Queens New York Quitclaim Deed by Two Individuals to LLC: A Comprehensive Overview A Queens New York Quitclaim Deed by Two Individuals to LLC is a legal document that transfers the ownership of real estate property located in Queens, New York, from two individuals to a limited liability company (LLC). This type of deed provides a straightforward and efficient method for transferring property ownership, without any warranties or guarantees. Keywords: Queens New York, Quitclaim Deed, Two Individuals, LLC There are several types or variations of Queens New York Quitclaim Deed by Two Individuals to LLC, depending on specific circumstances and requirements. Some of these variations include: 1. Individual to LLC Transfer: This is the most common type of Queens New York Quitclaim Deed by Two Individuals to LLC. It involves the transfer of property ownership from two individual owners to an LLC. This transfer allows the individuals to utilize the limited liability protection and tax benefits offered by an LLC. 2. Family Members to LLC Transfer: In certain situations, family members may choose to utilize a Queens New York Quitclaim Deed to transfer property ownership to an LLC. This can be a strategic move to simplify family estate planning, asset protection, or tax management. 3. Joint Owners to LLC Transfer: When two individuals jointly own a property, they may decide to transfer their ownership interest to an LLC using a Quitclaim Deed. This type of transfer can be useful in cases where joint owners want to separate their interests or restructure their ownership in a more organized and manageable way. 4. Investment Property Transfer: Investors who own property in Queens, New York, may choose to transfer their ownership interest to an LLC to protect their personal assets and limit liability. This type of Quitclaim Deed ensures that the property is owned by the LLC, shielding the owner's personal assets from potential legal claims or obligations related to the property. 5. Inheritance or Estate Transfer: In cases of inheritance or estate planning, a Quitclaim Deed can be utilized to transfer property ownership from two individuals to an LLC. This approach may help simplify the administration of the estate and ensure smooth transition of the property to the intended beneficiaries. In conclusion, a Queens New York Quitclaim Deed by Two Individuals to LLC is a legal document that facilitates the transfer of property ownership from two individuals to an LLC. This type of deed offers flexibility and efficiency in transferring ownership rights, while providing limited liability protection and potential tax advantages to the parties involved. Keywords: Queens New York, Quitclaim Deed, Two Individuals, LLC, Transfer, Ownership, Real Estate, Limited Liability Company, Property, Variation, Family Members, Joint Owners, Investment Property, Inheritance, Estate Transfer.

Queens New York Quitclaim Deed by Two Individuals to LLC

Description

How to fill out Queens New York Quitclaim Deed By Two Individuals To LLC?

Benefit from the US Legal Forms and have immediate access to any form sample you want. Our beneficial website with a huge number of templates makes it simple to find and obtain almost any document sample you will need. You are able to export, fill, and sign the Queens New York Quitclaim Deed by Two Individuals to LLC in just a few minutes instead of surfing the Net for many hours seeking an appropriate template.

Utilizing our catalog is a wonderful strategy to increase the safety of your record submissions. Our professional attorneys regularly check all the documents to ensure that the forms are relevant for a particular region and compliant with new laws and regulations.

How do you get the Queens New York Quitclaim Deed by Two Individuals to LLC? If you have a subscription, just log in to the account. The Download button will appear on all the samples you look at. Additionally, you can get all the previously saved files in the My Forms menu.

If you haven’t registered a profile yet, stick to the tips below:

