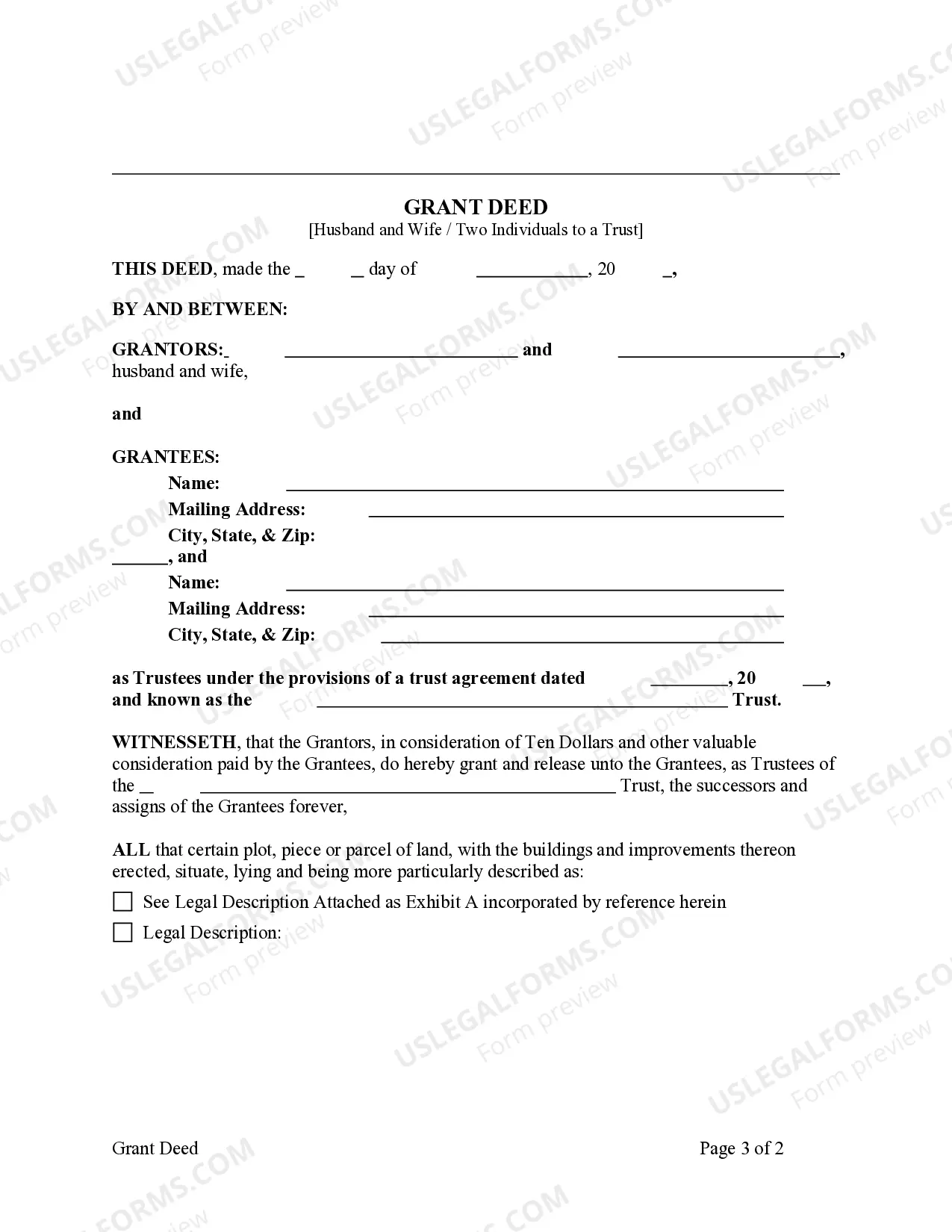

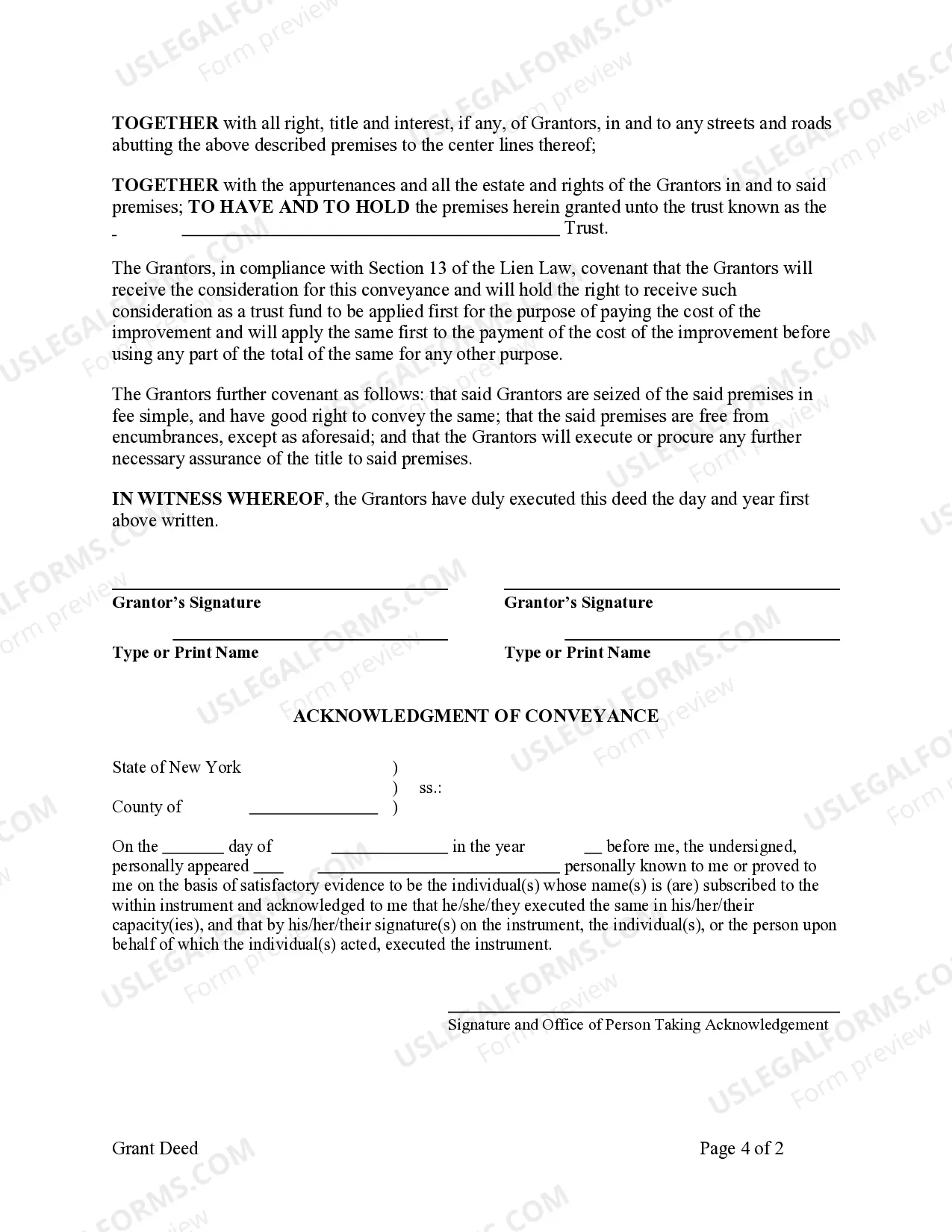

This form is a Grant Deed where the Grantors are two individuals, or husband and wife, and the Grantee is a Trust with two Trustees. This deed complies with all state statutory laws.

