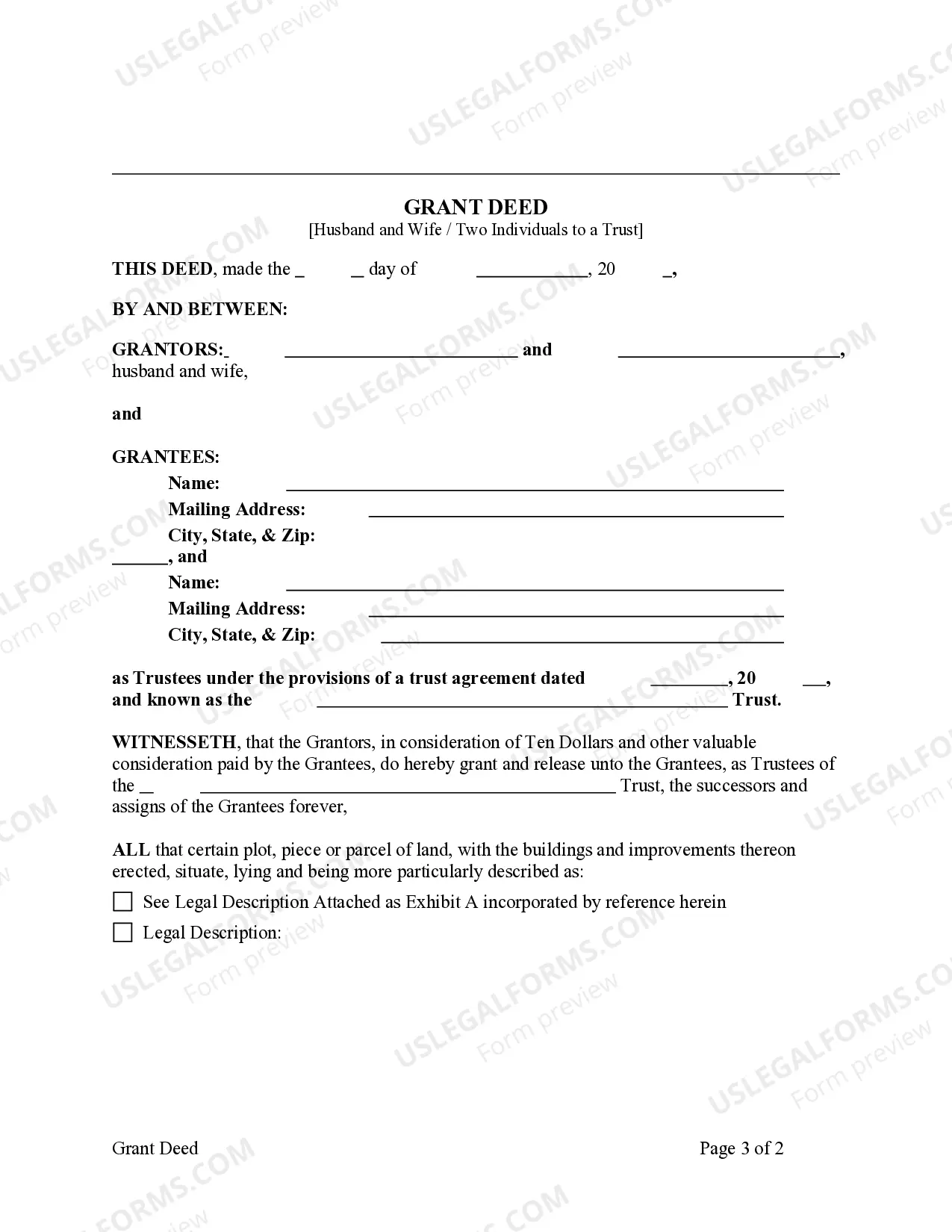

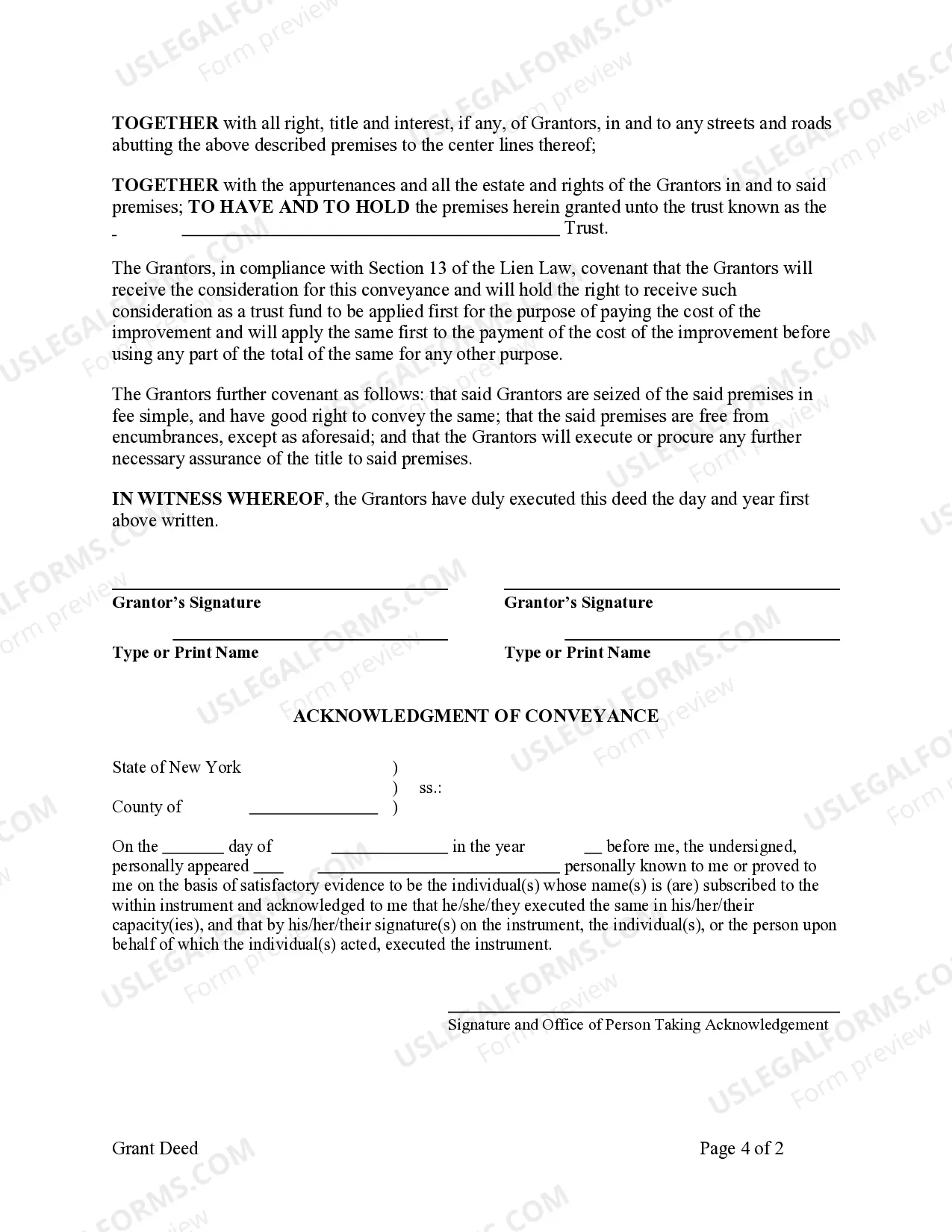

This form is a Grant Deed where the Grantors are two individuals, or husband and wife, and the Grantee is a Trust with two Trustees. This deed complies with all state statutory laws.

