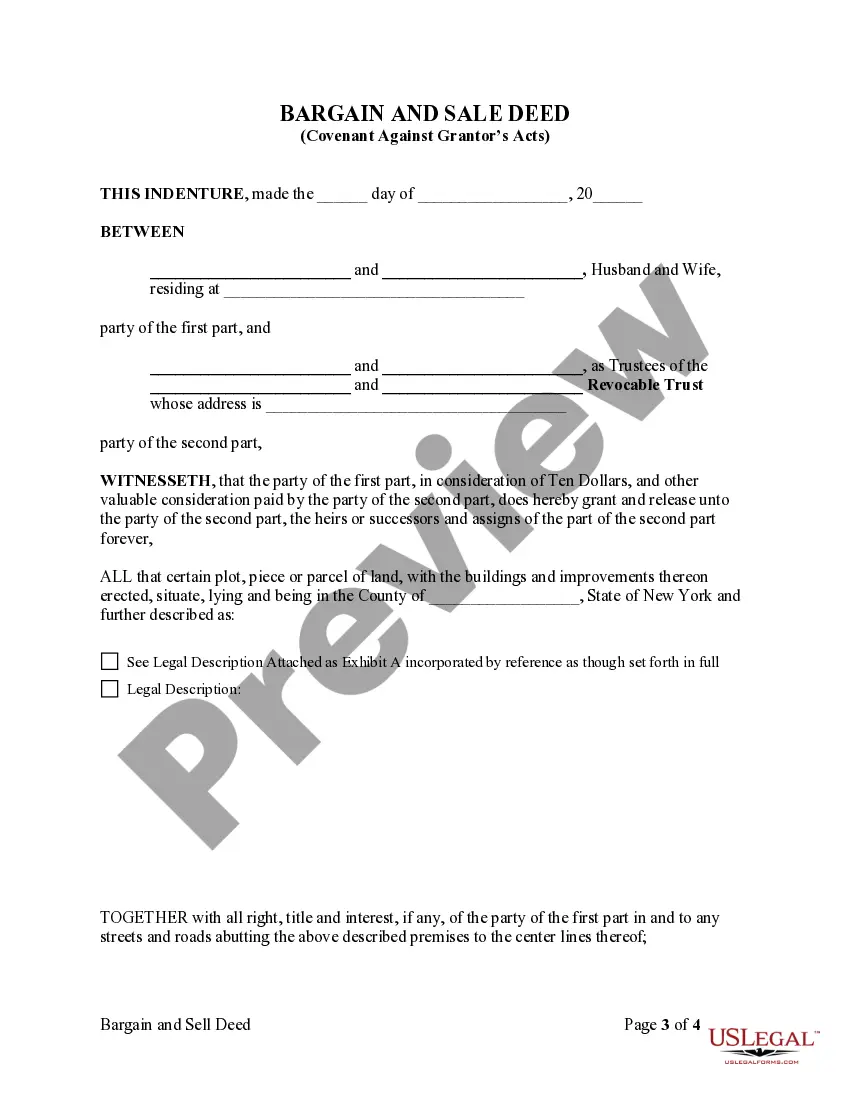

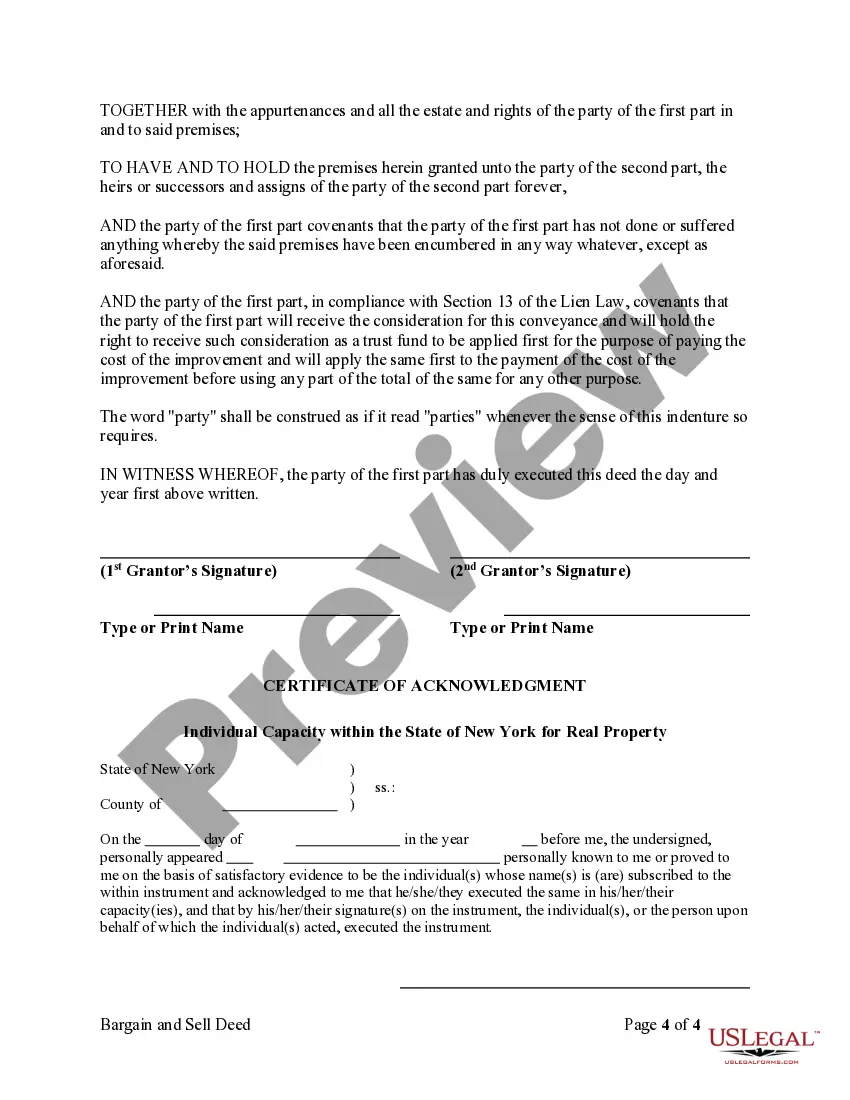

This form is a Bargain and Sale Deed with Covenants Against Grantor's Acts between Husband and Wife, party of the first part, and the Trustees of a Revocable Trust as party of the second part. This deed complies with all state statutory laws.

