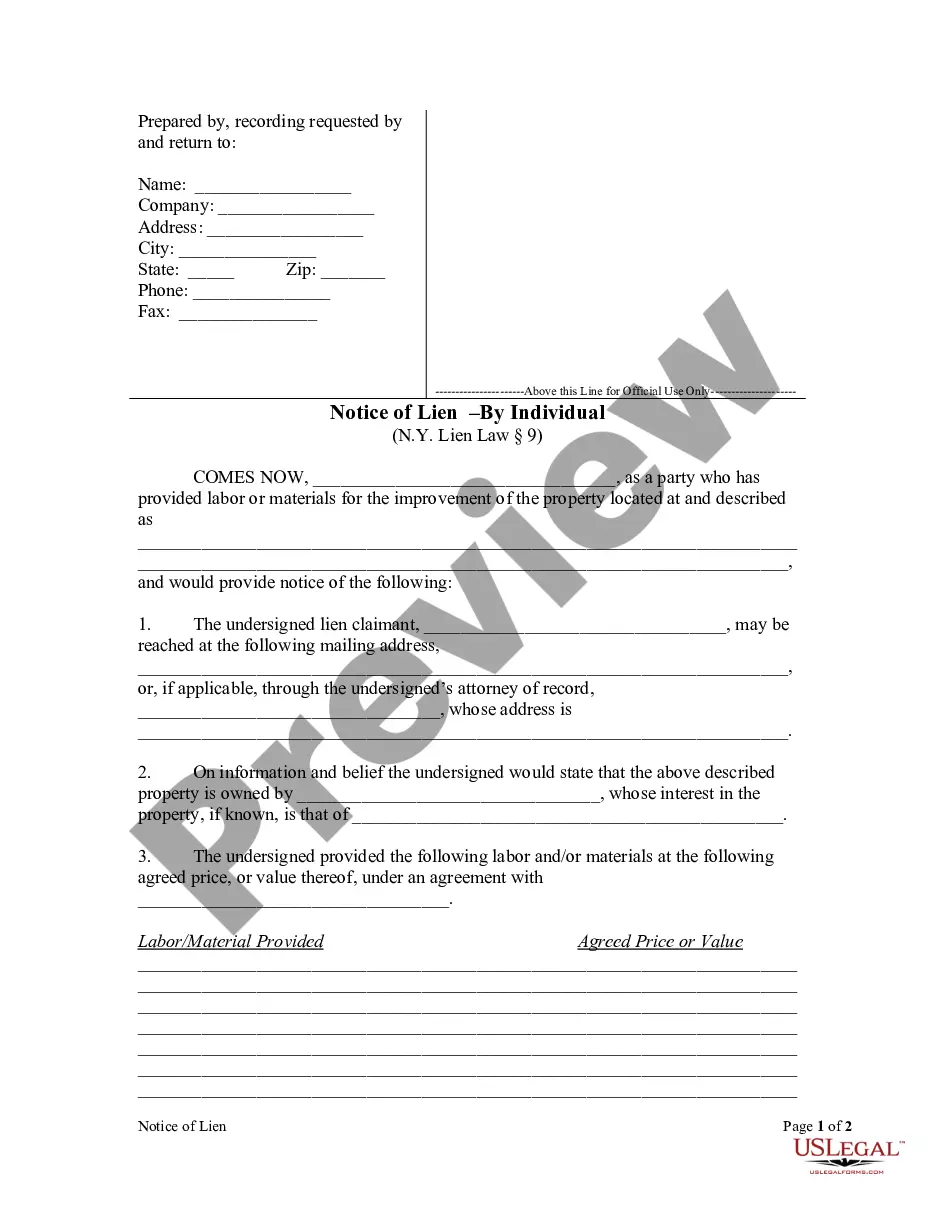

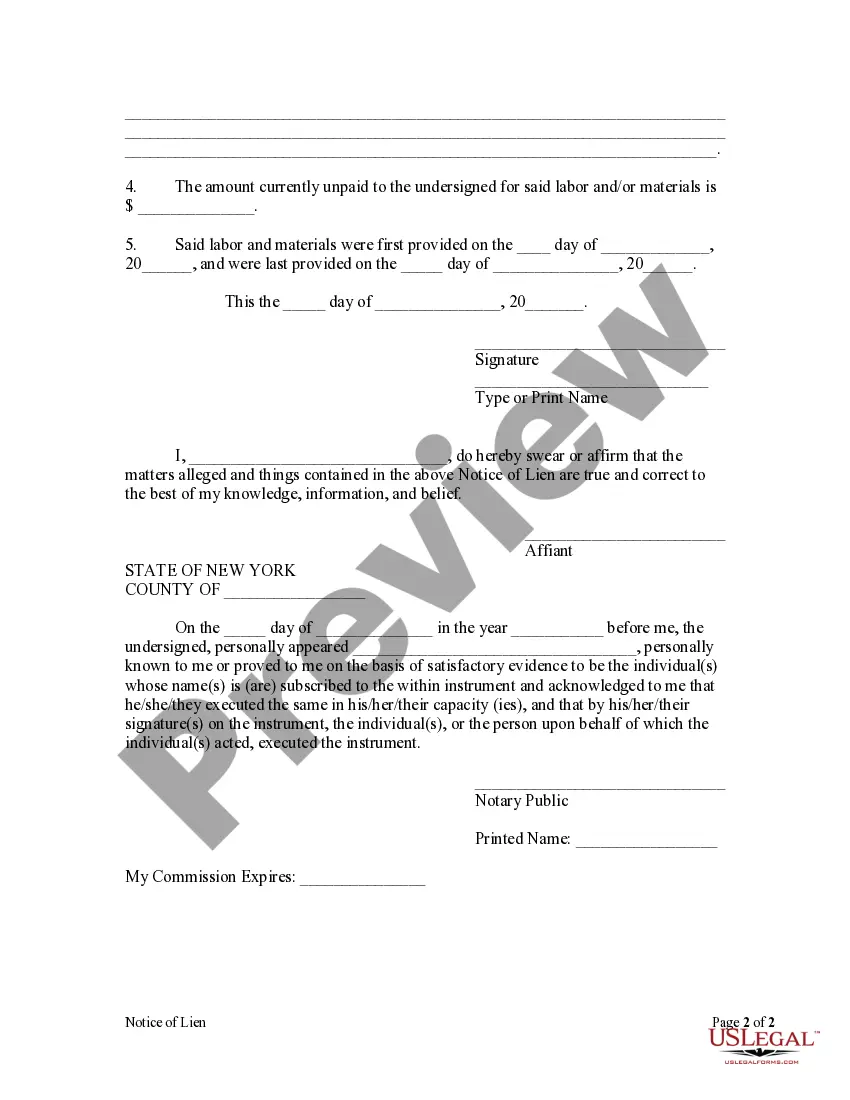

New York law requires a party desiring to claim a lien to file a Notice of Lien form in the office of the clerk of the county where the property is situated. The notice may be filed at any time during the progress of the work and the furnishing of the materials, or, within eight months after the completion of the contract, or the final performance of the work, or the final furnishing of the materials.

The Nassau New York Notice of Lien by Individual is a legal document that establishes a claim against a property or assets owned by an individual in Nassau County, New York. This notice is filed by an individual, typically a creditor who is owed money or has a judgment against the property owner. The primary purpose of filing a Notice of Lien is to ensure that the creditor's rights are protected and that they have a legal claim to the property. The lien alerts potential buyers or lenders that there is an existing debt owed on the property. This means that the property cannot be sold or refinanced until the debt is satisfied or otherwise resolved. There are different types of Nassau New York Notice of Lien by Individual, including: 1. Mechanics Lien: This type of lien is filed by contractors, subcontractors, or suppliers who have provided labor or materials for construction or improvement projects. It ensures that they receive payment for their services. 2. Judgment Lien: When a creditor obtains a court judgment against an individual, they can file a notice of lien to place a claim on the individual's property. This type of lien is used to help guarantee that the creditor is paid the amount owed. 3. Tax Lien: The Nassau County Department of Assessment may file a tax lien against a property owner who has unpaid property taxes. This lien allows the county to collect the outstanding tax debt by potentially seizing and selling the property. 4. HOA Lien: Homeowners' associations (Has) can file a notice of lien against a property owner who has delinquent dues or fees. This lien ensures that the HOA has a claim to the property to enforce payment. It is important to note that filing a Notice of Lien by Individual is a legal process that follows specific guidelines and procedures. The property owner will receive a copy of the lien and have an opportunity to respond or resolve the debt. Failure to address the lien may result in further legal action or the eventual sale of the property to satisfy the debt. In summary, the Nassau New York Notice of Lien by Individual is a crucial document that establishes a creditor's claim on a property in Nassau County. It