The Kings New York Grant Deed from two individuals, or husband and wife, to a trust is an important legal document used in real estate transactions. This type of deed signifies the transfer of ownership of real property in Kings County, New York, from the individuals or spouses to a trust entity. It provides protection, flexibility, and estate planning benefits for the granters and their beneficiaries. A Kings New York Grant Deed from two individuals, or husband and wife, to a trust can be categorized into two main types based on the purpose and rights conveyed: 1. Revocable Living Trust Grant Deed: This type of grant deed transfers ownership of the property from the individuals or spouse(s) to a revocable living trust. The trust is created during the lifetime of the granters, who usually serve as trustees, allowing them to have full control and access to the property. With this deed, they can freely manage, sell, or transfer the property at their discretion. The trust's beneficiaries may include the granters themselves, their children, or other individuals they designate. 2. Irrevocable Living Trust Grant Deed: In this variation, the individuals or spouse(s) convey ownership of the property to an irrevocable living trust. Unlike a revocable trust, an irrevocable trust cannot be modified or revoked without the permission of the beneficiaries. The granters relinquish their control over the property, providing potential tax advantages and asset protection. This deed type is often used for estate planning purposes, minimizing estate taxes, protecting assets from creditors, or ensuring specific provisions for beneficiaries. Key advantages of transferring property through a Kings New York Grant Deed to a trust include the avoidance of probate, privacy preservation, seamless transition in case of incapacity or death, and the ability to maintain continuous management and control. It is critical to consult with a professional attorney or real estate expert to navigate the legalities and understand the implications specific to individual circumstances. In conclusion, the Kings New York Grant Deed from two individuals, or husband and wife, to a trust is a legal tool enabling the transfer of property ownership to a trust entity. The revocable and irrevocable living trust deed variations offer different levels of control and protection, catering to various estate planning objectives. Proper understanding and execution of these deeds are vital for individuals in Kings County, New York, who wish to establish secure and flexible property ownership arrangements within a trust framework.The Kings New York Grant Deed from two individuals, or husband and wife, to a trust is an important legal document used in real estate transactions. This type of deed signifies the transfer of ownership of real property in Kings County, New York, from the individuals or spouses to a trust entity. It provides protection, flexibility, and estate planning benefits for the granters and their beneficiaries. A Kings New York Grant Deed from two individuals, or husband and wife, to a trust can be categorized into two main types based on the purpose and rights conveyed: 1. Revocable Living Trust Grant Deed: This type of grant deed transfers ownership of the property from the individuals or spouse(s) to a revocable living trust. The trust is created during the lifetime of the granters, who usually serve as trustees, allowing them to have full control and access to the property. With this deed, they can freely manage, sell, or transfer the property at their discretion. The trust's beneficiaries may include the granters themselves, their children, or other individuals they designate. 2. Irrevocable Living Trust Grant Deed: In this variation, the individuals or spouse(s) convey ownership of the property to an irrevocable living trust. Unlike a revocable trust, an irrevocable trust cannot be modified or revoked without the permission of the beneficiaries. The granters relinquish their control over the property, providing potential tax advantages and asset protection. This deed type is often used for estate planning purposes, minimizing estate taxes, protecting assets from creditors, or ensuring specific provisions for beneficiaries. Key advantages of transferring property through a Kings New York Grant Deed to a trust include the avoidance of probate, privacy preservation, seamless transition in case of incapacity or death, and the ability to maintain continuous management and control. It is critical to consult with a professional attorney or real estate expert to navigate the legalities and understand the implications specific to individual circumstances. In conclusion, the Kings New York Grant Deed from two individuals, or husband and wife, to a trust is a legal tool enabling the transfer of property ownership to a trust entity. The revocable and irrevocable living trust deed variations offer different levels of control and protection, catering to various estate planning objectives. Proper understanding and execution of these deeds are vital for individuals in Kings County, New York, who wish to establish secure and flexible property ownership arrangements within a trust framework.