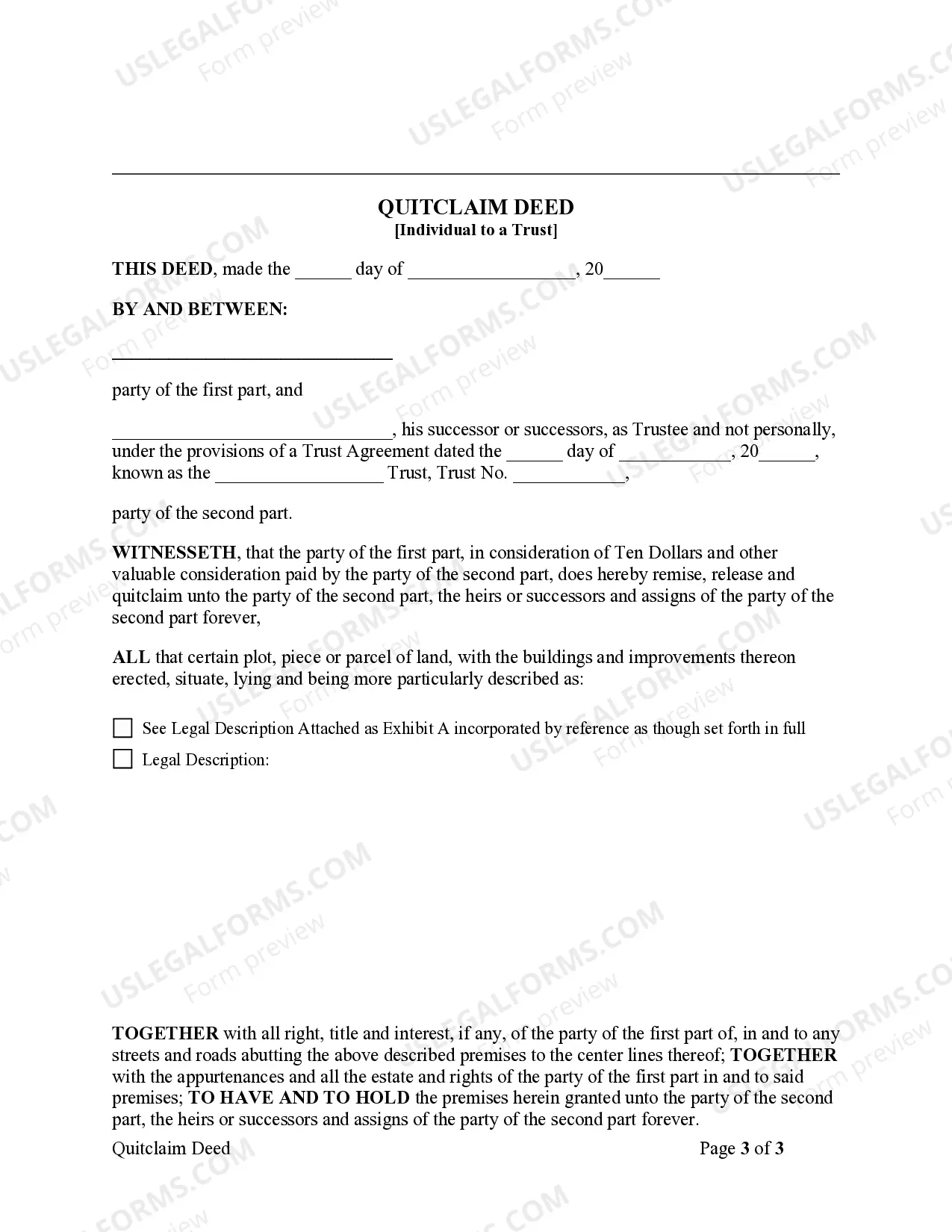

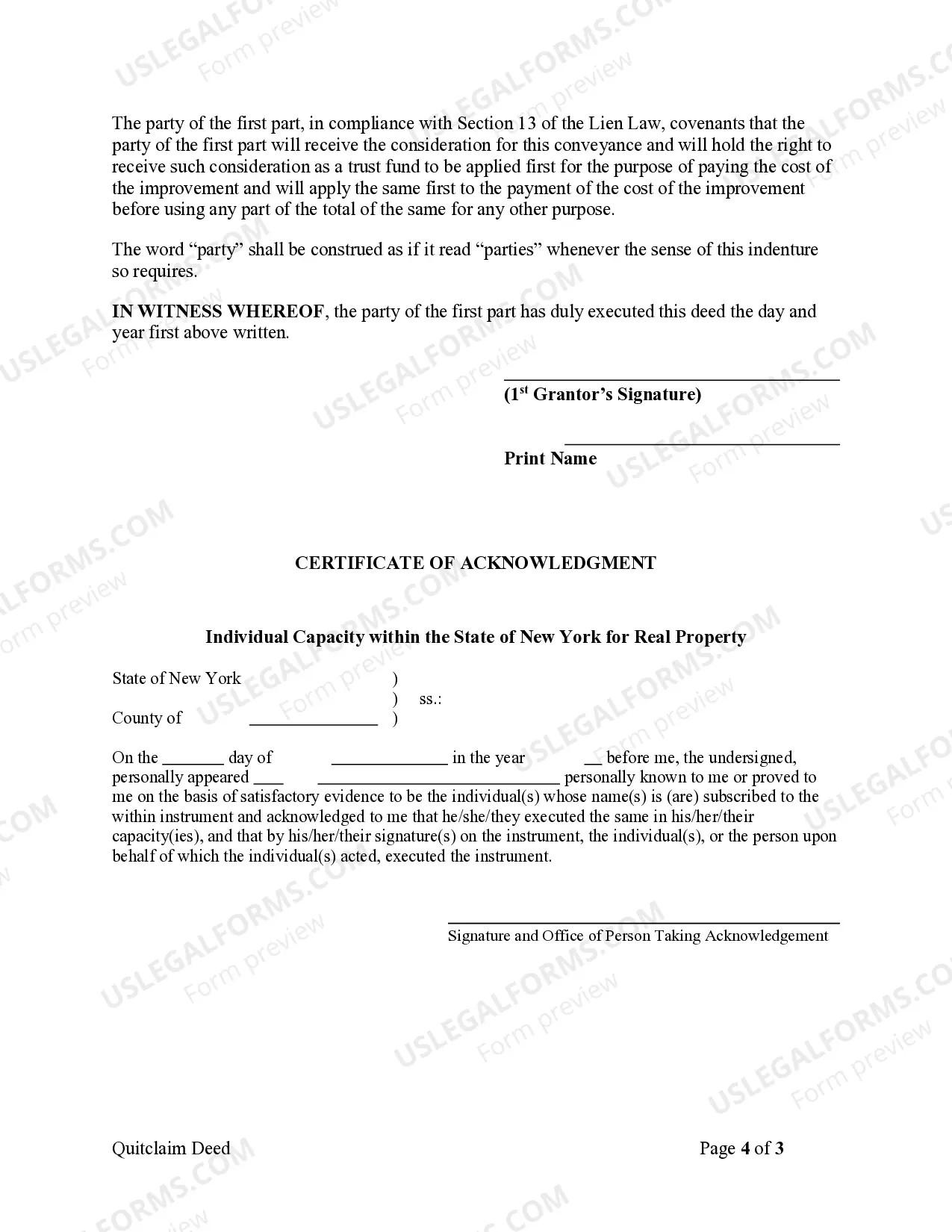

This form is a Quitclaim Deed where the grantor is an individual and the grantee is a trust. Grantor conveys and quitclaims the described property to grantee. This deed complies with all state statutory laws.

A Nassau New York Quitclaim Deed — Individual to a Trust is a legal document used to transfer property ownership from an individual to a trust entity. It is commonly utilized for estate planning purposes, allowing property owners to transfer their assets into a trust for the benefit of chosen beneficiaries. The quitclaim deed serves as proof of the transfer of ownership and outlines the details of the transfer, including the property description, the names of the individual granter and the trust beneficiary, and any conditions or limitations attached to the transfer. In Nassau, New York, there are a few different types of Quitclaim Deeds that can be used for transferring property from an individual to a trust. Some common variations include: 1. Nassau New York Quitclaim Deed with Reservation: This type of quitclaim deed allows the individual granter to retain certain rights or interests in the property, even after transferring it to the trust. These reservations can include the right to live on the property or receive rental income from it. 2. Nassau New York Quitclaim Deed without Warranty: In this type of quitclaim deed, the individual granter transfers whatever interest they have in the property to the trust without making any warranties or guarantees regarding the title or condition of the property. The granter simply releases any claim they may have. 3. Nassau New York Quitclaim Deed with Full Covenant and Warranty: This type of quitclaim deed provides the highest level of protection for the trust beneficiary. The individual granter guarantees that they have full ownership rights to the property and will defend the title against any claims that may arise. 4. Nassau New York Quitclaim Deed with Limited Warranty: This variation offers a middle ground between the two previous types. The individual granter warrants that they have not done anything to impair the title during their ownership, but they do not provide as broad of a guarantee as in a full covenant and warranty deed. It is important to consult with a legal professional or an experienced attorney specializing in real estate law when considering the use of a Nassau New York Quitclaim Deed — Individual to a Trust. They can provide guidance on the specific type of deed that best suits your needs and ensure that all legal requirements are met during the transfer process.