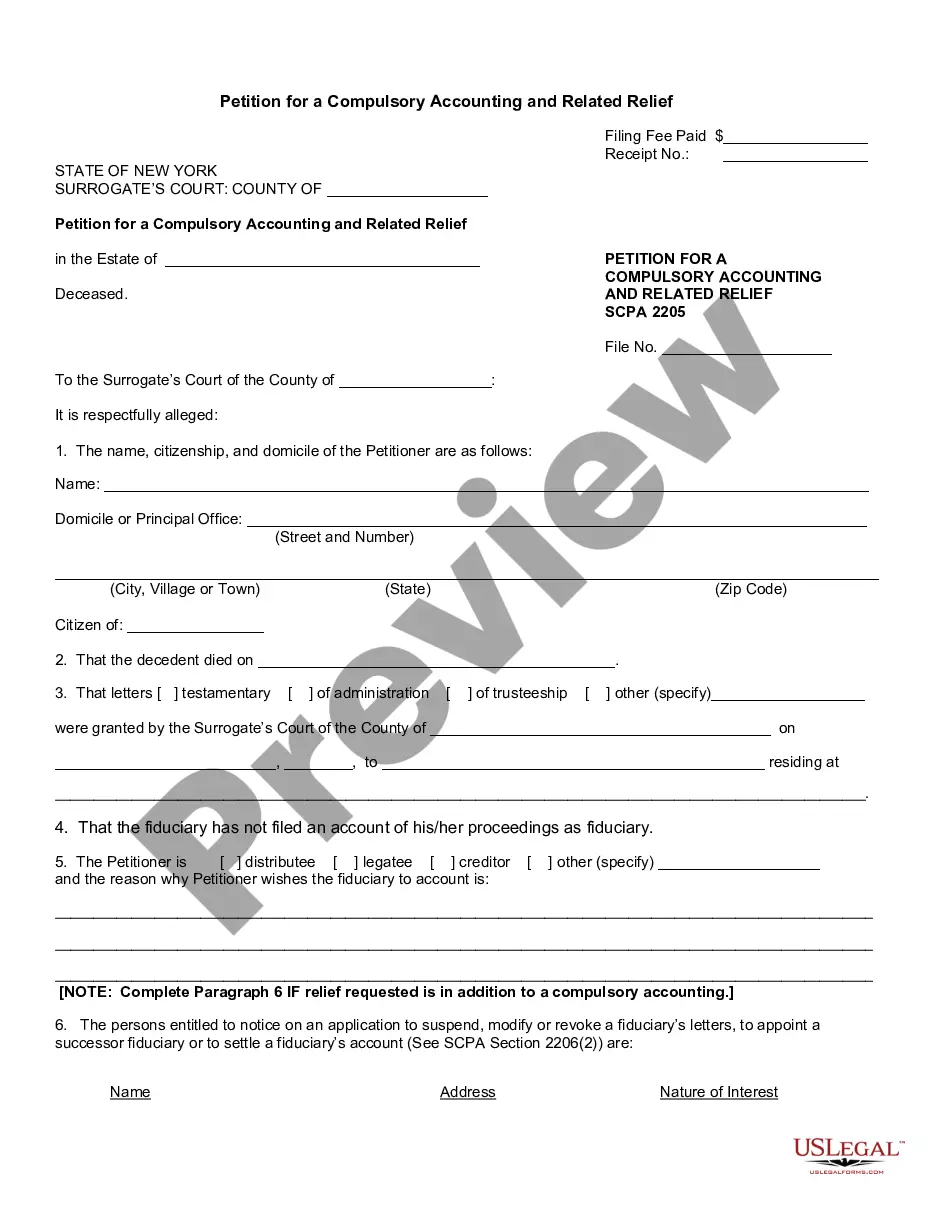

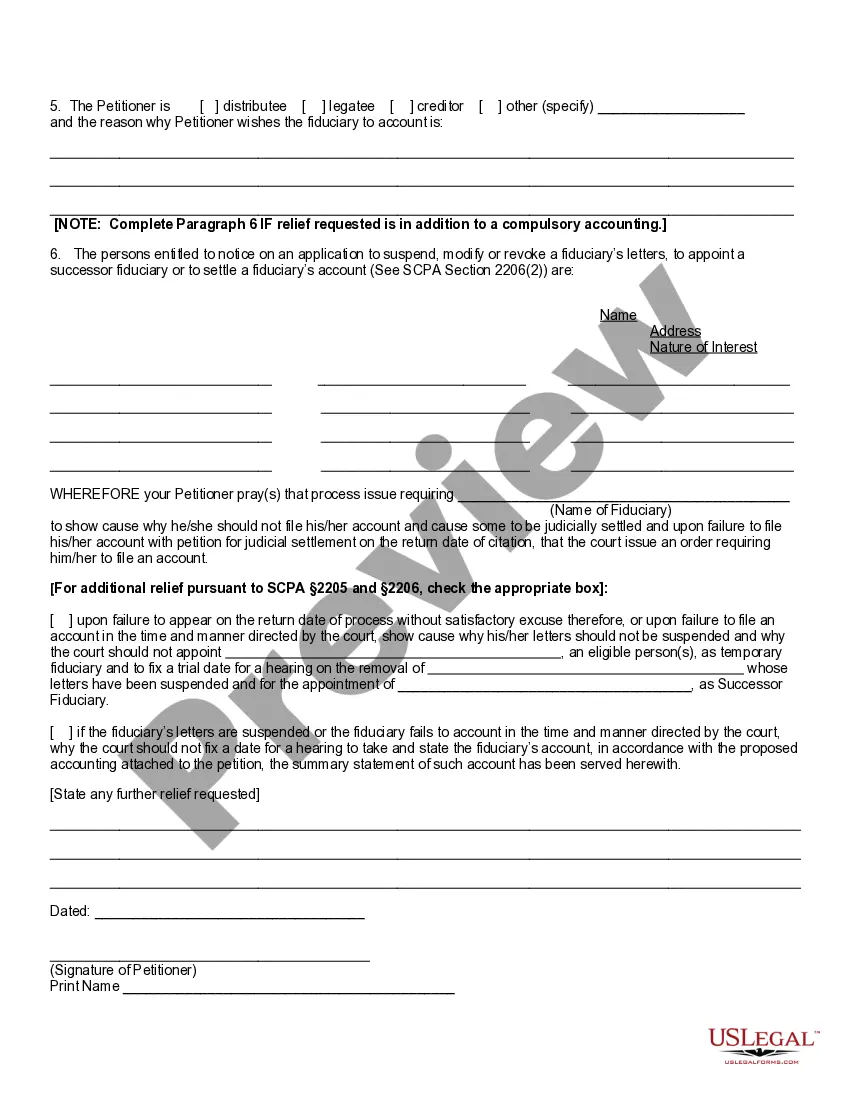

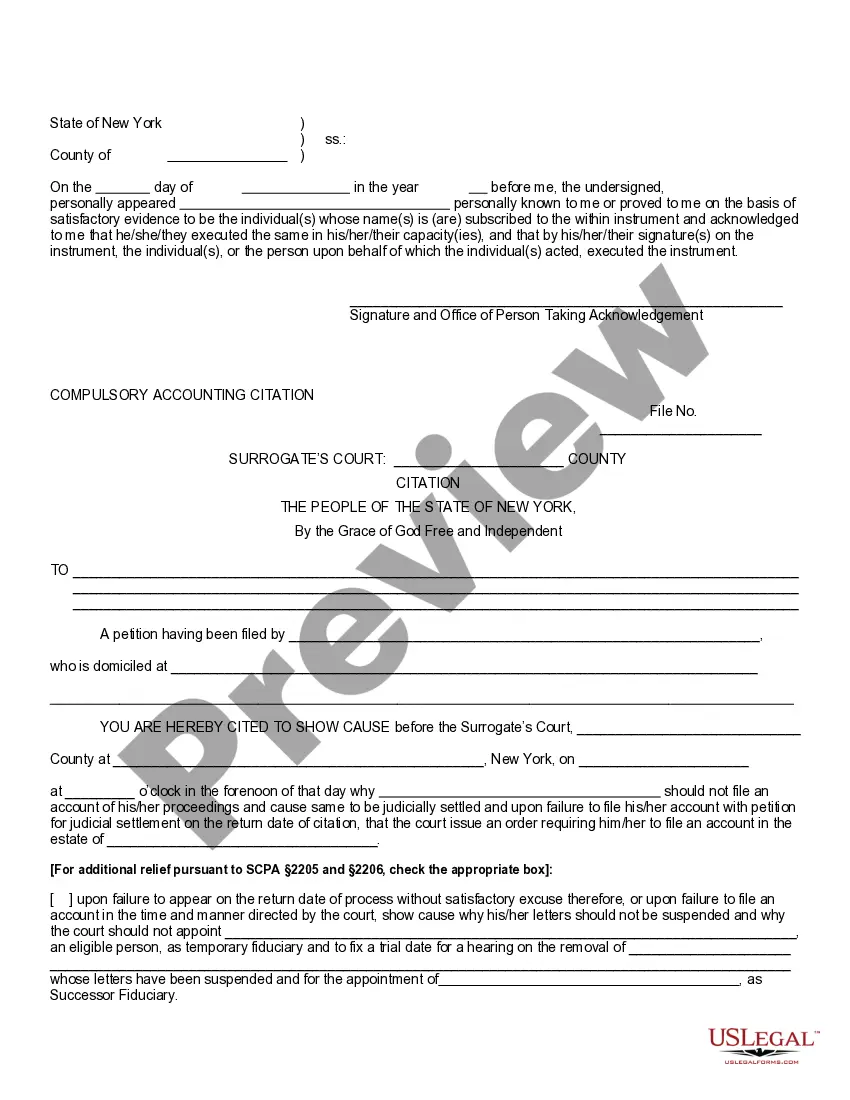

If the personal representative of a decedent's estate does not report to the court, the beneficiaries can ask the court to order him or her to file an accounting or take other actions to close probate. The court can remove the personal representative and appoint someone else.

