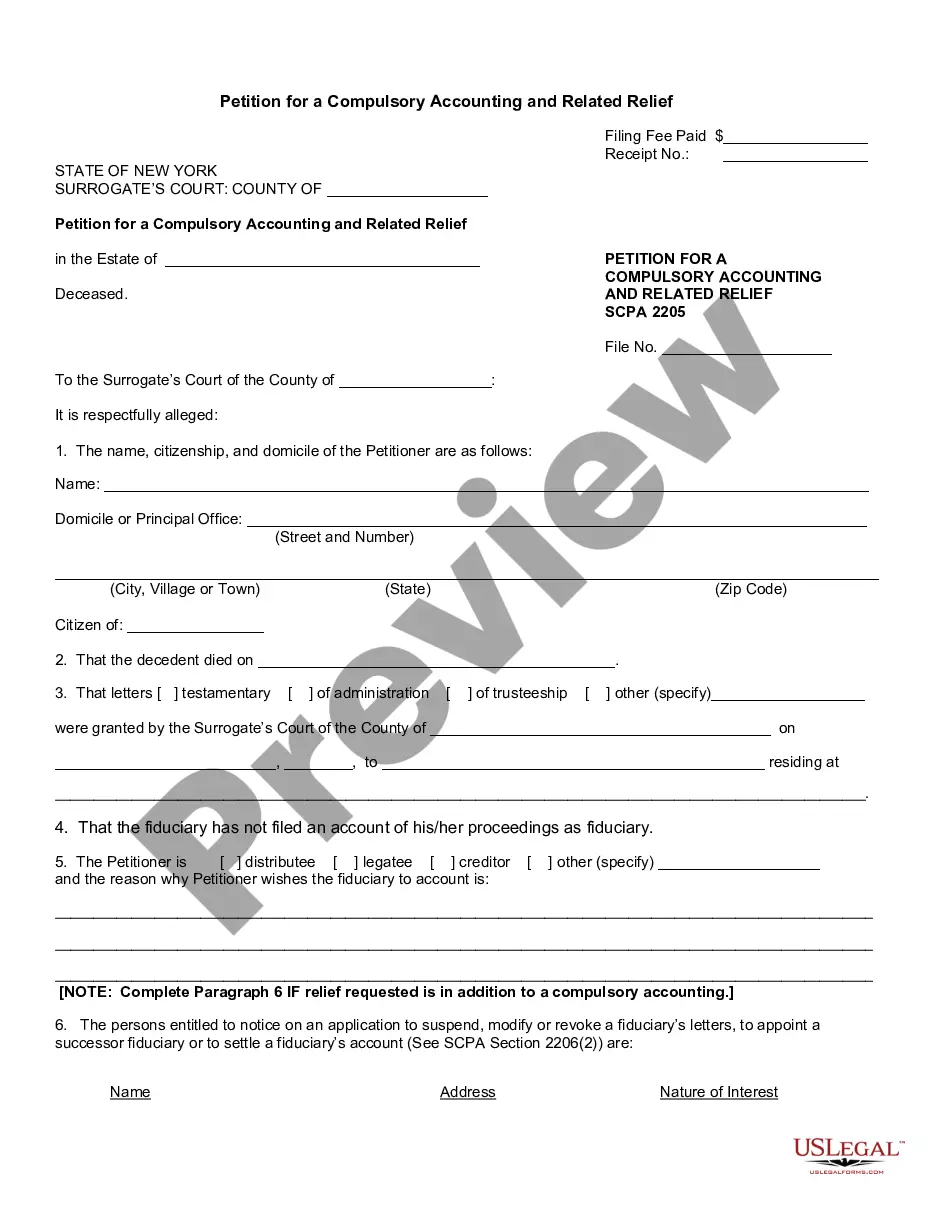

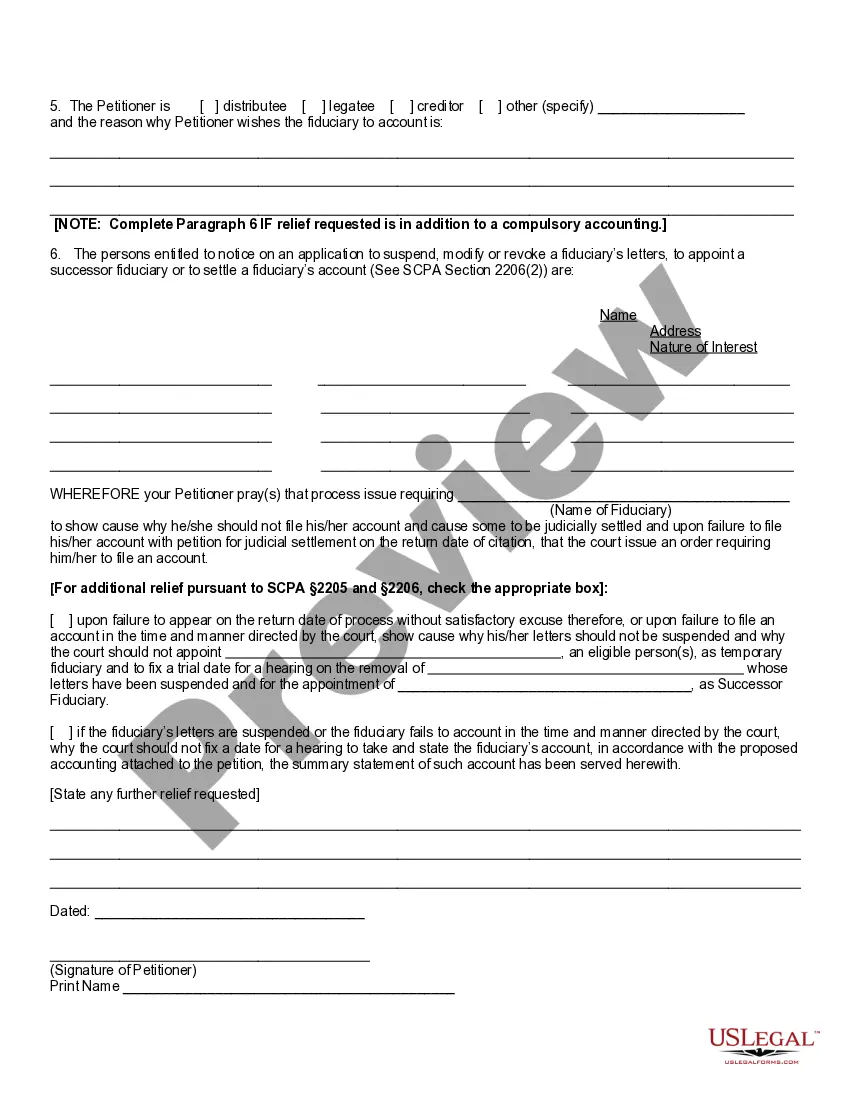

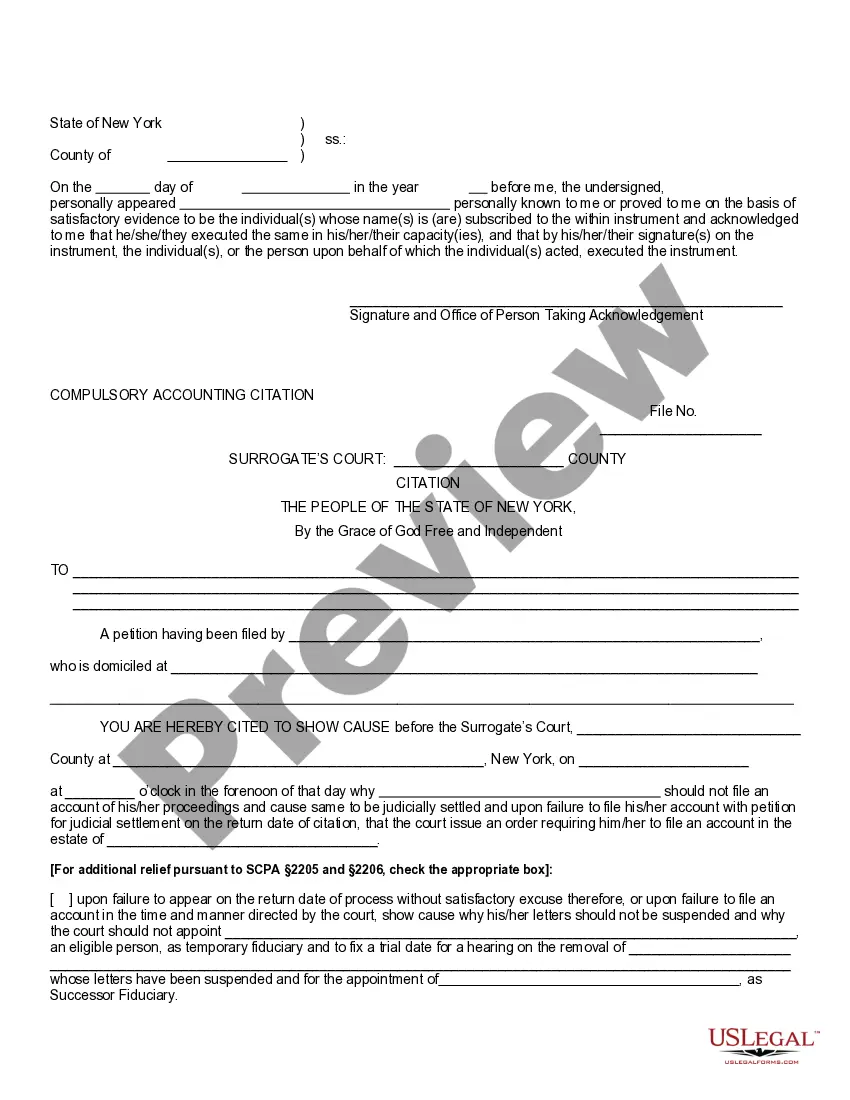

If the personal representative of a decedent's estate does not report to the court, the beneficiaries can ask the court to order him or her to file an accounting or take other actions to close probate. The court can remove the personal representative and appoint someone else.

One prominent type of Syracuse New York Petition for a Compulsory Accounting and Related Relief is the legal document filed by a concerned party seeking an accurate and thorough financial record of a trust, estate, or business entity. This petition is typically filed with the Surrogate's Court to ensure transparency and accountability in financial matters. It aims to address any potential mismanagement, fraud, or other irregularities that may have occurred. The Syracuse New York Petition for a Compulsory Accounting and Related Relief is commonly used in cases involving disputes among beneficiaries, heirs, partners, or shareholders who suspect wrongdoing or seek clarity regarding the financial affairs of a specific entity. By filing this petition, the concerned party requests the court to order the individual or entity responsible for handling the finances to provide a comprehensive account, including details of income, expenses, assets, liabilities, and distribution of