helps protect the creditor's rights and ensures proper payment for services rendered or debts owed. Different types of liens, such as mechanics liens, judgment liens, tax liens, and HOA liens, can be filed depending on the specific circumstance.The Nassau New York Notice of Lien by Individual is a legal document that establishes a claim against a property or assets owned by an individual in Nassau County, New York. This notice is filed by an individual, typically a creditor who is owed money or has a judgment against the property owner. The primary purpose of filing a Notice of Lien is to ensure that the creditor's rights are protected and that they have a legal claim to the property. The lien alerts potential buyers or lenders that there is an existing debt owed on the property. This means that the property cannot be sold or refinanced until the debt is satisfied or otherwise resolved. There are different types of Nassau New York Notice of Lien by Individual, including: 1. Mechanics Lien: This type of lien is filed by contractors, subcontractors, or suppliers who have provided labor or materials for construction or improvement projects. It ensures that they receive payment for their services. 2. Judgment Lien: When a creditor obtains a court judgment against an individual, they can file a notice of lien to place a claim on the individual's property. This type of lien is used to help guarantee that the creditor is paid the amount owed. 3. Tax Lien: The Nassau County Department of Assessment may file a tax lien against a property owner who has unpaid property taxes. This lien allows the county to collect the outstanding tax debt by potentially seizing and selling the property. 4. HOA Lien: Homeowners' associations (Has) can file a notice of lien against a property owner who has delinquent dues or fees. This lien ensures that the HOA has a claim to the property to enforce payment. It is important to note that filing a Notice of Lien by Individual is a legal process that follows specific guidelines and procedures. The property owner will receive a copy of the lien and have an opportunity to respond or resolve the debt. Failure to address the lien may result in further legal action or the eventual sale of the property to satisfy the debt. In summary, the Nassau New York Notice of Lien by Individual is a crucial document that establishes a creditor's claim on a property in Nassau County. It helps protect the creditor's rights and ensures proper payment for services rendered or debts owed. Different types of liens, such as mechanics liens, judgment liens, tax liens, and HOA liens, can be filed depending on the specific circumstance.