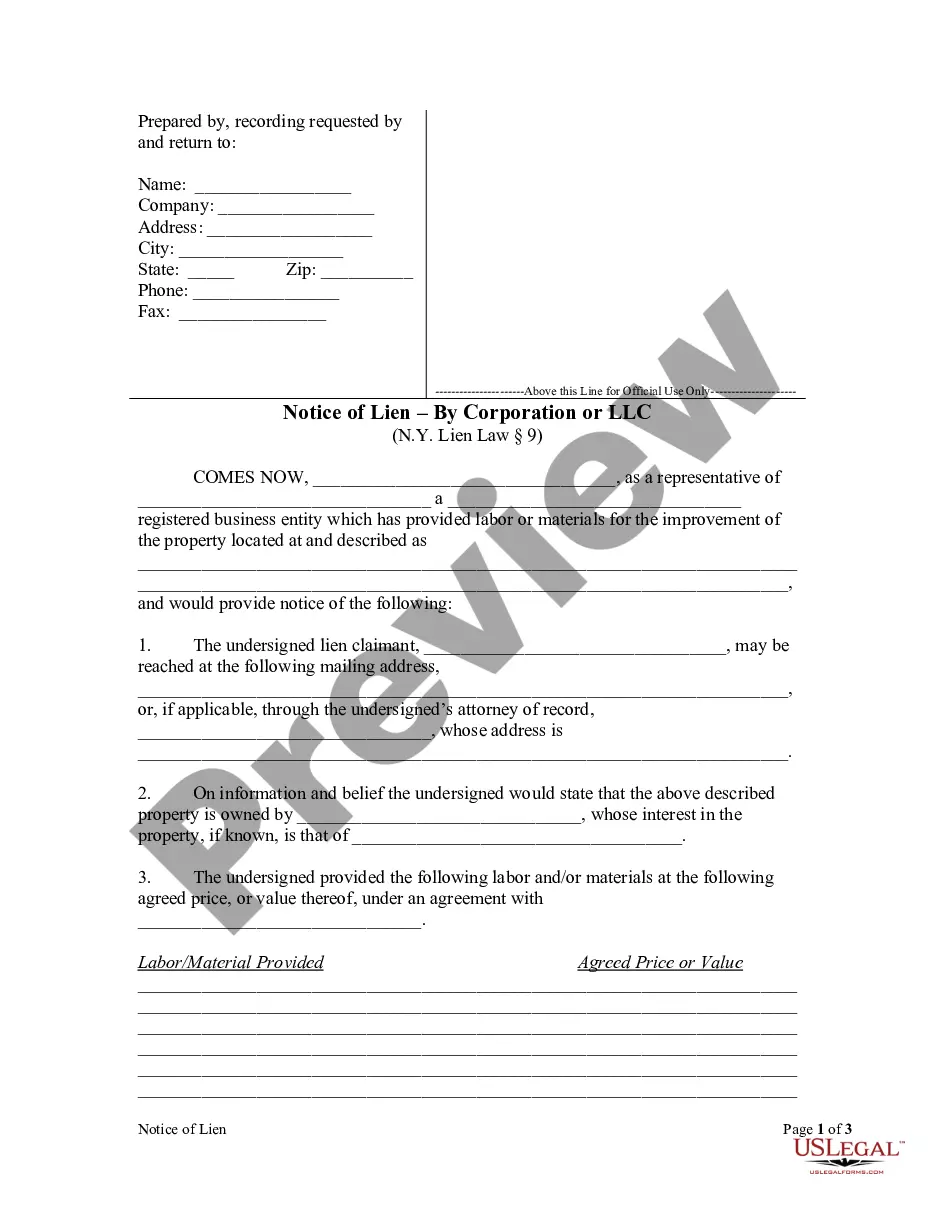

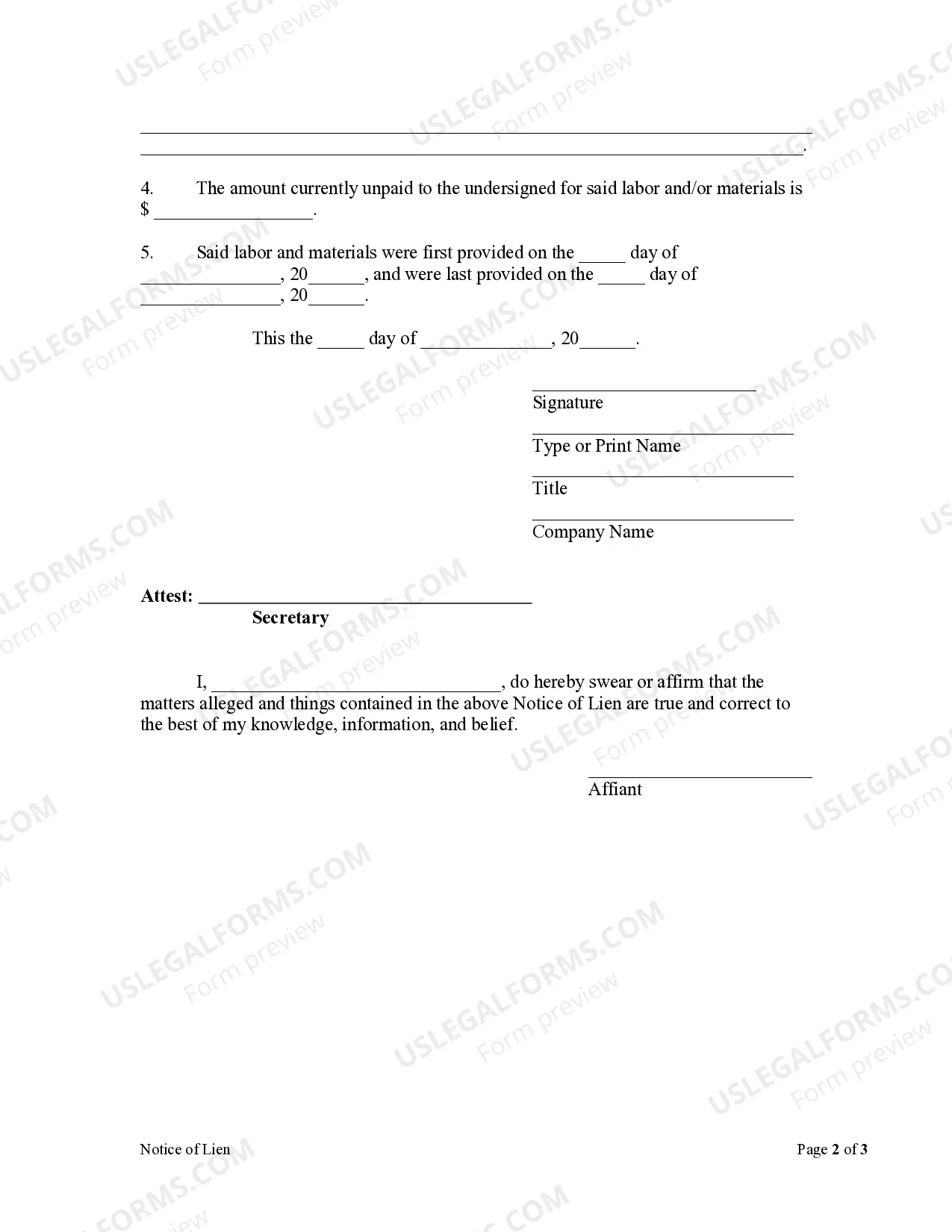

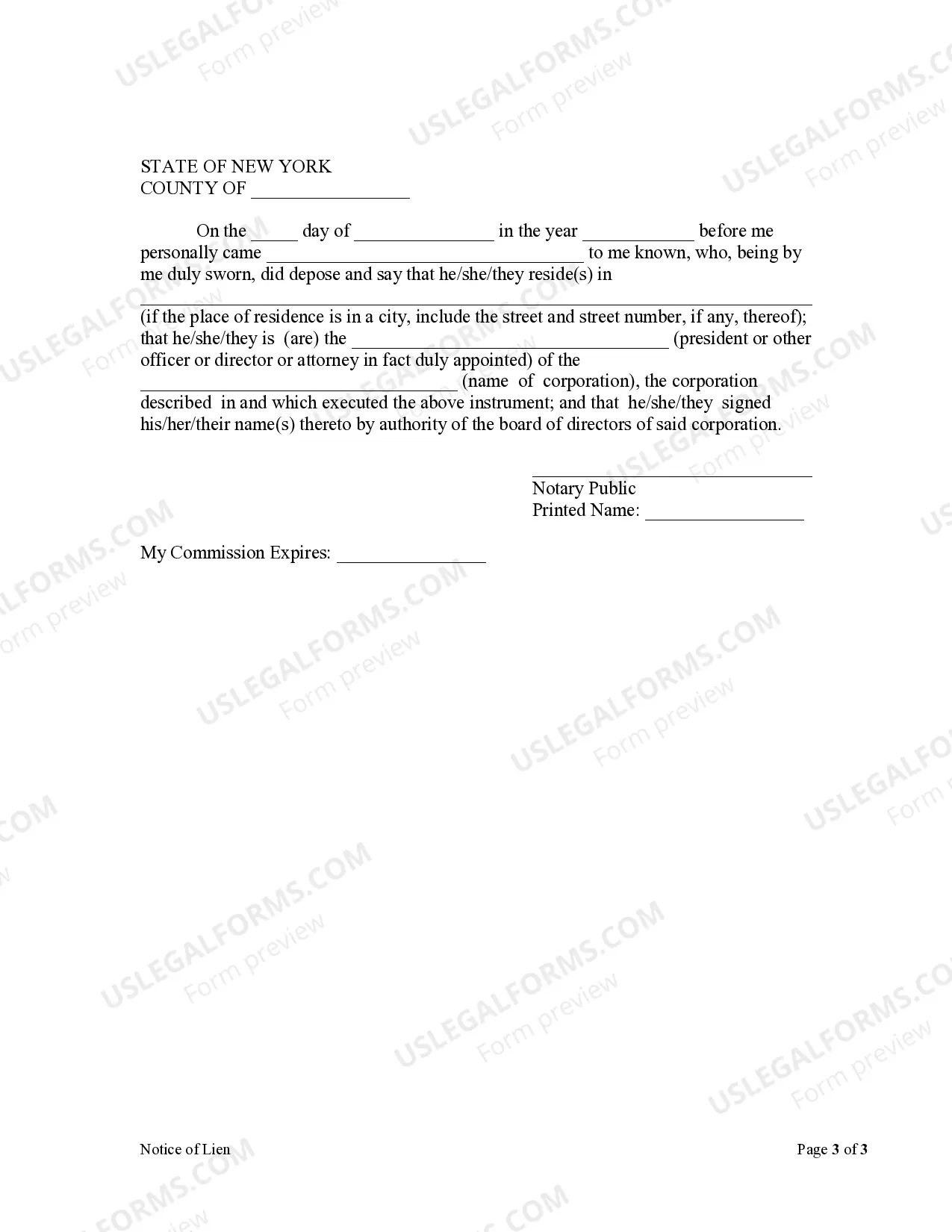

New York law requires a party desiring to claim a lien to file a Notice of Lien form in the office of the clerk of the county where the property is situated. The notice may be filed at any time during the progress of the work and the furnishing of the materials, or, within eight months after the completion of the contract, or the final performance of the work, or the final furnishing of the materials.

