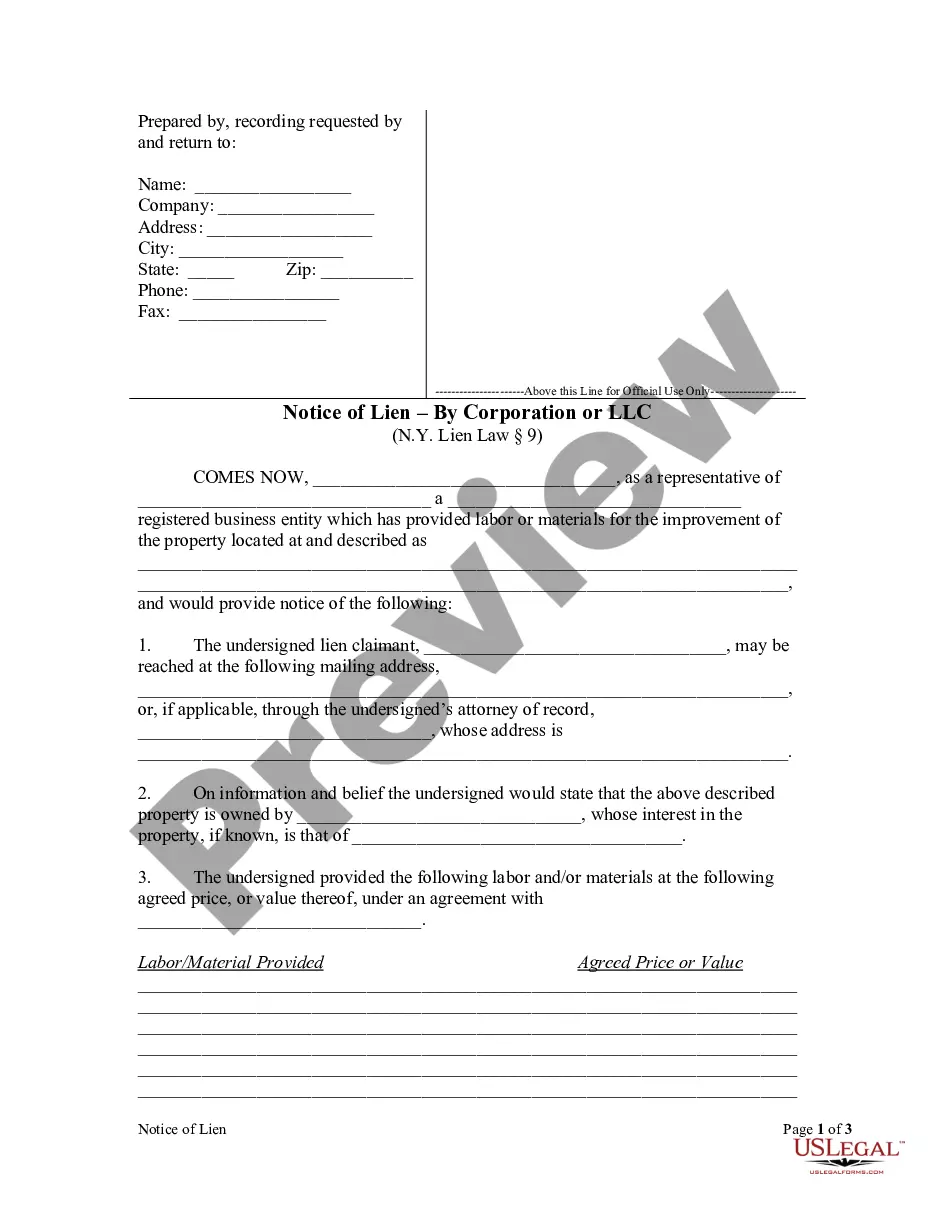

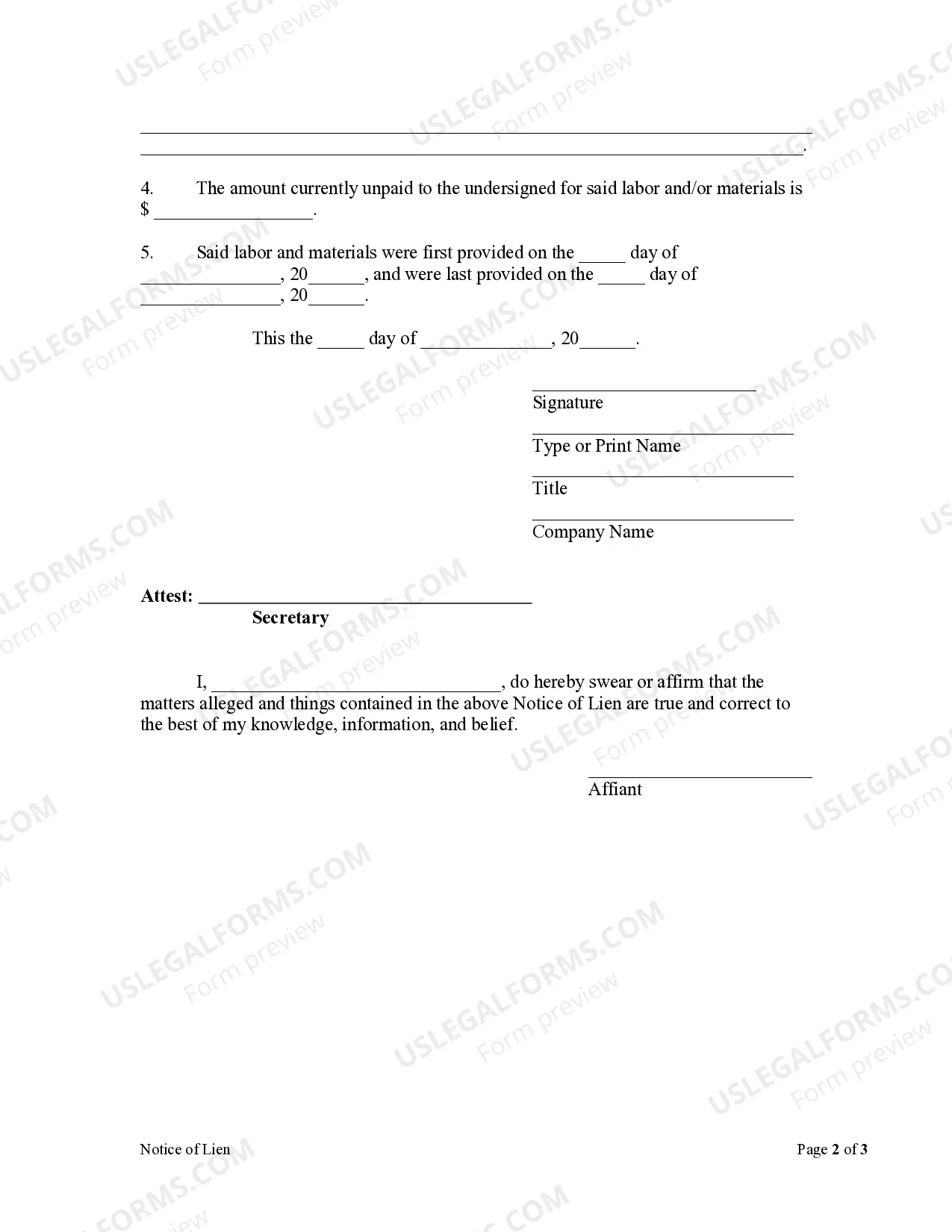

New York law requires a party desiring to claim a lien to file a Notice of Lien form in the office of the clerk of the county where the property is situated. The notice may be filed at any time during the progress of the work and the furnishing of the materials, or, within eight months after the completion of the contract, or the final performance of the work, or the final furnishing of the materials.