profits. The petitioner may also seek related relief alongside the compulsory accounting, such as the appointment of a neutral third-party accountant or financial expert to oversee the accounting process or to evaluate the accuracy and fairness of the presented financial statements. Additionally, the petitioner can request the court to impose penalties or legal consequences if the accounting process reveals any wrongdoing or mismanagement. Keywords: Syracuse New York Petition for a Compulsory Accounting, Surrogate's Court, financial record, trust, estate, business entity, transparency, accountability, mismanagement, fraud, irregularities, beneficiaries, heirs, partners, shareholders, concerns, wrongdoing, clarity, income, expenses, assets, liabilities, distribution of profits, related relief, appointment, neutral third-party, accountant, financial expert, penalties, legal consequences.One prominent type of Syracuse New York Petition for a Compulsory Accounting and Related Relief is the legal document filed by a concerned party seeking an accurate and thorough financial record of a trust, estate, or business entity. This petition is typically filed with the Surrogate's Court to ensure transparency and accountability in financial matters. It aims to address any potential mismanagement, fraud, or other irregularities that may have occurred. The Syracuse New York Petition for a Compulsory Accounting and Related Relief is commonly used in cases involving disputes among beneficiaries, heirs, partners, or shareholders who suspect wrongdoing or seek clarity regarding the financial affairs of a specific entity. By filing this petition, the concerned party requests the court to order the individual or entity responsible for handling the finances to provide a comprehensive account, including details of income, expenses, assets, liabilities, and distribution of profits. The petitioner may also seek related relief alongside the compulsory accounting, such as the appointment of a neutral third-party accountant or financial expert to oversee the accounting process or to evaluate the accuracy and fairness of the presented financial statements. Additionally, the petitioner can request the court to impose penalties or legal consequences if the accounting process reveals any wrongdoing or mismanagement. Keywords: Syracuse New York Petition for a Compulsory Accounting, Surrogate's Court, financial record, trust, estate, business entity, transparency, accountability, mismanagement, fraud, irregularities, beneficiaries, heirs, partners, shareholders, concerns, wrongdoing, clarity, income, expenses, assets, liabilities, distribution of profits, related relief, appointment, neutral third-party, accountant, financial expert, penalties, legal consequences.