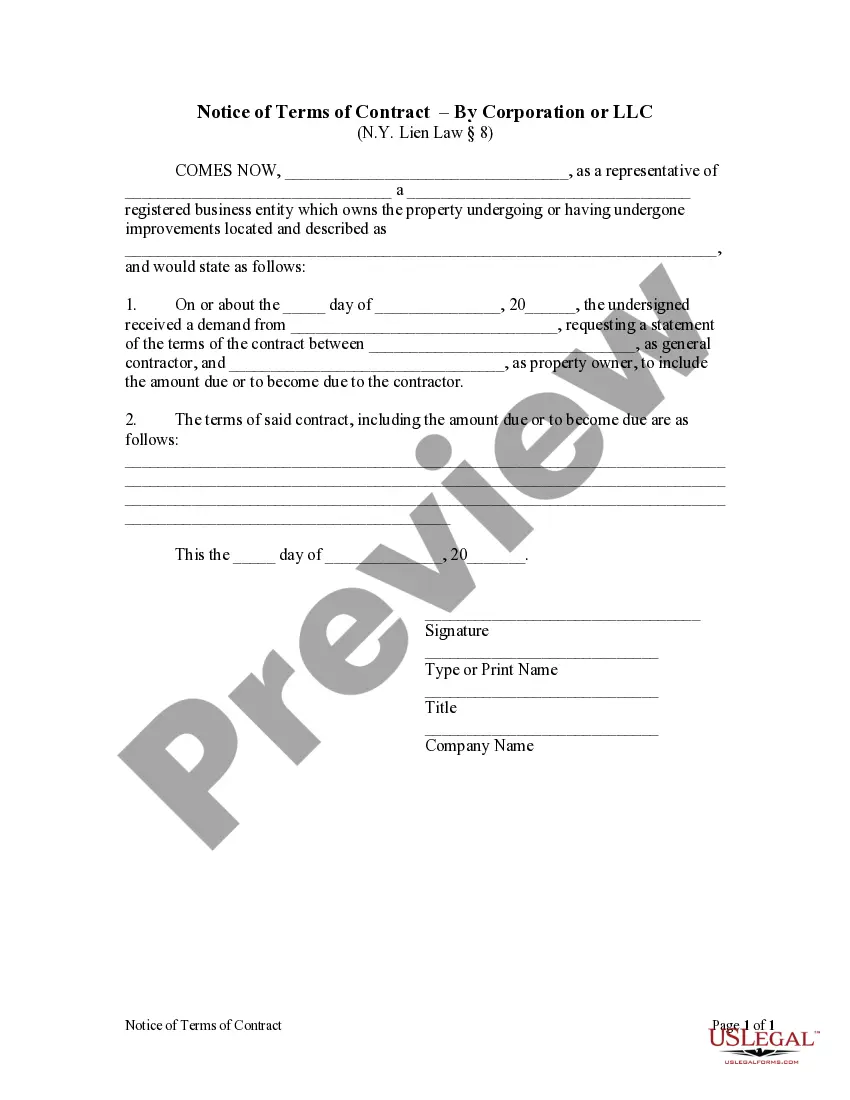

New York statutes provide that a subcontractor, laborer, or materialman providing labor or materials to a contractor or subcontractor may issue a written demand to the property owner for the terms of the contract between the contractor and the property owner. The owner is required to provide the terms of said contract within thirty (30) days or be held liable for any damages that result. This form can be used by a property owner to respond to said demand.

Title: Understanding Suffolk New York Notice of Terms of Contract by Corporation or LLC Introduction: In Suffolk County, New York, corporations and limited liability companies (LCS) are required to provide a Notice of Terms of Contract to their clients or customers to ensure transparency and protect both parties involved in a business transaction. This article aims to provide a detailed description of the Suffolk New York Notice of Terms of Contract by Corporation or LLC, its purpose, and the key elements involved. Keywords: Suffolk New York, Notice of Terms of Contract, Corporation, LLC, business transaction, transparency, key elements 1. Overview of Suffolk New York Notice of Terms of Contract: The Suffolk New York Notice of Terms of Contract is a legally binding document that outlines the terms and conditions of a business agreement between a corporation or LLC and its client or customer. This notice serves as a means to establish clear expectations and protect both parties' rights. 2. Purpose of the Notice: The primary purpose of the Suffolk New York Notice of Terms of Contract is to provide important information regarding the nature of the business agreement, including terms of payment, delivery, liability, dispute resolution, and other relevant provisions. It ensures that clients or customers are aware of their rights and responsibilities while engaging in a business transaction with a corporation or LLC. 3. Key Elements of the Notice: a. Identification: The Notice should clearly state the legal name, address, and contact information of the corporation or LLC involved. b. Terms and Conditions: The notice must provide a comprehensive description of the terms and conditions that govern the business agreement, such as product or service specifications, payment methods, delivery timelines, cancellation policies, warranties, and any limitations of liability. c. Intellectual Property: If relevant, the notice should address any intellectual property rights associated with the product or service being provided, including copyright, trademarks, or patents. d. Governing Law: The notice should specify which jurisdiction's laws apply to the agreement, typically stating that Suffolk County, New York laws govern the contract. e. Dispute Resolution: The notice may include information about the preferred method of dispute resolution, such as mediation, arbitration, or litigation, should conflicts arise during the course of the contract. f. Severability: This provision ensures that if any part of the contract is found invalid or unenforceable, the remaining terms will still be upheld to the extent legally possible. 4. Types of Suffolk New York Notice of Terms of Contract by Corporation or LLC: a. General Business Contract Notice: This notice applies to most standard business agreements between a corporation or LLC and its clients or customers, outlining the typical terms and conditions. b. Specific Industry Contract Notice: Certain industries, such as construction or healthcare, may require additional terms and provisions tailored to their unique requirements. In such cases, a specialized Notice of Terms of Contract might be necessary. Conclusion: Utilizing a Suffolk New York Notice of Terms of Contract by Corporation or LLC is crucial to maintaining transparency and ensuring a mutually beneficial business relationship between parties. By addressing the key elements mentioned above, corporations and LCS operating in Suffolk County can protect themselves and their clients or customers while fostering trust and compliance within their agreements.