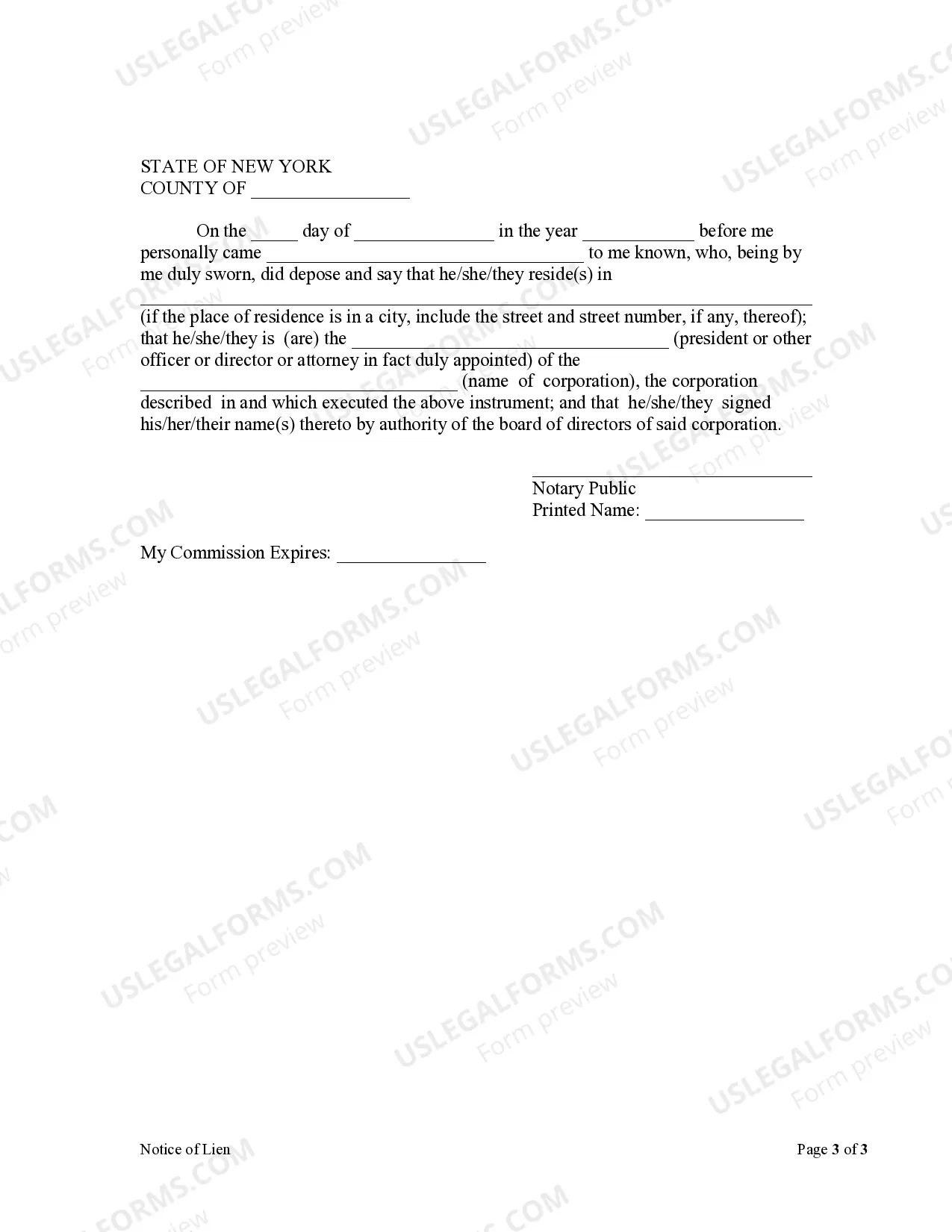

A Queens New York Notice of Lien by Corporation or LLC refers to a legal document filed by a corporation or Limited Liability Company (LLC) in Queens, New York, to assert their right to a lien on a property or other assets belonging to a debtor. This notice serves as a formal notification to the debtor, as well as other interested parties, that the corporation or LLC has a legal claim or interest in the property and that if the debtor fails to satisfy their debt, the corporation or LLC has the right to pursue legal action to enforce their claim. The Queens New York Notice of Lien by Corporation or LLC is typically used when a debtor fails to repay a debt owed to the corporation or LLC, causing financial harm or loss. This can occur in various situations, such as when a contractor hires a corporation or LLC for services or when an individual or business fails to fulfill their financial obligations to the corporation or LLC. Different types of Queens New York Notices of Lien by Corporation or LLC may include: 1. Construction Lien: This type of lien is filed by construction companies or contractors when they have not been paid for their services or materials provided for a construction project in Queens, New York. It allows the construction company or contractor to claim a legal interest in the property until their debt is settled. 2. Mechanic's Lien: Similar to a construction lien, a mechanic's lien is filed by individuals or businesses that have provided services or materials for the repair, improvement, or maintenance of a property in Queens, New York. It allows them to assert their right to payment and potentially foreclose on the property if the debt remains unpaid. 3. Tax Lien: In cases where a corporation or LLC hasn't paid its taxes to the government, particularly the Internal Revenue Service (IRS) or the New York State Department of Taxation and Finance, a tax lien can be filed. This type of lien allows the government to claim an interest in the corporation or LLC's property and assets to satisfy the unpaid tax debt. Regardless of the specific type of Queens New York Notice of Lien by Corporation or LLC, it is a crucial legal document that protects the rights of the corporation or LLC and provides a method for them to enforce their claim. It effectively notifies the debtor and potential buyers or lenders that the property has an outstanding debt obligation. The debtor is expected to resolve the debt to remove the lien, and failure to do so may result in legal action and potential foreclosure