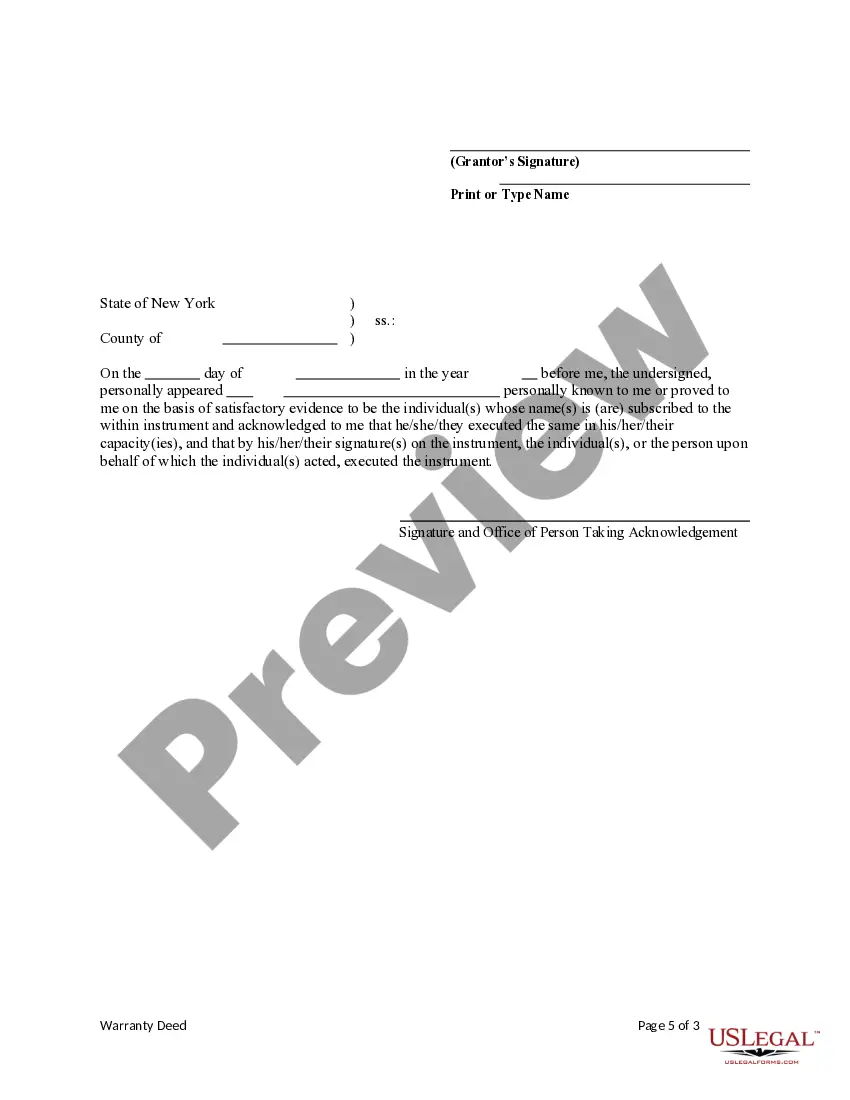

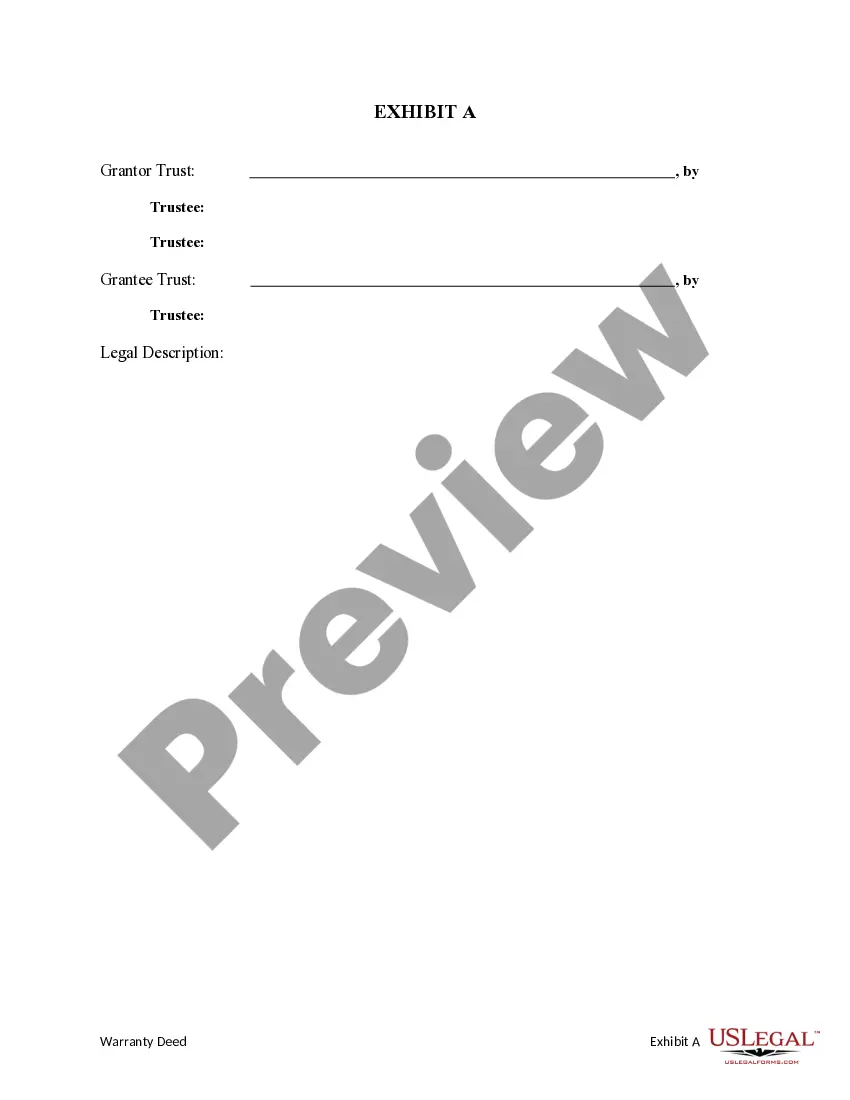

This form is a Warranty Deed where the Grantors are the Trustees of a Joint Trust and the Grantee is the trustee of an individual Trust. Grantors convey and warrant the described property to Trustee of the Grantee. This deed complies with all state statutory laws.

