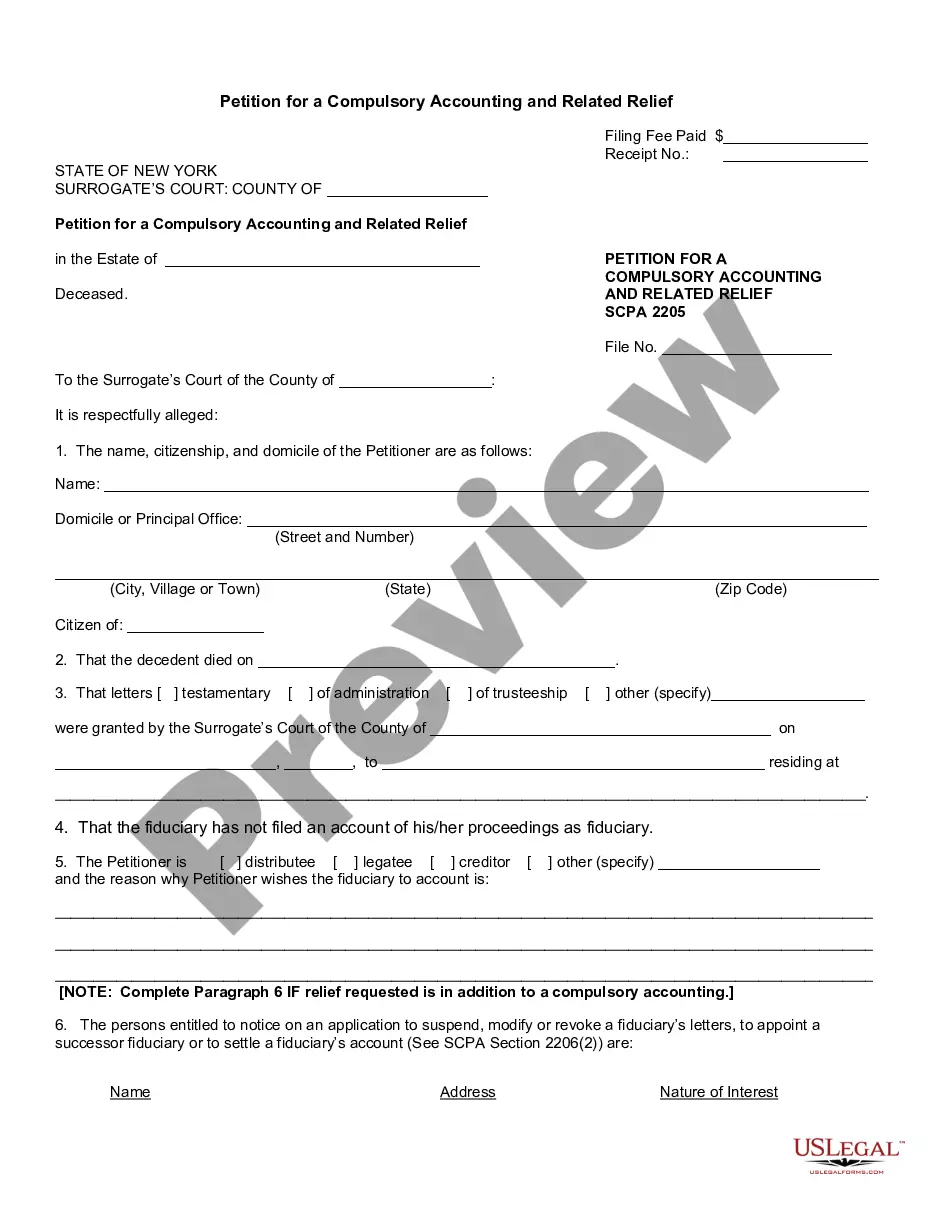

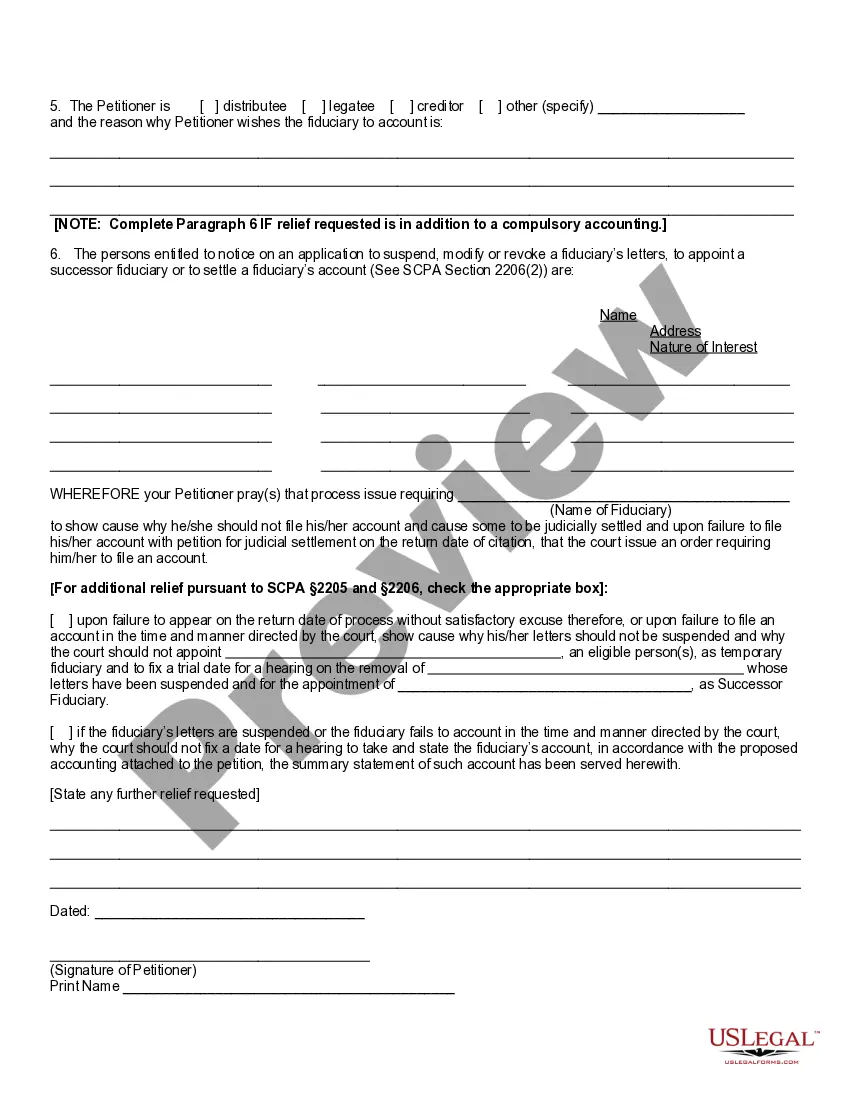

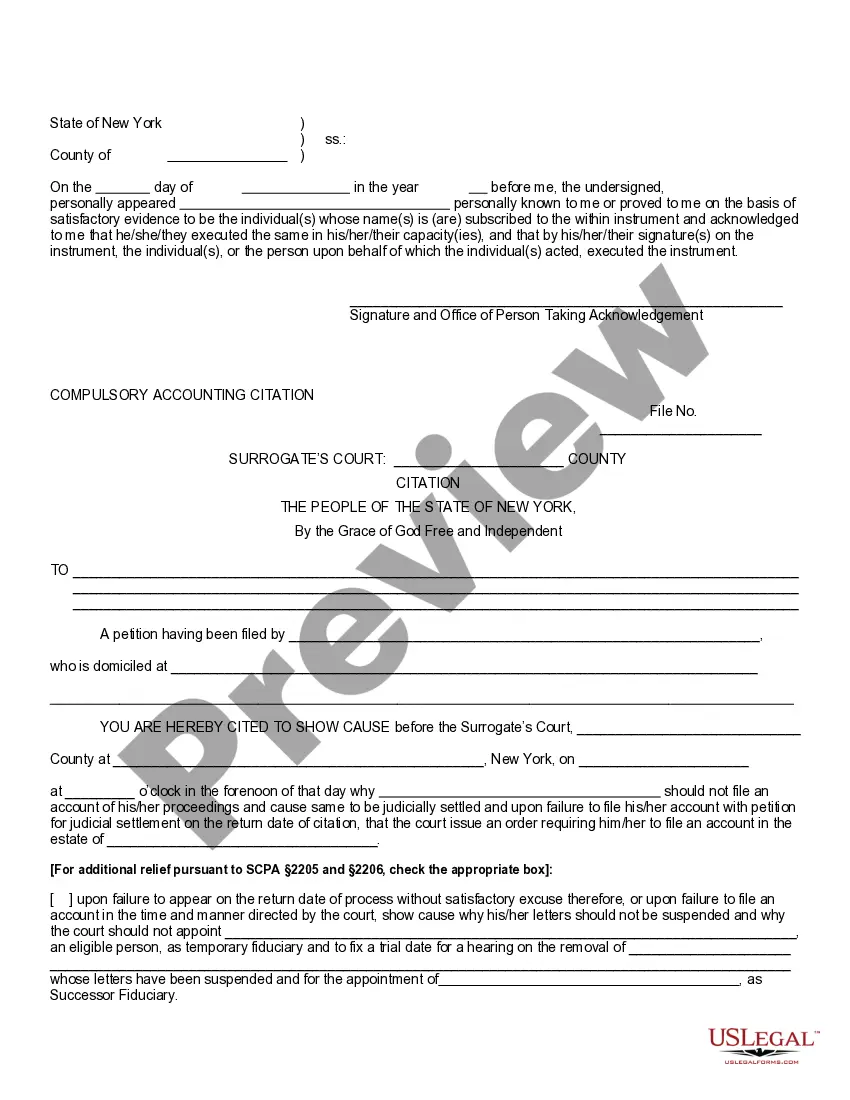

If the personal representative of a decedent's estate does not report to the court, the beneficiaries can ask the court to order him or her to file an accounting or take other actions to close probate. The court can remove the personal representative and appoint someone else.

