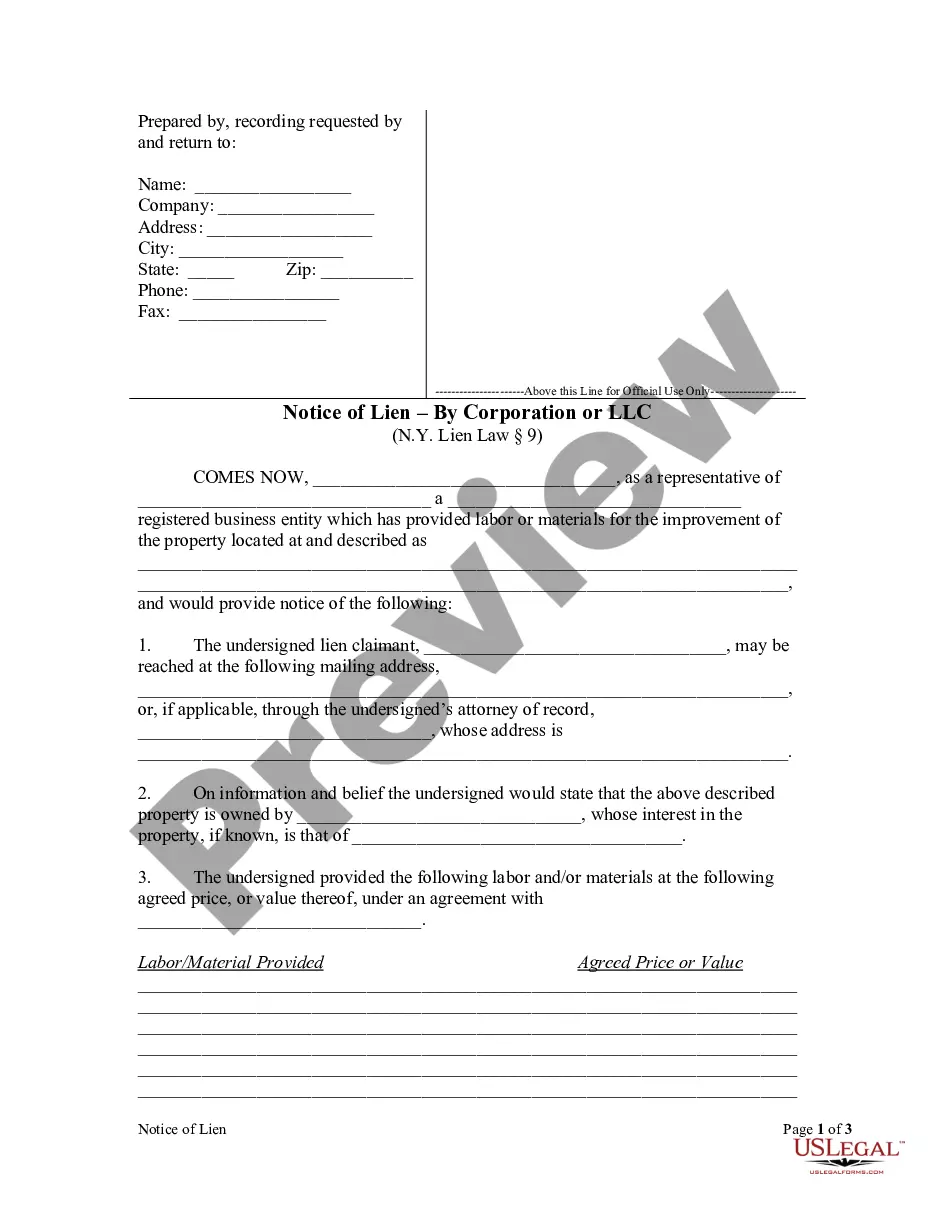

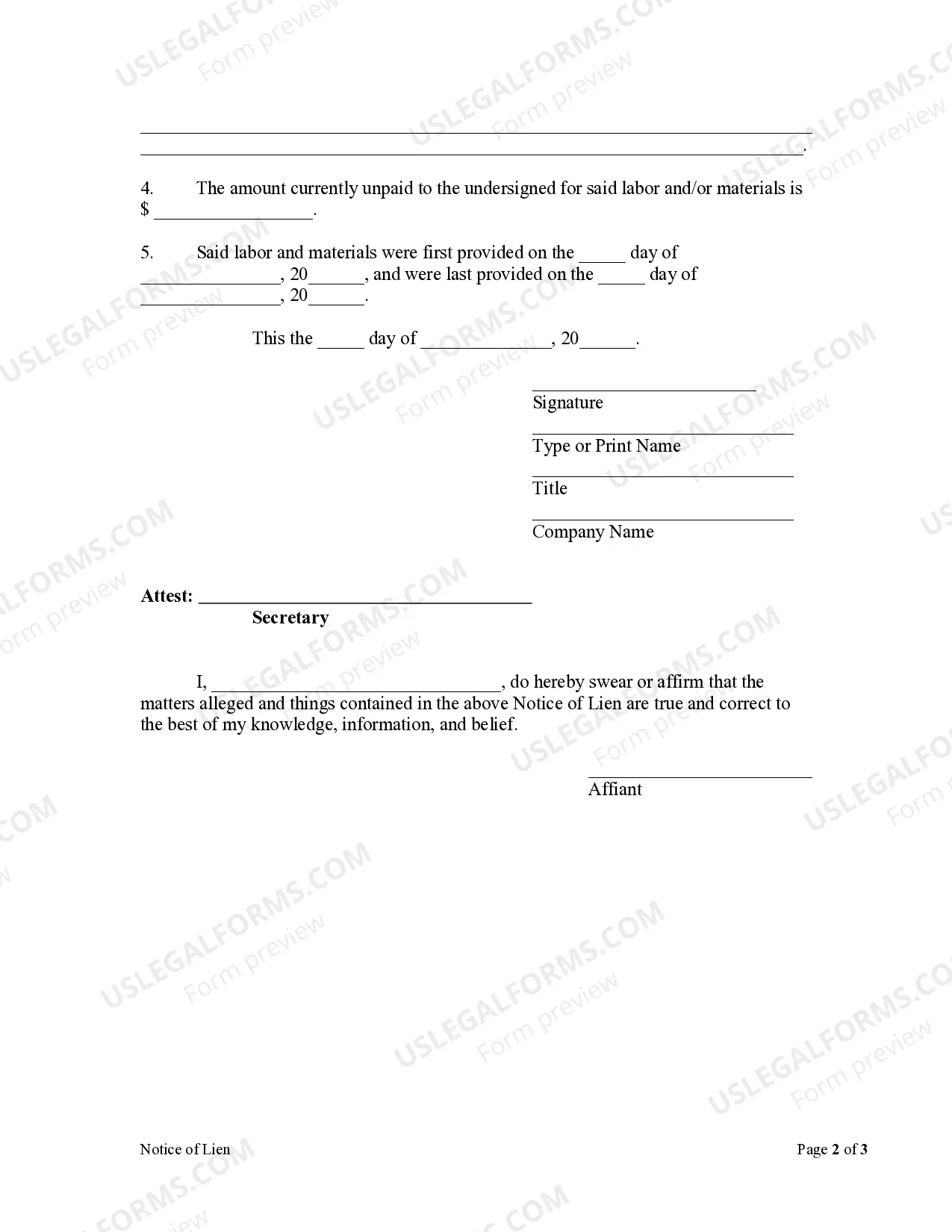

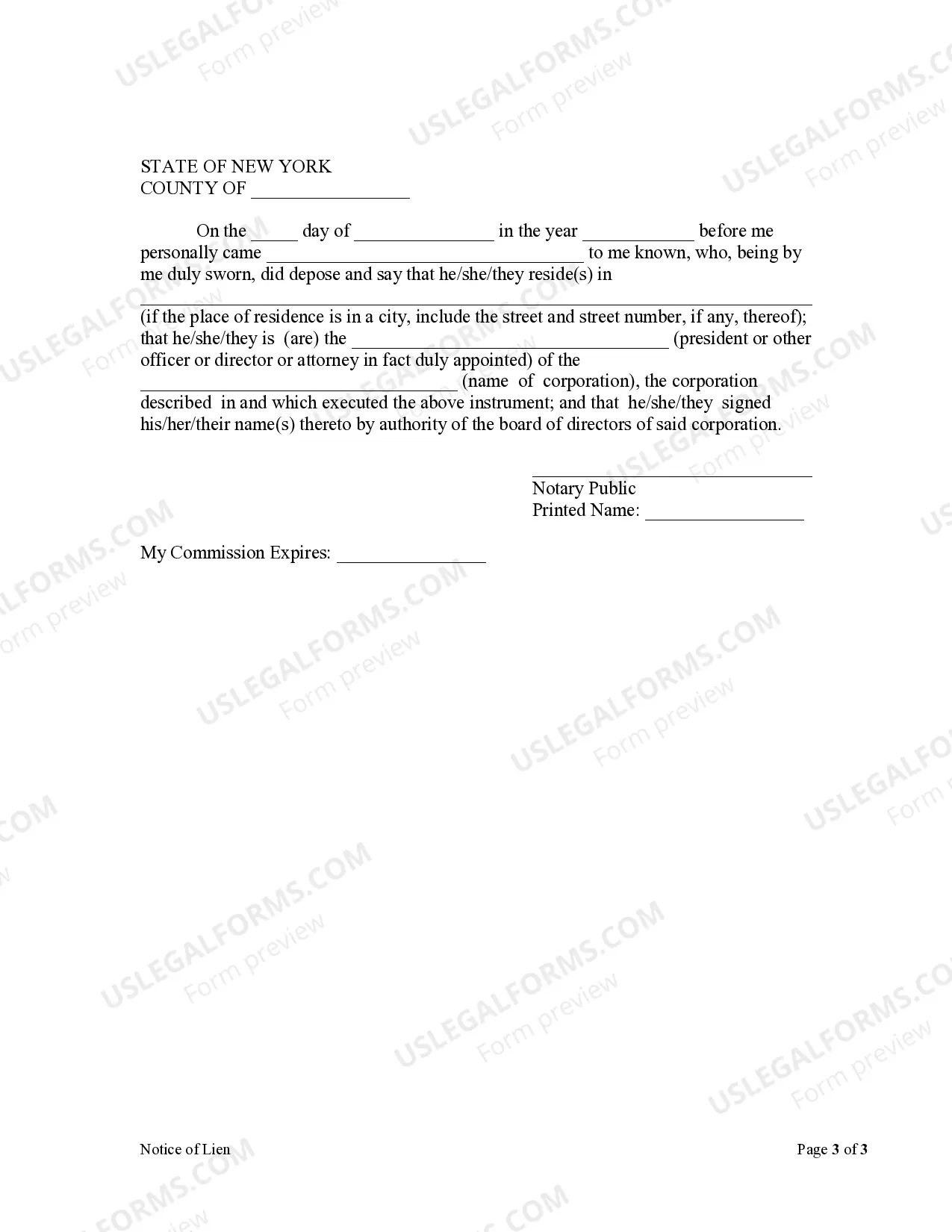

New York law requires a party desiring to claim a lien to file a Notice of Lien form in the office of the clerk of the county where the property is situated. The notice may be filed at any time during the progress of the work and the furnishing of the materials, or, within eight months after the completion of the contract, or the final performance of the work, or the final furnishing of the materials.

The Bronx, located in New York City, has its own specific processes and regulations when it comes to placing a Notice of Lien by Corporation or LLC. A Notice of Lien is a legal document that establishes a claim against someone's property for unpaid debts or obligations. When filed by a Corporation or LLC in the Bronx, it serves to protect their rights and interests in the event of non-payment or a dispute. Here, we will provide a detailed description of the Bronx New York Notice of Lien by Corporation or LLC, including any distinct types that may exist. The Bronx New York Notice of Lien by Corporation or LLC is a formal document that is filed with the appropriate authority, usually the Bronx County Clerk's Office or the Bronx County Supreme Court, to notify the public of the debt owed to the filing Corporation or LLC. This lien can be placed against various types of properties, including real estate, personal property, business assets, or any other assets that the debtor owns in the Bronx. Types of Bronx New York Notice of Lien by Corporation or LLC: 1. Mechanic's Lien: This type of lien is placed by a Corporation or LLC that has provided labor, materials, or services for construction, repair, or improvement of a property. It ensures that the filer has a legal claim to be paid for their work. 2. Tax Lien: A tax lien is filed by a Corporation or LLC when a property owner fails to pay their taxes. This lien gives the Corporation or LLC the right to collect the unpaid taxes from the property's sale or foreclosure. 