If the personal representative of a decedent's estate does not report to the court, the beneficiaries can ask the court to order him or her to file an accounting or take other actions to close probate. The court can remove the personal representative and appoint someone else.

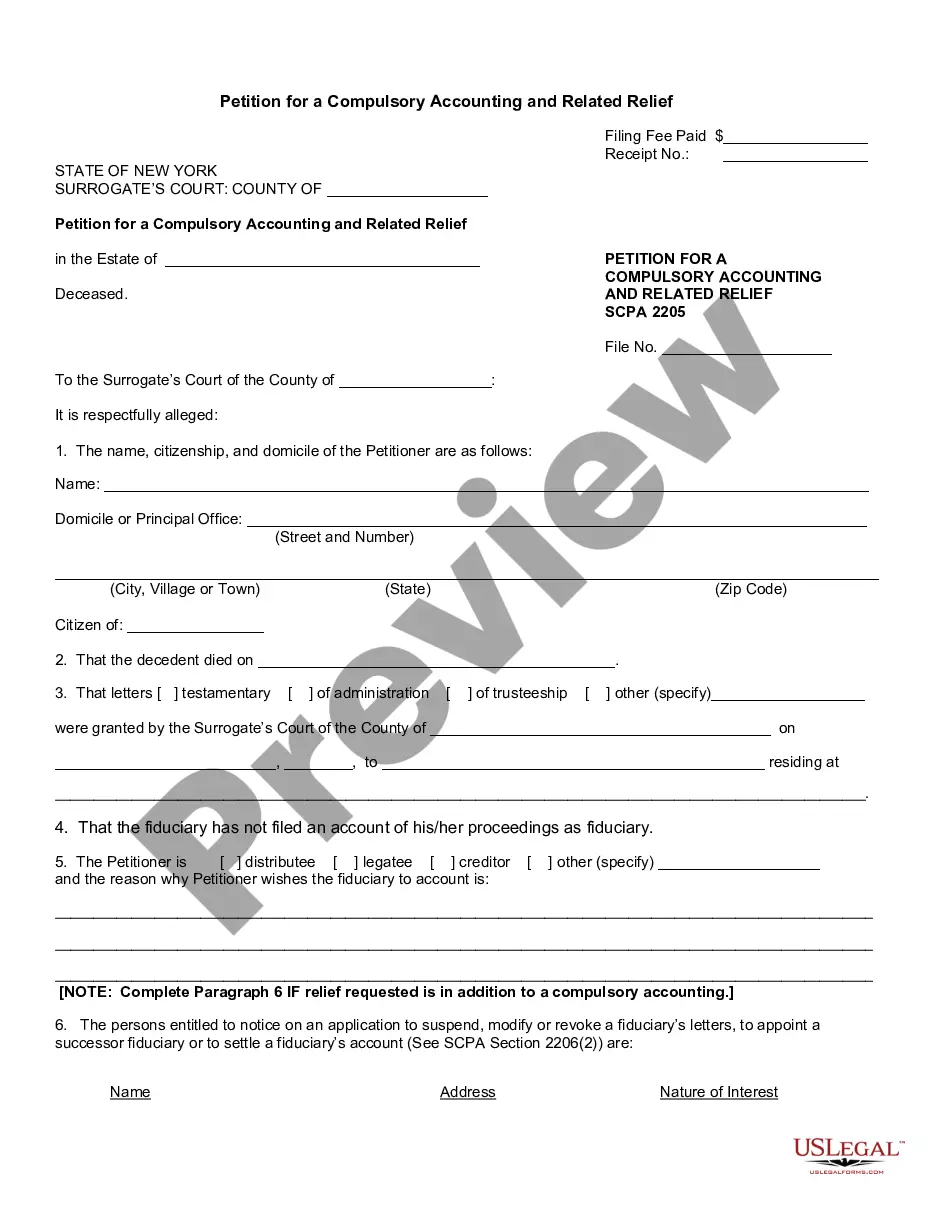

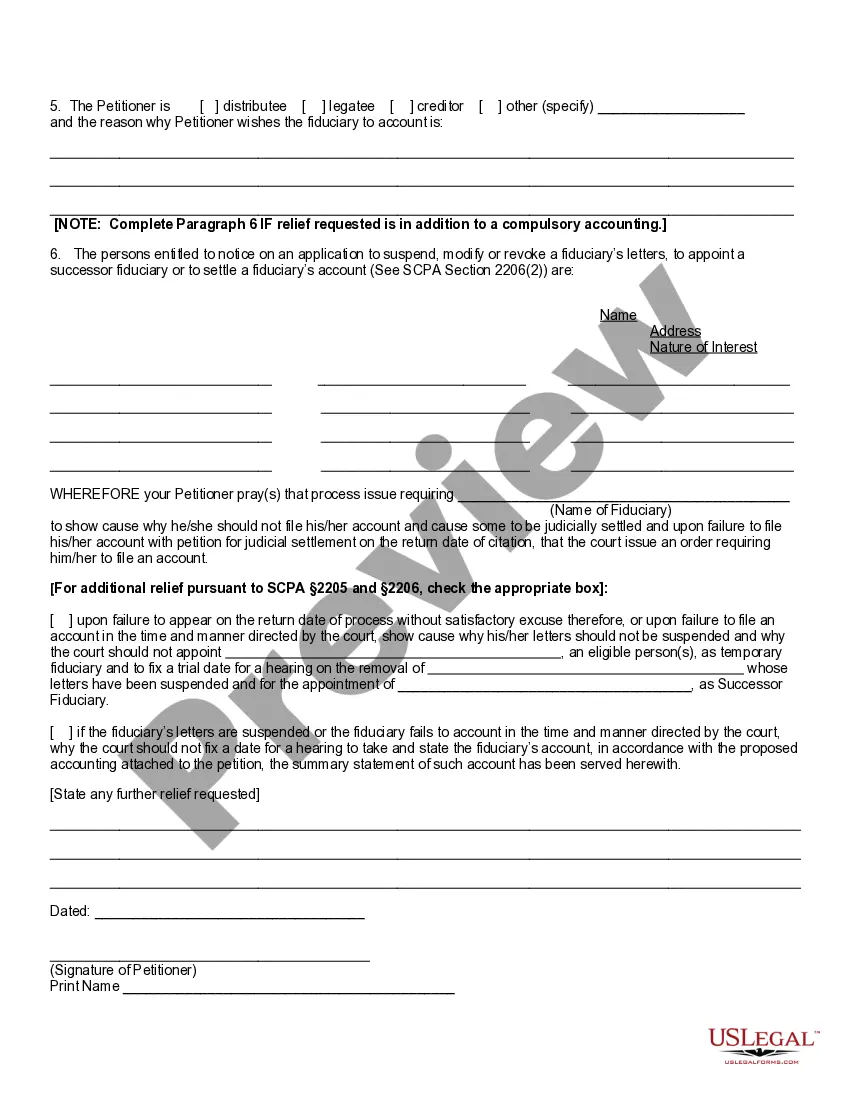

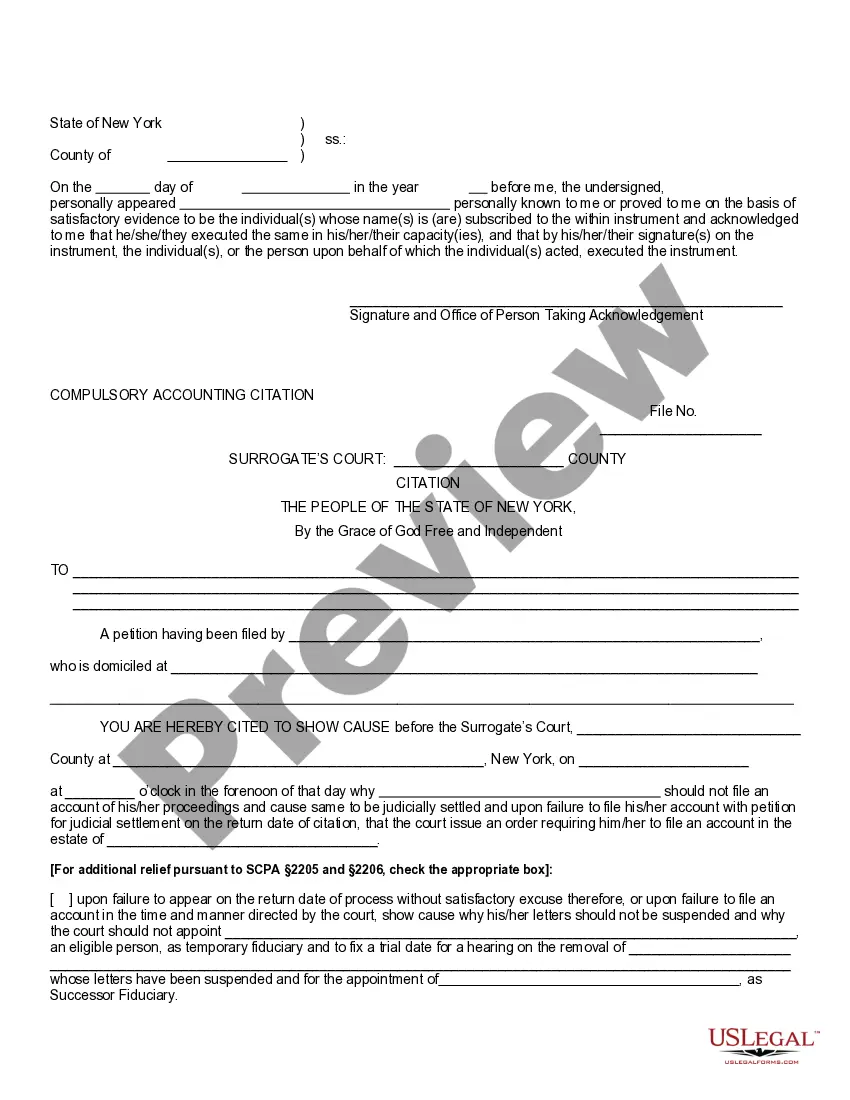

Queens New York Petition for a Compulsory Accounting and Related Relief is a legal document used in the Queens County, New York, to request an accounting and related relief in certain legal matters. This type of petition is commonly filed in probate cases, trust and estate disputes, and business partnerships. It plays a crucial role in allowing interested parties to obtain a detailed and accurate account of financial transactions, assets, and liabilities. Keywords: — Queens New York Petition: Refers to the legal request filed specifically in Queens County, New York, seeking a compulsory accounting and related relief. — Compulsory Accounting: It is an accounting process mandated by law that requires the party in possession of financial records to provide a detailed and comprehensive account of all relevant transactions, assets, and liabilities. — Related Relief: In addition to accounting, this term encompasses other requested remedies and relief sought in the legal matter, which may include injunctions, freezing assets, removal of fiduciaries, distribution of assets, appointment of new trustees, or any other appropriate actions. — Probate: Refers to the legal process of distributing a deceased person's assets and settling their debts. A Queens New York Petition for a Compulsory Accounting and Related Relief can be filed in probate cases when concerns about mismanagement, embezzlement, or fraud arise. — Trust and Estate Disputes: In situations where there are disagreements among beneficiaries, trustees, or executors regarding the administration of a trust or estate, a Queens New York Petition for a Compulsory Accounting and Related Relief can be filed to ensure transparency and accountability. — Business Partnerships: When disputes