Queens New York Warranty Deed from two Individuals to Corporation

Description

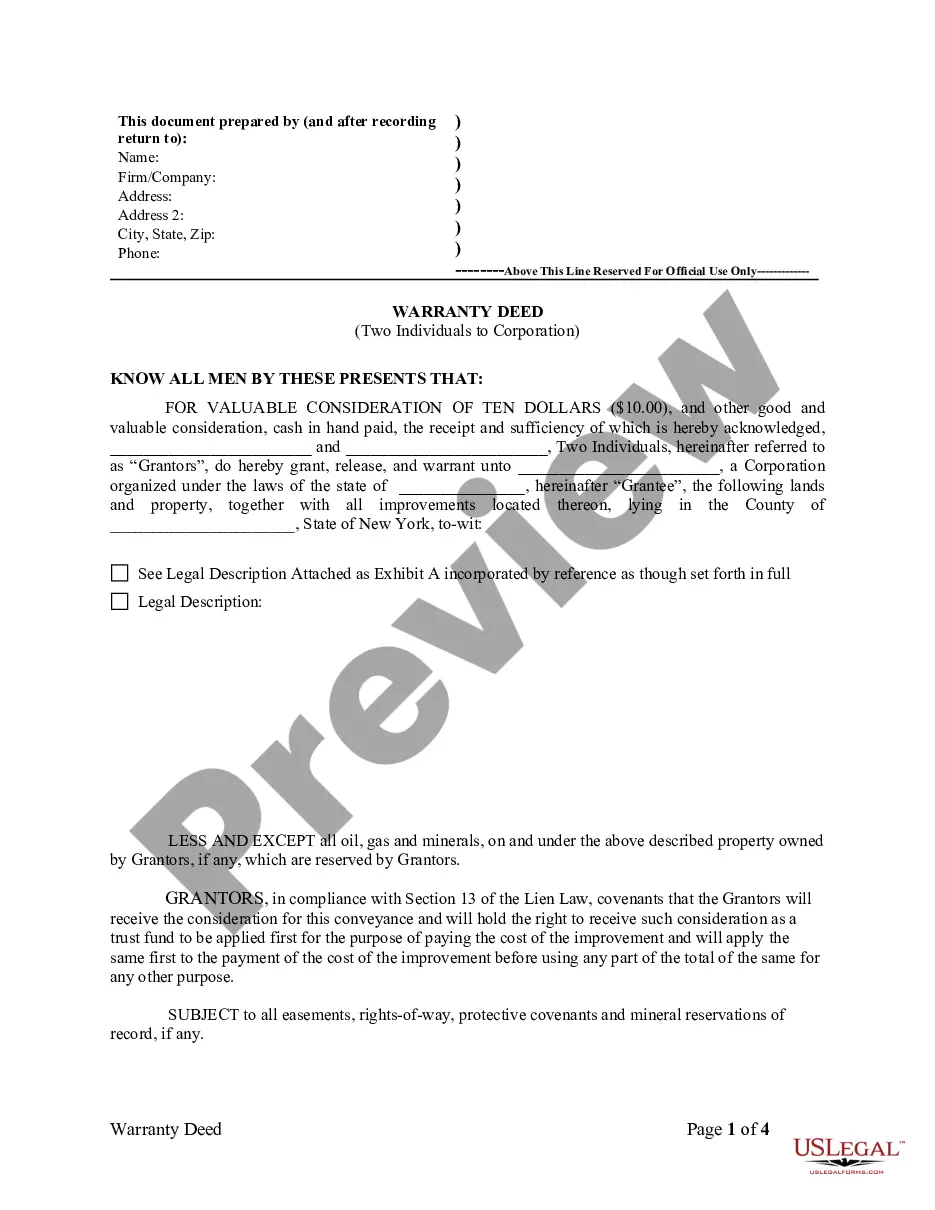

How to fill out New York Warranty Deed From Two Individuals To Corporation?

