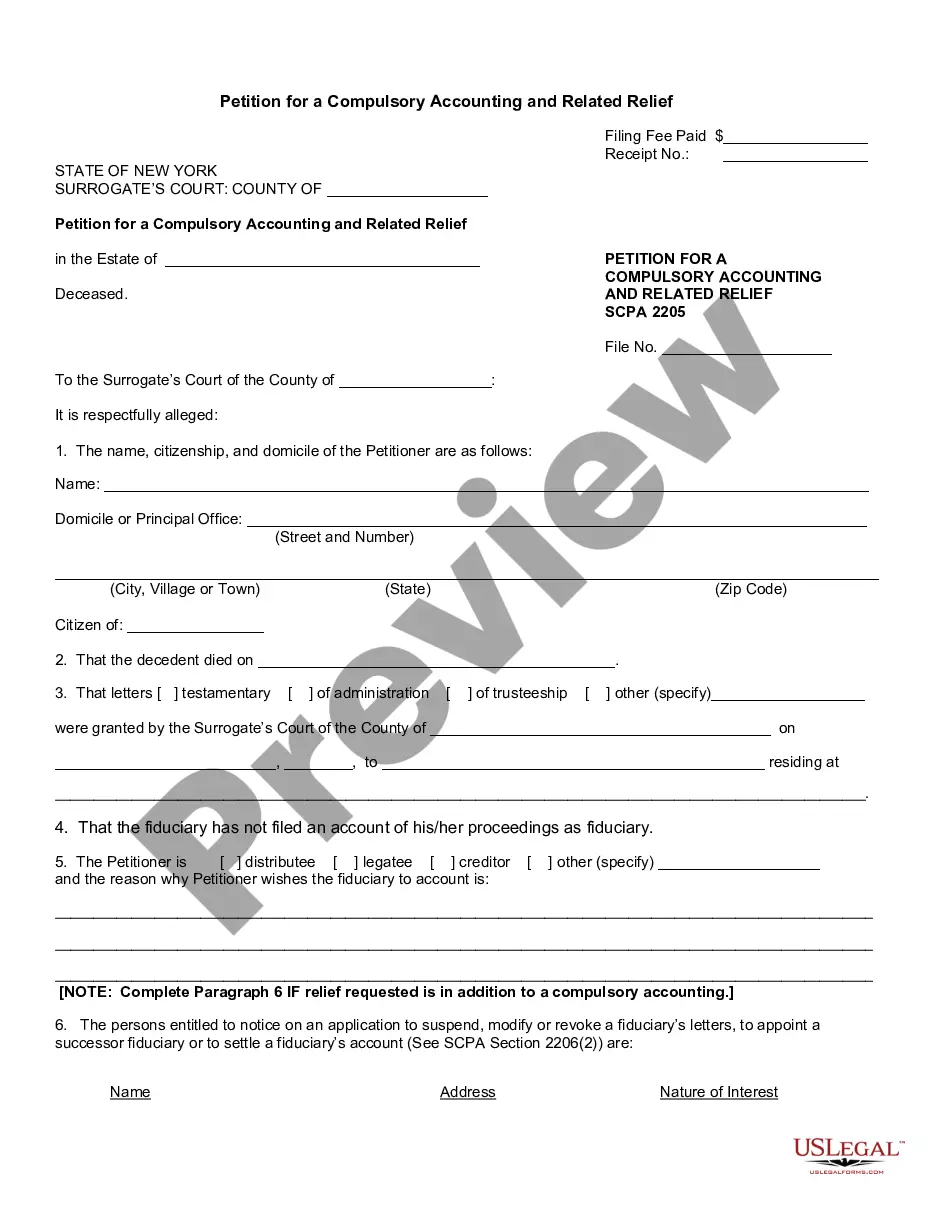

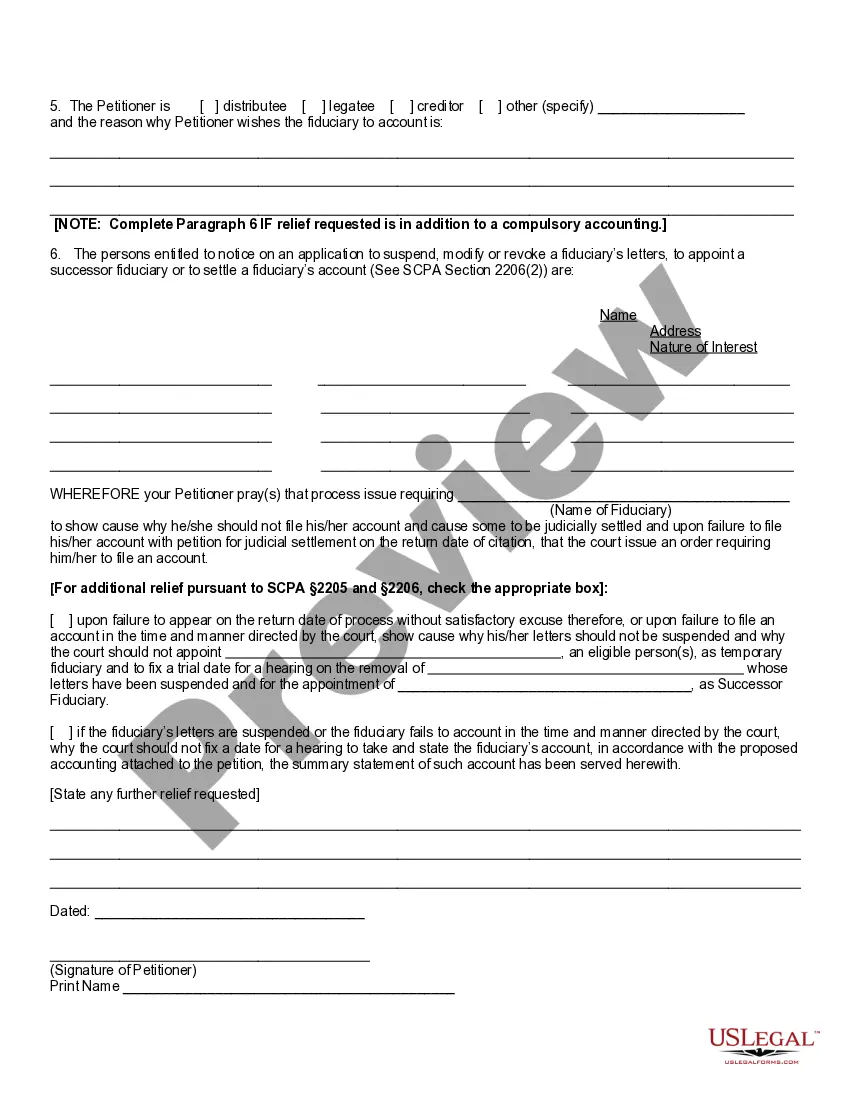

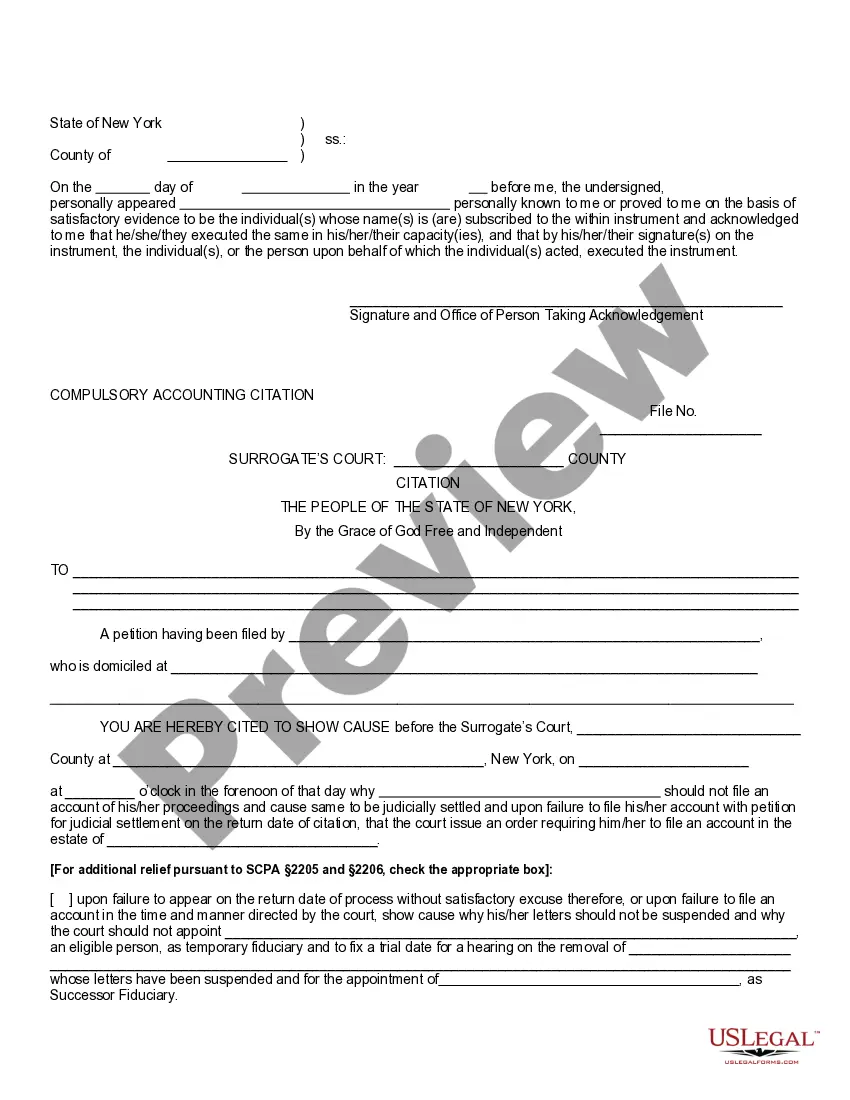

If the personal representative of a decedent's estate does not report to the court, the beneficiaries can ask the court to order him or her to file an accounting or take other actions to close probate. The court can remove the personal representative and appoint someone else.