3. Judgment Lien: Corporations or LCS may file a judgment lien after winning a lawsuit or obtaining a court judgment against an individual or business. This lien allows them to claim the value of the judgment from the defaulted party's assets. 4. Condominium Lien: In the case of a Corporation or LLC owning a condominium unit, they can place a lien against that unit for unpaid common expenses or fees. The process of filing a Notice of Lien involves completing the necessary paperwork, providing detailed information about the debtor, and paying the required filing fee. It is crucial to ensure that the filing is accurate, complete, and compliant with the specific requirements of the Bronx County Clerk's Office or the Bronx County Supreme Court. Once the Notice of Lien is properly filed and recorded, it becomes a public record, visible to potential buyers, lenders, or anyone seeking information about the property's indebtedness. This public notice acts as a warning to potential buyers or investors, preventing the debtor from disposing of the property or assets until the lien is resolved. To remove a Notice of Lien, the debtor must satisfy the debt or reach a settlement with the Corporation or LLC that filed the lien. Once the debt is cleared or paid, the Corporation or LLC should file a Notice of Lien Release or a Satisfaction of Lien document with the appropriate authority to remove the lien from public records. In summary, the Bronx New York Notice of Lien by Corporation or LLC is a crucial tool for protecting the rights and interests of Corporations or LCS in the Bronx when facing unpaid debts or obligations. Mechanic's liens, tax liens, judgment liens, and