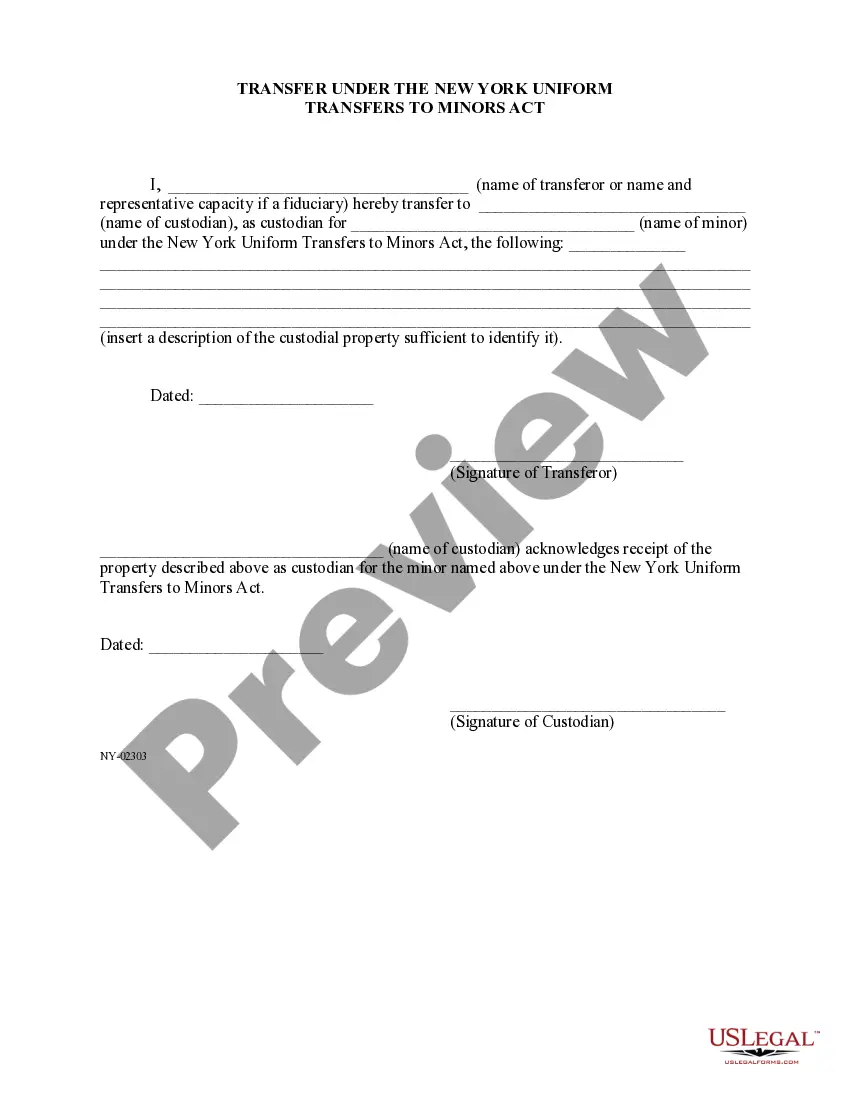

This form, a Transfer Under The New York Uniform Transfers to Minors Act, is easily completed or adapted to fit your circumstances. Available for download now.

Queens Transfer Under The New York Uniform Transfers to Minors Act, also known as TMA, is a legal provision that allows for the transfer of property or assets to a minor in Queens, New York. This act provides a mechanism for minors to receive and manage assets without the need for a formal trust. Below, we will delve into a detailed description of this act and its various types under the New York Uniform Transfers to Minors Act. The purpose of the Queens Transfer Under The New York Uniform Transfers to Minors Act is to facilitate the transfer of assets to minors while ensuring their best interests are protected. It allows for the establishment of custodial accounts, with a designated custodian who will manage the transferred property on behalf of the minor until they reach the age of majority. Under this act, various types of assets can be transferred to minors, including cash, real estate, stocks, bonds, and other securities. These assets are typically held in a custodial account, which the custodian manages for the benefit of the minor. The custodian acts as a fiduciary, making investment decisions and managing the assets until the minor reaches the age specified by the act, usually 18 or 21 years old. One of the key features of the Queens Transfer Under The New York Uniform Transfers to Minors Act is that it provides flexibility in how assets can be transferred. The act allows for both irrevocable and revocable transfers, depending on the preference of the transferor. Irrevocable transfers mean that once the assets are transferred to the minor, the transferor cannot change or revoke the transfer. On the other hand, revocable transfers allow the transferor to reclaim the assets if necessary. Additionally, the act allows for a custodian to make distributions from the custodial account for the minor's benefit. These distributions must be used for the minor's expenses, such as education, healthcare, and general welfare. However, the custodian must act in the minor's best interest and is required to keep accurate records of all transactions and distributions made from the account. While the Queens Transfer Under The New York Uniform Transfers to Minors Act primarily focuses on the transfer of assets to minors, it is important to note that the act also addresses certain tax implications. Any income generated from the transferred assets is generally taxable under the minor's name, which may have different tax implications compared to adult taxpayers. In conclusion, the Queens Transfer Under The New York Uniform Transfers to Minors Act provides a legal framework for the transfer of assets to minors in Queens, New York. It allows for the establishment of custodial accounts and enables the transferor to designate a custodian to manage the assets until the minor reaches the age of majority. By providing flexibility and ensuring the minor's best interests are protected, this act offers a practical solution for individuals seeking to transfer assets to minors under New York law.

How to fill out Queens Transfer Under The New York Uniform Transfers To Minors Act?

If you’ve already utilized our service before, log in to your account and save the Queens Transfer Under The New York Uniform Transfers to Minors Act on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your document:

- Make certain you’ve found the right document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to obtain the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Queens Transfer Under The New York Uniform Transfers to Minors Act. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!