The Bronx New York Petition for a Compulsory Accounting and Related Relief is a legal document that seeks to compel an accounting and related relief in relation to a specific matter in the Bronx, New York. This petition is typically filed by an individual or entity who believes they have a right to an accounting or are seeking relief related to financial matters, such as inheritance, partnership agreement disputes, or guardianship. Keywords: Bronx New York, petition, compulsory accounting, related relief, legal document, financial matters, inheritance, partnership agreement disputes, guardianship. There are several types of Bronx New York Petitions for Compulsory Accounting and Related Relief, which may include: 1. Petition for Compulsory Accounting and Relief in Estate Matters: This type of petition is filed when there are concerns regarding the administration and distribution of assets in an estate. It aims to ensure proper transparency and accountability regarding the handling of the deceased person's assets, debts, and final wishes. 2. Petition for Compulsory Accounting and Relief in Partnership Disputes: Partnership agreement disputes sometimes arise, leading to financial disagreements between partners. In such cases, a petition for compulsory accounting and related relief can be filed to compel an accurate and transparent financial accounting of the partnership's assets, liabilities, profits, and losses. 3. Petition for Compulsory Accounting and Relief in Guardianship Cases: When concerns about the management and accounting of assets and finances of a ward arise, especially in cases involving minors or incapacitated individuals, a petition for compulsory accounting and related relief may be filed. This petition ensures that the appointed guardian is fulfilling their duties responsibly and transparently. 4. Petition for Compulsory Accounting and Relief in Trust Matters: In situations where there are doubts or concerns about the administration of a trust, beneficiaries may file a petition for compulsory accounting and related relief. This petition aims to obtain an accurate accounting of trust assets, income, expenses, and distributions to ensure the trustee's compliance with their fiduciary duties. Regardless of the specific type of Bronx New York Petition for a Compulsory Accounting and Related Relief, the ultimate goal is to ensure transparency, accuracy, and fairness in financial matters while providing a legal avenue to address any disputes or concerns related to accounting.The Bronx New York Petition for a Compulsory Accounting and Related Relief is a legal document that seeks to compel an accounting and related relief in relation to a specific matter in the Bronx, New York. This petition is typically filed by an individual or entity who believes they have a right to an accounting or are seeking relief related to financial matters, such as inheritance, partnership agreement disputes, or guardianship. Keywords: Bronx New York, petition, compulsory accounting, related relief, legal document, financial matters, inheritance, partnership agreement disputes, guardianship. There are several types of Bronx New York Petitions for Compulsory Accounting and Related Relief, which may include: 1. Petition for Compulsory Accounting and Relief in Estate Matters: This type of petition is filed when there are concerns regarding the administration and distribution of assets in an estate. It aims to ensure proper transparency and accountability regarding the handling of the deceased person's assets, debts, and final wishes. 2. Petition for Compulsory Accounting and Relief in Partnership Disputes: Partnership agreement disputes sometimes arise, leading to financial disagreements between partners. In such cases, a petition for compulsory accounting and related relief can be filed to compel an accurate and transparent financial accounting of the partnership's assets, liabilities, profits, and losses. 3. Petition for Compulsory Accounting and Relief in Guardianship Cases: When concerns about the management and accounting of assets and finances of a ward arise, especially in cases involving minors or incapacitated individuals, a petition for compulsory accounting and related relief may be filed. This petition ensures that the appointed guardian is fulfilling their duties responsibly and transparently. 4. Petition for Compulsory Accounting and Relief in Trust Matters: In situations where there are doubts or concerns about the administration of a trust, beneficiaries may file a petition for compulsory accounting and related relief. This petition aims to obtain an accurate accounting of trust assets, income, expenses, and distributions to ensure the trustee's compliance with their fiduciary duties. Regardless of the specific type of Bronx New York Petition for a Compulsory Accounting and Related Relief, the ultimate goal is to ensure transparency, accuracy, and fairness in financial matters while providing a legal avenue to address any disputes or concerns related to accounting.