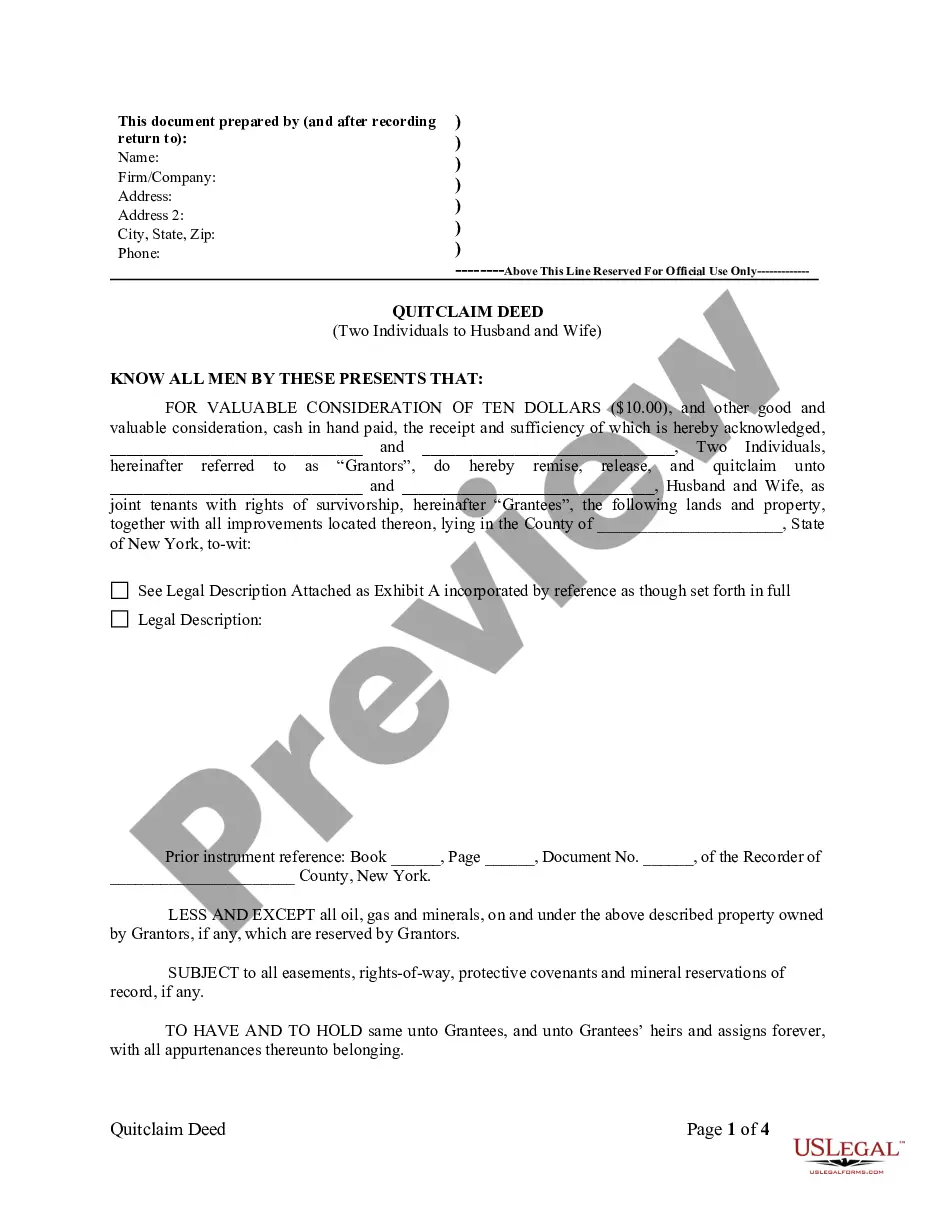

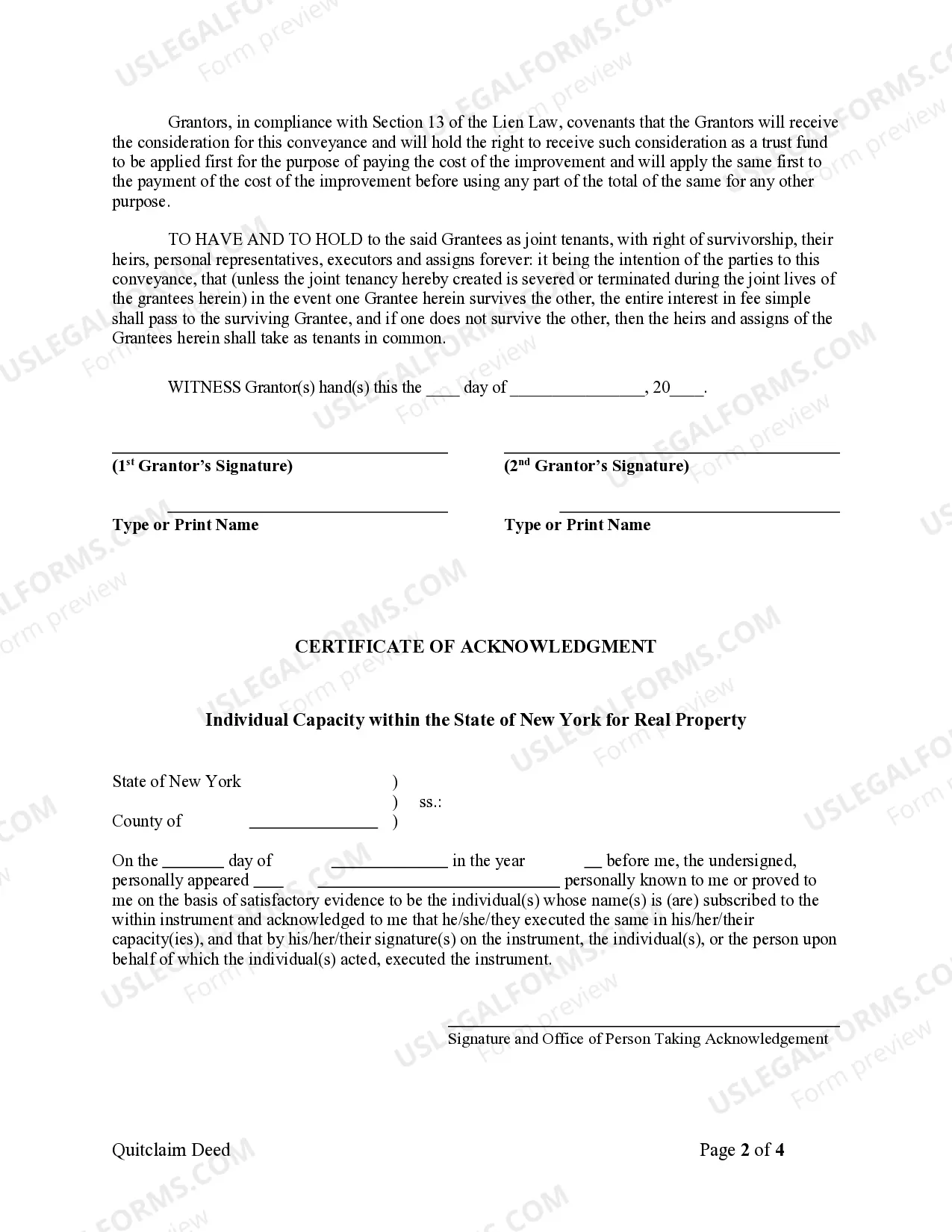

Queens New York Quitclaim Deed by Two Individuals to Husband and Wife is a legal document that transfers ownership of a property from two individuals to a married couple. In this type of deed, the individuals, known as granters, relinquish any claims or interests they may have in the property, while the husband and wife, known as grantees, gain complete ownership. This type of transfer is commonly used when two individuals who jointly own a property want to transfer the property to a married couple. It ensures a smooth and legally binding transfer of ownership rights. By executing a quitclaim deed, the granters effectively terminate their interests in the property, and the grantees gain full legal ownership. The Queens New York Quitclaim Deed by Two Individuals to Husband and Wife may have variations based on specific circumstances or requirements, including: 1. Joint Tenancy with Right of Survivorship: This type of quitclaim deed grants ownership to the husband and wife as joint tenants with the right of survivorship. In the event of one spouse's death, the surviving spouse automatically becomes the sole owner of the property. 2. Tenancy by the Entirety: This variation of a quitclaim deed is specific to married couples and provides unique protections. It grants the husband and wife equal ownership interest in the property, with the right of survivorship. The property cannot be divided or sold without the consent of both spouses. 3. Tenants in Common: This type of quitclaim deed grants equal or unequal ownership interests in the property to the husband and wife as tenants in common. Each spouse has a distinct share of ownership, and in the event of one spouse's death, their share becomes part of their estate. It is crucial for individuals involved in such property transfers to consult with a real estate attorney or legal professional experienced in Queens New York real estate laws. This ensures that all necessary legal requirements are met, potential issues are addressed, and the transfer is properly documented to provide clarity and protection for all parties involved. Keywords: Queens New York, quitclaim deed, two individuals, husband and wife, transfer of ownership, legal document, granters, grantees, joint tenancy, right of survivorship, tenancy by the entirety, tenants in common, property transfer, real estate attorney, Queens New York real estate laws.