Nassau New York Warranty Deed from a Joint Trust (H&W) two an Individual Trust

Description

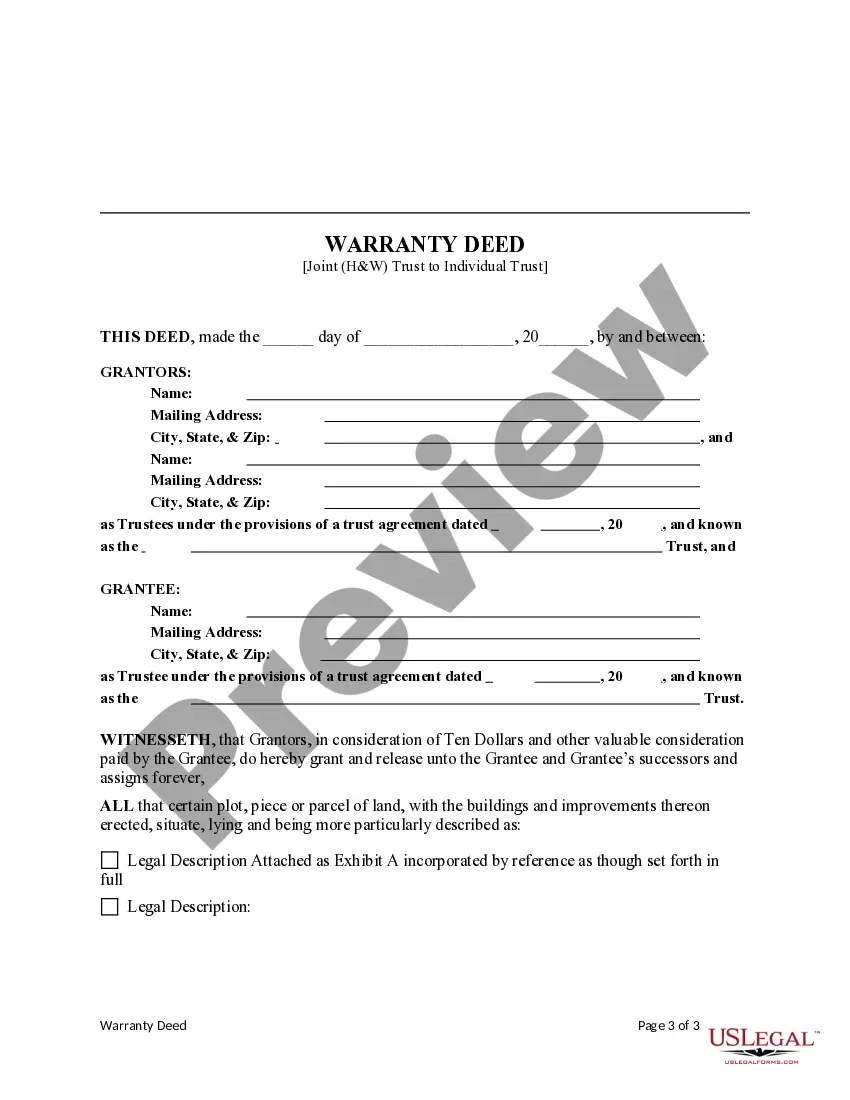

How to fill out New York Warranty Deed From A Joint Trust (H&W) Two An Individual Trust?

Acquiring validated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms repository.

It’s a digital compilation of over 85,000 legal documents catering to both personal and professional requirements along with any real-world scenarios.

All the paperwork is appropriately categorized by usage area and jurisdictional regions, making it effortless to find the Nassau New York Warranty Deed from a Joint Trust (H&W) to an Individual Trust.

Ensure you’ve chosen the right one that satisfies your requirements and fully aligns with your local jurisdiction stipulations.

- For those already acquainted with our catalog and have utilized it previously, obtaining the Nassau New York Warranty Deed from a Joint Trust (H&W) to an Individual Trust requires only a few clicks.

- Simply Log In to your account, select your document, and click Download to save it on your device.

- The procedure will involve just a few extra steps for new users.

- Follow the instructions below to begin with the most extensive online form collection.

- Review the Preview mode and form description.

Form popularity

FAQ

Joint trusts can lead to a few issues, such as misalignment of beneficiaries' interests and complexities when one party wishes to make changes. For instance, transferring property through a Nassau New York Warranty Deed from a Joint Trust (H&W) to an Individual Trust may become complicated if both parties do not agree. Additionally, joint trusts can create challenges in estate planning and asset management. Address potential problems early by consulting reliable resources, like uslegalforms, to guide you.

Yes, two people can establish and share ownership of a trust, often referred to as a joint trust. This arrangement allows both individuals to manage and benefit from the trust's assets. If you are considering a Nassau New York Warranty Deed from a Joint Trust (H&W) to an Individual Trust, it's crucial to evaluate how this change affects ownership and control. Collaborating with experts can help you navigate this process effectively.

In a trust, the property legally belongs to the trust itself, which is managed by a trustee. The beneficiaries of the trust are the individuals who benefit from the property. When dealing with a Nassau New York Warranty Deed from a Joint Trust (H&W) to an Individual Trust, it's important to understand how ownership transfers. This ensures clarity in ownership rights and responsibilities.

Yes, you can file a Nassau New York Warranty Deed from a Joint Trust (H&W) to an Individual Trust yourself. However, it is essential to understand the legal requirements and ensure that all forms are completed correctly. Mistakes in filing can lead to complications down the road. Consider using the uslegalforms platform for guidance and access to necessary forms.

