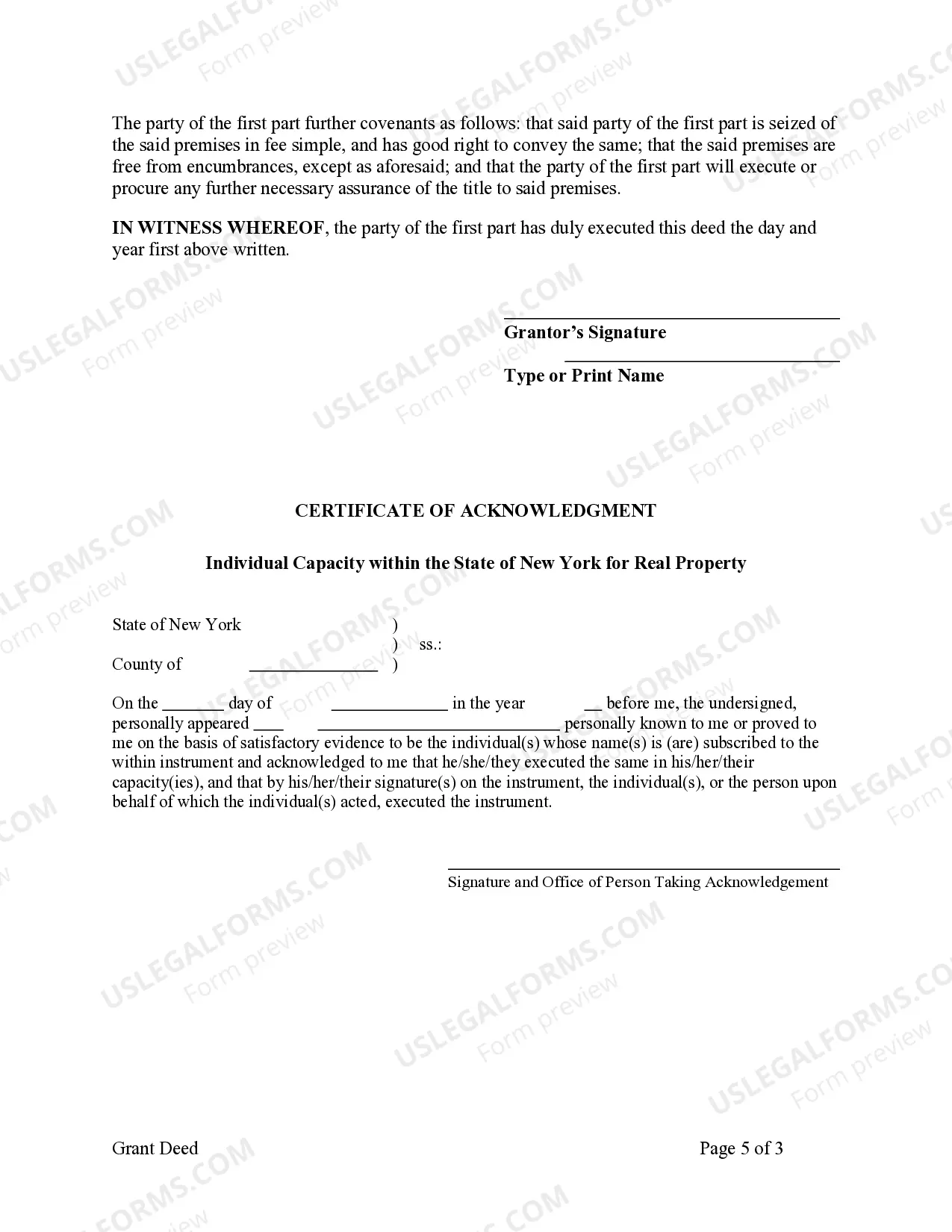

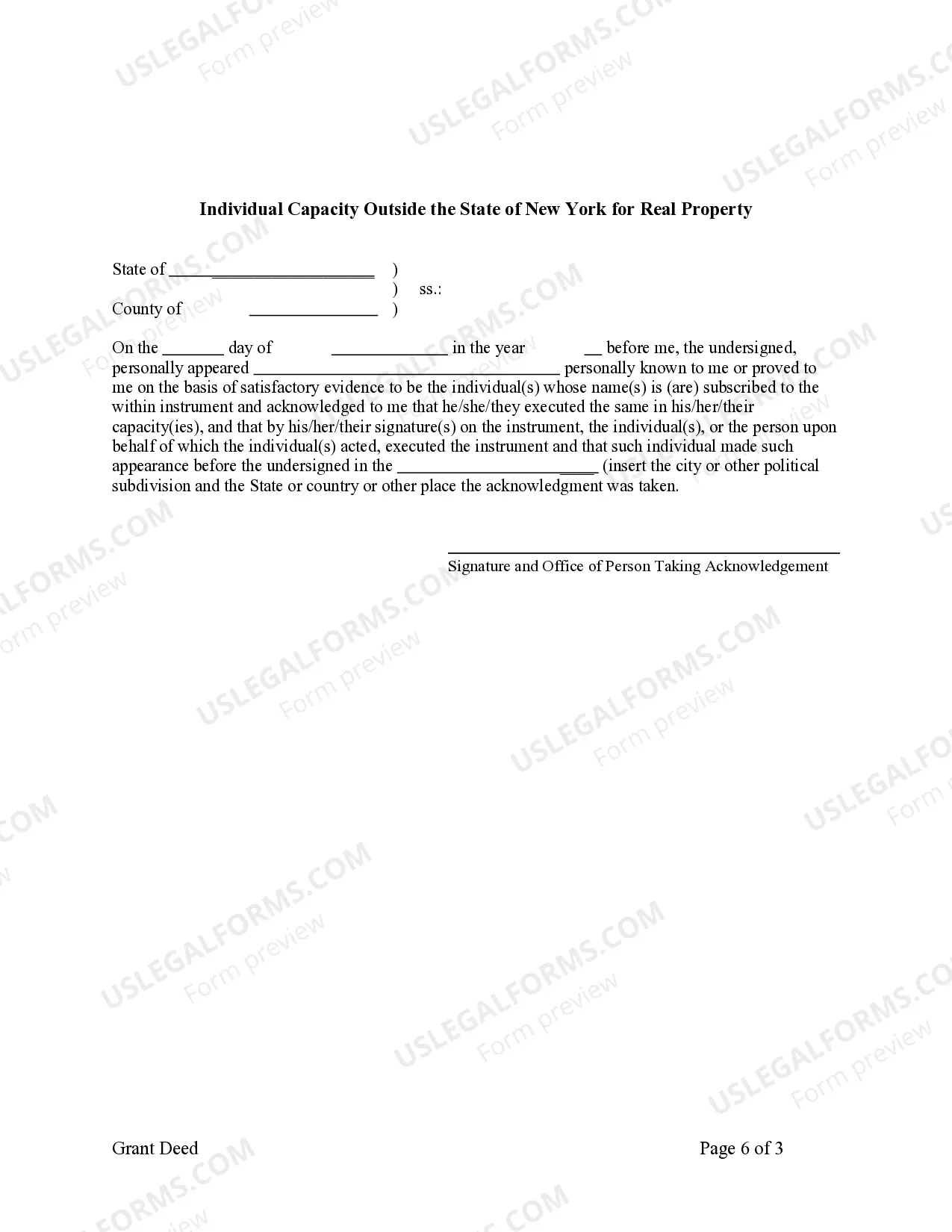

This form is a Grant Deed where the Grantor is an individual and the Grantees are two individuals or husband and wife. This deed complies with all state statutory laws.

A Queens New York Grant Deed from an Individual to Two Individuals or Husband and Wife is a legal document that transfers ownership of real estate from one individual (the granter) to two individuals (the grantees), who may be married or classified as husband and wife. This type of deed establishes joint ownership of the property being transferred. The grant deed serves as evidence of the granter's intention to convey their property rights to the grantees. It includes crucial details, such as the full legal names of the granter and grantees, a detailed description of the property being transferred (including its address), and the consideration (payment) exchanged for the transfer. The granter's signature must be notarized to ensure the deed's authenticity. There are different variations of Queens New York Grant Deeds that cater to specific circumstances. These include: 1. Queens New York Grant Deed from Individual to Husband and Wife: This deed is used when an unmarried individual wishes to transfer property ownership to a legally married couple. 2. Queens New York Grant Deed from an Individual to Two Individuals: This variation is utilized when a granter intends to transfer property to two individuals who may not necessarily be married. 3. Queens New York Grant Deed from Individual A and Individual B, Husband and Wife, to Individual C and Individual D, Husband and Wife: In this instance, both husband and wife from one married couple (Individual A and Individual B) transfer their property rights jointly to another married couple (Individual C and Individual D). It is vital to consult a real estate attorney or professional when drafting and executing a Queens New York Grant Deed to ensure compliance with applicable laws and regulations. This document enables the smooth transfer of