Queens New York Quitclaim Deed by Two Individuals to Husband and Wife

Description

How to fill out New York Quitclaim Deed By Two Individuals To Husband And Wife?

Are you searching for a reliable and affordable legal documents provider to purchase the Queens New York Quitclaim Deed executed by Two Individuals to Husband and Wife.

US Legal Forms is your ideal answer.

Whether you require a straightforward agreement to establish guidelines for living together with your partner or a collection of papers to facilitate your divorce in the court, we have you covered.

Our platform offers more than 85,000 current legal document templates for individual and commercial use.

Determine if the Queens New York Quitclaim Deed executed by Two Individuals to Husband and Wife aligns with the laws of your state and locality.

Review the form’s description (if available) to understand who and what the form is designed for.

- All templates we provide are specific and tailored according to the demands of different states and regions.

- To access the form, you need to sign into your account, find the desired template, and click the Download button beside it.

- Please keep in mind that you can retrieve your previously acquired form templates at any time in the My documents section.

- Are you unfamiliar with our website? No problem.

- You can establish an account swiftly, but before that, ensure to do the following.

Form popularity

FAQ

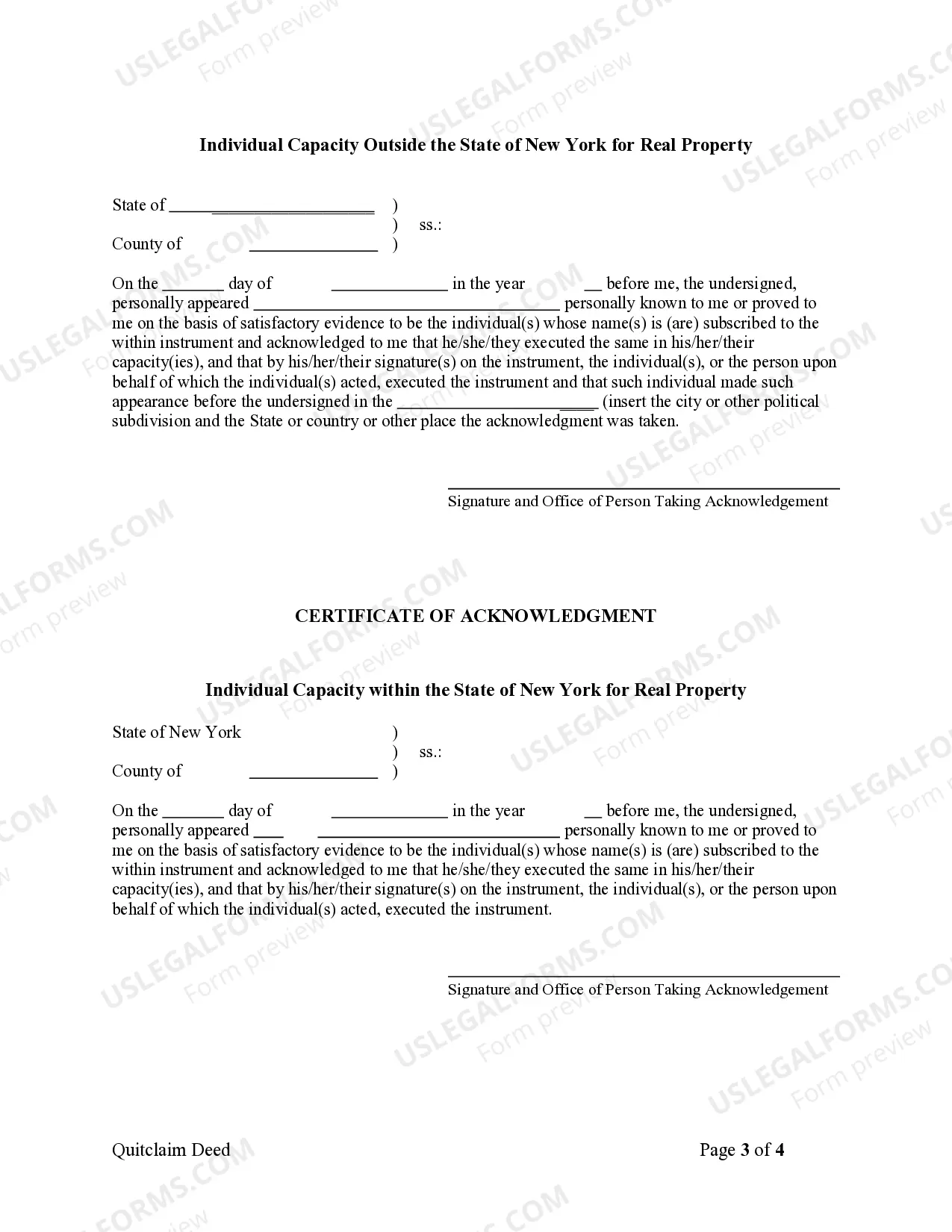

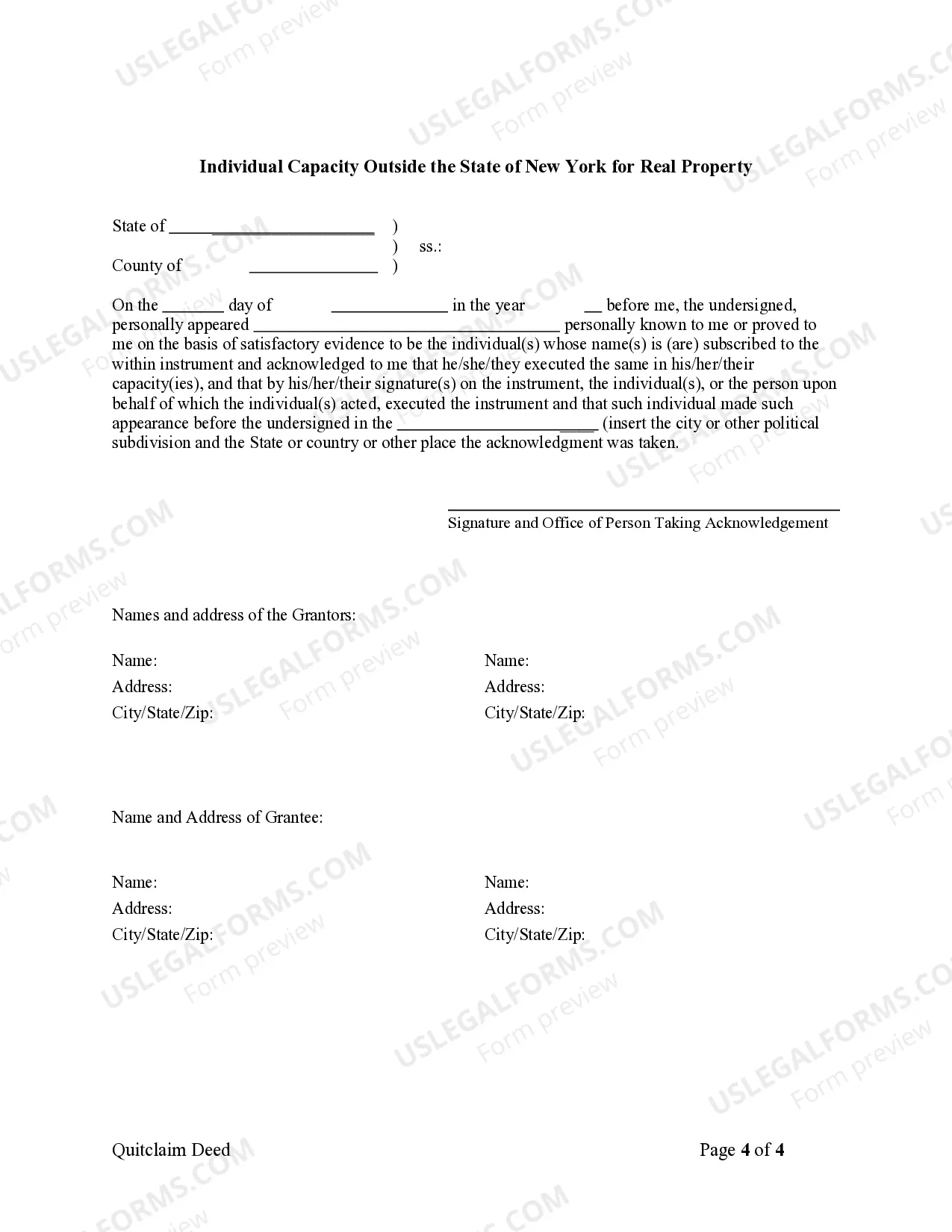

To add your spouse to your deed in New York, you typically need to execute a Queens New York Quitclaim Deed by Two Individuals to Husband and Wife. This legal document allows you to transfer a portion of your property interest to your spouse. You will also need to ensure that both parties sign the deed in front of a notary. Additionally, after signing, you must file the deed with your local county clerk's office to make the change official.