A Syracuse New York Grant Deed from two Individuals, or Husband and Wife, to Trust is a legal document that transfers ownership of real property from two individual owners, who may be married, to a trust entity. This type of deed is commonly used to execute estate planning strategies, asset protection, or to provide for the seamless transfer of property upon the death of the granters. A Grant Deed is a type of deed used in Syracuse, New York, which assures the grantee (the trust) that the granters (individuals or married couple) have full legal authority to transfer the property, and that the property is free from any liens, encumbrances, or claims. This type of deed is particularly essential when transferring real property to a trust. A trust is a legal entity that holds ownership of assets, including real estate, on behalf of beneficiaries. By transferring the property through a Grant Deed, the trust becomes the new legal owner, allowing for greater flexibility in managing and distributing the property in accordance with the granters' wishes. Some common variations or types of Syracuse New York Grant Deeds from two Individuals, or Husband and Wife, to Trust include: 1. Joint Tenancy Grant Deed: This type of deed is commonly used when individuals, typically a married couple, wish to hold equal shares in the property and have the right of survivorship. In the event of the death of one granter, the surviving granter automatically inherits the deceased's share without the need for probate. 2. Tenancy in Common Grant Deed: This type of deed allows individuals, including married couples, to hold unequal shares in the property. Each owner has the right to transfer or sell their share independently, and in case of a granter's death, their share will pass to their designated beneficiaries through their trust. 3. Life Estate Grant Deed: This type of deed grants the individuals, often a married couple, the right to occupy and use the property during their lifetime, while simultaneously transferring the remainder interest to the trust. It ensures that the trustee assumes control and ownership upon the death of the individuals, avoiding the property going through probate. Executing a Syracuse New York Grant Deed from two Individuals, or Husband and Wife, to Trust involves proper drafting and notarization, followed by recording the deed with the County Clerk's Office to make it public record. It is essential to consult with a qualified real estate attorney or estate planning professional to ensure compliance with relevant laws and to customize the deed to meet specific needs and intentions.A Syracuse New York Grant Deed from two Individuals, or Husband and Wife, to Trust is a legal document that transfers ownership of real property from two individual owners, who may be married, to a trust entity. This type of deed is commonly used to execute estate planning strategies, asset protection, or to provide for the seamless transfer of property upon the death of the granters. A Grant Deed is a type of deed used in Syracuse, New York, which assures the grantee (the trust) that the granters (individuals or married couple) have full legal authority to transfer the property, and that the property is free from any liens, encumbrances, or claims. This type of deed is particularly essential when transferring real property to a trust. A trust is a legal entity that holds ownership of assets, including real estate, on behalf of beneficiaries. By transferring the property through a Grant Deed, the trust becomes the new legal owner, allowing for greater flexibility in managing and distributing the property in accordance with the granters' wishes. Some common variations or types of Syracuse New York Grant Deeds from two Individuals, or Husband and Wife, to Trust include: 1. Joint Tenancy Grant Deed: This type of deed is commonly used when individuals, typically a married couple, wish to hold equal shares in the property and have the right of survivorship. In the event of the death of one granter, the surviving granter automatically inherits the deceased's share without the need for probate. 2. Tenancy in Common Grant Deed: This type of deed allows individuals, including married couples, to hold unequal shares in the property. Each owner has the right to transfer or sell their share independently, and in case of a granter's death, their share will pass to their designated beneficiaries through their trust. 3. Life Estate Grant Deed: This type of deed grants the individuals, often a married couple, the right to occupy and use the property during their lifetime, while simultaneously transferring the remainder interest to the trust. It ensures that the trustee assumes control and ownership upon the death of the individuals, avoiding the property going through probate. Executing a Syracuse New York Grant Deed from two Individuals, or Husband and Wife, to Trust involves proper drafting and notarization, followed by recording the deed with the County Clerk's Office to make it public record. It is essential to consult with a qualified real estate attorney or estate planning professional to ensure compliance with relevant laws and to customize the deed to meet specific needs and intentions.