A Nassau New York Bargain and Sale Deed with Covenant Against Granters Acts — Husband and Wife to Trust is a legal document that serves as a means to transfer property ownership from a married couple to a trust. In this type of deed, both the husband and wife, referred to as granters, transfer their individual ownership interests to the trust. This process allows them to protect their property assets and manage them more effectively for estate planning, tax purposes, or other specific objectives. The deed includes a covenant against granters acts, which ensures that the granters hold full legal title to the property and have not incurred any liens or encumbrances that may affect the trust's ownership rights. The covenant also guarantees that the granters will defend the trust's ownership against any future claims, except for those arising from previously undisclosed defects or encumbrances. The Nassau New York Bargain and Sale Deed with Covenant Against Granters Acts — Husband and Wife to Trust provides a straightforward and efficient method for married couples to transfer property to a trust without warranty or guarantee of title. Different types of Nassau New York Bargain and Sale Deed with Covenant Against Granters Acts — Husband and Wife to Trust may include: 1. Revocable Living Trust Deed: This type of deed allows the granters to establish a revocable living trust, which can be modified or revoked during their lifetime. The trust assets are managed for the benefit of the granters and ultimately distributed to beneficiaries upon their death. 2. Irrevocable Trust Deed: In contrast to a revocable living trust, an irrevocable trust deed creates a trust that cannot be modified or revoked without the consent of the beneficiaries. This type of trust is often used for asset protection or estate tax planning purposes. 3. Special Needs Trust Deed: This variation of the deed is designed for couples who have a dependent with special needs. It allows them to transfer their property to a trust that provides for the long-term care and financial support of their special needs child. 4. Charitable Remainder Trust Deed: This type of trust deed enables the granters to transfer ownership of their property to a trust and receive income from the trust for a specific period, typically their lifetime. After their passing, the remaining trust assets are donated to a chosen charitable organization. 5. Testamentary Trust Deed: Unlike the other types, this deed is established within a last will and testament. Upon the death of the granters, the property ownership is automatically transferred to the trust, as specified in their will. In conclusion, the Nassau New York Bargain and Sale Deed with Covenant Against Granters Acts — Husband and Wife to Trust is a legal instrument used by married couples to transfer property ownership to a trust. Different types of this deed cater to specific estate planning or asset protection needs, such as revocable or irrevocable living trusts, special needs trusts, charitable remainder trusts, or testamentary trusts. It is crucial to consult with a qualified attorney to ensure compliance with all legal requirements and to tailor the deed to individual circumstances.A Nassau New York Bargain and Sale Deed with Covenant Against Granters Acts — Husband and Wife to Trust is a legal document that serves as a means to transfer property ownership from a married couple to a trust. In this type of deed, both the husband and wife, referred to as granters, transfer their individual ownership interests to the trust. This process allows them to protect their property assets and manage them more effectively for estate planning, tax purposes, or other specific objectives. The deed includes a covenant against granters acts, which ensures that the granters hold full legal title to the property and have not incurred any liens or encumbrances that may affect the trust's ownership rights. The covenant also guarantees that the granters will defend the trust's ownership against any future claims, except for those arising from previously undisclosed defects or encumbrances. The Nassau New York Bargain and Sale Deed with Covenant Against Granters Acts — Husband and Wife to Trust provides a straightforward and efficient method for married couples to transfer property to a trust without warranty or guarantee of title. Different types of Nassau New York Bargain and Sale Deed with Covenant Against Granters Acts — Husband and Wife to Trust may include: 1. Revocable Living Trust Deed: This type of deed allows the granters to establish a revocable living trust, which can be modified or revoked during their lifetime. The trust assets are managed for the benefit of the granters and ultimately distributed to beneficiaries upon their death. 2. Irrevocable Trust Deed: In contrast to a revocable living trust, an irrevocable trust deed creates a trust that cannot be modified or revoked without the consent of the beneficiaries. This type of trust is often used for asset protection or estate tax planning purposes. 3. Special Needs Trust Deed: This variation of the deed is designed for couples who have a dependent with special needs. It allows them to transfer their property to a trust that provides for the long-term care and financial support of their special needs child. 4. Charitable Remainder Trust Deed: This type of trust deed enables the granters to transfer ownership of their property to a trust and receive income from the trust for a specific period, typically their lifetime. After their passing, the remaining trust assets are donated to a chosen charitable organization. 5. Testamentary Trust Deed: Unlike the other types, this deed is established within a last will and testament. Upon the death of the granters, the property ownership is automatically transferred to the trust, as specified in their will. In conclusion, the Nassau New York Bargain and Sale Deed with Covenant Against Granters Acts — Husband and Wife to Trust is a legal instrument used by married couples to transfer property ownership to a trust. Different types of this deed cater to specific estate planning or asset protection needs, such as revocable or irrevocable living trusts, special needs trusts, charitable remainder trusts, or testamentary trusts. It is crucial to consult with a qualified attorney to ensure compliance with all legal requirements and to tailor the deed to individual circumstances.