arise among business partners regarding the handling of financial matters, such as allegations of misappropriation of funds, a Queens New York Petition for a Compulsory Accounting and Related Relief can be filed to investigate and address these concerns. Types of Queens New York Petition for a Compulsory Accounting and Related Relief: 1. Probate Accounting Petition: Filed in probate cases to obtain a mandatory accounting of a deceased person's assets and ensure the fair and accurate distribution of the estate. 2. Trust Accounting Petition: Used in trust disputes to request a compulsory accounting to determine if there have been any financial improprieties relating to the management of a trust's assets. 3. Estate Accounting Petition: Filed in estate-related disputes, it seeks a compulsory accounting to examine the administration of an estate, including income, expenses, and asset distribution. 4. Partnership Accounting Petition: Relevant to business partnerships, this petition is utilized to obtain a compulsory accounting and related relief when there are concerns regarding the financial management of the partnership. It is worth noting that these are general categories, and the specifics of each petition will vary depending on the particular legal circumstances.Queens New York Petition for a Compulsory Accounting and Related Relief is a legal document used in the Queens County, New York, to request an accounting and related relief in certain legal matters. This type of petition is commonly filed in probate cases, trust and estate disputes, and business partnerships. It plays a crucial role in allowing interested parties to obtain a detailed and accurate account of financial transactions, assets, and liabilities. Keywords: — Queens New York Petition: Refers to the legal request filed specifically in Queens County, New York, seeking a compulsory accounting and related relief. — Compulsory Accounting: It is an accounting process mandated by law that requires the party in possession of financial records to provide a detailed and comprehensive account of all relevant transactions, assets, and liabilities. — Related Relief: In