property ownership between individuals or married couples and protects the legal rights and interests of all parties involved.A Queens New York Grant Deed from an Individual to Two Individuals or Husband and Wife is a legal document that transfers ownership of real estate from one individual (the granter) to two individuals (the grantees), who may be married or classified as husband and wife. This type of deed establishes joint ownership of the property being transferred. The grant deed serves as evidence of the granter's intention to convey their property rights to the grantees. It includes crucial details, such as the full legal names of the granter and grantees, a detailed description of the property being transferred (including its address), and the consideration (payment) exchanged for the transfer. The granter's signature must be notarized to ensure the deed's authenticity. There are different variations of Queens New York Grant Deeds that cater to specific circumstances. These include: 1. Queens New York Grant Deed from Individual to Husband and Wife: This deed is used when an unmarried individual wishes to transfer property ownership to a legally married couple. 2. Queens New York Grant Deed from an Individual to Two Individuals: This variation is utilized when a granter intends to transfer property to two individuals who may not necessarily be married. 3. Queens New York Grant Deed from Individual A and Individual B, Husband and Wife, to Individual C and Individual D, Husband and Wife: In this instance, both husband and wife from one married couple (Individual A and Individual B) transfer their property rights jointly to another married couple (Individual C and Individual D). It is vital to consult a real estate attorney or professional when drafting and executing a Queens New York Grant Deed to ensure compliance with applicable laws and regulations. This document enables the smooth transfer of property ownership between individuals or married couples and protects the legal rights and interests of all parties involved.