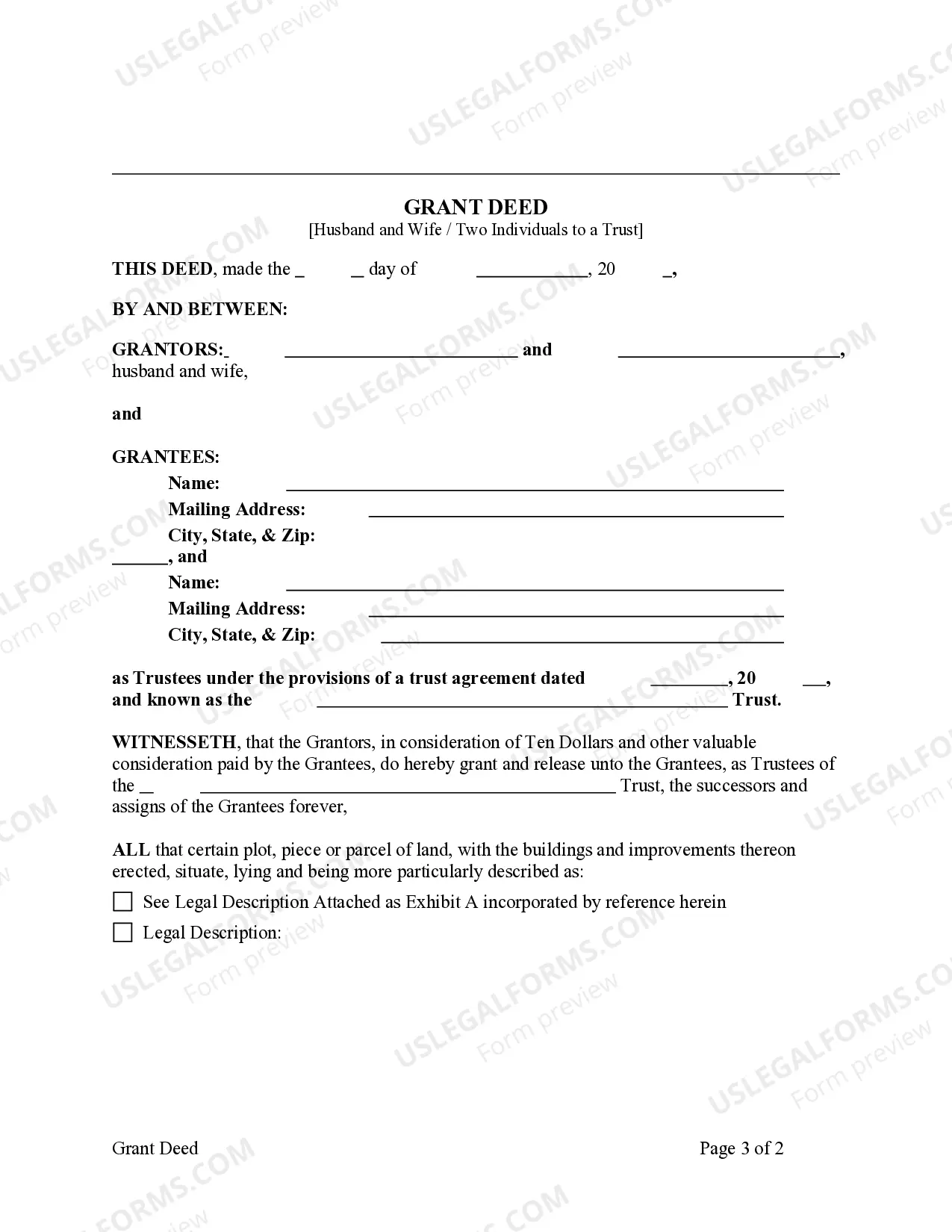

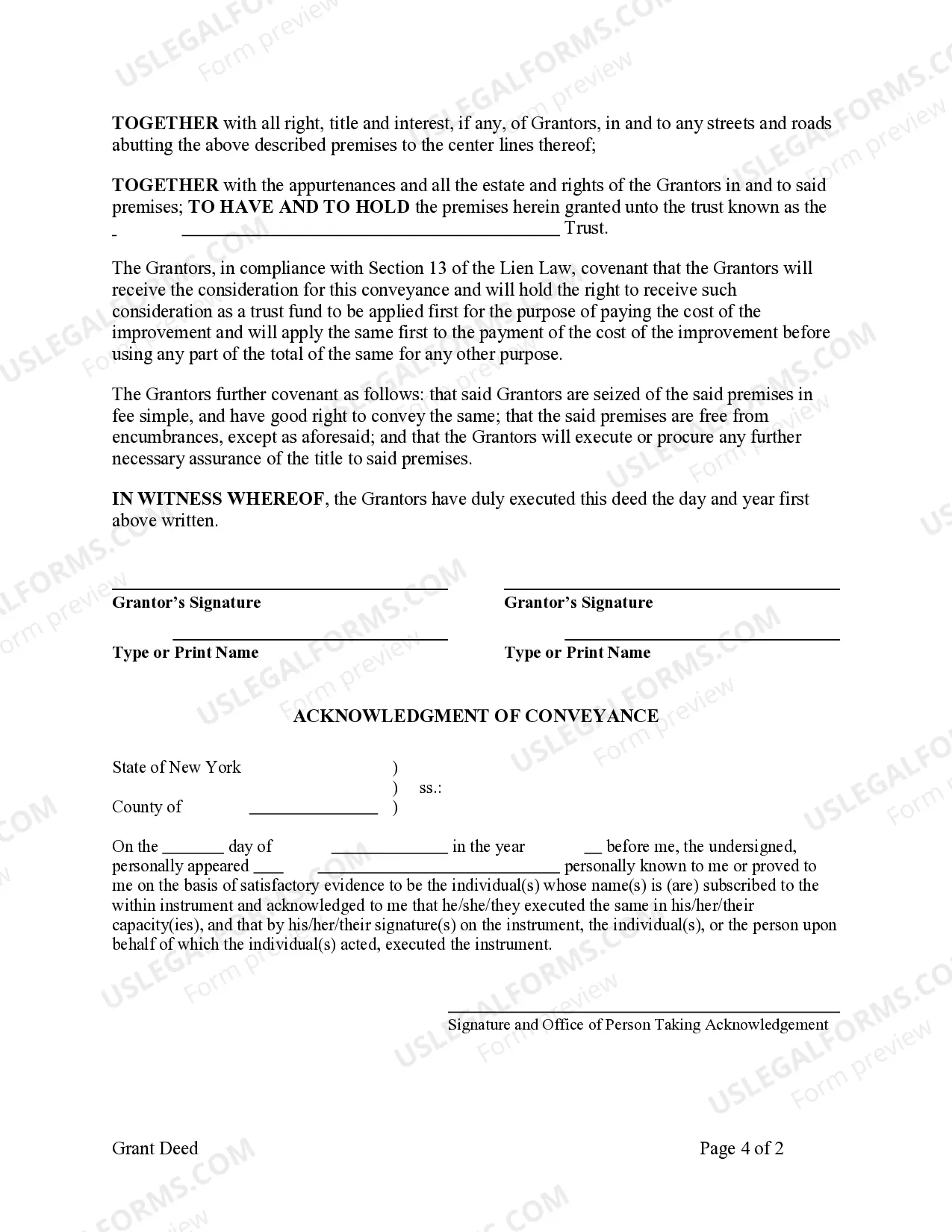

This form is a Grant Deed where the Grantors are two individuals, or husband and wife, and the Grantee is a Trust with two Trustees. This deed complies with all state statutory laws.

A Queens New York Grant Deed from two Individuals, or Husband and Wife, to Trust is a legal document that transfers real property ownership from two individuals, who may also be a married couple, to a trust. This type of deed is commonly used to transfer property ownership while maintaining asset protection and estate planning benefits. Keywords: Queens New York, Grant Deed, two Individuals, Husband and Wife, Trust, property ownership, transfer, asset protection, estate planning. Different types of Queens New York Grant Deed from two Individuals, or Husband and Wife, to Trust can include: 1. Revocable Trust Grant Deed: This type of grant deed transfers property ownership from two individuals, or a married couple, to a revocable living trust. A revocable trust allows for flexibility as the granters can modify or revoke the trust during their lifetime. The transfer of ownership to a revocable living trust helps avoid probate and provides a clear plan for asset distribution after the granters' passing. 2. Irrevocable Trust Grant Deed: This grant deed transfers ownership from two individuals, or a married couple, to an irrevocable trust. Unlike a revocable trust, an irrevocable trust cannot be modified or revoked after its creation. This type of trust is often used for long-term asset protection, tax planning, and Medicaid eligibility purposes. Once the property is transferred to the irrevocable trust, the granters relinquish their control over the asset. 3. Family Trust Grant Deed: A family trust grant deed allows the transfer of property ownership from two individuals, or a married couple, to a trust established for the benefit of family members. The family trust can include multiple beneficiaries, such as children or grandchildren, enabling the granters to control the distribution of assets and provide for their loved ones. This type of grant deed is often used for estate planning purposes. It is important to consult with an attorney or a real estate professional experienced in trust matters when preparing a Queens New York Grant Deed from two Individuals, or Husband and Wife, to Trust. This ensures that the deed