Kings New York Petition for a Compulsory Accounting and Related Relief refers to a legal document filed in the Kings County of New York State to request a court-ordered scrutiny of the financial records and transactions related to a specific matter. This petition is typically utilized in cases where there are suspicions or concerns regarding mismanagement of assets, embezzlement, fraud, or other financial irregularities. A Kings New York Petition for a Compulsory Accounting and Related Relief aims to ensure transparency and accountability in financial matters. By requesting a compulsory accounting, the petitioner seeks an official examination of the financial records and reports of an individual, organization, or estate. This process assists in determining whether there have been malfeasance, fraud, breaches of fiduciary duty, or misappropriation of funds. The petition seeks related relief, meaning in addition to a compulsory accounting, it may also request additional measures such as freezing assets, restraining orders, or the appointment of a receiver to manage the assets until the accounting is completed. Different types of Kings New York Petition for a Compulsory Accounting and Related Relief can include: 1. Individual Petition: When an individual brings forth the petition alleging financial misconduct against another individual, such as in a business partnership dispute, divorce proceeding, or probate case. 2. Corporate Petition: In cases where a corporation or shareholders suspect financial impropriety by company officers, directors, or employees, a corporate petition for compulsory accounting may be filed. 3. Estate Petition: Filed in cases involving the management and distribution of estate assets, where beneficiaries or interested parties suspect mismanagement, fraud, or wrongful appropriation of estate funds. 4. Trust Petition: Similar to an estate petition, this type pertains to the examination of trust assets and seeks relief when trustees are suspected of breaching their fiduciary obligations or mismanaging the trust assets. It is important to note that the exact process and requirements for filing a Kings New York Petition for a Compulsory Accounting and Related Relief can vary depending on the specific legal jurisdiction and the nature of the case. Seeking legal counsel from an experienced attorney specializing in this area is advised to ensure the petition is properly prepared and submitted.Kings New York Petition for a Compulsory Accounting and Related Relief refers to a legal document filed in the Kings County of New York State to request a court-ordered scrutiny of the financial records and transactions related to a specific matter. This petition is typically utilized in cases where there are suspicions or concerns regarding mismanagement of assets, embezzlement, fraud, or other financial irregularities. A Kings New York Petition for a Compulsory Accounting and Related Relief aims to ensure transparency and accountability in financial matters. By requesting a compulsory accounting, the petitioner seeks an official examination of the financial records and reports of an individual, organization, or estate. This process assists in determining whether there have been malfeasance, fraud, breaches of fiduciary duty, or misappropriation of funds. The petition seeks related relief, meaning in addition to a compulsory accounting, it may also request additional measures such as freezing assets, restraining orders, or the appointment of a receiver to manage the assets until the accounting is completed. Different types of Kings New York Petition for a Compulsory Accounting and Related Relief can include: 1. Individual Petition: When an individual brings forth the petition alleging financial misconduct against another individual, such as in a business partnership dispute, divorce proceeding, or probate case. 2. Corporate Petition: In cases where a corporation or shareholders suspect financial impropriety by company officers, directors, or employees, a corporate petition for compulsory accounting may be filed. 3. Estate Petition: Filed in cases involving the management and distribution of estate assets, where beneficiaries or interested parties suspect mismanagement, fraud, or wrongful appropriation of estate funds. 4. Trust Petition: Similar to an estate petition, this type pertains to the examination of trust assets and seeks relief when trustees are suspected of breaching their fiduciary obligations or mismanaging the trust assets. It is important to note that the exact process and requirements for filing a Kings New York Petition for a Compulsory Accounting and Related Relief can vary depending on the specific legal jurisdiction and the nature of the case. Seeking legal counsel from an experienced attorney specializing in this area is advised to ensure the petition is properly prepared and submitted.