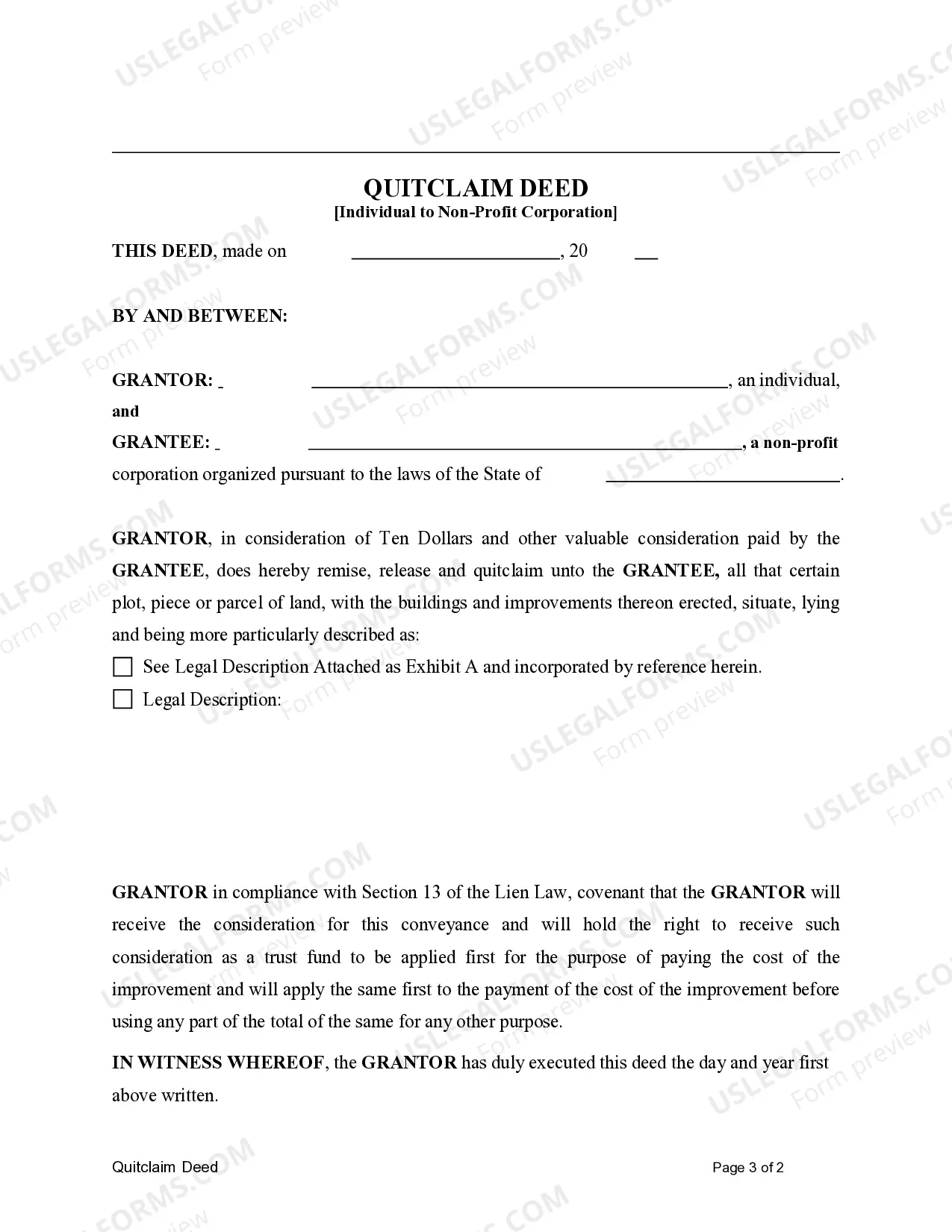

This form is a Quitclaim Deed where the Grantor is an individual, and the Grantee is a non-profit corporation. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

A Nassau New York Quitclaim Deed from an Individual to a Non-Profit Corporation is a legally binding document used to transfer ownership of real property from an individual to a non-profit organization. Unlike a warranty deed, which guarantees the title is free and clear of any liens or claims, a quitclaim deed offers no such warranties. Instead, it transfers only whatever interest the granter (individual) may have in the property to the grantee (non-profit corporation), excluding any guarantees. This type of quitclaim deed is commonly used when an individual intends to donate property to a non-profit organization, such as a charity or educational institution. By executing this deed, the individual relinquishes all rights, title, and interest in the property, allowing the non-profit corporation to assume ownership. There may be different types or variations of a Nassau New York Quitclaim Deed from an Individual to a Non-Profit Corporation, depending on specific circumstances or requirements. Some possible variations include: 1. General Quitclaim Deed: This is the standard form of a quitclaim deed used in the transfer of ownership from an individual to a non-profit corporation. It transfers both the present and future interest in the property. 2. Tax Exempt Quitclaim Deed: This specific type of quitclaim deed is executed when the transfer is eligible for certain tax exemptions, such as those provided to non-profit organizations. It ensures that the transfer is completed in compliance with tax laws. 3. Restricted Use Quitclaim Deed: In some cases, the individual may choose to restrict the use of the property being transferred to a non-profit corporation. This type of quitclaim deed includes specific clauses or restrictions regarding the property's future use or development. 4. Partial Quitclaim Deed: Occasionally, an individual may only transfer a portion of the property's ownership to a non-profit corporation. This type of deed specifies the exact portion being transferred, along with any relevant details or conditions. It is important to note that the specific terms and requirements for a Nassau New York Quitclaim Deed from an Individual to a Non-Profit Corporation may vary depending on the legal jurisdiction and the individual circumstances of the transfer. It is advisable to consult with a qualified real estate attorney to ensure compliance with all applicable laws and regulations.A Nassau New York Quitclaim Deed from an Individual to a Non-Profit Corporation is a legally binding document used to transfer ownership of real property from an individual to a non-profit organization. Unlike a warranty deed, which guarantees the title is free and clear of any liens or claims, a quitclaim deed offers no such warranties. Instead, it transfers only whatever interest the granter (individual) may have in the property to the grantee (non-profit corporation), excluding any guarantees. This type of quitclaim deed is commonly used when an individual intends to donate property to a non-profit organization, such as a charity or educational institution. By executing this deed, the individual relinquishes all rights, title, and interest in the property, allowing the non-profit corporation to assume ownership. There may be different types or variations of a Nassau New York Quitclaim Deed from an Individual to a Non-Profit Corporation, depending on specific circumstances or requirements. Some possible variations include: 1. General Quitclaim Deed: This is the standard form of a quitclaim deed used in the transfer of ownership from an individual to a non-profit corporation. It transfers both the present and future interest in the property. 2. Tax Exempt Quitclaim Deed: This specific type of quitclaim deed is executed when the transfer is eligible for certain tax exemptions, such as those provided to non-profit organizations. It ensures that the transfer is completed in compliance with tax laws. 3. Restricted Use Quitclaim Deed: In some cases, the individual may choose to restrict the use of the property being transferred to a non-profit corporation. This type of quitclaim deed includes specific clauses or restrictions regarding the property's future use or development. 4. Partial Quitclaim Deed: Occasionally, an individual may only transfer a portion of the property's ownership to a non-profit corporation. This type of deed specifies the exact portion being transferred, along with any relevant details or conditions. It is important to note that the specific terms and requirements for a Nassau New York Quitclaim Deed from an Individual to a Non-Profit Corporation may vary depending on the legal jurisdiction and the individual circumstances of the transfer. It is advisable to consult with a qualified real estate attorney to ensure compliance with all applicable laws and regulations.