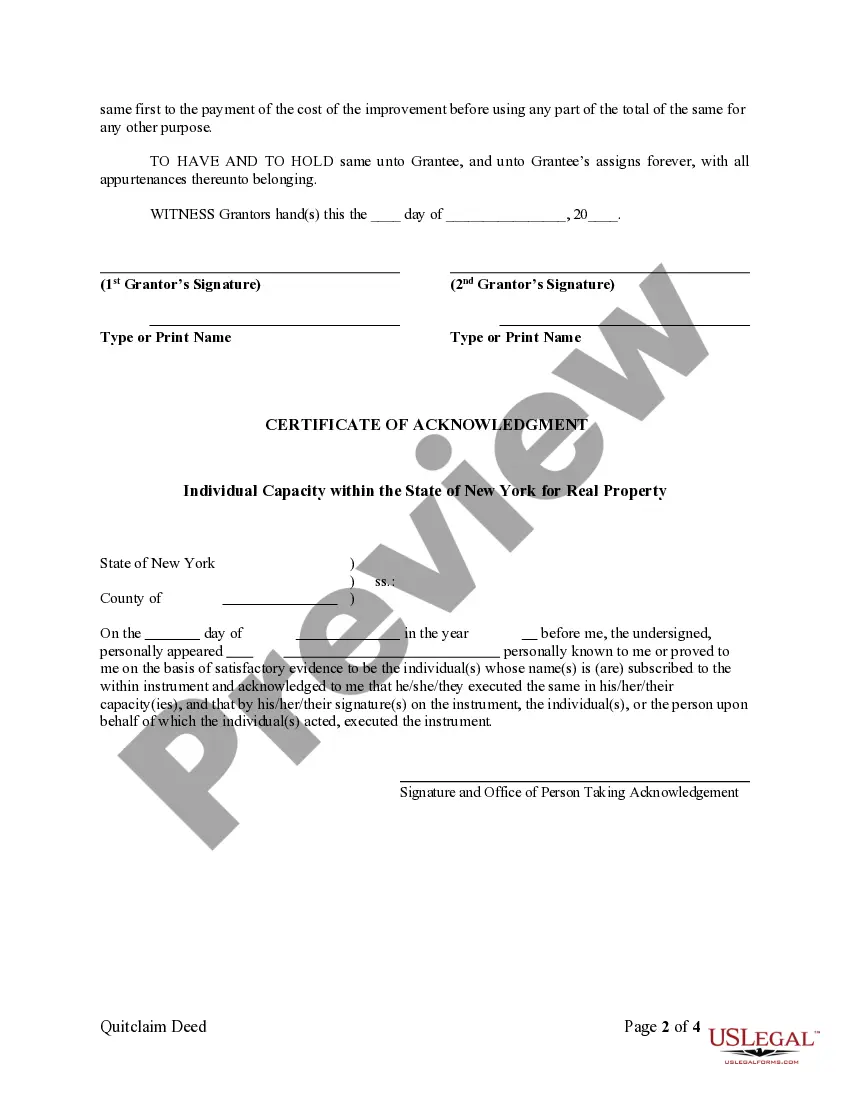

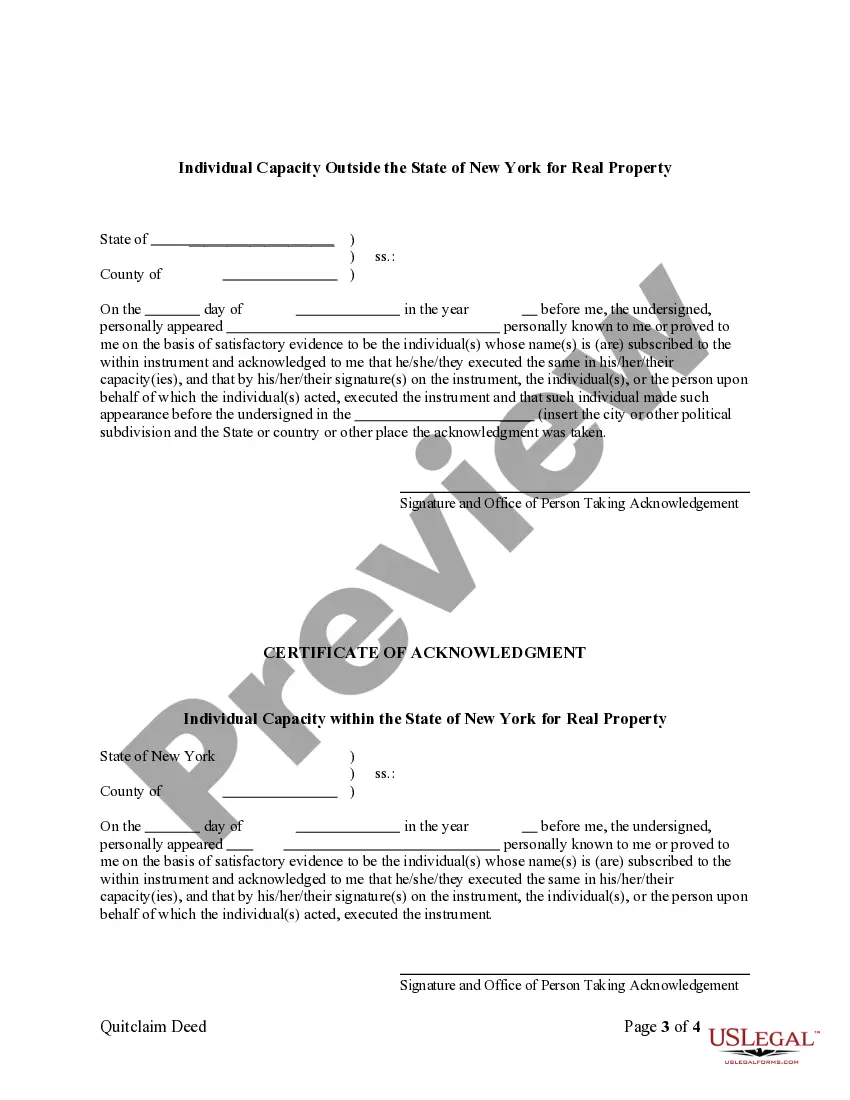

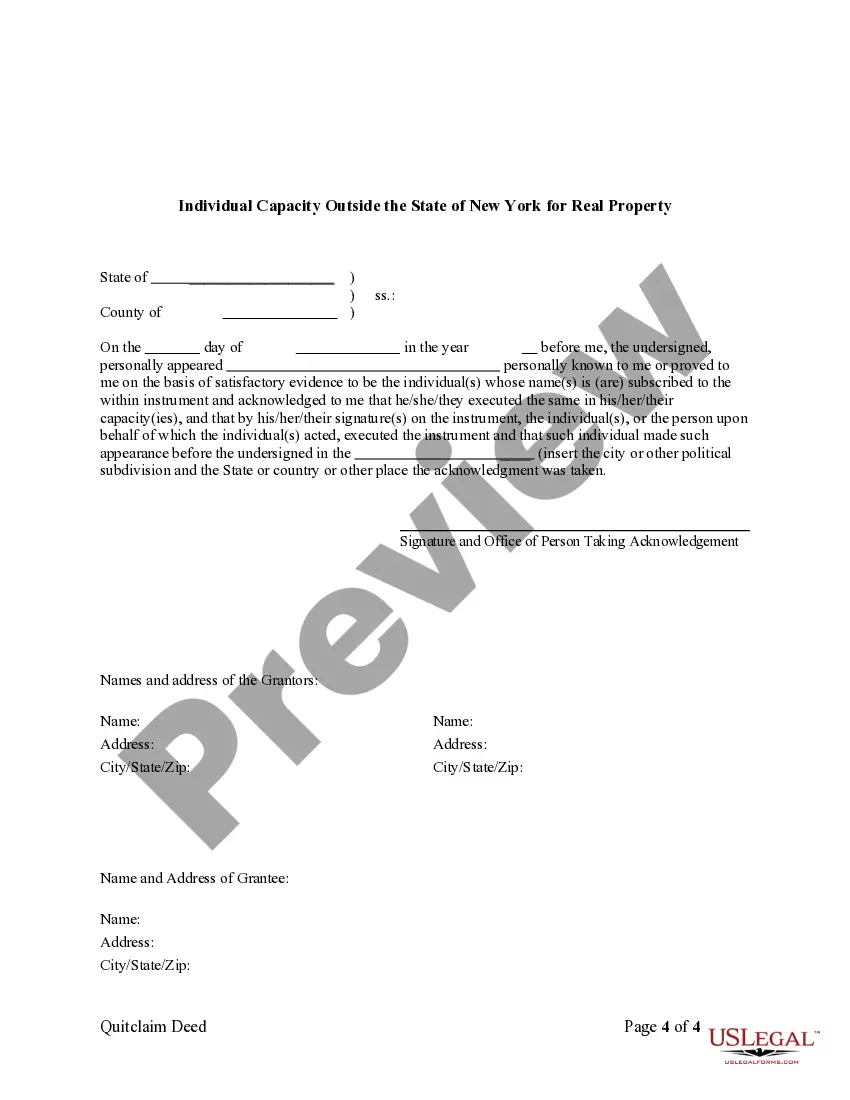

- Find the form you require. Make certain that it is the form you were hoping to find: examine its name and description, and take take advantage of the Preview feature if it is available. Otherwise, use the Search field to find the appropriate one.

- Start the downloading procedure. Select Buy Now and select the pricing plan you like. Then, create an account and pay for your order with a credit card or PayPal.

- Export the file. Pick the format to obtain the Queens New York Quitclaim Deed by Two Individuals to LLC and revise and fill, or sign it according to your requirements.

US Legal Forms is probably the most significant and reliable form libraries on the web. Our company is always happy to help you in virtually any legal process, even if it is just downloading the Queens New York Quitclaim Deed by Two Individuals to LLC.

Feel free to make the most of our service and make your document experience as convenient as possible!