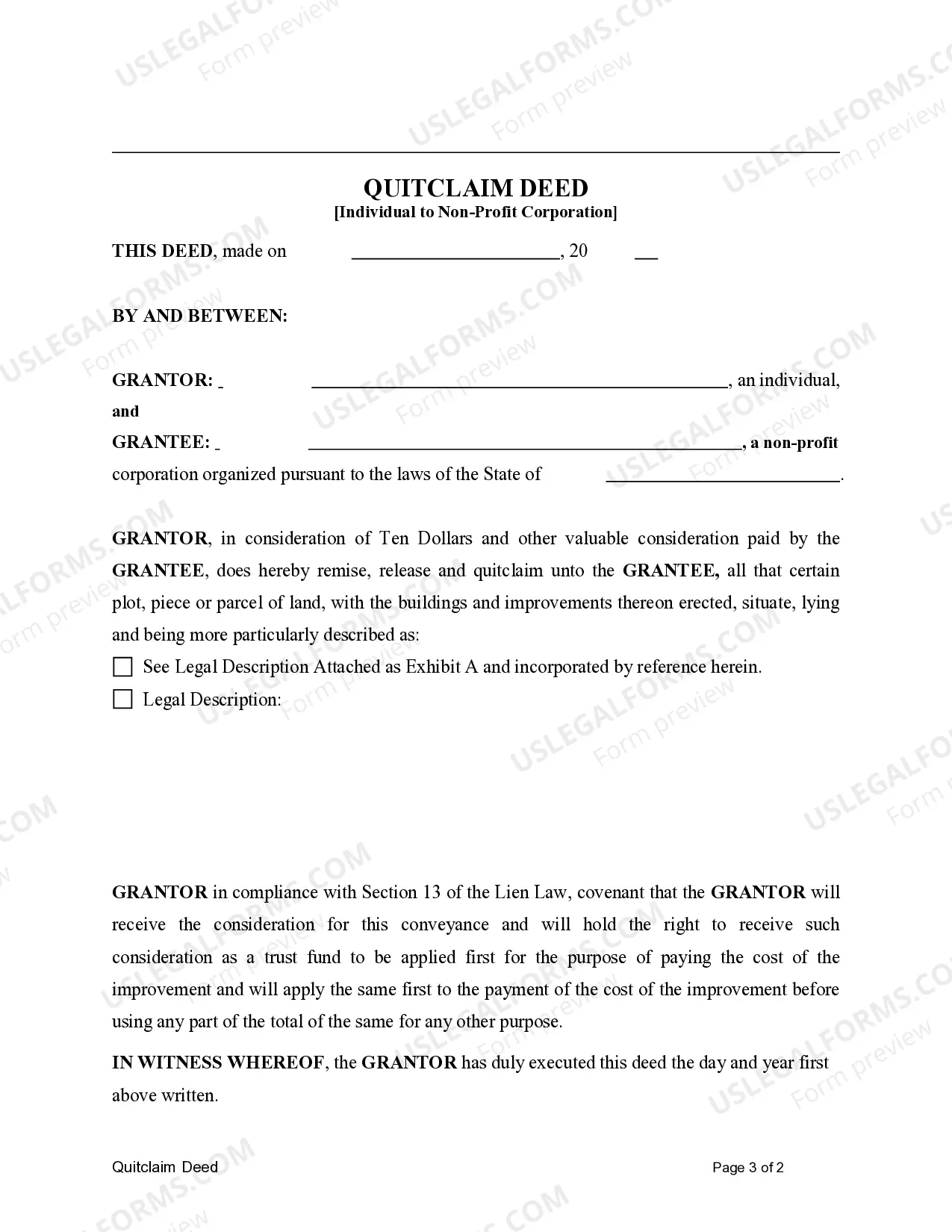

This form is a Quitclaim Deed where the Grantor is an individual, and the Grantee is a non-profit corporation. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

