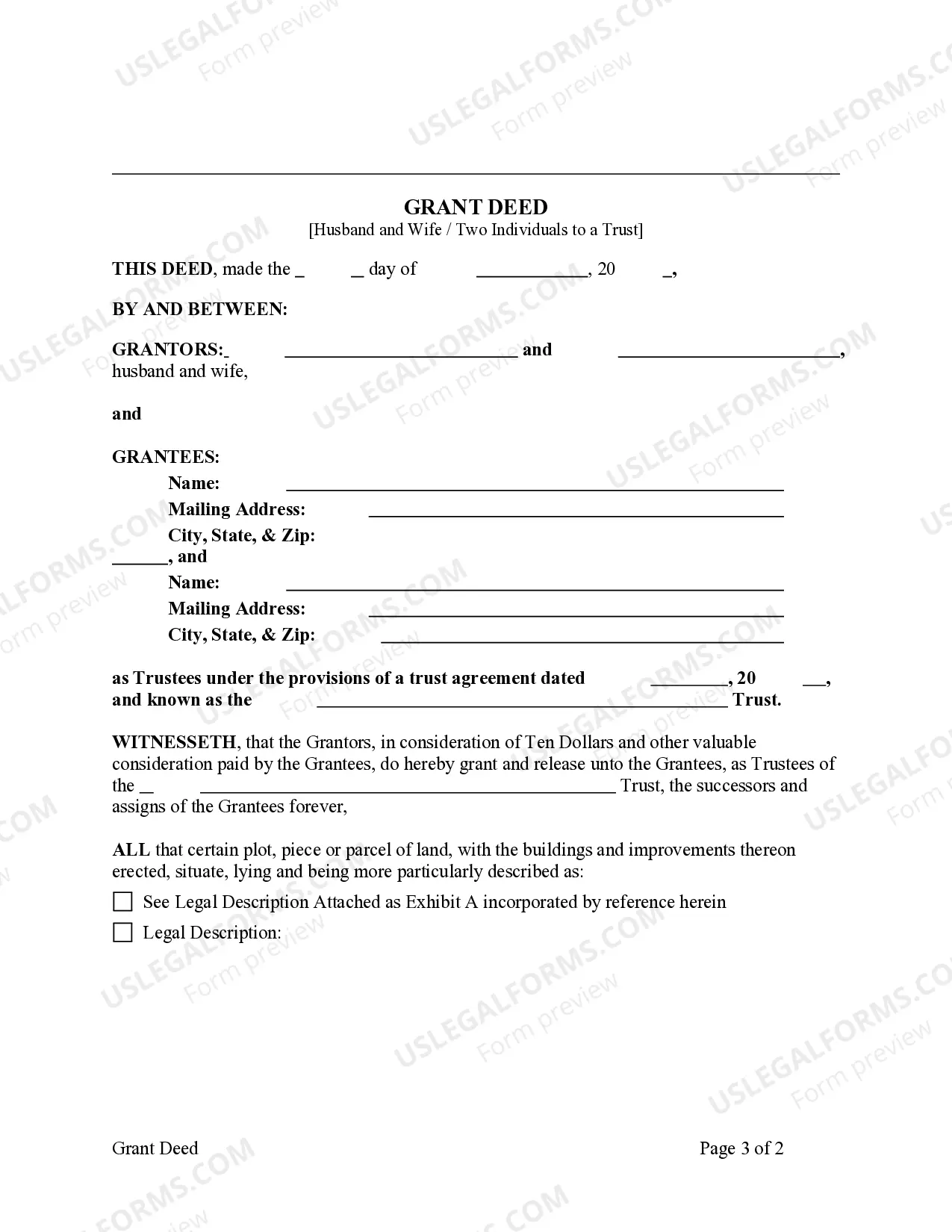

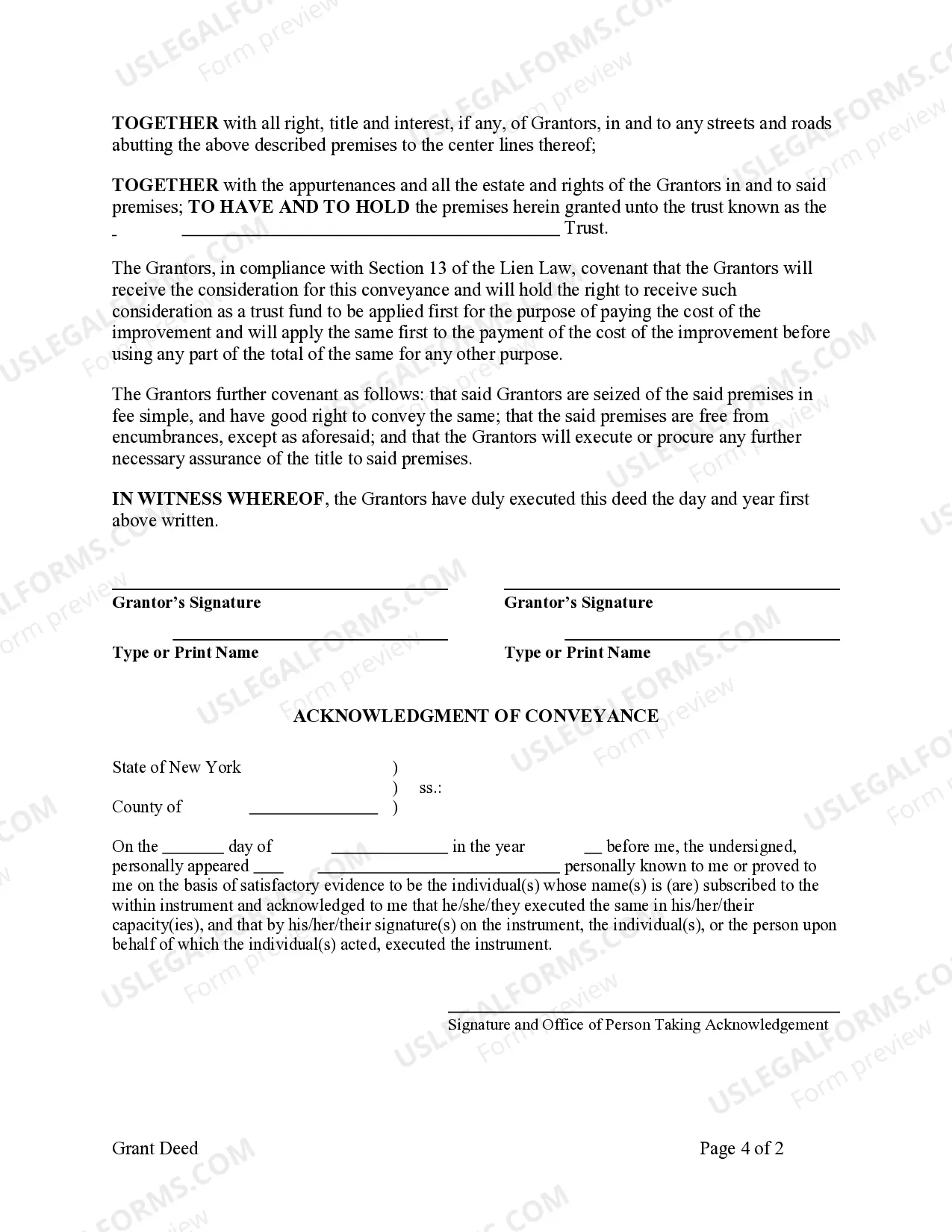

This form is a Grant Deed where the Grantors are two individuals, or husband and wife, and the Grantee is a Trust with two Trustees. This deed complies with all state statutory laws.

A Suffolk New York Grant Deed from two Individuals, or Husband and Wife, to Trust is a legal document used to transfer property ownership from two individuals who are either a married couple or unrelated partners to a trust. This type of deed is commonly used to establish asset protection, facilitate estate planning, and provide continuity in property ownership. The Suffolk New York Grant Deed includes specific keywords that each describe different types of deeds based on the circumstances and requirements of the individuals involved: 1. Joint Tenancy Grant Deed: This type of grant deed is used when two individuals, typically spouses, own a property together and wish to transfer their ownership interest to a trust. The grant deed specifies that the property will be held in joint tenancy by the trust, meaning that if one spouse passes away, their ownership interest automatically transfers to the surviving spouse. 2. Tenancy in Common Grant Deed: In cases where two unrelated individuals or partners own property and want to transfer it to a trust, a Tenancy in Common Grant Deed is used. Unlike joint tenancy, each owner's interest is individually owned and can be transferred or inherited separately. The grant deed specifies that both owners' interests will be held as tenants in common by the trust. 3. Community Property Grant Deed: This type of grant deed is applicable when a married couple owns property as community property and wishes to transfer it to a trust. Community property is a legal concept in which all assets acquired during a marriage are jointly owned by both spouses. The grant deed acknowledges this ownership structure and transfers the property to the trust accordingly. 4. Survivorship Community Property Grant Deed: Similar to the Joint Tenancy Grant Deed, this deed is used by a married couple to transfer their community property ownership to a trust with the added benefit of survivorship rights. If one spouse passes away, their share automatically transfers to the surviving spouse, ensuring the property remains under the trust's ownership. In conclusion, a Suffolk New York Grant Deed from two Individuals, or Husband and Wife, to Trust provides a means for married couples or unrelated individuals to transfer property ownership to a trust while preserving their desired ownership structure. Whether it be joint tenancy, tenancy in common, community property, or survivorship community property, each grant deed type caters to specific ownership scenarios and estate planning needs.