condominium liens are some different types of liens that can be filed by Corporations or LCS in the Bronx, each serving unique purposes. Understanding the relevant laws and procedures is vital for both filers and debtors to navigate this legal process effectively.The Bronx, located in New York City, has its own specific processes and regulations when it comes to placing a Notice of Lien by Corporation or LLC. A Notice of Lien is a legal document that establishes a claim against someone's property for unpaid debts or obligations. When filed by a Corporation or LLC in the Bronx, it serves to protect their rights and interests in the event of non-payment or a dispute. Here, we will provide a detailed description of the Bronx New York Notice of Lien by Corporation or LLC, including any distinct types that may exist. The Bronx New York Notice of Lien by Corporation or LLC is a formal document that is filed with the appropriate authority, usually the Bronx County Clerk's Office or the Bronx County Supreme Court, to notify the public of the debt owed to the filing Corporation or LLC. This lien can be placed against various types of properties, including real estate, personal property, business assets, or any other assets that the debtor owns in the Bronx. Types of Bronx New York Notice of Lien by Corporation or LLC: 1. Mechanic's Lien: This type of lien is placed by a Corporation or LLC that has provided labor, materials, or services for construction, repair, or improvement of a property. It ensures that the filer has a legal claim to be paid for their work. 2. Tax Lien: A tax lien is filed by a Corporation or LLC when a property owner fails to pay their taxes. This lien gives the Corporation or LLC the right to collect the unpaid taxes from the property's sale or foreclosure. 