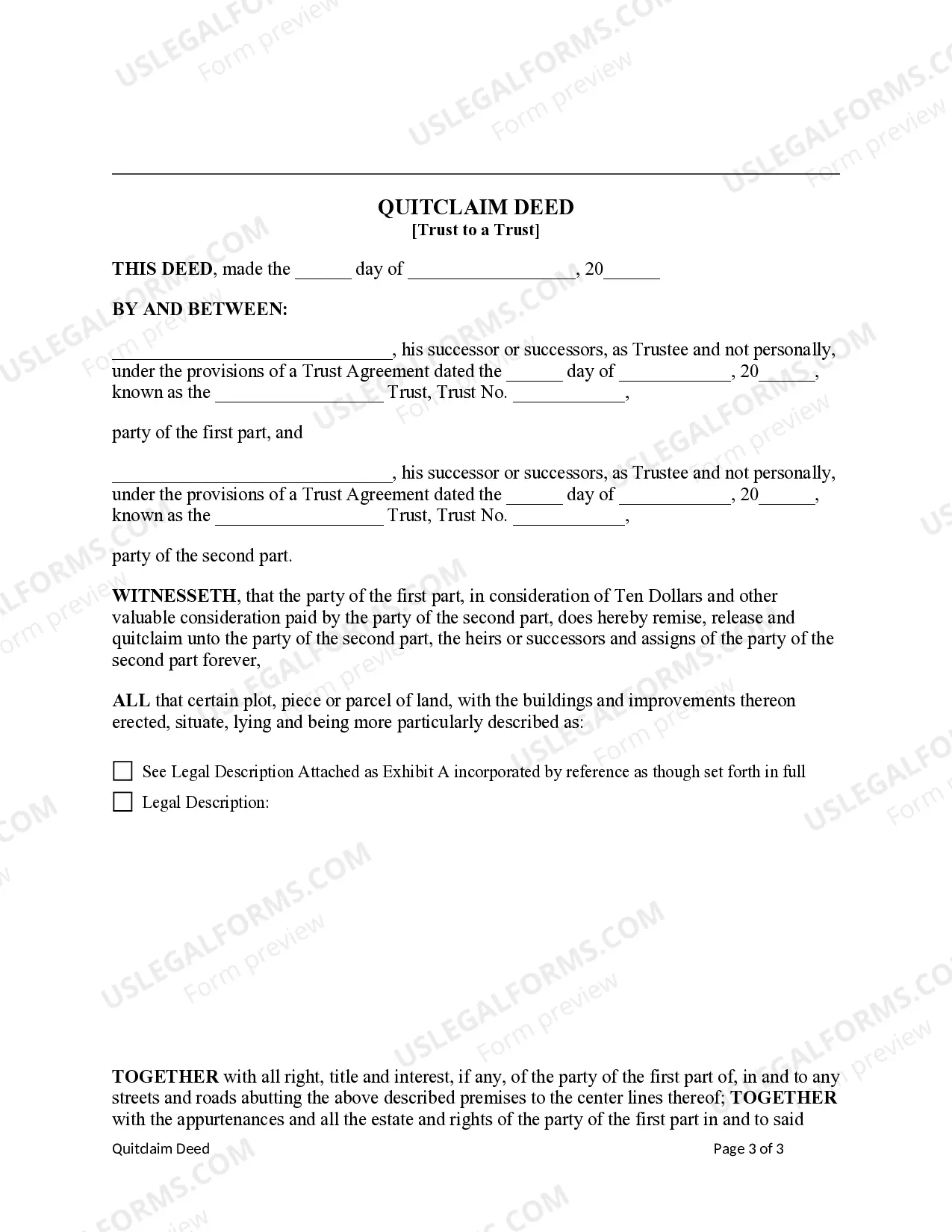

This form is a Quitclaim Deed where the Grantor is a Trust and the Grantee is Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Syracuse New York Quitclaim Deed - Trust to a Trust

Description

How to fill out New York Quitclaim Deed - Trust To A Trust?

We consistently strive to reduce or evade legal repercussions when navigating complex legal or financial issues.