If you have previously used our service, Log In to your account and retrieve the Queens New York Warranty Deed from two Individuals to Corporation onto your device by clicking the Download button. Ensure your subscription is active. If it's not, renew it as per your payment plan.

If this is your first time using our service, follow these straightforward steps to acquire your file.

You have ongoing access to all the documents you have purchased: you can locate them in your profile under the My documents section whenever you wish to use them again. Take advantage of the US Legal Forms service to quickly find and store any template for your personal or business requirements!

- Confirm you have found an appropriate document. Review the description and utilize the Preview feature, if accessible, to verify if it suits your needs. If it isn’t suitable, use the Search function above to discover the right one.

- Acquire the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and process a payment. Use your credit card information or the PayPal option to finalize the purchase.

- Receive your Queens New York Warranty Deed from two Individuals to Corporation. Choose the document format and save it to your device.

- Fill out your document. Print it or utilize professional online editors to complete it and sign it electronically.

Form popularity

FAQ

Adding someone to a deed can have several disadvantages, including potential complications with property rights and responsibilities. The original owner may lose some control over the property since both owners must agree on decisions. Additionally, adding someone may have tax implications and could influence future inheritance matters. These nuances are crucial for those considering a Queens New York Warranty Deed from two Individuals to Corporation.

Yes, you can have two names on a deed, reflecting joint ownership of the property. It is essential to choose the right form of ownership to comply with both parties' intentions and legal considerations, such as rights of survivorship. Having two names on the deed can impact how the property is passed on in case of death. This is particularly relevant for those executing a Queens New York Warranty Deed from two Individuals to Corporation.

To transfer ownership of property in Illinois, you must execute a new deed that names the parties involved. Both the current owner and new owner should sign this document, and it will need to be notarized. Finally, file the deed with the local recorder's office to make the transfer official. This process is similar for handling a Queens New York Warranty Deed from two Individuals to Corporation.

When two people are on a deed, it is commonly referred to as 'joint ownership' or 'co-ownership'. This arrangement can take various forms, such as tenants in common or joint tenants, depending on how the ownership is structured. Each type has its legal implications, especially concerning inheritance and equal rights to the property. Understanding this concept is vital for anyone navigating a Queens New York Warranty Deed from two Individuals to Corporation.

Yes, you can add someone to a warranty deed, but it requires careful consideration. Both parties need to sign the new deed, and you must follow your state's specific requirements for the transfer. Be aware that adding someone may change the ownership structure and could affect tax liabilities and estate planning down the line. This is a key factor to consider when transitioning a Queens New York Warranty Deed from two Individuals to Corporation.