3. Judgment Lien: Corporations or LCS may file a judgment lien after winning a lawsuit or obtaining a court judgment against an individual or business. This lien allows them to claim the value of the judgment from the defaulted party's assets. 4. Condominium Lien: In the case of a Corporation or LLC owning a condominium unit, they can place a lien against that unit for unpaid common expenses or fees. The process of filing a Notice of Lien involves completing the necessary paperwork, providing detailed information about the debtor, and paying the required filing fee. It is crucial to ensure that the filing is accurate, complete, and compliant with the specific requirements of the Bronx County Clerk's Office or the Bronx County Supreme Court. Once the Notice of Lien is properly filed and recorded, it becomes a public record, visible to potential buyers, lenders, or anyone seeking information about the property's indebtedness. This public notice acts as a warning to potential buyers or investors, preventing the debtor from disposing of the property or assets until the lien is resolved. To remove a Notice of Lien, the debtor must satisfy the debt or reach a settlement with the Corporation or LLC that filed the lien. Once the debt is cleared or paid, the Corporation or LLC should file a Notice of Lien Release or a Satisfaction of Lien document with the appropriate authority to remove the lien from public records. In summary, the Bronx New York Notice of Lien by Corporation or LLC is a crucial tool for protecting the rights and interests of Corporations or LCS in the Bronx when facing unpaid debts or obligations. Mechanic's liens, tax liens, judgment liens, and condominium liens are some different types of liens that can be filed by Corporations or LCS in the Bronx, each serving unique purposes. Understanding the relevant laws and procedures is vital for both filers and debtors to navigate this legal process effectively.