The Suffolk New York Petition for a Compulsory Accounting and Related Relief is a legal document that allows individuals and beneficiaries to request an accounting of a decedent's estate or trust. This petition is used when there are concerns or suspicions regarding the management or administration of the estate or trust assets. Keywords: Suffolk New York, petition, compulsory accounting, related relief, legal document, beneficiaries, decedent's estate, trust, management, administration, assets. There are two main types of Suffolk New York Petition for a Compulsory Accounting and Related Relief: 1. Estate Petition for Compulsory Accounting: This type of petition is filed when someone questions the handling of assets in the estate of a deceased person. Beneficiaries of the estate can petition the court to order the personal representative (executor or administrator) to create a detailed account of all transactions, income, expenses, distributions, and any other relevant financial information related to the estate. 2. Trust Petition for Compulsory Accounting: This type of petition is filed when concerns arise regarding the administration of a trust. Beneficiaries of the trust can request the court to compel the trustee to provide a comprehensive accounting of the trust's financial activities. The trustee will be required to report all transactions, disbursements, investments, income, expenses, and overall management of the trust assets during a specified period. Filing a Suffolk New York Petition for a Compulsory Accounting and Related Relief can be crucial for beneficiaries or interested parties who suspect mismanagement, fraud, or negligence in the handling of an estate or trust. It allows the court to ensure transparency and accountability in the administration of these assets, ensuring that the interests of the beneficiaries are well-protected. In summary, the Suffolk New York Petition for a Compulsory Accounting and Related Relief is a legal tool to investigate and rectify any irregularities pertaining to the management and administration of a decedent's estate or a trust. By filing this petition, concerned individuals can request a comprehensive accounting of the financial activities and practices associated with the estate or trust, helping to safeguard beneficiaries' rights and interests.The Suffolk New York Petition for a Compulsory Accounting and Related Relief is a legal document that allows individuals and beneficiaries to request an accounting of a decedent's estate or trust. This petition is used when there are concerns or suspicions regarding the management or administration of the estate or trust assets. Keywords: Suffolk New York, petition, compulsory accounting, related relief, legal document, beneficiaries, decedent's estate, trust, management, administration, assets. There are two main types of Suffolk New York Petition for a Compulsory Accounting and Related Relief: 1. Estate Petition for Compulsory Accounting: This type of petition is filed when someone questions the handling of assets in the estate of a deceased person. Beneficiaries of the estate can petition the court to order the personal representative (executor or administrator) to create a detailed account of all transactions, income, expenses, distributions, and any other relevant financial information related to the estate. 2. Trust Petition for Compulsory Accounting: This type of petition is filed when concerns arise regarding the administration of a trust. Beneficiaries of the trust can request the court to compel the trustee to provide a comprehensive accounting of the trust's financial activities. The trustee will be required to report all transactions, disbursements, investments, income, expenses, and overall management of the trust assets during a specified period. Filing a Suffolk New York Petition for a Compulsory Accounting and Related Relief can be crucial for beneficiaries or interested parties who suspect mismanagement, fraud, or negligence in the handling of an estate or trust. It allows the court to ensure transparency and accountability in the administration of these assets, ensuring that the interests of the beneficiaries are well-protected. In summary, the Suffolk New York Petition for a Compulsory Accounting and Related Relief is a legal tool to investigate and rectify any irregularities pertaining to the management and administration of a decedent's estate or a trust. By filing this petition, concerned individuals can request a comprehensive accounting of the financial activities and practices associated with the estate or trust, helping to safeguard beneficiaries' rights and interests.