of the property.A Queens New York Notice of Lien by Corporation or LLC refers to a legal document filed by a corporation or Limited Liability Company (LLC) in Queens, New York, to assert their right to a lien on a property or other assets belonging to a debtor. This notice serves as a formal notification to the debtor, as well as other interested parties, that the corporation or LLC has a legal claim or interest in the property and that if the debtor fails to satisfy their debt, the corporation or LLC has the right to pursue legal action to enforce their claim. The Queens New York Notice of Lien by Corporation or LLC is typically used when a debtor fails to repay a debt owed to the corporation or LLC, causing financial harm or loss. This can occur in various situations, such as when a contractor hires a corporation or LLC for services or when an individual or business fails to fulfill their financial obligations to the corporation or LLC. Different types of Queens New York Notices of Lien by Corporation or LLC may include: 1. Construction Lien: This type of lien is filed by construction companies or contractors when they have not been paid for their services or materials provided for a construction project in Queens, New York. It allows the construction company or contractor to claim a legal interest in the property until their debt is settled. 2. Mechanic's Lien: Similar to a construction lien, a mechanic's lien is filed by individuals or businesses that have provided services or materials for the repair, improvement, or maintenance of a property in Queens, New York. It allows them to assert their right to payment and potentially foreclose on the property if the debt remains unpaid. 3. Tax Lien: In cases where a corporation or LLC hasn't paid its taxes to the government, particularly the Internal Revenue Service (IRS) or the New York State Department of Taxation and Finance, a tax lien can be filed. This type of lien allows the government to claim an interest in the corporation or LLC's property and assets to satisfy the unpaid tax debt. Regardless of the specific type of Queens New York Notice of Lien by Corporation or LLC, it is a crucial legal document that protects the rights of the corporation or LLC and provides a method for them to enforce their claim. It effectively notifies the debtor and potential buyers or lenders that the property has an outstanding debt obligation. The debtor is expected to resolve the debt to remove the lien, and failure to do so may result in legal action and potential foreclosure of the property.