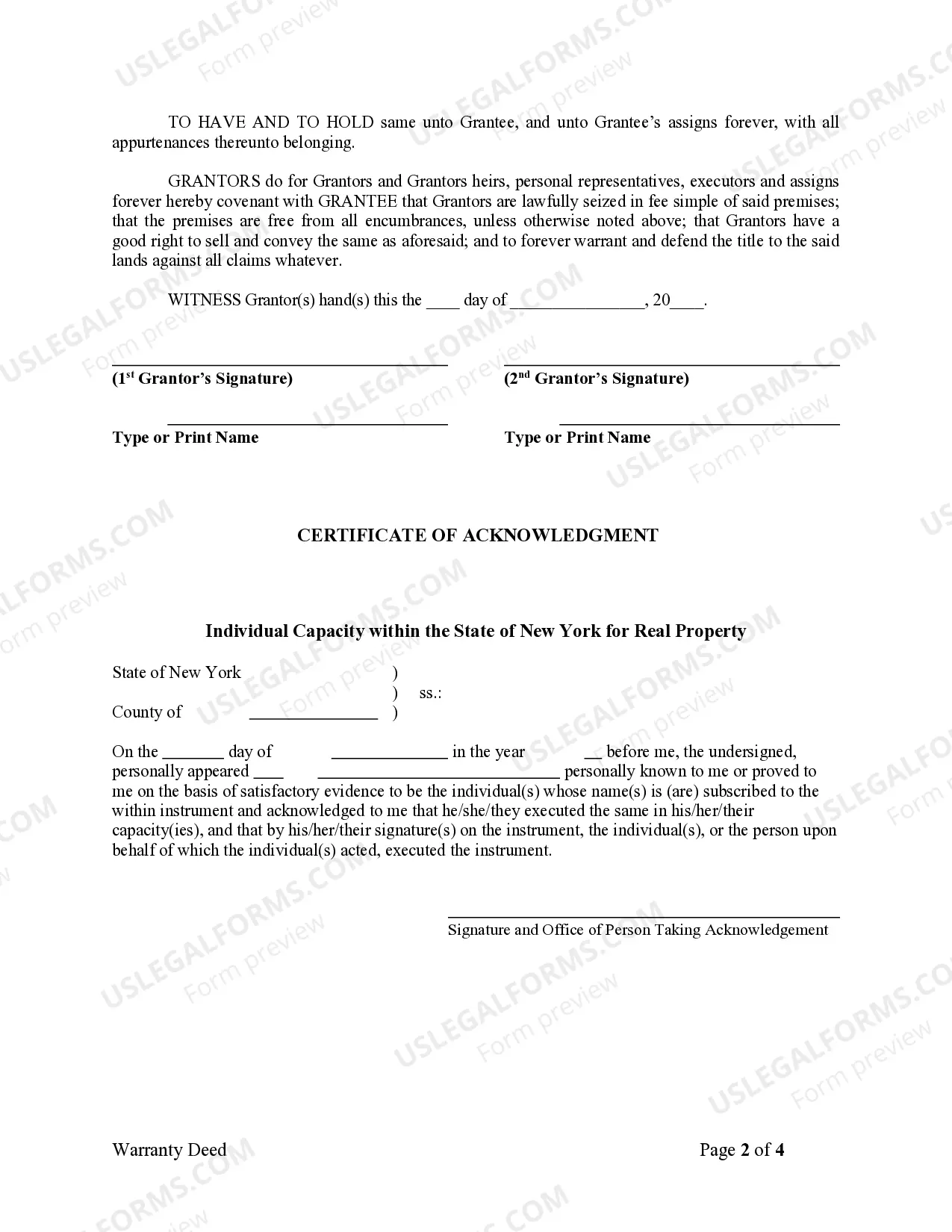

Transferring a warranty deed typically involves executing a new deed that clearly states the transfer of ownership. Both the current owner and the new owner must sign the document, and it often requires notarization. After signing, the deed must be filed with the local county clerk's office to complete the transfer legally. This procedure is essential when dealing with a Queens New York Warranty Deed from two Individuals to Corporation.

A warranty deed offers strong protection to the buyer, but it can hold disadvantages for the seller. If any issues arise regarding the property title, the seller may be liable to rectify these problems. This guarantees the buyer that the seller has legal ownership, which can be a risk for the seller in cases of disputes or claims. Understanding these potential pitfalls is crucial, especially when dealing with a Queens New York Warranty Deed from two Individuals to Corporation.

Yes, you can transfer a warranty deed, and it involves the same process as transferring any deed. The individuals transferring the property must ensure that the warranty deed is properly executed, which includes their signatures and the details of the transfer to a corporation. Once completed, you submit the warranty deed to the appropriate local government office for recording. For detailed guidance and templates related to a Queens New York Warranty Deed from two Individuals to Corporation, uslegalforms offers tools that simplify this process.