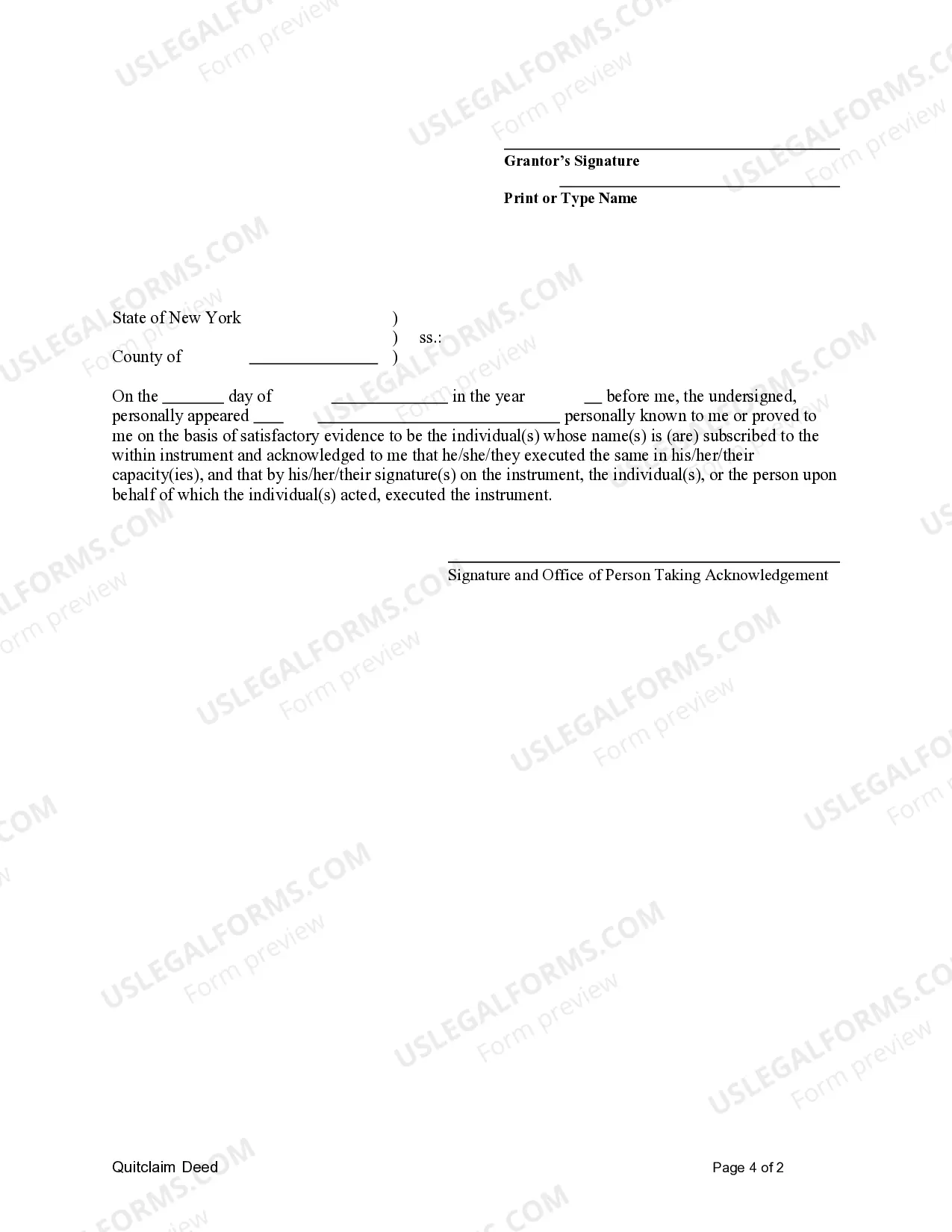

A Yonkers New York Quitclaim Deed from an Individual to a Non-Profit Corporation is a legal document that transfers ownership or interest in a real property located in Yonkers, New York, from an individual to a nonprofit organization. This type of deed is commonly used when the individual wants to donate or transfer their property to a nonprofit corporation. The Yonkers New York Quitclaim Deed ensures a smooth transfer of property rights and protects the interests of both parties involved. It serves as an irrevocable and binding legal instrument, documenting the transfer of ownership from the individual (the granter) to the nonprofit corporation (the grantee) without guaranteeing any warranties, covenants, or title rights. The quitclaim deed includes essential information such as the names and addresses of the granter and grantee, a detailed legal description of the property being transferred, and the amount, if any, paid for the transfer. It is essential to correctly describe the property to avoid any future disputes, and to ensure that the quitclaim deed complies with the requirements of the Yonkers, New York jurisdiction. One type of Yonkers New York Quitclaim Deed is the Full Consideration Quitclaim Deed. In this case, the individual transfers ownership to the nonprofit corporation in exchange for a certain agreed-upon consideration. The consideration may be monetary, assets, or a combination of both. Another type is the Gift Quitclaim Deed, where the individual owner donates the property to the nonprofit corporation without any monetary compensation. It is crucial for both the granter and grantee to consult an attorney or real estate professional who is knowledgeable about Yonkers, New York real estate laws to ensure the proper execution and recording of the quitclaim deed. Additionally, it is advisable to conduct a title search to ensure that the property is free of any liens or encumbrances before completing the transfer. By executing a Yonkers New York Quitclaim Deed from an Individual to a Non-Profit Corporation, the granter relinquishes all their rights, title, and interest in the property, while the nonprofit corporation becomes the lawful owner. This type of transfer can be a significant step for individuals who wish to support charitable causes or pass on their property for nonprofit use.A Yonkers New York Quitclaim Deed from an Individual to a Non-Profit Corporation is a legal document that transfers ownership or interest in a real property located in Yonkers, New York, from an individual to a nonprofit organization. This type of deed is commonly used when the individual wants to donate or transfer their property to a nonprofit corporation. The Yonkers New York Quitclaim Deed ensures a smooth transfer of property rights and protects the interests of both parties involved. It serves as an irrevocable and binding legal instrument, documenting the transfer of ownership from the individual (the granter) to the nonprofit corporation (the grantee) without guaranteeing any warranties, covenants, or title rights. The quitclaim deed includes essential information such as the names and addresses of the granter and grantee, a detailed legal description of the property being transferred, and the amount, if any, paid for the transfer. It is essential to correctly describe the property to avoid any future disputes, and to ensure that the quitclaim deed complies with the requirements of the Yonkers, New York jurisdiction. One type of Yonkers New York Quitclaim Deed is the Full Consideration Quitclaim Deed. In this case, the individual transfers ownership to the nonprofit corporation in exchange for a certain agreed-upon consideration. The consideration may be monetary, assets, or a combination of both. Another type is the Gift Quitclaim Deed, where the individual owner donates the property to the nonprofit corporation without any monetary compensation. It is crucial for both the granter and grantee to consult an attorney or real estate professional who is knowledgeable about Yonkers, New York real estate laws to ensure the proper execution and recording of the quitclaim deed. Additionally, it is advisable to conduct a title search to ensure that the property is free of any liens or encumbrances before completing the transfer. By executing a Yonkers New York Quitclaim Deed from an Individual to a Non-Profit Corporation, the granter relinquishes all their rights, title, and interest in the property, while the nonprofit corporation becomes the lawful owner. This type of transfer can be a significant step for individuals who wish to support charitable causes or pass on their property for nonprofit use.