Suffolk New York Notice of Lien by Corporation or LLC A Suffolk New York Notice of Lien by Corporation or LLC is a legally significant document that establishes a creditor's claim against a property. This notice is filed by a corporation or limited liability company (LLC) when there is an outstanding debt owed to them, and serves as a public proclamation that the debtor's property may be subject to foreclosure or sale in order to satisfy the debt. The Suffolk County Clerk's Office is responsible for accepting and recording the Notice of Lien by Corporation or LLC, ensuring its validity and public accessibility. This process helps protect the rights of the creditor, establishing priority in case of multiple claims against a property. Key elements included in a Suffolk New York Notice of Lien by Corporation or LLC are: 1. Creditor Information: The name, address, and contact details of the corporation or LLC filing the lien are provided. This identifies the entity claiming the debt. 2. Debtor Information: The name, address, and often other identifying details of the debtor are included. This allows for clear identification of the individual or entity owing the debt. 3. Property Information: A detailed description of the property subject to the lien is provided. This typically includes the address, legal description, and other relevant details to ensure precise identification. 4. Lien Claim: The Notice of Lien outlines the specific debt or obligation owed by the debtor to the creditor. The amount owed, dates of validity, and any relevant contractual agreements or terms are included. 5. Filing and Expiration Dates: The date of filing is noted, signifying the official commencement of the lien's validity. Similarly, an expiration date is specified, after which the lien may become unenforceable unless certain actions are taken. Different types of Suffolk New York Notice of Lien by Corporation or LLC may include: 1. Mechanic's Lien: This type of lien is typically filed by a construction company or contractor when they have not been paid for their services or materials provided for a construction or improvement project. 2. Tax Lien: Filed by local, state, or federal authorities, a tax lien is imposed on a property when the owner has outstanding tax obligations. This lien ensures the government's right to collect the owed taxes. 3. Judgment Lien: When a creditor obtains a judgment against a debtor through a lawsuit, they may file a judgment lien to secure the debt. This lien ensures that if the debtor sells or refinances their property, the creditor will be paid from the proceeds. By filing a Suffolk New York Notice of Lien by Corporation or LLC, creditors protect their legal rights and increase the chances of collecting the outstanding debt. However, it is crucial for both the creditor and debtor to understand their rights and obligations, seeking legal advice if necessary, to comply with all relevant laws and regulations during the lien process.Suffolk New York Notice of Lien by Corporation or LLC A Suffolk New York Notice of Lien by Corporation or LLC is a legally significant document that establishes a creditor's claim against a property. This notice is filed by a corporation or limited liability company (LLC) when there is an outstanding debt owed to them, and serves as a public proclamation that the debtor's property may be subject to foreclosure or sale in order to satisfy the debt. The Suffolk County Clerk's Office is responsible for accepting and recording the Notice of Lien by Corporation or LLC, ensuring its validity and public accessibility. This process helps protect the rights of the creditor, establishing priority in case of multiple claims against a property. Key elements included in a Suffolk New York Notice of Lien by Corporation or LLC are: 1. Creditor Information: The name, address, and contact details of the corporation or LLC filing the lien are provided. This identifies the entity claiming the debt. 2. Debtor Information: The name, address, and often other identifying details of the debtor are included. This allows for clear identification of the individual or entity owing the debt. 3. Property Information: A detailed description of the property subject to the lien is provided. This typically includes the address, legal description, and other relevant details to ensure precise identification. 4. Lien Claim: The Notice of Lien outlines the specific debt or obligation owed by the debtor to the creditor. The amount owed, dates of validity, and any relevant contractual agreements or terms are included. 5. Filing and Expiration Dates: The date of filing is noted, signifying the official commencement of the lien's validity. Similarly, an expiration date is specified, after which the lien may become unenforceable unless certain actions are taken. Different types of Suffolk New York Notice of Lien by Corporation or LLC may include: 1. Mechanic's Lien: This type of lien is typically filed by a construction company or contractor when they have not been paid for their services or materials provided for a construction or improvement project. 2. Tax Lien: Filed by local, state, or federal authorities, a tax lien is imposed on a property when the owner has outstanding tax obligations. This lien ensures the government's right to collect the owed taxes. 3. Judgment Lien: When a creditor obtains a judgment against a debtor through a lawsuit, they may file a judgment lien to secure the debt. This lien ensures that if the debtor sells or refinances their property, the creditor will be paid from the proceeds. By filing a Suffolk New York Notice of Lien by Corporation or LLC, creditors protect their legal rights and increase the chances of collecting the outstanding debt. However, it is crucial for both the creditor and debtor to understand their rights and obligations, seeking legal advice if necessary, to comply with all relevant laws and regulations during the lien process.