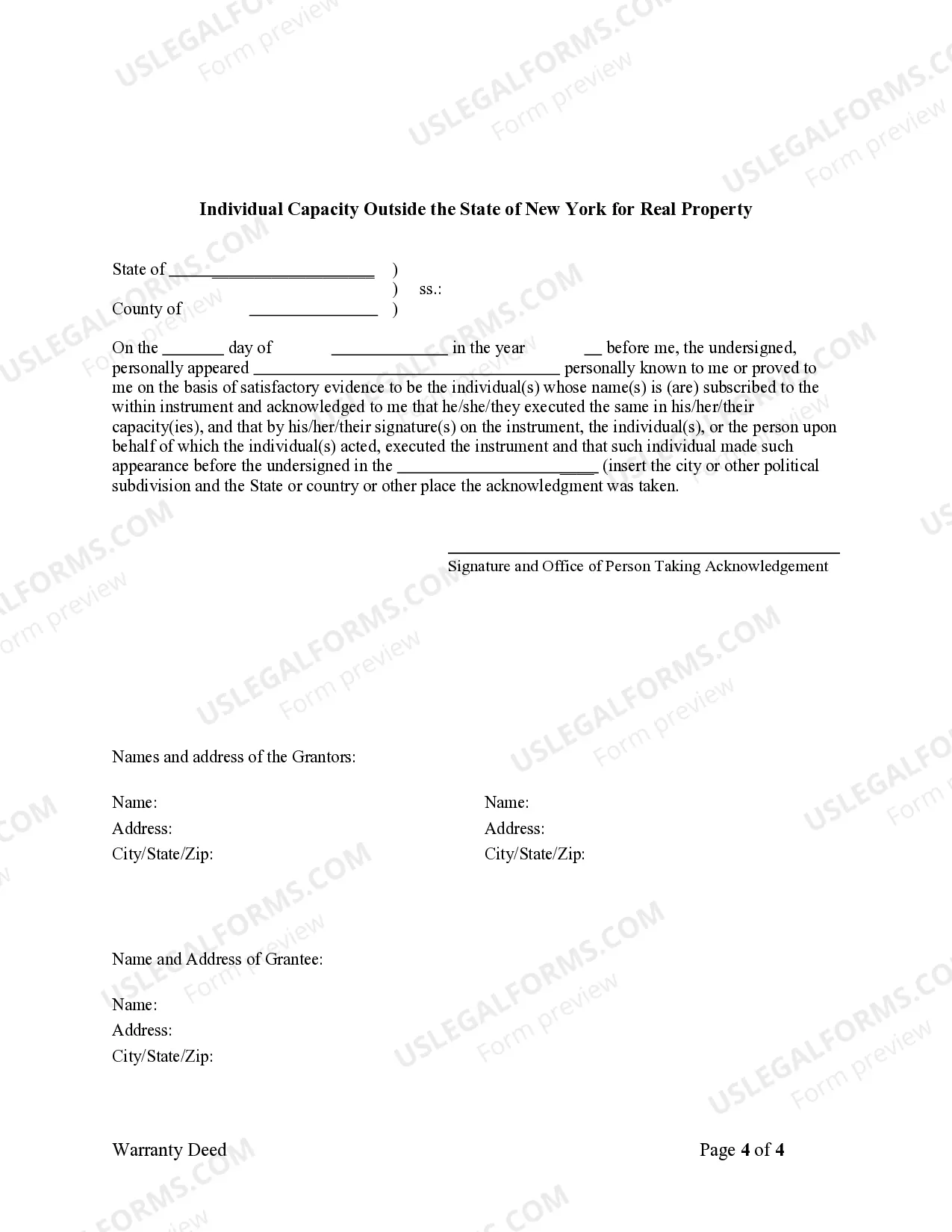

To transfer a deed in New York, you need to complete a written deed, which includes the names of the individuals involved and the corporation receiving the property. It is essential to ensure that the deed is signed by the individuals transferring the property. Additionally, you must file the deed with the county clerk's office where the property is located. For assistance in creating and filing the necessary documents related to a Queens New York Warranty Deed from two Individuals to Corporation, uslegalforms can provide the resources you need.

To transfer ownership of a property in New York, you must prepare a valid deed. This includes a Queens New York Warranty Deed from two Individuals to Corporation, where the grantors affirm their right to transfer the property. After completion, you need to file the deed with the appropriate county clerk’s office, ensuring a legal transfer of ownership.