complies with local laws and meets the specific needs and goals of the granters while protecting the interests of the trust beneficiaries.A Queens New York Grant Deed from two Individuals, or Husband and Wife, to Trust is a legal document that transfers real property ownership from two individuals, who may also be a married couple, to a trust. This type of deed is commonly used to transfer property ownership while maintaining asset protection and estate planning benefits. Keywords: Queens New York, Grant Deed, two Individuals, Husband and Wife, Trust, property ownership, transfer, asset protection, estate planning. Different types of Queens New York Grant Deed from two Individuals, or Husband and Wife, to Trust can include: 1. Revocable Trust Grant Deed: This type of grant deed transfers property ownership from two individuals, or a married couple, to a revocable living trust. A revocable trust allows for flexibility as the granters can modify or revoke the trust during their lifetime. The transfer of ownership to a revocable living trust helps avoid probate and provides a clear plan for asset distribution after the granters' passing. 2. Irrevocable Trust Grant Deed: This grant deed transfers ownership from two individuals, or a married couple, to an irrevocable trust. Unlike a revocable trust, an irrevocable trust cannot be modified or revoked after its creation. This type of trust is often used for long-term asset protection, tax planning, and Medicaid eligibility purposes. Once the property is transferred to the irrevocable trust, the granters relinquish their control over the asset. 3. Family Trust Grant Deed: A family trust grant deed allows the transfer of property ownership from two individuals, or a married couple, to a trust established for the benefit of family members. The family trust can include multiple beneficiaries, such as children or grandchildren, enabling the granters to control the distribution of assets and provide for their loved ones. This type of grant deed is often used for estate planning purposes. It is important to consult with an attorney or a real estate professional experienced in trust matters when preparing a Queens New York Grant Deed from two Individuals, or Husband and Wife, to Trust. This ensures that the deed complies with local laws and meets the specific needs and goals of the granters while protecting the interests of the trust beneficiaries.