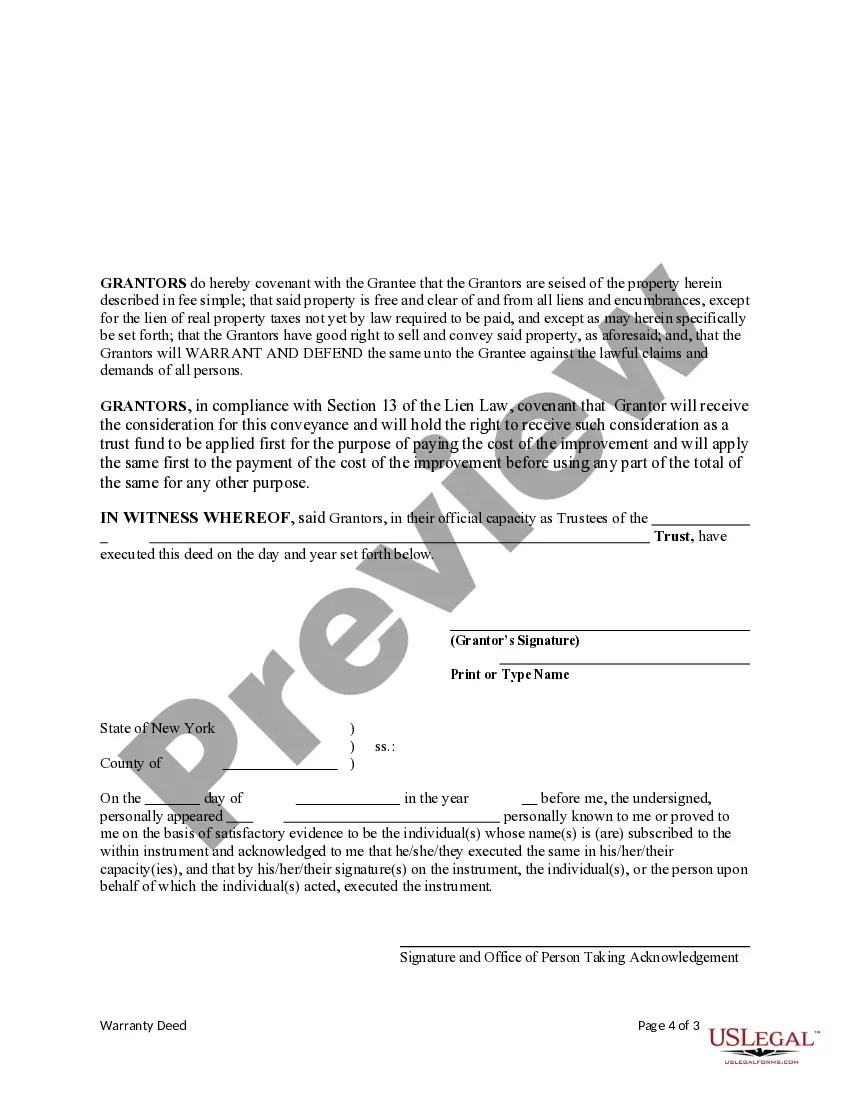

Someone would opt for a warranty deed to protect their investment in real estate. This deed assures the buyer that the property is unencumbered and that they can be confident in their ownership. The process of executing a Nassau New York Warranty Deed from a Joint Trust (H&W) to an Individual Trust can simplify estate planning and provide clear direction for property transfers. Overall, it ensures a smoother transaction for both buyers and sellers.

Homebuyers and property investors benefit the most from a warranty deed. This type of deed provides peace of mind as it offers a legal guarantee that the property's title is clear. Sellers also benefit, as using a warranty deed can make a property more appealing to buyers. In Nassau, a New York Warranty Deed from a Joint Trust (H&W) to an Individual Trust provides an added layer of assurance for all parties involved.

Adding someone to a deed can create complications, such as shared liability for property debts and obligations. Furthermore, if any disputes arise, ownership might become a point of contention. Hence, when dealing with a Nassau New York Warranty Deed from a Joint Trust (H&W) to an Individual Trust, it's essential to weigh these factors carefully and consider seeking professional advice.

When two people are on a deed, it is commonly referred to as joint tenancy or tenancy in common. This arrangement allows both parties to have legal interests in the property. For those involved in a Nassau New York Warranty Deed from a Joint Trust (H&W) to an Individual Trust, understanding these terms can help clarify ownership rights and responsibilities.

Yes, you can add someone to a warranty deed with the proper documentation. To do so, ensure all current owners agree to the addition, which will also require the completion of a new deed reflecting the changes. If you're navigating a Nassau New York Warranty Deed from a Joint Trust (H&W) to an Individual Trust, obtaining legal advice can help ensure the process is smooth and compliant.

Yes, you can have two names on a deed. Including multiple names allows both parties to share ownership of the property, enhancing collaboration in property management. In the context of a Nassau New York Warranty Deed from a Joint Trust (H&W) to an Individual Trust, this arrangement can streamline the transfer process when one party wishes to transition to individual ownership.