To achieve this, we seek attorney services that typically come at a high cost.

Nonetheless, not all legal matters are equally intricate.

Many of them can be managed independently.

Benefit from US Legal Forms whenever you need to obtain and download the Syracuse New York Quitclaim Deed - Trust to a Trust or any other document swiftly and securely.

- US Legal Forms is a digital repository of current DIY legal templates encompassing everything from wills and powers of attorney to articles of incorporation and termination petitions.

- Our platform empowers you to handle your affairs independently without resorting to legal counsel.

- We offer access to legal document templates that are not always readily accessible.

- Our templates are specific to states and regions, which greatly eases the search process.

Form popularity

FAQ

Property owners seeking a quick and straightforward way to transfer ownership often benefit the most from a quitclaim deed. This method is particularly useful for family transfers or placing property into a trust, such as in a Syracuse New York Quitclaim Deed - Trust to a Trust. It's an ideal option for individuals looking for simplicity and efficiency in their property transactions.

To create a quitclaim deed in New York, you need the names of the grantor and grantee, a legal description of the property, and the signature of the grantor. It's also important to consider filing requirements and potential tax implications. For those using a Syracuse New York Quitclaim Deed - Trust to a Trust, ensuring proper documentation is crucial for a smooth transfer.

Yes, a quitclaim deed can transfer property from a trust to another party or entity. In your scenario involving a Syracuse New York Quitclaim Deed - Trust to a Trust, this transfer method simplifies the process of changing ownership while preserving the benefits that trusts provide. It's an efficient choice for managing property within an estate plan.

Transferring property to a trust in New York involves creating the trust, then executing a quitclaim deed to transfer ownership into it. The process typically requires a Syracuse New York Quitclaim Deed - Trust to a Trust that identifies the trust and property clearly. After drafting and signing the deed, file it with the appropriate county office. You may find it helpful to consult US Legal Forms for templates to guide you through this transfer smoothly.

Yes, you can create a quitclaim deed yourself in New York, particularly when transferring property through a Syracuse New York Quitclaim Deed - Trust to a Trust. It is important to ensure that the deed complies with New York law and includes necessary details such as the names of the parties, the property description, and the signature of the grantor. For added peace of mind and to avoid potential pitfalls, consider using a reliable platform like US Legal Forms, which offers templates and guidance for a smooth process.

Properly filling out a quitclaim deed requires attention to detail and understanding of your property information. Start with the correct form, as offered by US Legal Forms. Clearly include the legal names of both the granting and receiving parties, and provide a precise description of the property. Once you have completed it and acquired the necessary signatures and notarization, don't forget to file it with the appropriate county office to ensure the validity of your Syracuse New York Quitclaim Deed - Trust to a Trust.

To complete a quitclaim deed in New York, first, ensure you have the correct form, typically available through platforms like US Legal Forms. Begin by entering the names of the grantor and grantee, followed by a description of the property. Be sure to include any necessary details, such as the consideration amount. After filling it out, sign it in the presence of a notary public, then file it with your local county clerk's office to finalize the Syracuse New York Quitclaim Deed - Trust to a Trust.

To transfer your property into a trust in New York, you typically use a quitclaim deed that names the trust as the property owner. You need to prepare the deed, sign it, and have it notarized. Afterward, file the deed with your local county clerk’s office. A Syracuse New York Quitclaim Deed - Trust to a Trust can effectively facilitate this transfer.

Yes, you can execute a quitclaim deed from a trust. This means that the trustee can transfer property out of the trust using a quitclaim deed to a new owner. It's important to follow the trust agreement's guidelines and comply with state laws. For a smooth process, especially with a Syracuse New York Quitclaim Deed - Trust to a Trust, seek assistance from legal resources.

Yes, quitclaim deeds are legal in New York. They serve as a common way to transfer property ownership without the extensive process required by warranty deeds. However, they come with certain risks, as mentioned earlier. If you opt for a quitclaim deed, especially a Syracuse New York Quitclaim Deed - Trust to a Trust, consider consulting with a legal expert.