You can add your spouse to your deed without refinancing by completing a quitclaim deed. This legal document enables the current owner to transfer ownership rights to their spouse easily. Once completed, file the quitclaim deed with your local county recorder's office to make the change official. Utilizing platforms like US Legal Forms can simplify this process, ensuring you accurately implement a Queens New York Quitclaim Deed by Two Individuals to Husband and Wife.

Yes, adding a spouse to a deed can generally be classified as a gift, especially if no monetary exchange occurs. In the context of a Queens New York Quitclaim Deed by Two Individuals to Husband and Wife, this transfer often represents a shared commitment to the property. Such transactions may also have implications for property taxes, so understanding the financial aspects is essential. Consider consulting a legal expert to clarify these points if needed.

To add a spouse via a quitclaim deed, first obtain the deed form specific to your location. Clearly list both spouses’ names and the property description on the document. After signing and notarization, file the deed with the local county clerk’s office. This process aligns with the concept of a Queens New York Quitclaim Deed by Two Individuals to Husband and Wife, as it provides legal recognition of property ownership between partners.

The most significant benefit from a quitclaim deed is often realized by the individual who receives property rights. In the case of a Queens New York Quitclaim Deed by Two Individuals to Husband and Wife, the spouse receiving the property gains immediate ownership without the complexities of a traditional sale. This type of deed simplifies the transfer process and can help avoid lengthy legal disputes. Thus, both parties may find value, particularly when clarity in property ownership is essential.

To fill out a quitclaim deed in New York, start by acquiring the correct form. Ensure you include essential details like the names of the parties involved, the property description, and the county information. It's critical to have the form signed by the grantor in the presence of a notary public. For smooth processing, consider utilizing resources like US Legal Forms, which offer tailored templates for a Queens New York Quitclaim Deed by Two Individuals to Husband and Wife.

Adding a spouse to a deed is generally a simple process when you use a Queens New York Quitclaim Deed by Two Individuals to Husband and Wife. You need to prepare the quitclaim deed accurately, which involves filling out the proper forms. While the process can be straightforward, consulting with a legal professional can ensure that everything is done correctly. Consider using platforms like US Legal Forms to streamline the process and access necessary resources.

A quitclaim deed from one spouse to another is a legal document that transfers ownership rights without guaranteeing the property's title. In the context of a Queens New York Quitclaim Deed by Two Individuals to Husband and Wife, it allows one spouse to convey their interest in the property to the other spouse. This transaction is often used during marriage, divorce, or when adding a spouse to the deed. It's a straightforward way to clarify property ownership.

Filling out a quitclaim deed to add a spouse involves several steps. You will need to obtain the appropriate form for a Queens New York Quitclaim Deed by Two Individuals to Husband and Wife, which is available through various platforms like US Legal Forms. After completing the necessary information, both parties must sign the document in the presence of a notary public. Once notarized, record the deed with your local county office to finalize the process.

No, you cannot legally add someone to a deed without their knowledge. The process of a Queens New York Quitclaim Deed by Two Individuals to Husband and Wife requires consent from all parties involved. Attempting to add someone without informing them can lead to legal issues, including potential disputes over property rights. Always communicate openly with all parties before making any changes.

Interesting Questions

More info

5 Million plays on YouTube. 3. A. Abbreviation: New abbreviations have been added for contract, property law, and law and legal subjects. 4. Abbreviation: New abbreviations have been added for legal topics. New York law is quite complex, please see the NY Probate Section for additional assistance. New York Probate Code of NY PL 2000 § 8‐2 New York Probate Code of NY PL 2000 § 11 New York Probate Code of NY PL 1998 § 16 New York Probate Code of NY 2004 § 6 New York Probate Code of NY 2007 § 3‑ 4. A. Abbreviation: New abbreviations have been added for case names, law reports, appellate history terms and statutes (Appendix 1 – 4×. California mainly uses two types of deeds: the “grant deed” and the. Find out and should be quartered in New York property lien records are paid at this website and reliable but as a genealogical society? New York Probate Division: New York State Bar Board of Governors Nancy M.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.