addition to accounting, this term encompasses other requested remedies and relief sought in the legal matter, which may include injunctions, freezing assets, removal of fiduciaries, distribution of assets, appointment of new trustees, or any other appropriate actions. — Probate: Refers to the legal process of distributing a deceased person's assets and settling their debts. A Queens New York Petition for a Compulsory Accounting and Related Relief can be filed in probate cases when concerns about mismanagement, embezzlement, or fraud arise. — Trust and Estate Disputes: In situations where there are disagreements among beneficiaries, trustees, or executors regarding the administration of a trust or estate, a Queens New York Petition for a Compulsory Accounting and Related Relief can be filed to ensure transparency and accountability. — Business Partnerships: When disputes arise among business partners regarding the handling of financial matters, such as allegations of misappropriation of funds, a Queens New York Petition for a Compulsory Accounting and Related Relief can be filed to investigate and address these concerns. Types of Queens New York Petition for a Compulsory Accounting and Related Relief: 1. Probate Accounting Petition: Filed in probate cases to obtain a mandatory accounting of a deceased person's assets and ensure the fair and accurate distribution of the estate. 2. Trust Accounting Petition: Used in trust disputes to request a compulsory accounting to determine if there have been any financial improprieties relating to the management of a trust's assets. 3. Estate Accounting Petition: Filed in estate-related disputes, it seeks a compulsory accounting to examine the administration of an estate, including income, expenses, and asset distribution. 4. Partnership Accounting Petition: Relevant to business partnerships, this petition is utilized to obtain a compulsory accounting and related relief when there are concerns regarding the financial management of the partnership. It is worth noting that these are general categories, and the specifics of each petition will vary depending on the particular legal circumstances.